Filing Alert: Aleon Metals Chapter 11

Aleon Metals Files Chapter 11 in Southern District of Texas

Aleon Metals, LLC and its debtor affiliates⁽¹⁾, a Freeport, TX-based recycler of spent oil-refining catalysts, filed for Chapter 11 protection on Aug. 17 in the U.S. Bankruptcy Court for the Southern District of Texas.

The filing comes after operational setbacks and liquidity strain at Freeport’s GMR facility, where production was largely offline from February through July 2025 following SO₂ scrubber failures. The shutdown, compounded by vanadium/molybdenum price volatility and constrained catalyst supply, coincided with the cessation of equity support.

Bondholders initially bridged liquidity and are now funding the case with a $187.5 million DIP and serving as stalking horse. The debtors intend to pursue a Jefferies-run §363 sale of substantially all assets to maximize going-concern value.

The company reports $100 million to $500 million in both assets and liabilities. The filing indicates that no funds will be available for distribution to unsecured creditors after administrative expenses are paid. The case number is 25-90305.

⁽¹⁾ Aleon Renewable Metals, LLC and Gladieux Metals Recycling, LLC.

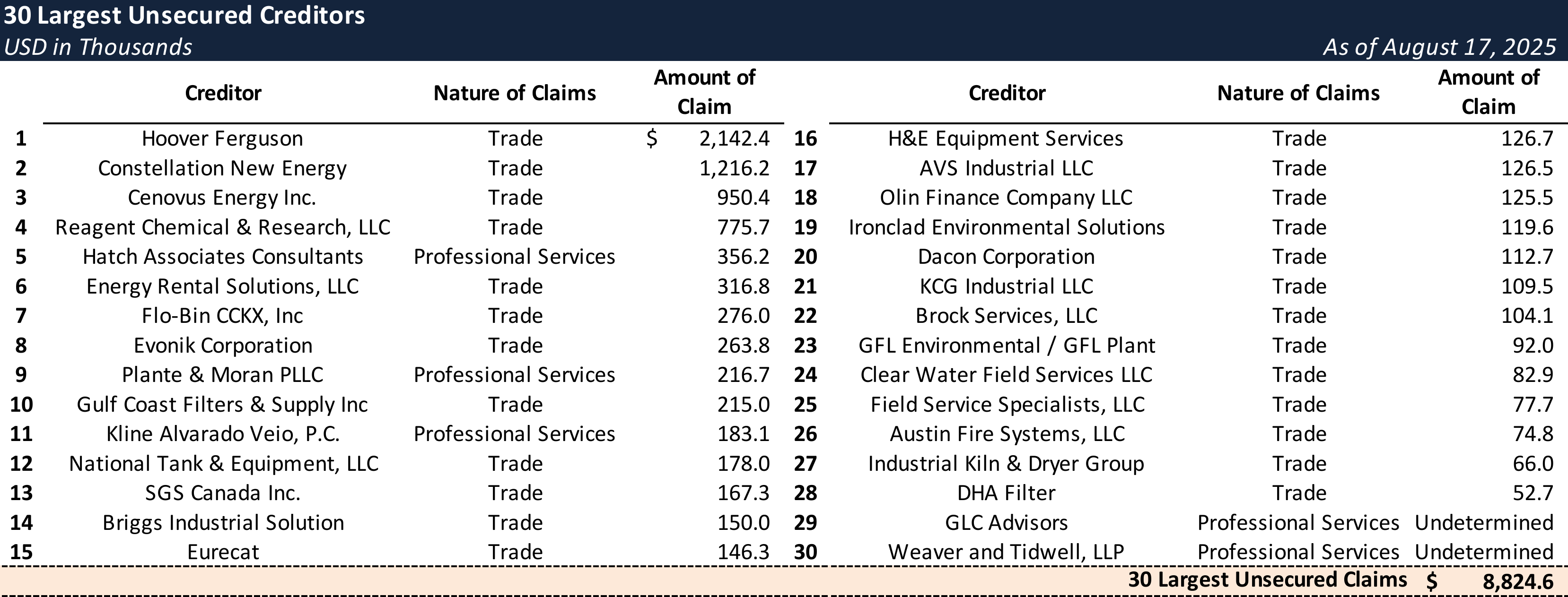

Top Unsecured Claims

Key Parties

Local Bankruptcy Counsel:

- Jason L. Boland

- Norton Rose Fulbright US LLP

- Email: [email protected]

Bankruptcy Counsel:

- Morrison & Foerster LLP

Financial Advisor / CRO:

- Ankura Consulting Group, LLC (Roy Gallagher)

Investment Banker:

- Jefferies LLC

Claims Agent:

Equity Security Holders:

- GM-FTAI HoldCo LLC – 100% Equity Interest

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.