Filing Alert: AmplifyBio Chapter 11

AmplifyBio Files Chapter 11 in Southern District of Ohio

AmplifyBio, LLC and its debtor affiliate⁽¹⁾ (collectively, "AmplifyBio" or the "Company"), a West Jefferson, OH-based contract research and manufacturing organization specializing in advanced therapies including cell and gene therapies, mRNA, and gene editing technologies, filed for Chapter 11 protection on May 16 in the U.S. Bankruptcy Court for the Southern District of Ohio.

The filing follows mounting liquidity pressures stemming from aggressive expansion efforts that outpaced revenue generation. After spinning out of Battelle Memorial Institute ("Battelle") in 2021, AmplifyBio invested heavily in a 350,000-square-foot manufacturing facility in New Albany, OH, and acquired cell therapy assets from PACT Pharma. However, escalating losses—$26 million in 2022, $56 million in 2023, and $74 million in 2024—drained liquidity, leaving the Company with just $3 million in cash and over $30 million in unsecured obligations by early 2025.

AmplifyBio began cost-cutting in late 2024, closing its San Francisco site and cutting 25% of its Ohio workforce. In February 2025, it defaulted on a $28 million secured loan, later assigned to Battelle, now its prepetition secured lender and majority equity holder. By April 2025, the Company ceased operations, laid off all staff, and began asset liquidation, including its ~300 non-human primates in late April. With no viable going-concern sale, AmplifyBio plans a Section 363 sale of its West Jefferson real estate, equipment, and IP, funded by a proposed $2.5 million DIP loan from Battelle.

AmplifyBio, LLC reports $100 million to $500 million in assets and $50 million to $100 million in liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The case number is 25-52140.

⁽¹⁾ ADOC SSF, LLC.

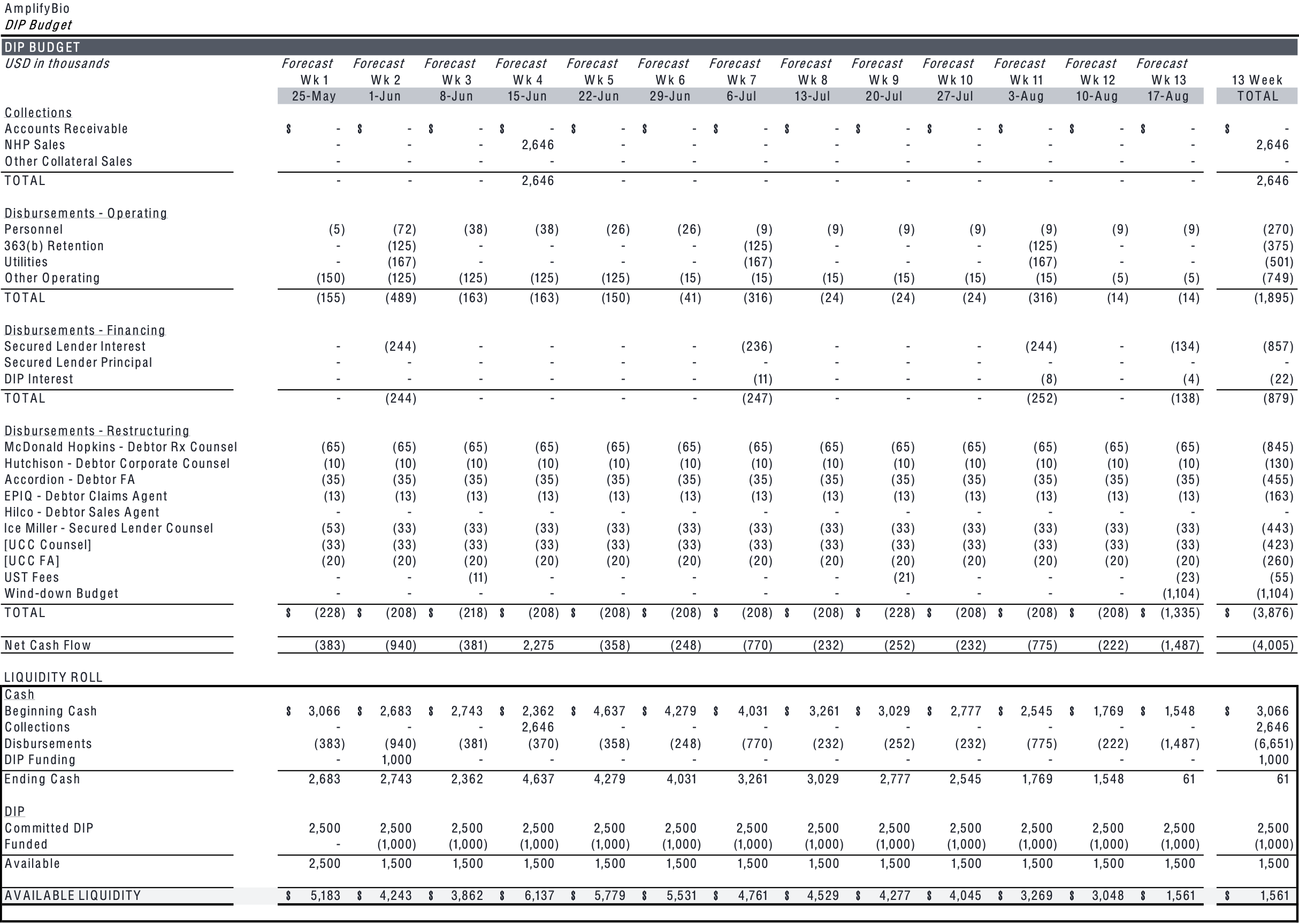

Initial DIP Budget

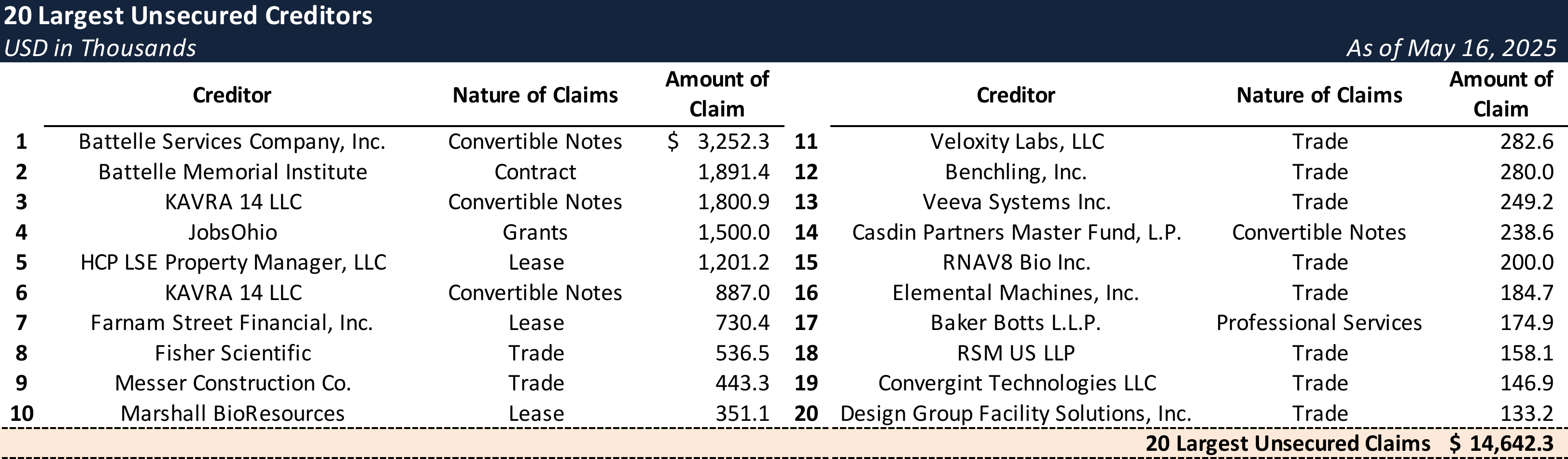

Top Unsecured Claims

Key Parties

Counsel:

- Scott N. Opincar

- McDonald Hopkins LLC

- Email: [email protected]

Co-Counsel:

- Hutchison PLLC

Signatories:

- Kasey Rosado (Accordion) – Chief Restructuring Officer

Claims Agent:

Equity Security Holders:

- Battelle Services Company, Inc. – 10,000,000 Class A Units

- KAVRA 14 LLC – 6,250,000 Class A Units

- Casdin Partners Master Fund, L.P. – 2,000,000 Class A Units

- Other Members – 1,250,000 Class A Units

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.