Case Summary: Anthology Chapter 11

Anthology has filed for Chapter 11 bankruptcy to execute a pre-arranged breakup of the company, driven by an unsustainable debt load from its Blackboard merger and subsequent performance declines, supported by $100 million in DIP financing.

Business Description

Headquartered in Boca Raton, FL, Anthology Inc., along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, "Anthology" or the "Company"), is a leading global provider of education technology ("EdTech") software and services, primarily serving the higher education market. The Company offers a comprehensive, cloud-based suite of solutions designed to manage the entire student lifecycle, from recruitment and enrollment to teaching, learning, and alumni engagement.

- Anthology’s end-to-end ecosystem includes its flagship learning management system (LMS), Blackboard Learn; a student information system (SIS) with enterprise resource planning capabilities, Anthology Student; and a constituent relationship management (CRM) platform, Anthology Reach.

- In addition to its software products, the Company provides managed services such as advising, enrollment management, and IT help desk support to enhance student outcomes and institutional effectiveness.

Anthology delivers its solutions primarily through a recurring software-as-a-service (SaaS) subscription model, supplemented by implementation and managed services fees. The Company serves a global client base of academic, business, and government institutions in more than 80 countries, with millions of learners and educators utilizing its platform.

For the fiscal year 2025, Anthology generated approximately $450 million in revenue but reported adjusted EBITDA of only $4 million, reflecting a significant decline in profitability amid intense competitive pressures and high fixed costs.

Anthology Inc. and certain affiliates filed for Chapter 11 protection on September 29, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the Southern District of Texas, reporting $1 billion to $10 billion in both assets and liabilities.

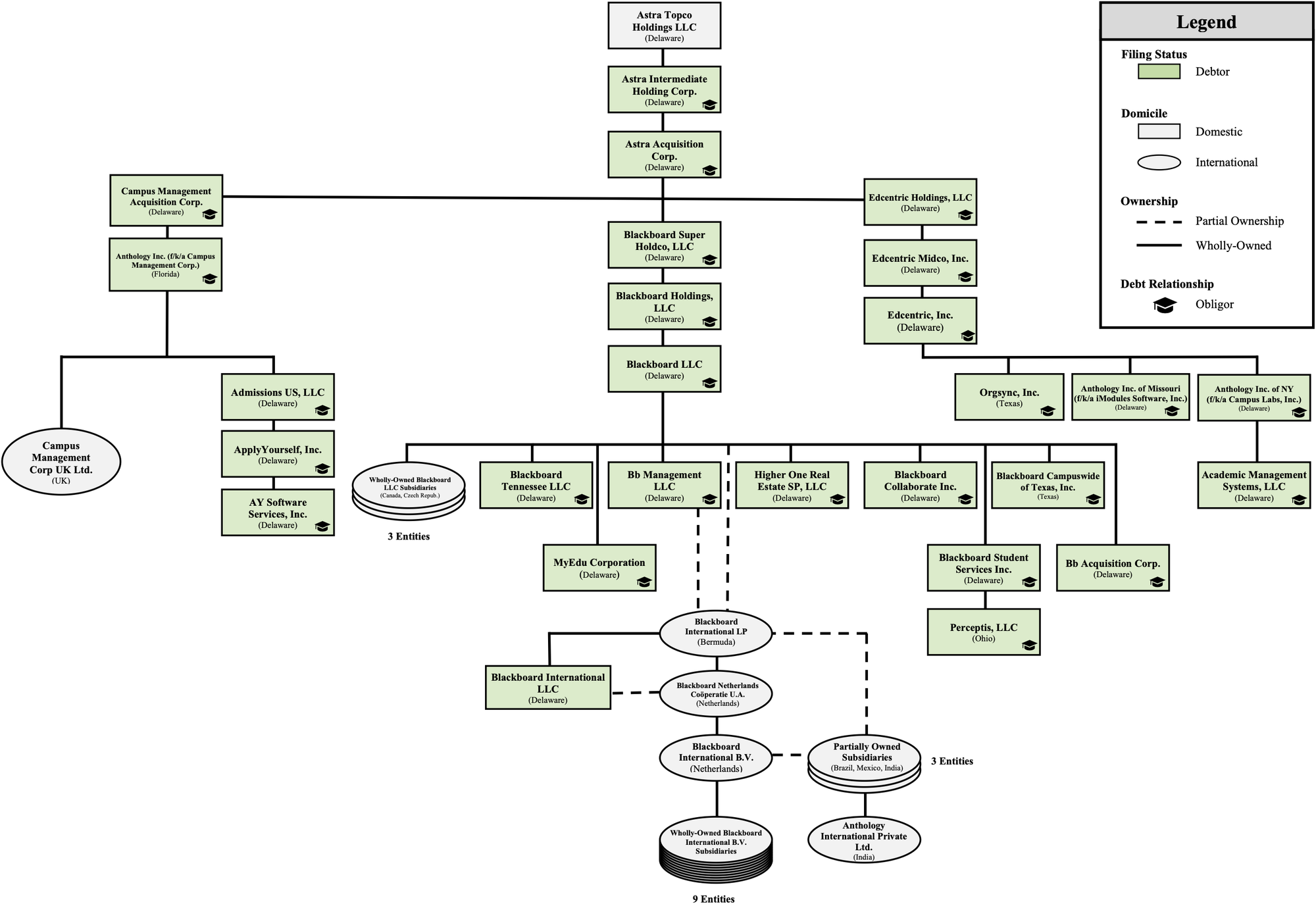

⁽¹⁾ For a complete list of Debtor entities, see organizational structure chart below.

Corporate History

Anthology was formed in July 2020 through a strategic combination engineered by private equity firm Veritas Capital, with co-investor Leeds Equity Partners. The transaction merged three distinct EdTech companies—Campus Management (student information systems), Campus Labs (student engagement tools), and iModules (alumni management software)—to create a unified provider with a broad product portfolio serving over 2,100 institutions.

Transformational Merger with Blackboard

- In a transformational deal completed on October 25, 2021, Anthology merged with Blackboard Inc., a globally recognized leader in the LMS market.

- The merger dramatically expanded Anthology’s scale and product offerings, creating one of the world's largest EdTech ecosystems, supporting over 150 million users across 80 countries.

- Following the transaction, Veritas Capital held a majority stake in the combined entity, with Leeds Equity Partners and Blackboard’s prior majority owner, Providence Equity Partners, retaining minority equity positions.

Strategic Refinements and Leadership

- To sharpen its focus on its core higher education platforms, Anthology executed several strategic divestitures in 2022:

- In May, it sold its synchronous classroom tool, Blackboard Collaborate, to Class Technologies.

- In September, it divested its K-12 Community Engagement division to Finalsite.

- In August 2023, Bruce Dahlgren was appointed CEO, succeeding Jim Milton, to guide the company through its next phase of growth and address mounting operational and financial challenges.

While this acquisition-led strategy established Anthology as a comprehensive EdTech platform, it also created a complex organization burdened by significant integration challenges and a heavy debt load, which ultimately precipitated its financial restructuring.

Corporate Organizational Structure

Operations Overview

Anthology operates a global business with approximately 3,250 employees. Its U.S. operations, which encompass roughly 1,550 staff, are the subject of the Chapter 11 filing, while its international subsidiaries in Europe, Asia, and Latin America are non-Debtor affiliates.

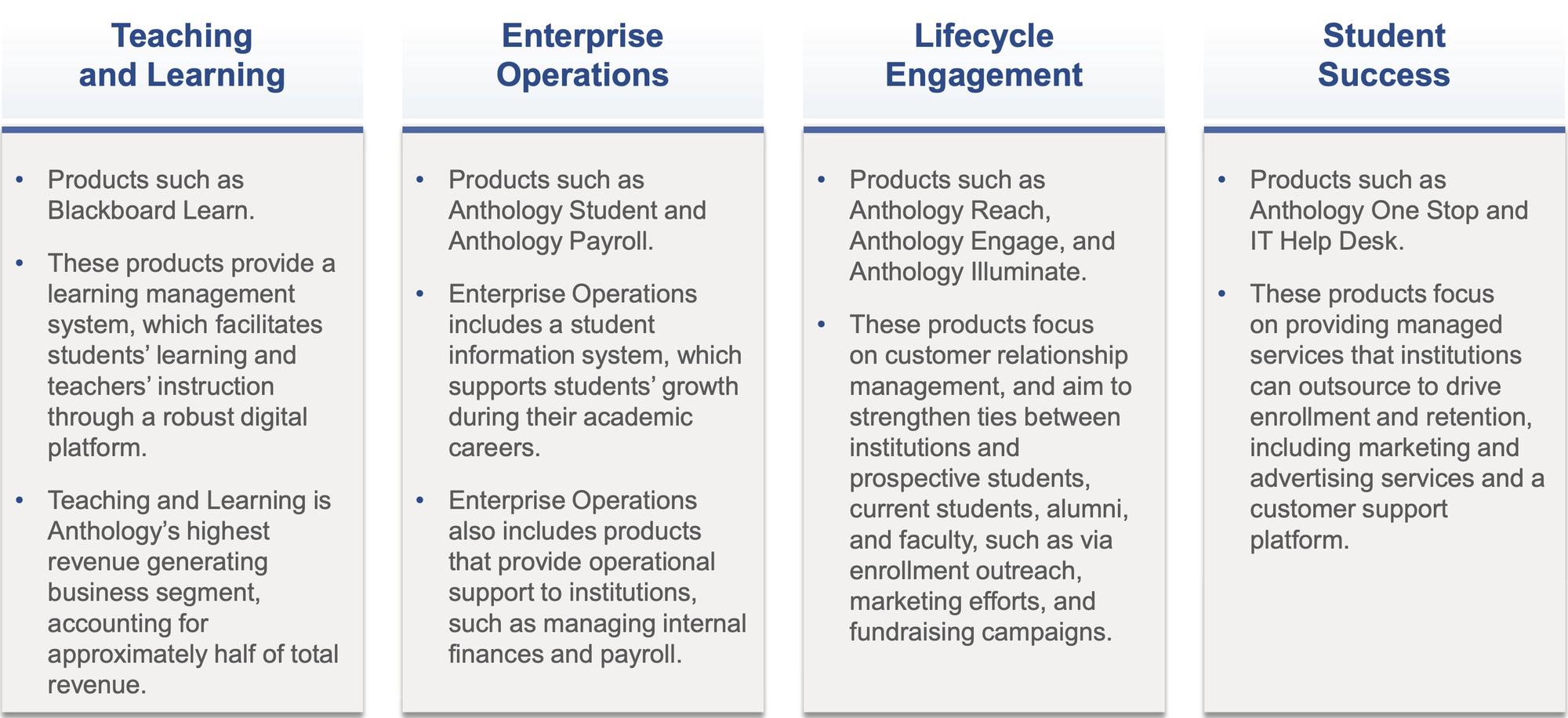

Business Segments

The Company’s operations are organized across four primary business segments, which collectively generated approximately $450 million in revenue in fiscal year 2025:

- Teaching & Learning: The Company’s highest-revenue-generating segment, serving academic institutions, businesses, and government agencies.

- Its primary products are Blackboard Learn, an LMS that accounts for approximately $240 million in annual revenue (roughly half of the Company’s total), and Anthology Ally, a digital accessibility platform generating approximately $26 million in annual revenue.

- Enterprise Operations: Provides a software platform for managing institutional administrative functions and day-to-day operations.

- The flagship product is Anthology Student, a cloud-based SIS with embedded ERP capabilities.

- This segment generated over $100 million in revenue in FY’25 from approximately 300 customers.

- Lifecycle Engagement: Manages a learner’s journey from recruiting and enrollment through alumni relations.

- This segment, which generated approximately $55 million in annual revenue in FY’25, includes Anthology Reach, a higher-education CRM built on Microsoft Dynamics 365.

- Student Success: Offers managed services that institutions can outsource to drive enrollment and retention, including marketing support, student advising, and technical support.

FY 2025 Financial Performance

By fiscal year 2025, Anthology's financial condition had deteriorated significantly, driven by customer attrition and operational pressures.

- Revenue declined by nearly $80 million over the preceding two years to approximately $450 million.

- Profitability collapsed, with adjusted EBITDA plummeting to approximately $4 million from nearly $33 million in FY 2023, while gross profit margins compressed from 57% to 55%.

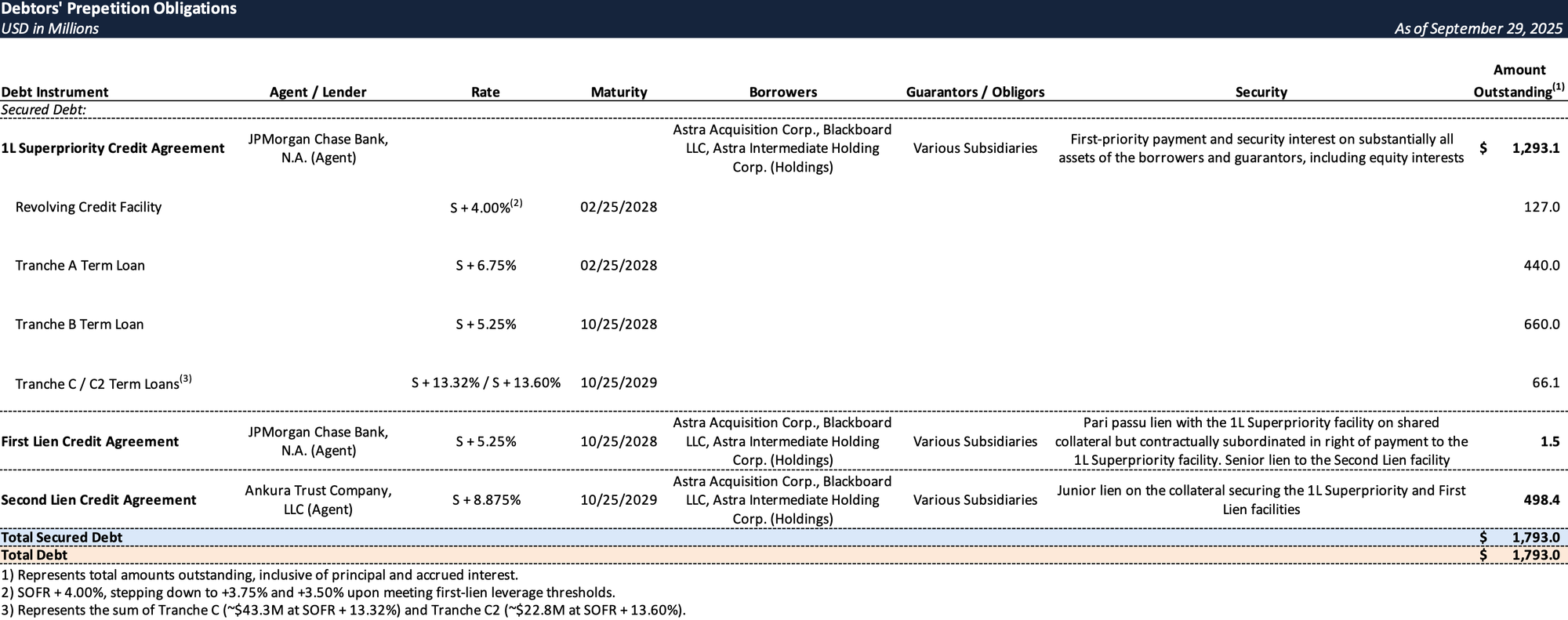

- The Company’s minimal operating cash flow was insufficient to service its debt, which required approximately $185 million in annual cash interest payments following a 2024 refinancing. This unsustainable financial position and ongoing cash burn necessitated a comprehensive balance sheet restructuring.

Prepetition Obligations

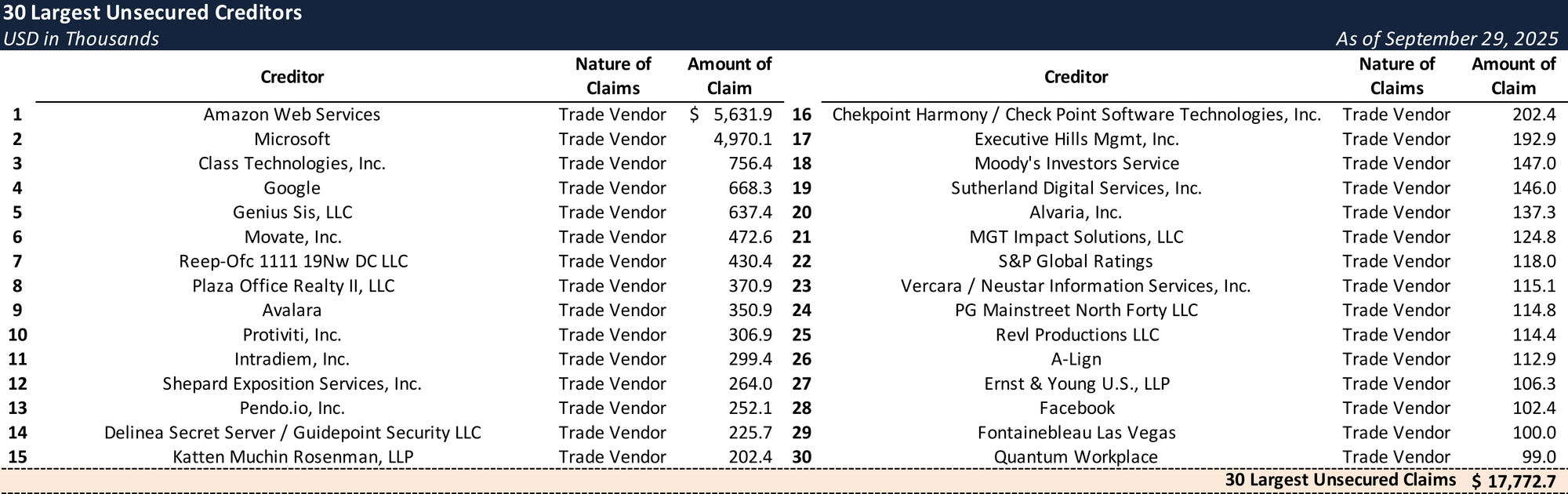

Top Unsecured Claims

Events Leading to Bankruptcy

Post-Merger Challenges and Competitive Pressures

- The rapid integration of multiple legacy companies, particularly the 2021 Blackboard merger, created significant operational complexity and an inflated cost structure. Anthology struggled to consolidate disparate software platforms and inherited overlapping teams, delaying the realization of anticipated synergies.

- While the Company was focused internally on integration, intense competition from market participants, including Instructure (Canvas) and Ellucian, eroded its market share. This led to significant customer attrition and a corresponding top-line decline of approximately $80 million between 2023 and 2025.

Unsustainable Capital Structure and Refinancing Efforts

- Anthology’s highly leveraged balance sheet, a product of its debt-funded acquisition strategy, became unsustainable amid declining revenues.

- To address looming debt maturities and a pending liquidity shortfall, the Company executed a superpriority financing transaction in the spring of 2024. The deal infused ~$250 million in new money and extended most debt maturities to 2028, providing a temporary lifeline.

- However, the refinancing failed to address the underlying operational weaknesses, and the Company’s financial performance continued to deteriorate throughout 2024.

Liquidity Crisis and Default Events

- To preserve dwindling cash, Anthology began skipping debt service payments, including a second-lien interest payment on Dec. 31, 2024, and a first-lien interest payment on March 31, 2025.

- These defaults prompted negotiations with lenders, resulting in forbearance agreements that temporarily prevented enforcement actions while the Company explored strategic alternatives.

- The liquidity crisis was exacerbated in March 2025 when a lender, Vector Capital, failed to fund its ~$18.5 million portion of a $100 million revolver draw, further constraining the Company's cash position.

Strategic Alternatives and Path to Chapter 11

- In early 2025, Anthology engaged PJT Partners, Kirkland & Ellis, and FTI Consulting to advise on a strategic review process, which included a comprehensive effort to market the Company for sale.

- The sale process, initiated in April 2025, revealed that a breakup of the company would likely maximize value. The Company identified stalking horse bidders for several of its business lines:

- Ellucian Company, L.L.C. for the Enterprise Operations segment.

- Encoura, LLC for the combined Lifecycle Engagement and Student Success segments.

- Concurrently, Anthology negotiated a Restructuring Support Agreement (RSA) with an ad hoc group of its first-lien lenders and its equity sponsor, Veritas Capital. The RSA provides a framework for the asset sales and a balance sheet reorganization of the remaining Teaching & Learning business.

- With a pre-arranged plan in place, the Board determined that a Chapter 11 filing was the optimal path to implement the transactions. To fund operations during the cases, the ad hoc lender group committed to a $100 million DIP financing facility, including $50 million in new money.

Key Parties

- Haynes & Boone, LLP (local bankruptcy and conflict matters counsel); Kirkland & Ellis LLP and Kirkland & Ellis International LLP (bankruptcy counsel); PJT Partners LP (investment banker); FTI Consulting, Inc. (financial advisor / CRO, Heath C. Gray); Stretto Inc. (claims agent).

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.