Filing Alert: Anthology Chapter 11

Anthology Files Chapter 11 in Southern District of Texas

Update (Sept. 30, 2025): A comprehensive case summary is now available for the Chapter 11 bankruptcy filing of Anthology.

Anthology Inc. and its debtor affiliates⁽¹⁾, a Boca Raton, FL-based provider of education technology software and services, filed for Chapter 11 protection on Sep. 29 in the U.S. Bankruptcy Court for the Southern District of Texas.

The prearranged filing aims to implement a dual-track restructuring through a Restructuring Support Agreement (RSA) with key stakeholders including an ad hoc group of lenders holding a majority of its 1L superpriority debt and its equity sponsor, Veritas Capital. The plan follows a five-month prepetition marketing process led by PJT that resulted in two stalking horse bids: one from Ellucian Company LLC for the Enterprise Operations segment, and another from Encoura, LLC for the Lifecycle Engagement and Student Success segments. The remaining Teaching & Learning business segment will be reorganized into a new go-forward enterprise with a debt-free balance sheet.

To fund the cases and sale process, the debtors have secured a $100 million superpriority priming DIP facility from members of the ad hoc group, comprising $50 million in new money and a $50 million roll-up of prepetition Tranche A loans.

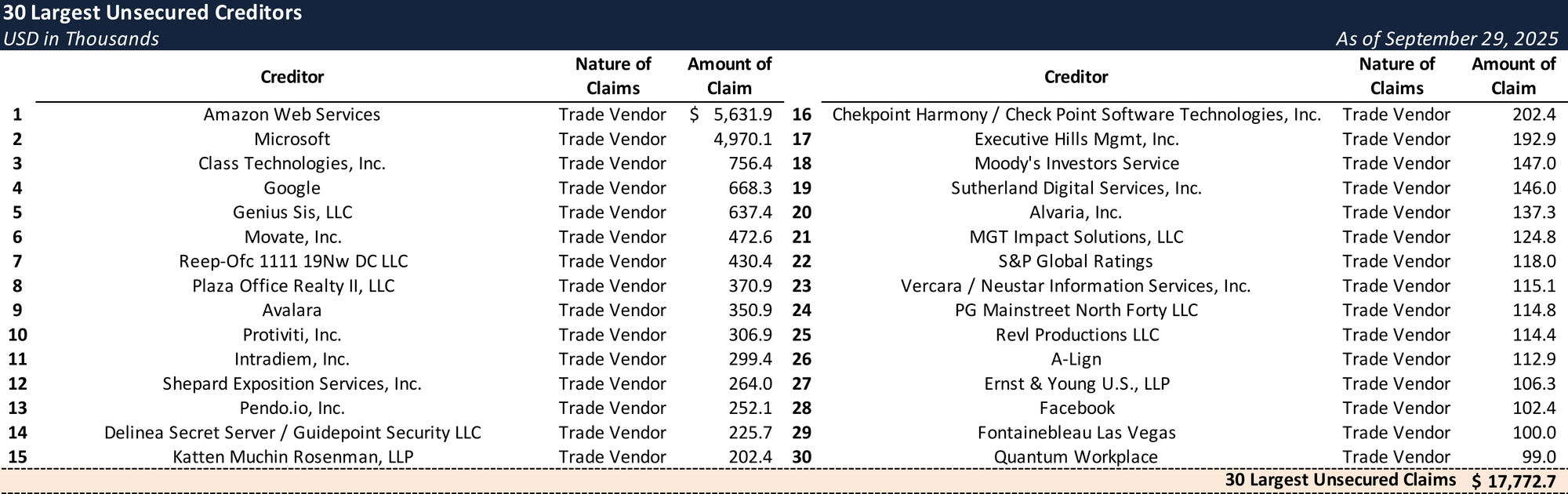

The company reports $1 billion to $10 billion in both assets and liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The case number is 25-90498.

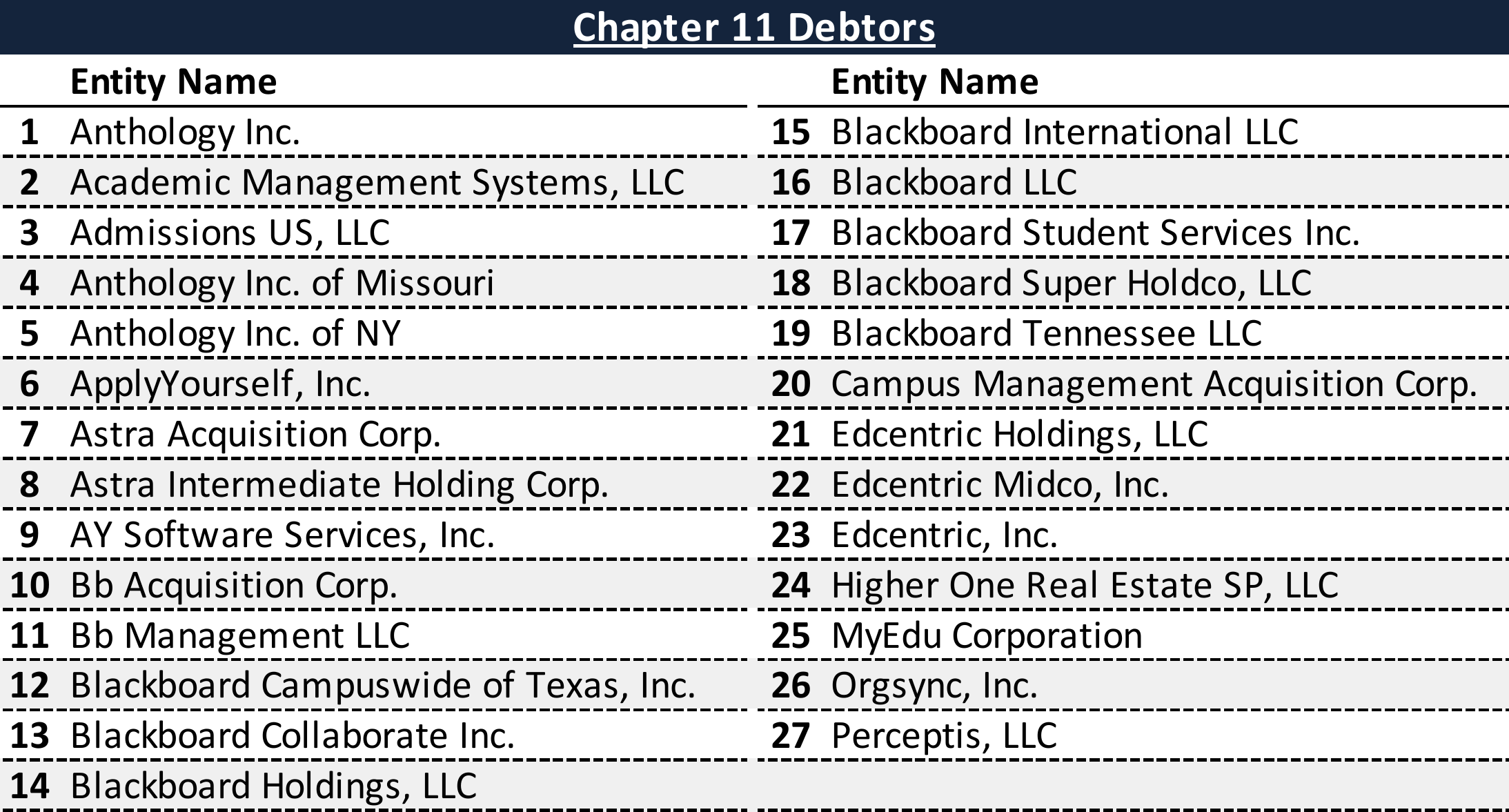

⁽¹⁾ For a complete list of debtor entities, see the Chapter 11 Debtors table.

Chapter 11 Debtors

Top Unsecured Claims

Key Parties

Local Bankruptcy and Conflict Matters Counsel:

- Charles A. Beckham, Jr.

Haynes & Boone, LLP

Email: [email protected]

Bankruptcy Counsel:

- Kirkland & Ellis LLP

- Kirkland & Ellis International LLP

Investment Banker:

- PJT Partners LP

Financial Advisor / CRO:

- FTI Consulting, Inc. (Heath C. Gray)

Claims Agent:

Equity Security Holders:

- Campus Management Acquisition Corp. – 100% Equity Interest

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.