Case Summary: Arch Therapeutics Chapter 11

Arch Therapeutics has filed for Chapter 11 bankruptcy following chronic losses and failed capital-raising efforts, seeking a court-supervised asset sale amid a DIP financing dispute.

Business Description

Headquartered in Framingham, MA, Arch Therapeutics, Inc. ("Arch"), along with its wholly-owned subsidiary Arch Biosurgery, Inc. ("ABS," collectively the "Company" or the "Debtors"), is a commercial-stage medical device company focused on developing and marketing wound care and hemostasis products based on its proprietary AC5® self-assembling peptide technology platform.

- The Company's lead product, AC5® Advanced Wound System ("AC5"), is an FDA-cleared (510(k)) synthetic, acellular peptide hydrogel designed to manage complex chronic and acute wounds, including diabetic foot ulcers (DFUs), venous leg ulcers, pressure ulcers, and surgical wounds.

- AC5 self-assembles in situ after application, forming a protective, biocompatible nano-peptide barrier that integrates with tissue, provides a scaffold for healing, modulates inflammation, and mitigates contamination.

- The technology is differentiated by its ability to conform to irregular wound geometries and allow for manipulation through the material ("Crystal Clear Surgery™").

- Arch has also invested in developing variants for internal surgical sealant and hemostasis applications.

Since inception, the Company has focused resources primarily on research and development, intellectual property, commercialization efforts, and fulfilling public company obligations. This capital-intensive process has resulted in a substantial accumulated deficit ($72.6M as of 6/30/24) and insufficient revenue generation ($108.6K for the 9 months ended 6/30/24) to cover operating expenses.

The Debtors filed for Chapter 11 protection on April 18, 2025, in the U.S. Bankruptcy Court for the District of Massachusetts. As of the Petition Date, the Debtors reported $1 million to $10 million in assets and $10 million to $50 million in liabilities.

Corporate History

The Company's origins date back to 2006 with the founding of Clear Nano Solutions, Inc., a Massachusetts startup focused on self-assembling biomaterials. It was renamed Arch Therapeutics, Inc. (Massachusetts) in 2008.

- 2013 Restructuring & Public Listing: Through a three-way reverse merger on June 26, 2013, involving Almah, Inc. (a Nevada corporation founded in 2009), Arch Acquisition Corp., and the original Massachusetts-based Arch entity, the current structure was formed.

- Almah, Inc. became the public parent company, renamed Arch Therapeutics, Inc. (Nevada), and adopted the business plan of the Massachusetts entity.

- The original Massachusetts entity was renamed Arch Biosurgery, Inc. ("ABS") and became the wholly-owned operating subsidiary.

- Following the merger, the Company focused on the AC5 platform and its stock began trading on OTC markets (symbol ARTH).

- Leadership: Co-founder Dr. Terrence Norchi has served as CEO. The Company maintained a small management team, experiencing recent turnover in finance leadership, including the resignation of CFO Michael Abrams in February 2025.

- Failed Uplisting Efforts: For several years, Arch pursued an uplisting to a national exchange (Nasdaq/NYSE) to improve access to capital.

- On January 9, 2023, the board approved a 1-for-200 reverse stock split (effective January 17, 2023) to facilitate this effort.

- Despite multiple attempts and related costs, the Company never achieved a national exchange listing, which was a covenant in certain debt agreements and a significant strategic setback.

- Going Concern Warnings: Company auditors expressed substantial doubt about its ability to continue as a going concern in both the FY2022 and FY2023 10-K filings due to recurring losses, negative cash flows, accumulated deficit, and reliance on external financing.

Operations Overview

Arch operates as a lean, commercial-stage medical device company primarily focused on the clinical development, regulatory maintenance, and limited commercialization of its AC5 product line. As of the Petition Date, the Debtors employed only one full-time salaried employee, supported by consultants and advisors.

Product Portfolio & Technology

- AC5® Advanced Wound System: Primary commercial product; FDA 510(k) cleared (Dec 2018). Class II medical device (US).

- AC5® Topical Hemostat: CE-marked in Europe (Apr 2020). Class IIb medical device (EU).

- Pipeline: AC5-G™, AC5-V®, AC5® Surgical Hemostat (investigational devices).

- Technology Platform: Proprietary self-assembling peptides (SAPs).

Operational Model & Assets

- Outsourced Model: R&D, cGMP manufacturing, regulatory affairs primarily via contractors. Maintained ISO 13485 certification.

- Intellectual Property: ABS owned patents/applications; Arch held trademarks. Key IP licensed from MIT.

- MIT License Agreement: Critical exclusive and non-exclusive licenses required annual maintenance fees and potential royalties. Approximately $252k was owed under this agreement at the Petition Date.

- Tangible Assets: Primarily inventory ($1.3M-$1.4M book value in late 2023/mid-2024).

- Facilities: Leased office space in Framingham, MA (month-to-month from April 2022).

Commercial Strategy & Market Access

- Limited US Launch: Focused on AC5® Advanced Wound System sales in physician offices, ambulatory settings, and government channels (VA/DoD).

- Distribution Partnerships: Utilized Lovell Government Services (for federal access) and Centurion Therapeutics (broader network).

- Clinical Validation: Conducted preclinical and early human studies; initiated a multi-site trial (Sept 2022).

- Reimbursement: Secured dedicated HCPCS code A2020, effective April 1, 2023. While revenue increased modestly in the nine months ended June 30, 2024 ($109k vs $36k prior year), attributed partly to the new code, it remained insufficient to sustain operations.

Prepetition Obligations

- The Debtors are encumbered by four blanket-lien UCC-1 filings: two filed by Oasis Capital, LLC (reportedly assigned to Tiburon Opportunity Fund LP) in July 2022, and two filed by Brandt and Mona Wilson in April 2024. The Oasis and Wilson filings cover all assets of each Debtor. The Debtors did not disclose the face amount, maturity, or interest rate of the obligations secured by these liens in their Chapter 11 filings.

- The Debtors also received a $120,476 prepetition secured bridge loan from the Vivex Biologics, Inc. ("Vivex"), secured by liens junior to the existing UCC-1 filings.

- The latest available Form 10-Q, for the period ended June 30, 2024, reported approximately $6.7M in senior secured convertible notes, $2.7M in unsecured convertible notes, and $1.2 million in accrued interest.

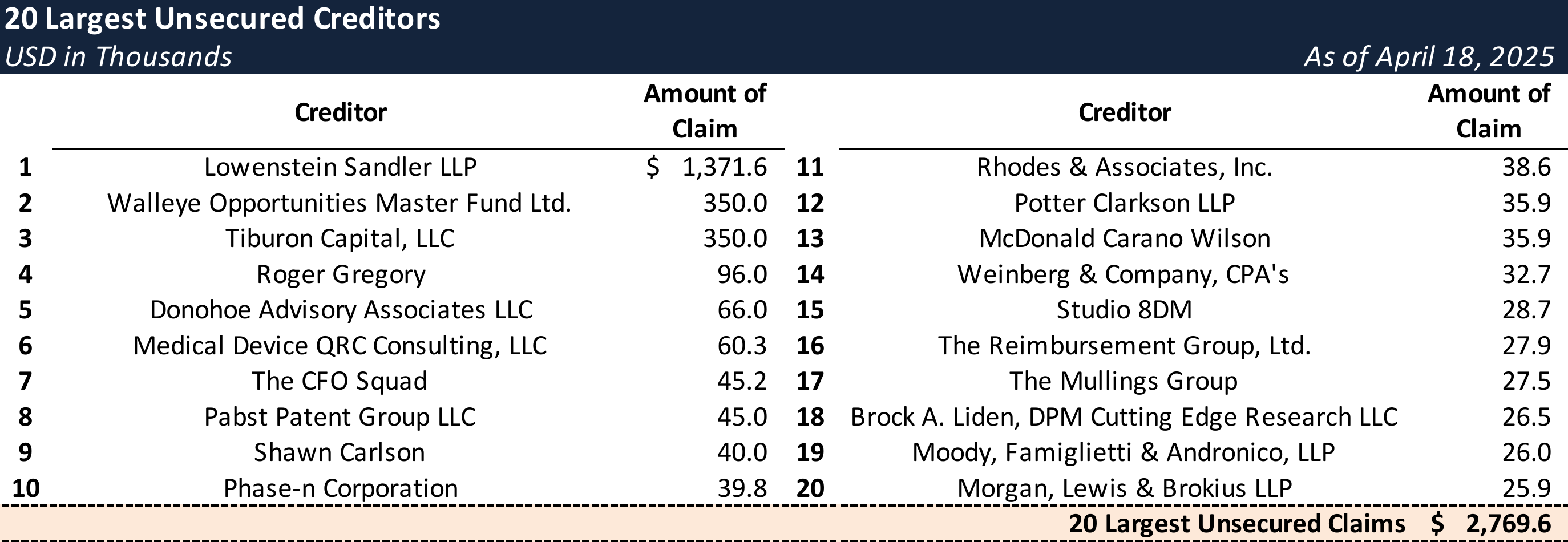

Top Unsecured Claims

Events Leading to Bankruptcy

The Debtors' Chapter 11 filing resulted from a prolonged inability to generate sufficient revenue to cover operating expenses, compounded by failed capital-raising initiatives and an increasingly burdensome debt structure.

Chronic Financial Underperformance & Cash Burn

- The Company consistently generated negligible revenue (e.g., $15.7k in FY2022, $75.7k in FY2023) while incurring significant net losses ($5.3M in FY2022, $7.0M in FY2023).

- Operations were capital-intensive, focused on R&D, IP protection, commercialization efforts, and public company costs, resulting in substantial accumulated deficits. Operating cash burn was approximately $3.4M in FY2023.

- Cash reserves dwindled significantly, reaching approximately $30k by June 30, 2024.

Failed Capital Raising and Uplisting Efforts

- The business plan relied heavily on infusions of investment capital for commercial launch and expansion, which ultimately did not materialize sufficiently.

- Multiple attempts to raise capital through equity offerings and strategic partnerships were unsuccessful.

- Discussions with potential strategic partners often stalled due to factors like reimbursement uncertainties in the broader wound care market (affecting counterparties) or the counterparties' own capital constraints.

- The persistent failure to uplist the Company's stock from OTC markets to Nasdaq or the NYSE severely limited access to broader capital markets and institutional investors.

Convertible Debt Burden

- Operations were primarily funded through numerous issuances of convertible notes and warrants between 2018-2024, often at deep discounts and carrying high interest rates (~10%).

- Convertible notes issued in July 2022 for ~$3.5M contained covenants requiring the Company to pursue the national exchange uplisting by February 15, 2023, later extended to April 30, 2024.

- Failure to achieve the uplist made servicing these (and subsequent) notes increasingly challenging and onerous.

- The Company incurred substantial legal and financing costs (approx. $1.6M over 18 months starting Jan 2023) supporting S-1 filings, processing convertible notes, managing maturity extensions, and meeting SEC disclosure requirements.

- By late 2024 / early 2025, existing noteholders became increasingly reluctant or unable to provide further financing on viable terms.

Liquidity Crisis and Chapter 11 Filing

- By early 2025, the Debtors had exhausted all cash reserves and were unable to meet payroll or other critical obligations. Operations were reduced to one unpaid full-time employee and essential consultants.

- On April 18, 2025, Arch Therapeutics, Inc. and Arch Biosurgery, Inc. filed for Chapter 11 protection in the U.S. Bankruptcy Court for the District of Massachusetts (Case No. 25-40409).

- The stated purpose of the Chapter 11 filing is to conduct a court-supervised sale process for the Debtors' assets (IP, regulatory approvals, inventory) to maximize value for creditors.

Contested DIP Financing & Competing Bid

- Post-petition, the Debtors sought approval for a $2M priming DIP financing facility from Vivex Biologics.

- Senior secured lenders (Oasis Capital, Wilsons, et al., the "Lender Group") objected, arguing the priming liens lacked adequate protection, included an improper "roll-up" of junior Vivex debt, and that the Debtors failed to seek financing from the senior lenders first.

- The Lender Group offered an alternative DIP facility and challenged the Debtors' low asset valuation by submitting a competing stalking horse bid valued at approx. $4.35M (comprising credit bids of the alternative DIP and prepetition debt, plus cash for cures).

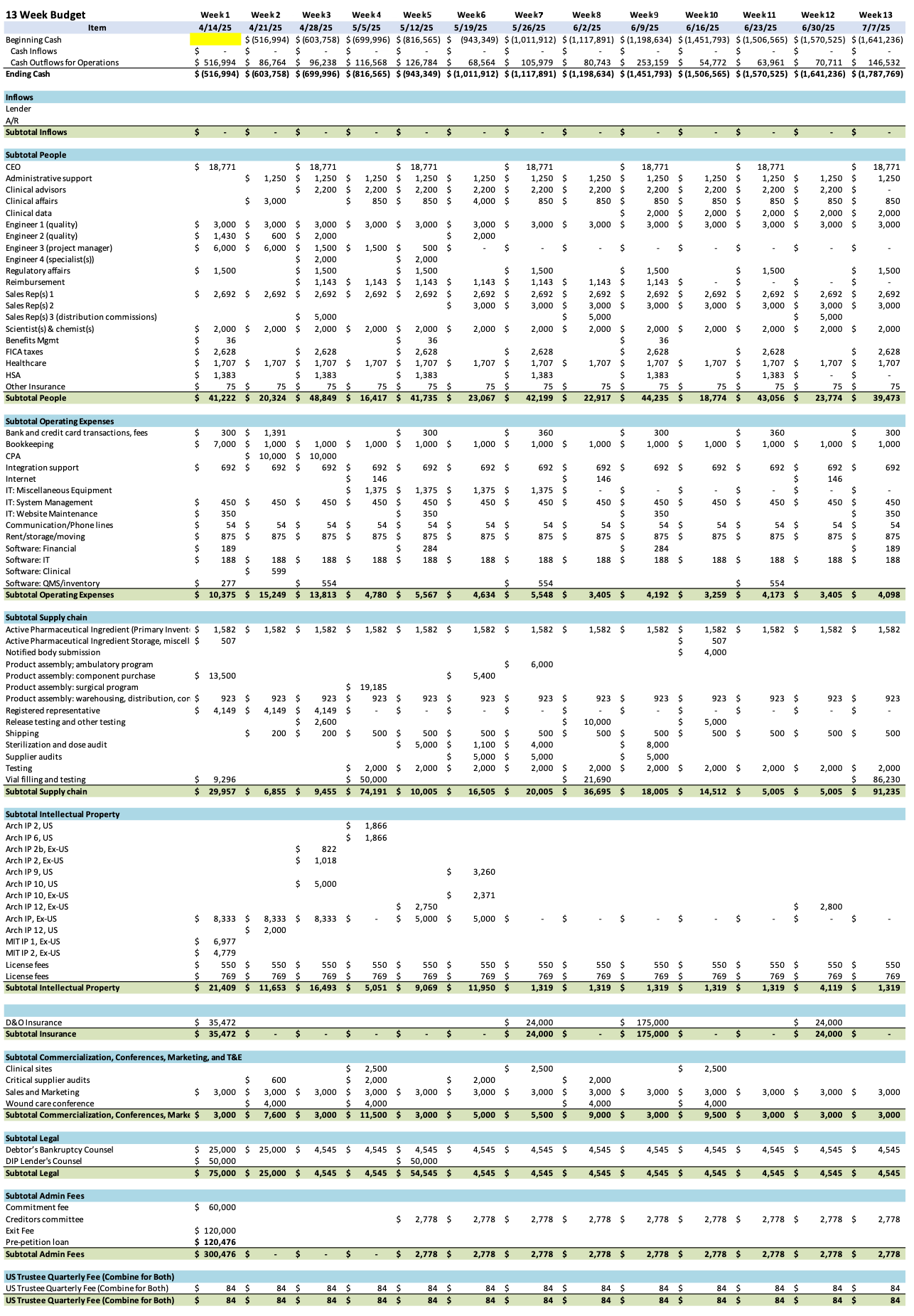

Initial DIP Budget

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.