Case Summary: Ascend Performance Materials Chapter 11

Ascend Performance Materials has filed for Chapter 11 bankruptcy amid nylon market headwinds, intensified Chinese competition, and operational disruptions, supported by lender-backed DIP financing.

Business Description

Headquartered in Houston, TX, Ascend Performance Materials Holdings Inc., along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, "Ascend" or the "Company"), is a leading, fully-integrated manufacturer of Nylon 6,6 (polyamide 66 or “PA66”) and its chemical precursors.

Ascend operates globally with regional offices in Shanghai, Brussels, and Detroit, and manufacturing facilities across North America, Europe, and Asia, employing approximately 2,200 people worldwide.

- The Company serves nearly 1,650 customers globally, supplying a portfolio of branded materials such as Vydyne® PA66 resins and various specialty chemicals and fibers.

- Its PA66 materials are utilized in diverse applications requiring impact, heat, abrasion, and chemical resistance, including:

- Automotive components (heating/cooling systems, airbags, tires, engine covers, radiators, fuel systems)

- Electrical equipment (electrical connectors, circuit breakers)

- Industrial fibers (airbag yarns, carpet fibers sold under names like Ultron™)

- Consumer goods and apparel (appliances, athletic apparel – notably used in approximately 50% of Lululemon Athletica Inc.’s “Nulu” yoga pants and sports bras)

- New technologies (electric vehicles, solar energy systems, batteries)

- Ascend holds significant market share in certain segments, composing approximately 40% of the global market for airbags and high-performance tires.

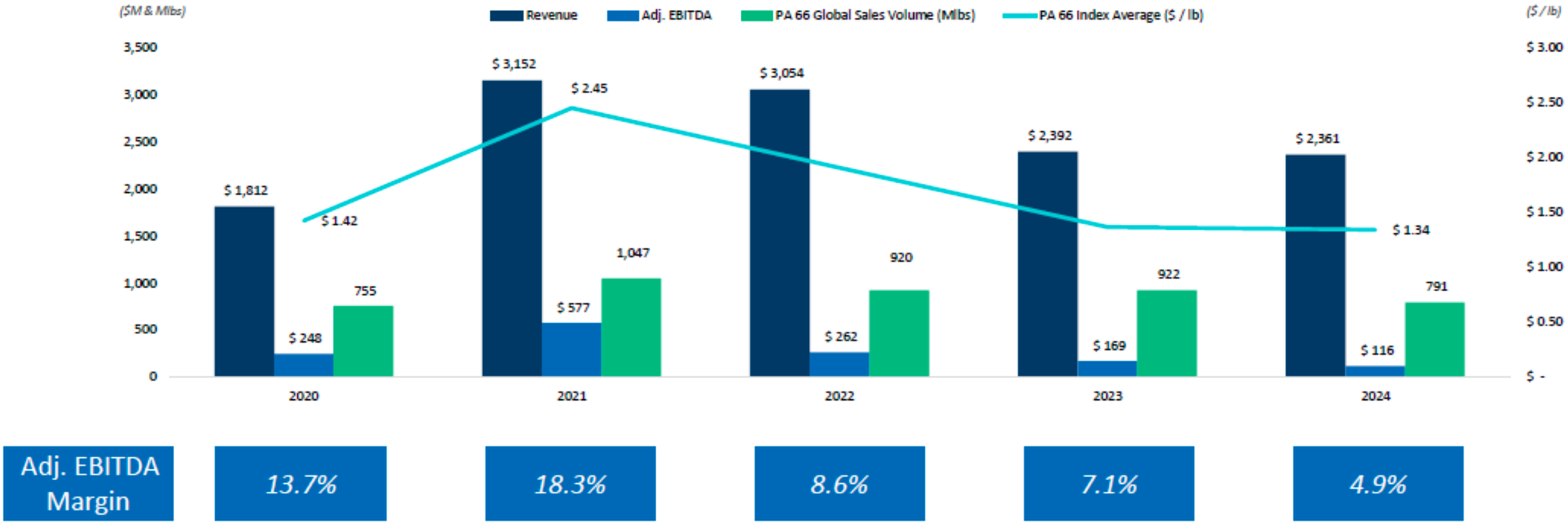

Since 2020, the Company has achieved average annual revenue of $2.7 billion. In 2024, sales were distributed geographically with approximately 41% in the Americas, 40% in Asia, and 19% in EMEAI.

The Debtors filed for Chapter 11 protection on April 21, 2025, in the U.S. Bankruptcy Court for the Southern District of Texas, reporting $1 billion to $10 billion in assets and liabilities as of the Petition Date.

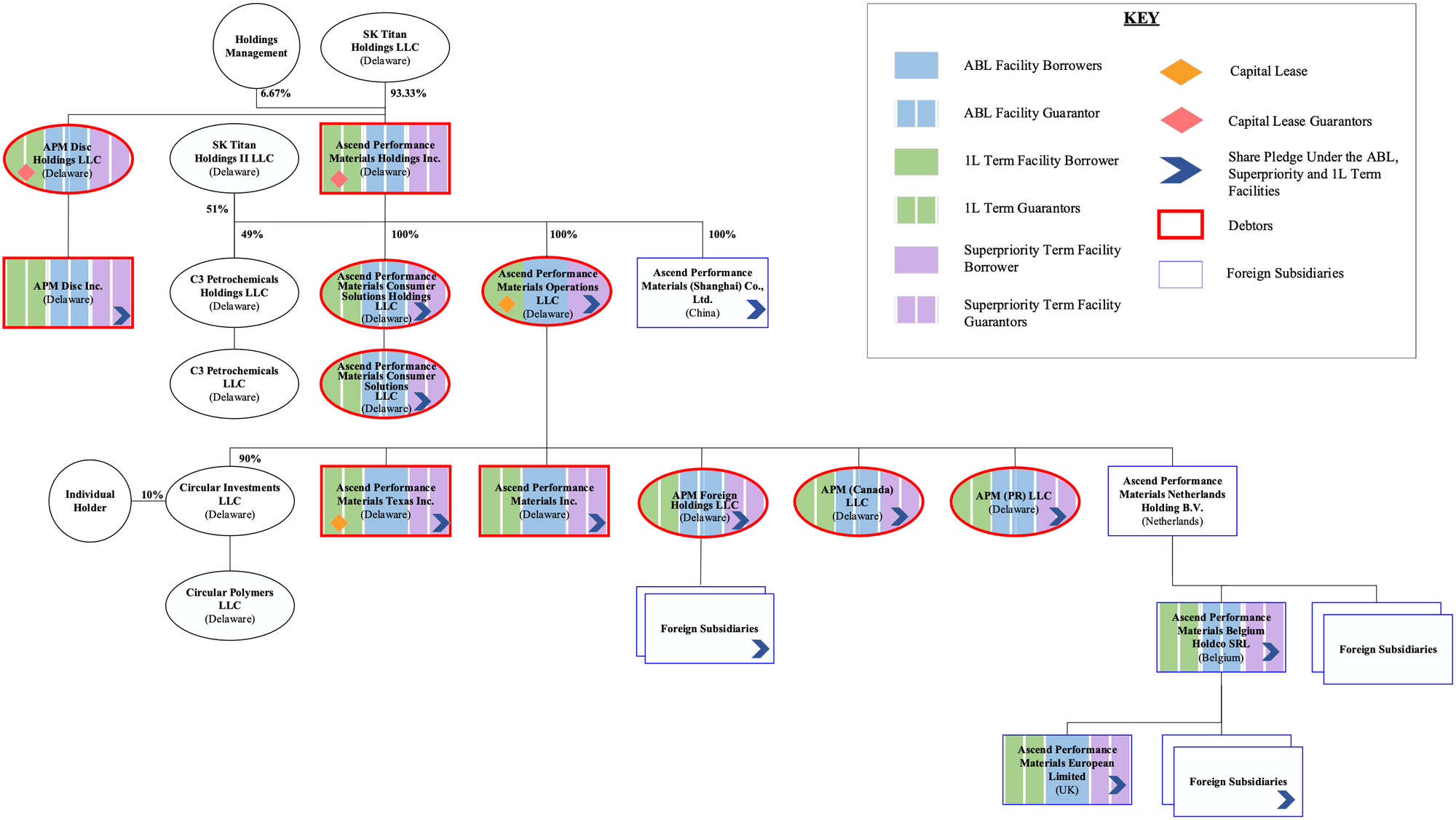

⁽¹⁾ For a complete list of Debtor entities, see the organizational structure chart below.

Corporate History

Ascend's origins trace back to the mid-twentieth century with Chemstrand Corporation, a joint venture between Monsanto Chemical Company (“Monsanto”) and American Viscose Corporation, established to produce nylon fibers licensed from DuPont.

- Chemstrand established the first fully-integrated U.S. nylon plant in Pensacola, FL, in 1953.

- Monsanto acquired Chemstrand in 1961, operating it as its chemicals division.

- In 1997, Monsanto spun off its industrial chemical and fibers divisions, including the nylon business, into an independent company, Solutia Inc. (“Solutia”).

Ascend Performance Materials, as it exists today, was formed in 2009 when SK Titan Holdings LLC, an affiliate of New York-based private equity firm SK Capital Partners, acquired the nylon business from Solutia for $50 million in cash. This acquisition carved out Ascend as an independent entity focused on polyamide production, providing capital and management focus to turn around the previously unprofitable business.

Global Expansion and Acquisitions

- Under SK Capital's ownership, Ascend pursued aggressive expansion:

- 2013: Expanded compounding capabilities in Pensacola, FL.

- 2018: Acquired a compounding facility in Tilburg, Netherlands (later closed in 2024).

- 2020: Acquired assets in Suzhou, China, and Poliblend/Esseti Plast in Mozzate, Italy. Also acquired Eurostar Engineering Plastics facility in Fosses, France (completed 2021).

- 2022: Acquired a compounding site in San Jose Iturbide, Mexico; purchased Formulated Polymers Limited in Chennai, India; and acquired Circular Polymers, a California-based recycler, marking a push into sustainable materials.

- 2024: Completed construction of its first non-U.S. chemical production facility in Lianyungang, China (Q3 2024).

Organizational Structure

Operations Overview

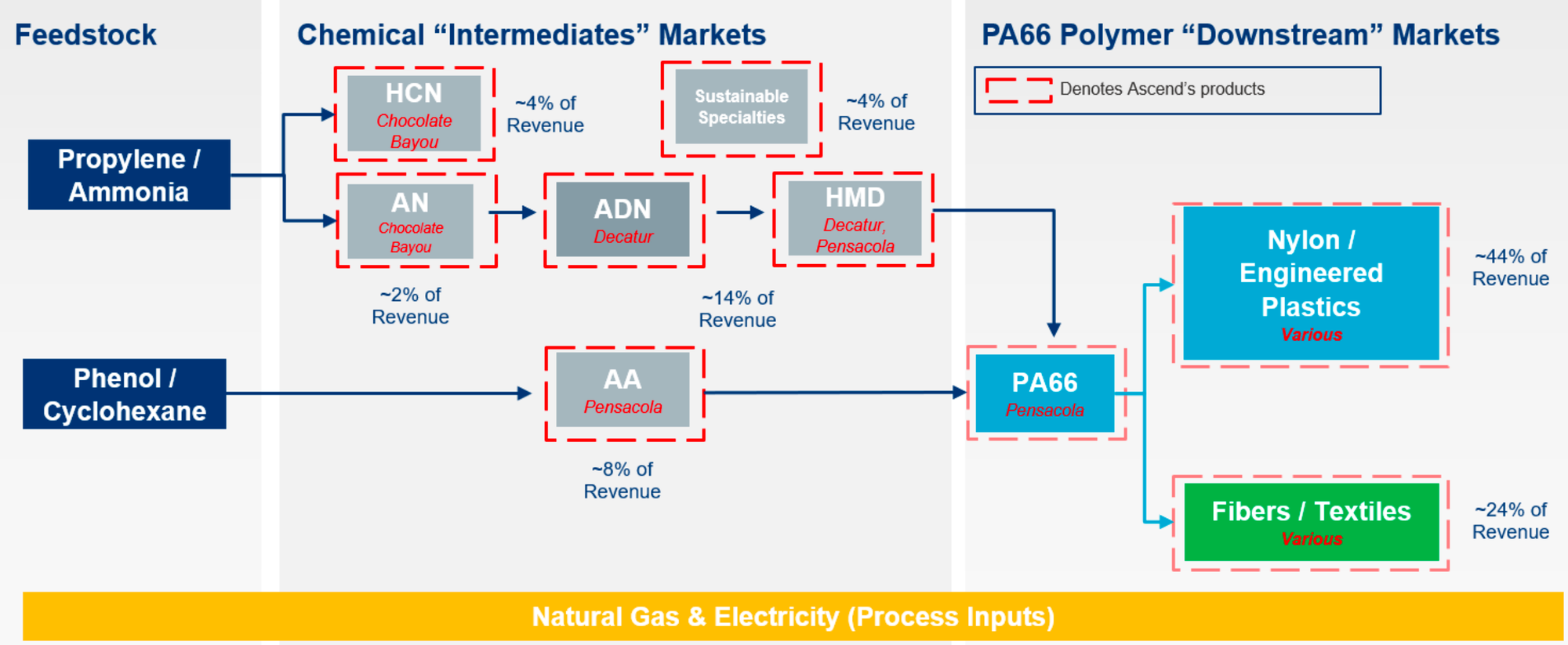

Ascend operates across the entire Nylon 6,6 value chain, from producing basic chemical intermediates to manufacturing finished engineered plastics and fibers. Its integrated structure allows participation in both the chemical intermediates and downstream PA66 markets.

PA66 Value Chain and Ascend's Participation

Manufacturing Footprint

- United States: Key facilities include Pensacola, FL (major nylon 6,6 polymer production); Decatur, AL (intermediates like ADN, polymer production); and Chocolate Bayou (Alvin), TX (produces AN and hydrogen cyanide (HCN)). These three sites account for approximately 85% of sales volume and 80% of revenue. A facility in Greenwood, SC (nylon polymer/fiber) was recently closed as part of cost-cutting. Circular Polymers operates a recycling facility in California.

- International: Facilities acquired for compounding and regional production/support include Mozzate, Italy; Fosses, France; Suzhou, China; Chennai, India; and San Jose Iturbide, Mexico. A new chemical plant operates in Lianyungang, China. A compounding facility in Tilburg, Netherlands, was closed in mid-2024.

Product Portfolio

- Chemical Intermediates: Ascend produces and sells key PA66 inputs, accounting for ~32% of 2024 revenue. These include:

- Hexamethylene Diamine (HMD): ~14% of 2024 total revenue.

- Adipic Acid (AA): ~8% of 2024 total revenue.

- Hydrogen Cyanide (HCN): ~4% of 2024 total revenue (difficult to transport, significant use in Guest Program).

- Acrylonitrile (AN): ~2% of 2024 total revenue.

- Adiponitrile (ADN): ~1% of 2024 total revenue (precursor to HMD).

- Acetonitrile (ACN): To be commercially available in 2026.

- Downstream PA66 Products: Sold into engineered materials, sustainable specialties, and textile markets (~65% of 2024 revenue combined).

- Nylon & Engineered Plastics Division (~40% of annual revenue): Includes Vydyne® branded resins used in molded parts. Focus shifted towards higher-value compounded products offering enhanced strength and heat resistance.

- Fibers & Textiles Division (~25% of annual revenue): Includes industrial fibers (e.g., for airbags) and residential carpet yarn (e.g., Ultron™).

- Sustainable Materials: Leveraging recycled feedstock from Circular Polymers.

- Innovation: Developed Acteev® antiviral nylon technology during the pandemic.

Guest Program

- Ascend operates a strategic partnership program at its Chocolate Bayou, Pensacola, and Decatur facilities involving nine "Guests."

- Guests utilize Ascend's facilities and certain chemical intermediates (notably HCN, which would otherwise require disposal) for their manufacturing processes. Ascend may also manage logistics for Guests.

- The program fosters economies of scale, shared expertise, and integrated production, lowering costs and enhancing efficiencies.

- In 2024, the Guest Program generated approximately $85 million in revenue and $167 million in cost recovery, making it a critical component of Ascend's operations.

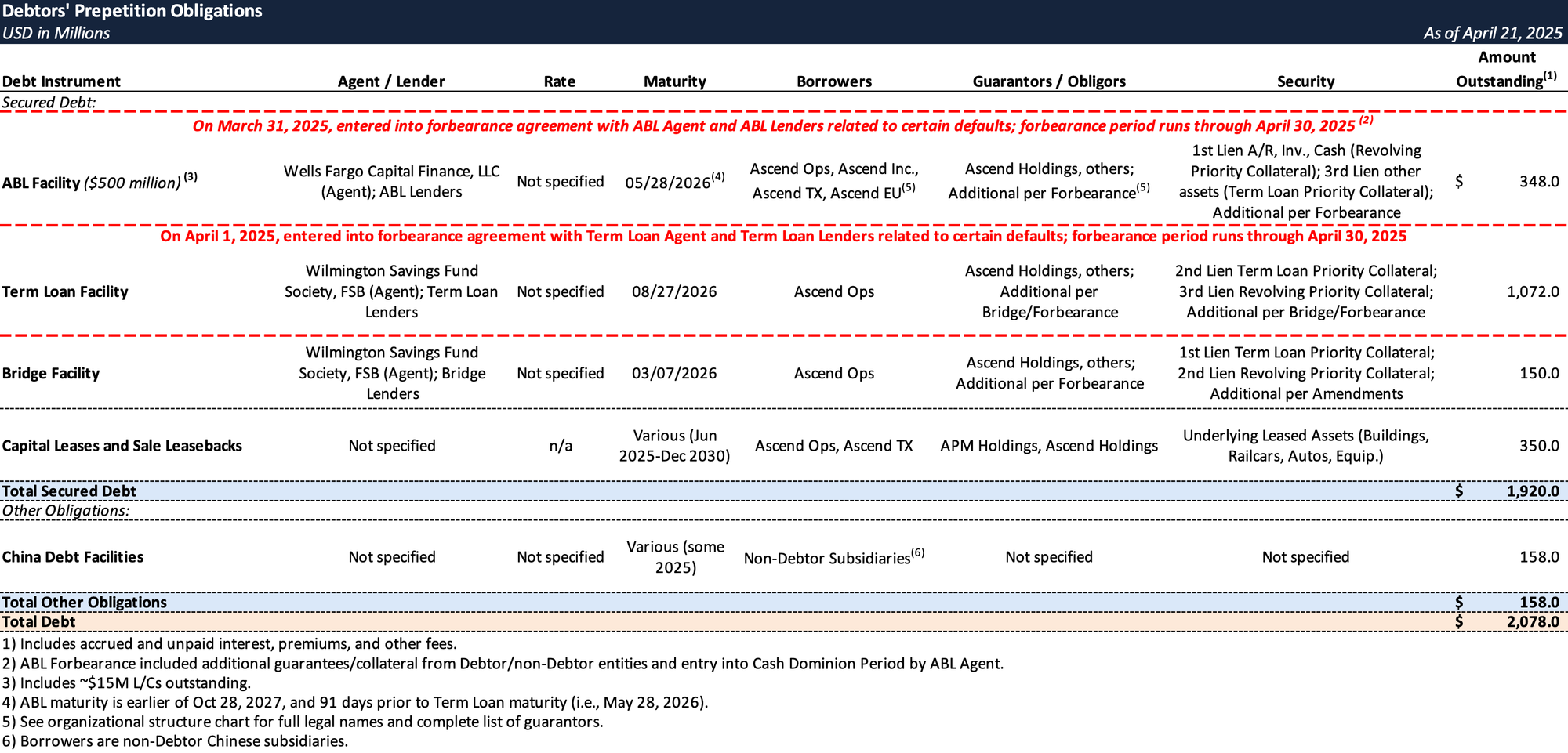

Prepetition Obligations

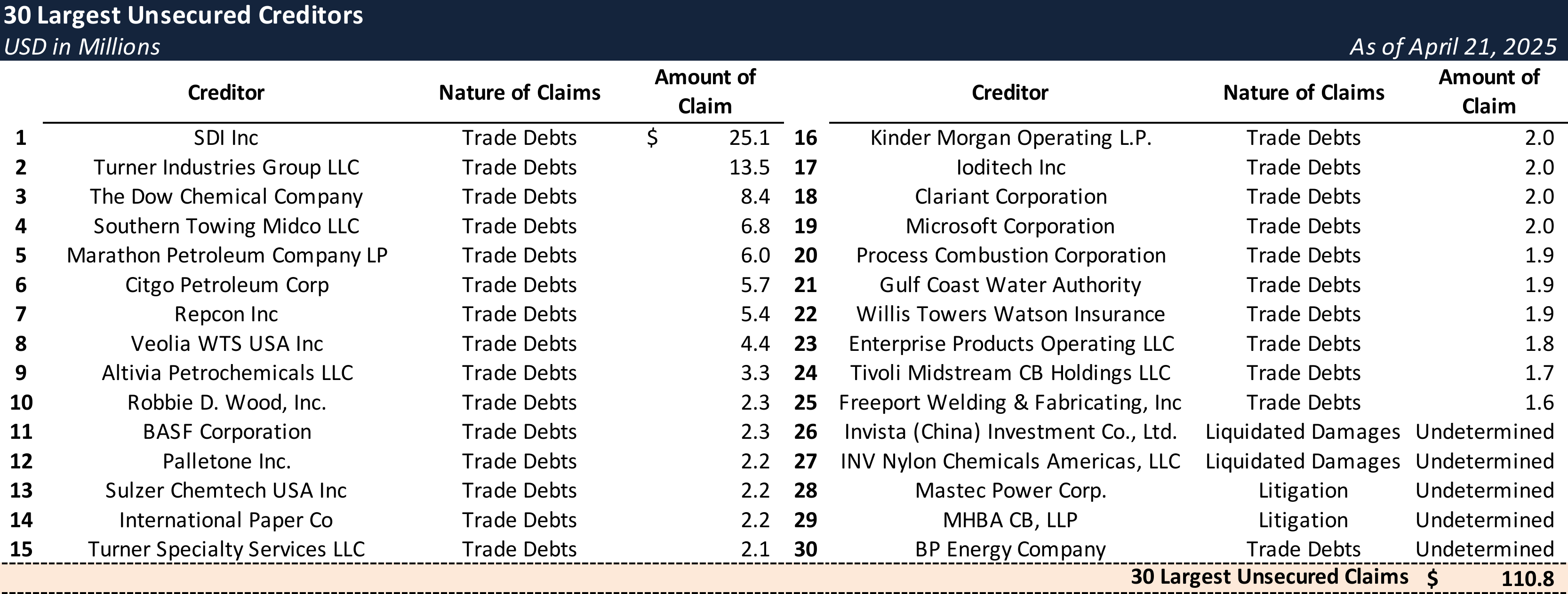

Top Unsecured Claims

Events Leading to Bankruptcy

Market Downturn and Competitive Pressures

- Global PA66 Market Trough (Since mid-2022): The industry experienced a significant downturn characterized by:

- Reduced demand across key end markets due to global economic malaise, destocking, inflation, labor shortages, and supply chain issues.

- Substantial price erosion, with average PA66 market prices dropping approximately 45% from their post-COVID peak.

- Increased Competition from China:

- Massive capacity expansion in China over the past six years (93% increase in intermediates, 64% in downstream PA66 production).

- Aggressive pricing strategies by new Chinese entrants, some allegedly selling at a loss or with subsidies, eroding established players' margins and pricing power. Ascend faced choices between losing customers or cutting prices significantly.

- Margin Compression: The combination of reduced demand and intense competition severely strained Ascend's profitability.

- Gross profit margin compressed by almost 4% since 2022.

- EBITDA declined by approximately 56% over the same period, nearing a decade low.

- Uneconomic Contracts: Ascend was party to long-term, take-or-pay contracts for chemical intermediates, entered into under different market conditions, which became loss-making in the depressed pricing environment.

Operational Rationalization and Liquidity Management Efforts

- Starting near the end of 2022, Ascend implemented proactive measures to combat headwinds:

- Cost Rationalization: Reduced SGA&T headcount by over 24% (generating ~$60M savings); cut fixed manufacturing costs by ~$100M in 2024; utilized a procurement cost-reduction pipeline (though effectiveness was later hampered by vendor payment issues).

- Footprint Consolidation: Closed the Tilburg, Netherlands compounding facility (mid-2024) and initiated the closure of the Greenwood, SC facility (shifting production to Pensacola, projected $30M recurring EBITDA benefit).

- Liquidity Enhancement: Executed ~$250 million in sale-leaseback transactions for U.S. assets; factored certain foreign accounts receivables; reduced inventory to safety stock levels; imposed strict spending controls. These measures extended runway by approximately 15 months.

- Vendor Payment Deferrals: Beginning Q4 2024, Ascend increasingly deferred vendor payments to conserve cash.

Compounding Crises (Late 2024 – Early 2025)

- A series of unforeseen operational events severely exacerbated the liquidity situation:

- Wilson Lock Closure (Sept. 2024 - ongoing): Unexpected closure of the main chamber of Wilson Lock on the Tennessee River disrupted critical barge transport to/from the Decatur facility. This forced reliance on more expensive trucking alternatives, increased transit times significantly (e.g., 14 days to 30+ days for Chocolate Bayou to Decatur), and necessitated premium third-party purchases of AN and ADN, costing ~$4M in unexpected cash outlays plus ~$4M impact on Q1/Q2 2025 financials.

- Pensacola Fire (Dec. 2024 - Mid-Feb. 2025): A fire shut down the major Pensacola nylon complex for approximately two months, resulting in lost production and an estimated $6 million EBITDA loss in Q1 2025.

- Texas Freeze (Jan./Feb. 2025): Extreme cold forced a preemptive shutdown of the Chocolate Bayou facility. This reduced AN supply, requiring Ascend to purchase AN on the open market at higher prices to keep the Decatur plant operational, further draining cash.

- Cumulative Impact: These three events collectively reduced Ascend’s Q1 2025 EBITDA by approximately $21 million, devastating earnings when liquidity was already critical.

Acute Liquidity Crisis and Stakeholder Engagement

- Vendor Pressure: The operational setbacks forced increased vendor payment deferrals, with past-due accounts payable exceeding $110 million by late February 2025. Vendors responded by demanding cash-in-advance, tightening terms, threatening to reclaim equipment, and potentially ceasing supply, creating an existential threat to plant operations.

- Credit Downgrades: S&P downgraded Ascend to 'CCC+' (Feb. 2025), followed by a Moody's downgrade (Mar. 2025), citing liquidity concerns, operational challenges, and the upcoming maturity of the Term Loan Facility. These downgrades intensified vendor pressure.

- Advisor Retention and Governance: In Jan./Feb. 2025, Ascend retained Kirkland & Ellis (legal), PJT Partners (investment banking), and FTI Consulting (financial advisory). Two independent directors were appointed (Jan. 2025), forming a Special Committee (with a third member added Mar. 2025) to oversee restructuring alternatives and potential conflicts, retaining Katten Muchin Rosenman as independent counsel.

- Search for Capital: Ascend explored capital infusions from existing stakeholders (lenders, sale-leaseback partners, equityholders). Equityholders conducted diligence but could not provide liquidity on the required expedited timeline.

- Bridge Financing: Facing an imminent shutdown risk, Ascend negotiated with an ad hoc group of term loan lenders (represented by Gibson Dunn and Evercore). On March 7, 2025, they secured a $40 million super-senior bridge term loan, subsequently upsized twice to a total of $120 million by early April 2025. This provided critical short-term liquidity to avoid operational collapse and prepare for Chapter 11.

- ABL Support: The ABL Lenders provided temporary relief by reducing minimum availability requirements, allowing an incremental $15 million draw on April 16, 2025.

Chapter 11 Filing and Path Forward

- With bridge financing providing temporary stability but a comprehensive solution needed, the Debtors filed for Chapter 11 protection on April 21, 2025, in the Southern District of Texas.

- The Debtors entered Chapter 11 with lender support, securing commitments for approximately $900 million in DIP financing:

- A $500 million DIP ABL Facility (roll-up of prepetition ABL).

- A $400 million DIP Term Loan Facility, including $250 million in new money ($150 million available on interim approval) and a ~$150 million roll-up of the Bridge Facility debt.

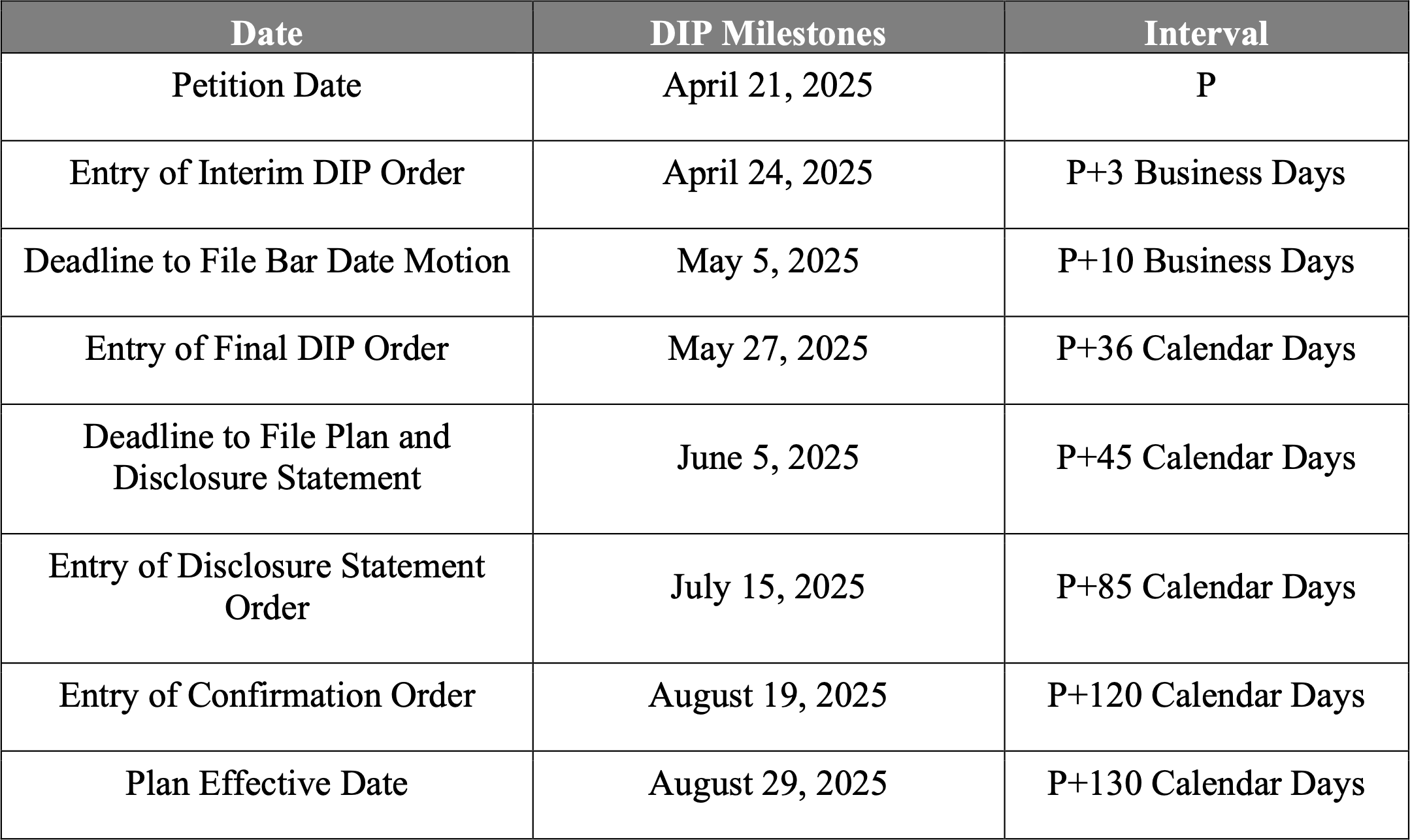

- Ascend aims for an expedited process, with DIP milestones targeting plan confirmation within 120 days and emergence within 130 days of the Petition Date.

DIP Milestones

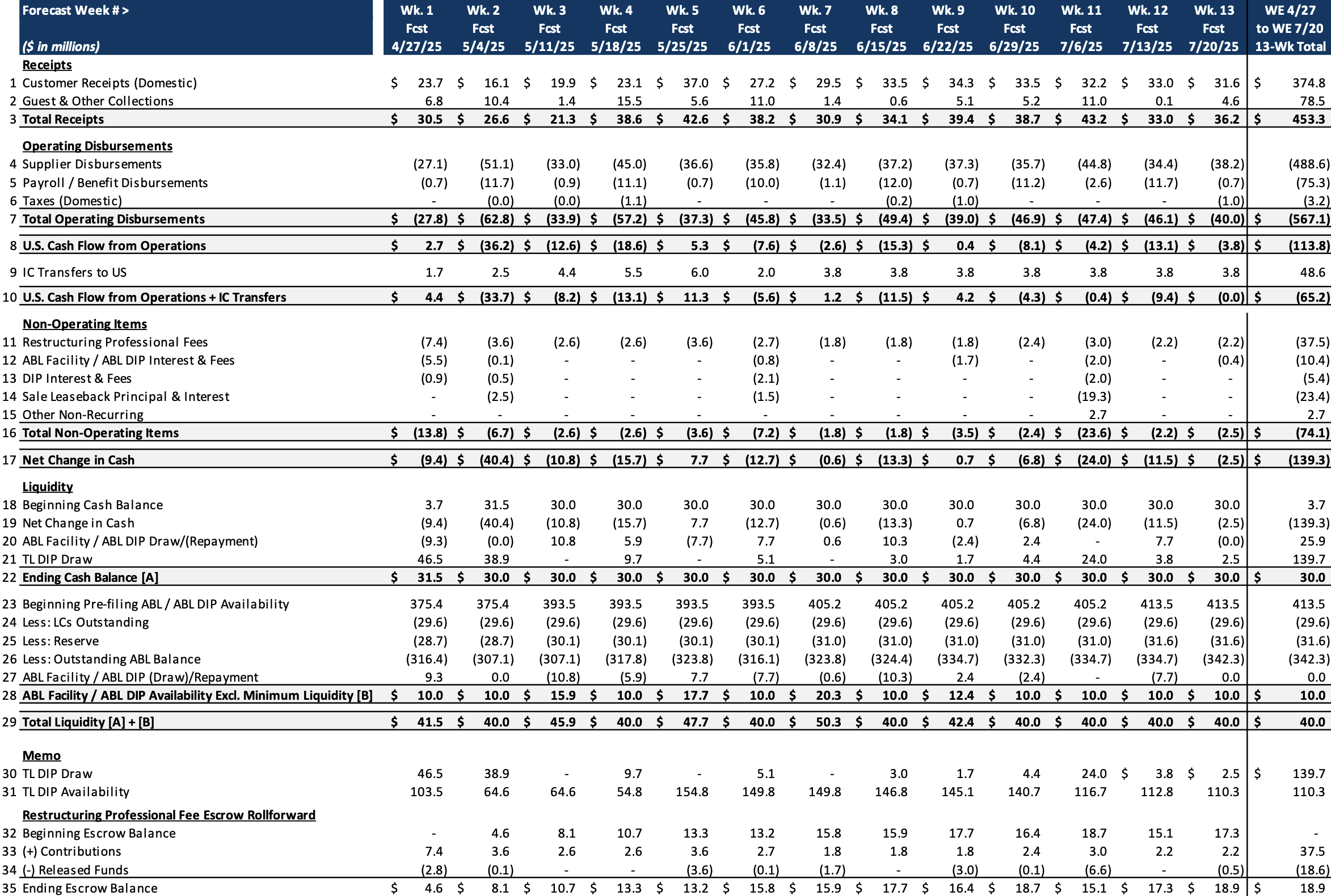

Initial DIP Budget

Key Parties

- Counsel: Bracewell LLP, Kirkland & Ellis LLP

- Investment Banker: PJT Partners

- Financial Advisor / CRO: FTI Consulting (Robert Del Genio)

- Counsel to the Disinterested Directors: Katten Muchin Rosenman LLP

- Tax Advisor: Deloitte

- Claims Agent: Epiq

- Equity Holders:

- SK Titan Holdings LLC – 93.3%

- Minority Holders – 6.7%

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.