Filing Alert: Ascend Performance Materials Chapter 11

Ascend Performance Materials Files Chapter 11 in Southern District of Texas

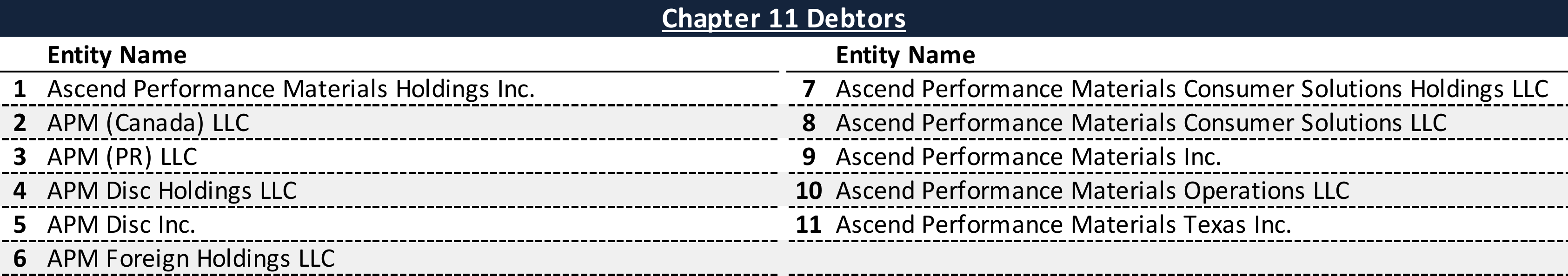

Ascend Performance Materials Holdings Inc. and its debtor affiliates⁽¹⁾, a Houston, TX-based manufacturer of high-performance nylon 6,6 and related chemical intermediates used in automotive, industrial, and consumer applications, filed for Chapter 11 protection on Apr. 21 in the U.S. Bankruptcy Court for the Southern District of Texas.

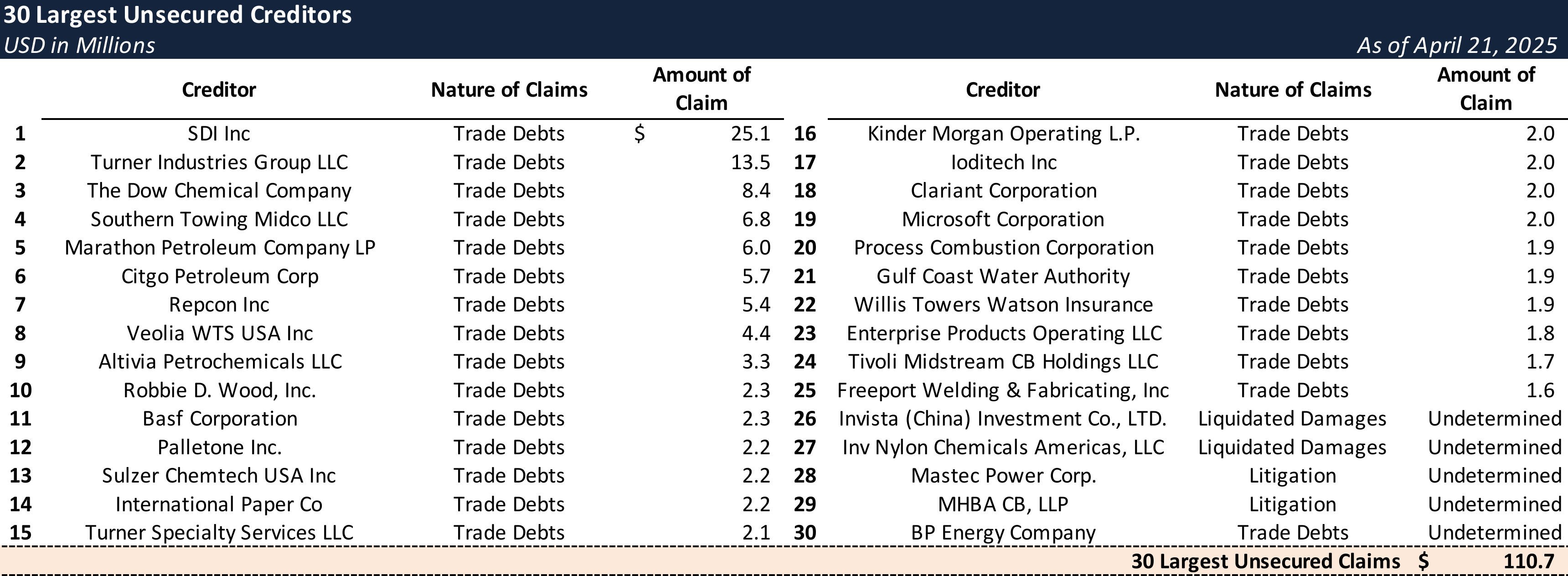

The filing follows a prolonged period of margin erosion triggered by declining demand, global economic headwinds, and aggressive pricing from Chinese competitors, which forced Ascend to cut prices or risk losing market share. Operational disruptions, including a fire at its Pensacola plant and a Texas freeze, further strained liquidity, leading to over $110 million in past-due vendor obligations.

To stabilize operations and avoid a shutdown, Ascend secured a $120 million bridge loan in March and now enters bankruptcy backed by approximately $900 million in DIP financing, including $250 million in new-money loans.

The company reports $1 billion to $10 billion in both assets and liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The case number is 25-90127.

⁽¹⁾ For a complete list of debtor entities, see the Chapter 11 Debtors table.

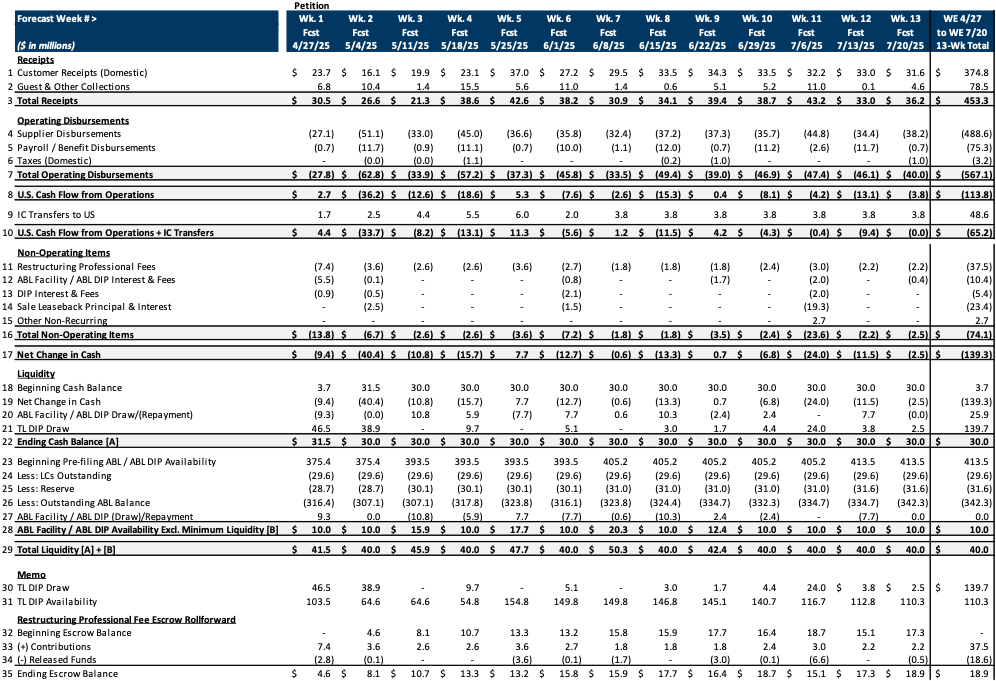

Initial DIP Budget

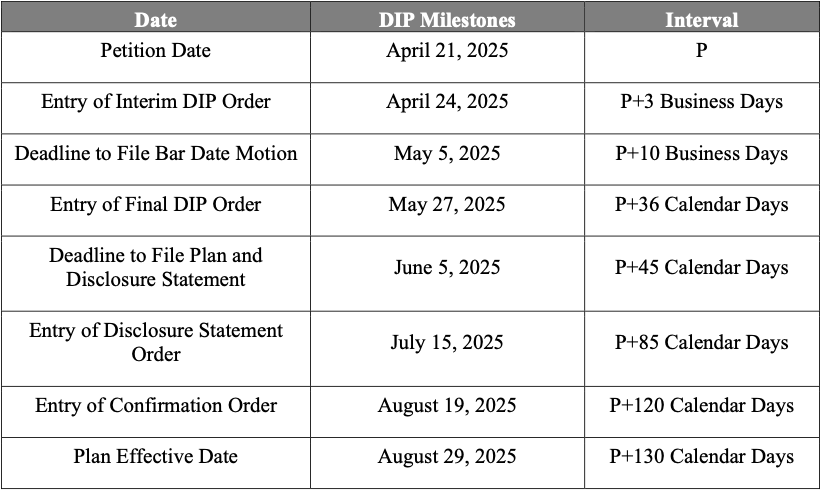

DIP Milestones

Chapter 11 Debtors

Top Unsecured Claims

Key Parties

Counsel:

- Jason G. Cohen

- Bracewell LLP

- Email: [email protected]

Restructuring Counsel:

- Kirkland & Ellis LLP and Kirkland & Ellis International LLP

Investment Banker:

- PJT Partners, Inc.

Financial Advisor:

- FTI Consulting, Inc

Tax Advisor:

- Deloitte LLP

Counsel to the Disinterested Directors:

- Katten Muchin Rosenman LLP

Signatories:

- Robert Del Genio – Chief Restructuring Officer

Claims Agent:

Equity Security Holders:

- SK Titan Holdings LLC – 93.3% Equity Interest

- Other Minority Holders – 6.7% Equity Interest

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.