Case Summary: At Home Chapter 11

At Home has filed for Chapter 11 bankruptcy amid weakening consumer demand, tariff-related cost pressures, and an unsustainable debt load from its 2021 buyout, with a lender-supported plan to restructure via a $600 million DIP and deleverage under a comprehensive RSA.

Business Description

Headquartered in Coppell, TX, At Home Group Inc., along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, "At Home" or the "Company"), operates as a leading home décor big-box retail chain known as “The Home Décor Superstore.” The Company offers a vast selection of furniture, furnishings, and seasonal goods at value prices through approximately 260 large-format retail locations across 40 states and its e-commerce website.

- Each store averages approximately 105,000 square feet of selling space, enabling At Home to stock over 50,000 SKUs, including everyday home furnishings (approximately 60% of fiscal year 2025 net sales) and holiday/seasonal décor (approximately 40% of FY2025 net sales).

- At Home emphasizes an “every room, every style, every budget” approach, with over 80% of its products being unbranded, private label, or specifically designed for the Company to offer on-trend styles at accessible price points. The average price point per product is less than $20, with a typical customer spend of approximately $75 per visit.

- Key differentiators include its expansive store formats facilitating a "treasure-hunt" shopping experience, a high mix of private-label goods, an everyday low price (EDLP) strategy minimizing reliance on promotions, and a self-service model with lean in-store staffing to maintain low operating costs.

The Company targets a broad demographic of value-oriented decorators and families, with approximately 70 million customers visiting its stores annually and 53 million visiting its website. Its Insider Perks loyalty program boasts approximately 7 million active members, accounting for roughly 70% of sales in fiscal year 2025.

At Home Group Inc. and its affiliates filed for Chapter 11 protection on June 16, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the District of Delaware, reporting $1 billion to $10 billion in both assets and liabilities.

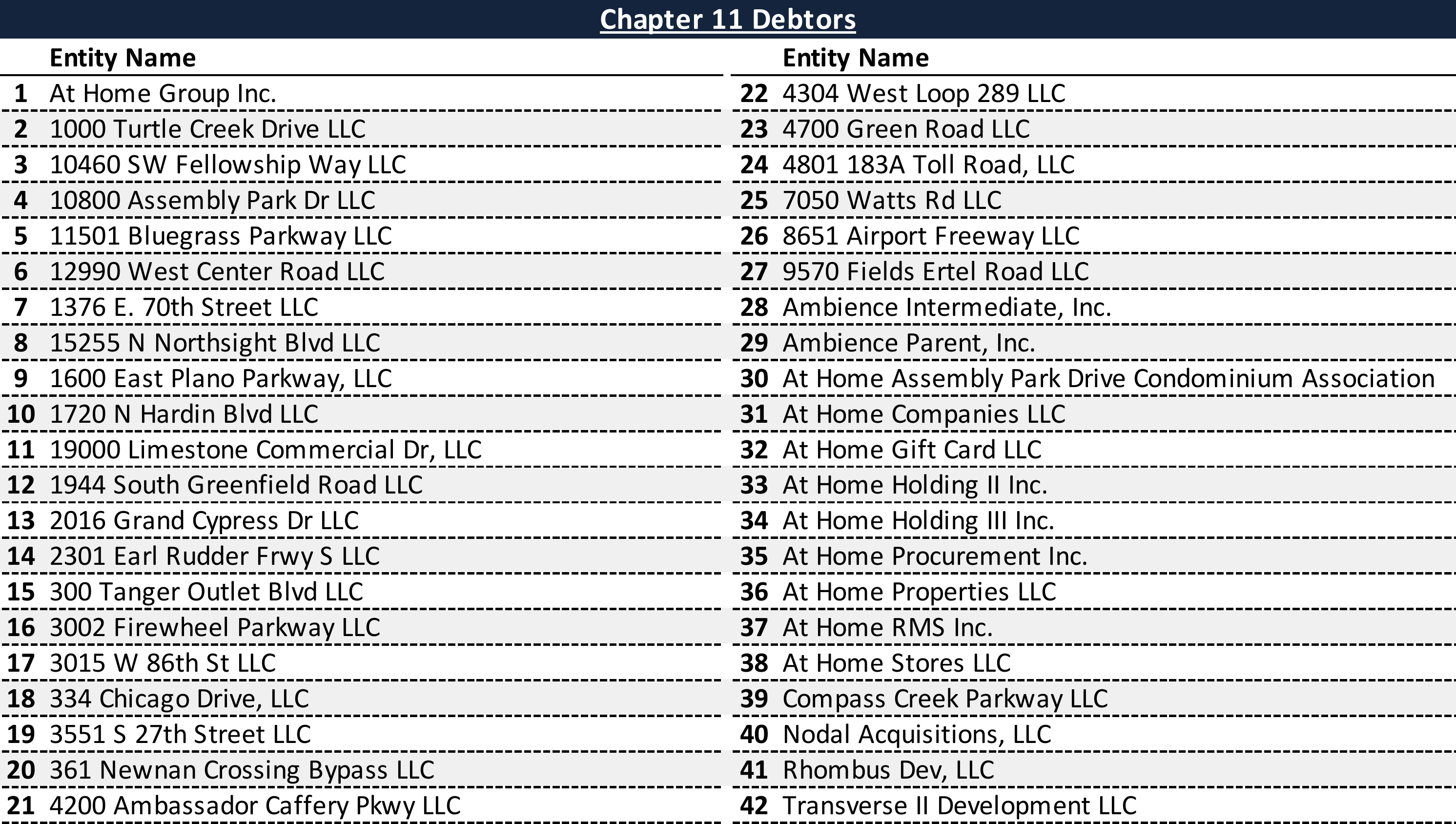

⁽¹⁾ For a complete list of Debtor entities, see the Chapter 11 Debtors table below.

Corporate History

At Home's origins date back to 1979 when founder Eric White opened the first Garden Ridge Pottery store in Schertz, TX. The Company experienced several transformations, including periods of growth, financial distress, and changes in ownership.

Origins and First Restructuring

- Garden Ridge grew modestly before being sold to outside investors in 1988. Facing difficulties, a new leadership team revamped the concept in 1990, focusing on home décor and a "warehouse adventure" layout.

- The company went public in 1995 to fund expansion but was taken private in 1999 by Three Cities Research.

- In February 2004, Garden Ridge filed for Chapter 11 bankruptcy, citing competition and high lease costs. It emerged in 2005 after closing nine stores, a distribution center, and renegotiating leases.

Rebranding, Growth, and Public Listing

- In October 2011, private equity firm AEA Investors acquired the company. Lewis “Lee” Bird III was appointed CEO in December 2012 and initiated a modernization effort.

- In 2014, the company rebranded all 71 stores from "Garden Ridge" to "At Home," relocating its headquarters from Houston to Plano, TX.

- At Home went public on the NYSE (ticker: HOME) in August 2016, fueling aggressive expansion. By mid to late 2019, the chain grew to 200 stores nationwide.

Private Equity Buyout and Pandemic Impact

- The COVID-19 pandemic significantly boosted sales in 2020, with net sales surging 27.3% in fiscal 2021.

- In July 2021, Hellman & Friedman ("H&F") acquired At Home in a $2.8 billion all-cash, take-private transaction, which included substantial debt financing. Consequently, At Home’s stock was delisted from the NYSE.

- Post-buyout, At Home launched new private-label brands, a mobile app, expanded same-day delivery, and continued store expansion.

Post-LBO Challenges and Leadership Transition

- By 2022, pandemic-driven tailwinds subsided, consumer spending shifted, and inflation rose. The Company faced declining sales, exacerbated by the significant debt load from the LBO and over $300 million in additional supply chain costs in 2021-2022.

- Credit rating agencies downgraded At Home in late 2022, citing weakening sales, rising costs, and an unsustainable capital structure.

- In May 2023, At Home raised $200 million through new senior secured notes and exchanged approximately $447 million of unsecured notes for $412 million in new notes to improve its balance sheet.

- Lee Bird retired as CEO in December 2023 after 11 years. Brad Weston was appointed CEO effective June 2024, tasked with leading a turnaround.

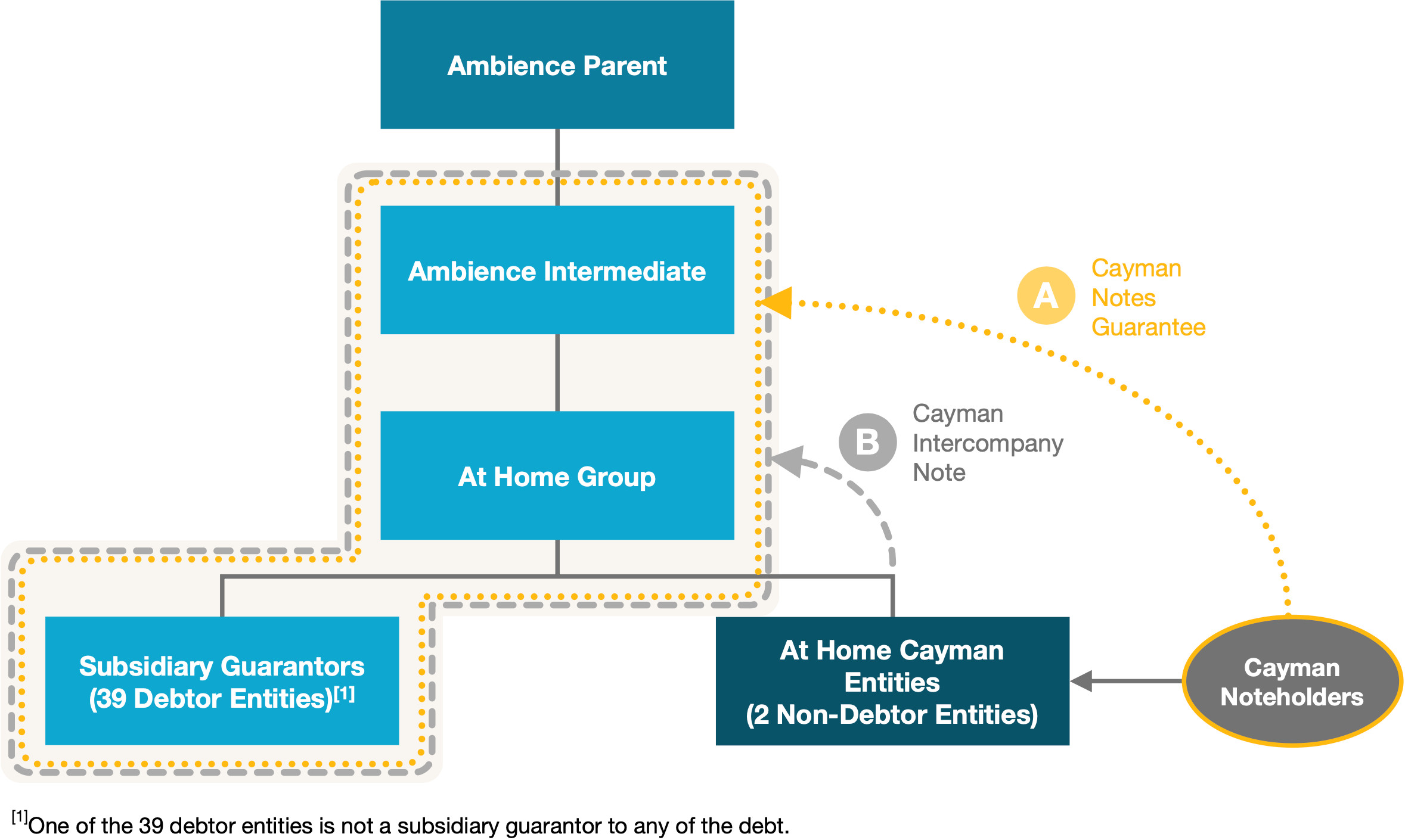

Corporate Organizational Structure

Chapter 11 Debtors

Operations Overview

At Home operates as an omnichannel home décor and furnishings retailer with a significant brick-and-mortar presence complemented by growing e-commerce capabilities.

Store Footprint and Format

- The Company operates approximately 260 stores across 40 states, with each store averaging about 105,000 square feet.

- Stores feature an open, warehouse-style layout designed for a self-service shopping experience, minimizing staffing needs and labor costs.

- As part of its initial restructuring efforts, the Company, through an agency agreement with Hilco Merchant Resources, LLC, intends to conduct store closing sales at an initial 26 locations, commencing around June 19, 2025, and concluding by September 30, 2025.

Merchandising, Sourcing, and Distribution

- Over 80% of At Home's products are unbranded, private label, or exclusively designed for the Company, focusing on delivering trend-right merchandise at value prices.

- The Company works with over 600 product partners, sourcing approximately 90% of its products from overseas in fiscal year 2025, with significant reliance on countries like China, Vietnam, India, Turkey, and Mexico. This global sourcing model exposed the Company to tariff volatility and supply chain disruptions.

- At Home utilizes two primary distribution centers—a 592,000 square foot facility in Plano, TX, and an 800,000 square foot facility in Carlisle, PA—which serve as cross-dock facilities with limited on-site inventory storage.

Retail Channels and Marketing

- While brick-and-mortar stores generate the majority of revenue (approximately 93% in FY2025), At Home significantly enhanced its e-commerce platform post-2020.

- Omnichannel capabilities include buy-online-pickup-in-store (BOPIS), curbside pickup, local delivery from most stores (often via partners like DoorDash), and a mobile shopping app launched in 2022.

- Marketing initiatives leverage a mix of traditional and digital media, email, social media, and influencer programs. Key programs include the "Insider Perks" loyalty program (approximately 7 million active members) and an At Home branded credit card.

Workforce

- As of the Petition Date, At Home employed approximately 7,170 individuals across its retail stores, corporate offices (Coppell, TX), and distribution centers.

- The in-store staffing model emphasizes self-service, with centralized decision-making for merchandising, inventory, and pricing, allowing store teams to focus on maintaining an organized shopping environment.

Prepetition Obligations

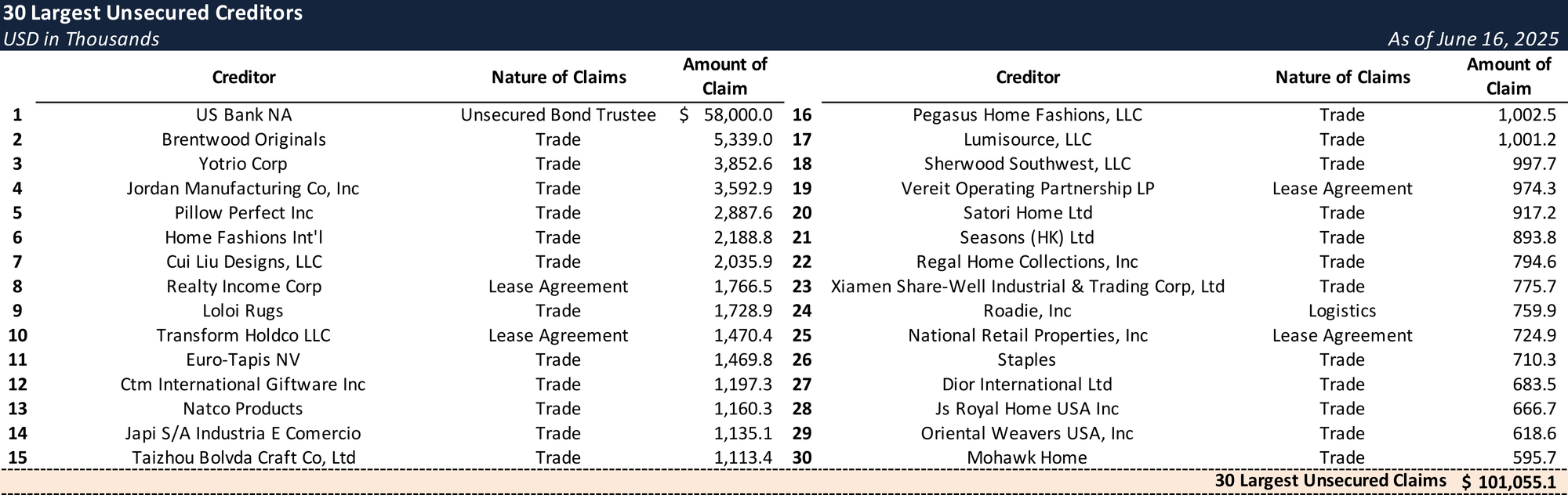

Top Unsecured Claims

Events Leading to Bankruptcy

At Home's Chapter 11 filing resulted from a combination of macroeconomic headwinds, industry-specific challenges, operational issues, significant debt burden, and acute tariff pressures.

Macroeconomic Shocks and Industry Headwinds

- The post-COVID-19 environment saw a slowdown in demand for home décor as consumer spending shifted. High interest rates, inflation, and depressed homebuying activity (a key customer segment for At Home) further strained sales.

- Global supply chain disruptions led to increased costs for materials, labor, and fuel, eroding profit margins. The Company's long-range merchandising plan and overseas price-tagging limited its ability to quickly react to cost volatility.

- In-store traffic fell approximately 24% at the start of 2025 compared to pre-pandemic averages, highlighting the shift towards e-commerce and reduced discretionary spending.

Operational Challenges and LBO Impact

- The Company struggled with a mismatch between its business plans, conceived during a period of high demand, and the subsequent economic realities of decreased consumer spending.

- Newly opened stores in new geographies underperformed due to low brand awareness and mixed execution.

- The substantial debt incurred from the 2021 leveraged buyout by Hellman & Friedman placed significant financial strain on the Company, limiting cash flow for reinvestment.

- Significant leadership turnover, including the CEO transition in 2023-2024, occurred amidst these mounting challenges.

Tariff Volatility and Cost Pressures

- At Home’s heavy reliance on imported goods, particularly from China, made it vulnerable to U.S. trade policy and tariff escalations.

- In early 2025, new and increased tariffs on Chinese imports (reaching a cumulative 145% on April 10, 2025, before being temporarily lowered and then set at 55% in June 2025) severely impacted merchandise costs and disrupted sourcing operations.

- This tariff environment exacerbated existing financial pressures, as the Company found it difficult to pass on all increased costs to consumers while maintaining its value proposition.

Liquidity Crisis and Debt Maturities

- By late 2024 and early 2025, At Home faced significant liquidity constraints, driven by declining performance and its debt service obligations.

- Pressure mounted due to the upcoming July 2026 maturity of its Prepetition ABL Credit Facility. Discussions with the ABL agent in early 2025 indicated potential borrowing base reductions and reserve implementations.

- The Company anticipated receiving a "going-concern" qualified opinion on its yearly audit (due May 2025), which would trigger defaults under its various debt agreements.

- In May 15, 2025, At Home missed an interest payment, triggering an event of default.

Prepetition Restructuring Efforts and Advisor Engagement

- In early 2025, At Home implemented cost-saving initiatives (e.g., "Close the Gap," "Project G.R.O.W.") and engaged financial and legal advisors, including PJT Partners, Kirkland & Ellis LLP, and AlixPartners, to explore strategic alternatives.

- Governance changes were made, including the appointment of two disinterested directors (Jill Frizzley and Elizabeth Abrams) in March 2025 and the formation of a Special Committee to oversee restructuring efforts and investigate potential conflicts of interest.

- The Company, with assistance from Hilco Real Estate, initiated a lease rationalization analysis to address underperforming stores and off-market lease terms.

Forbearance and RSA Negotiation

- In March 2025, an ad hoc group of lenders (the "Ad Hoc Group," including Redwood Capital Management, Farallon Capital Advisors, and Anchorage Capital Advisors) presented a comprehensive restructuring proposal.

- On May 23, 2025, At Home entered into forbearance agreements with its ABL lenders and the Ad Hoc Group to temporarily halt enforcement actions following missed interest payments and anticipated defaults.

- Intensive negotiations culminated in a Restructuring Support Agreement (RSA) executed on June 16, 2025, with holders of approximately 96% of the Company's first lien debt.

Chapter 11 Filing, RSA, and DIP Financing

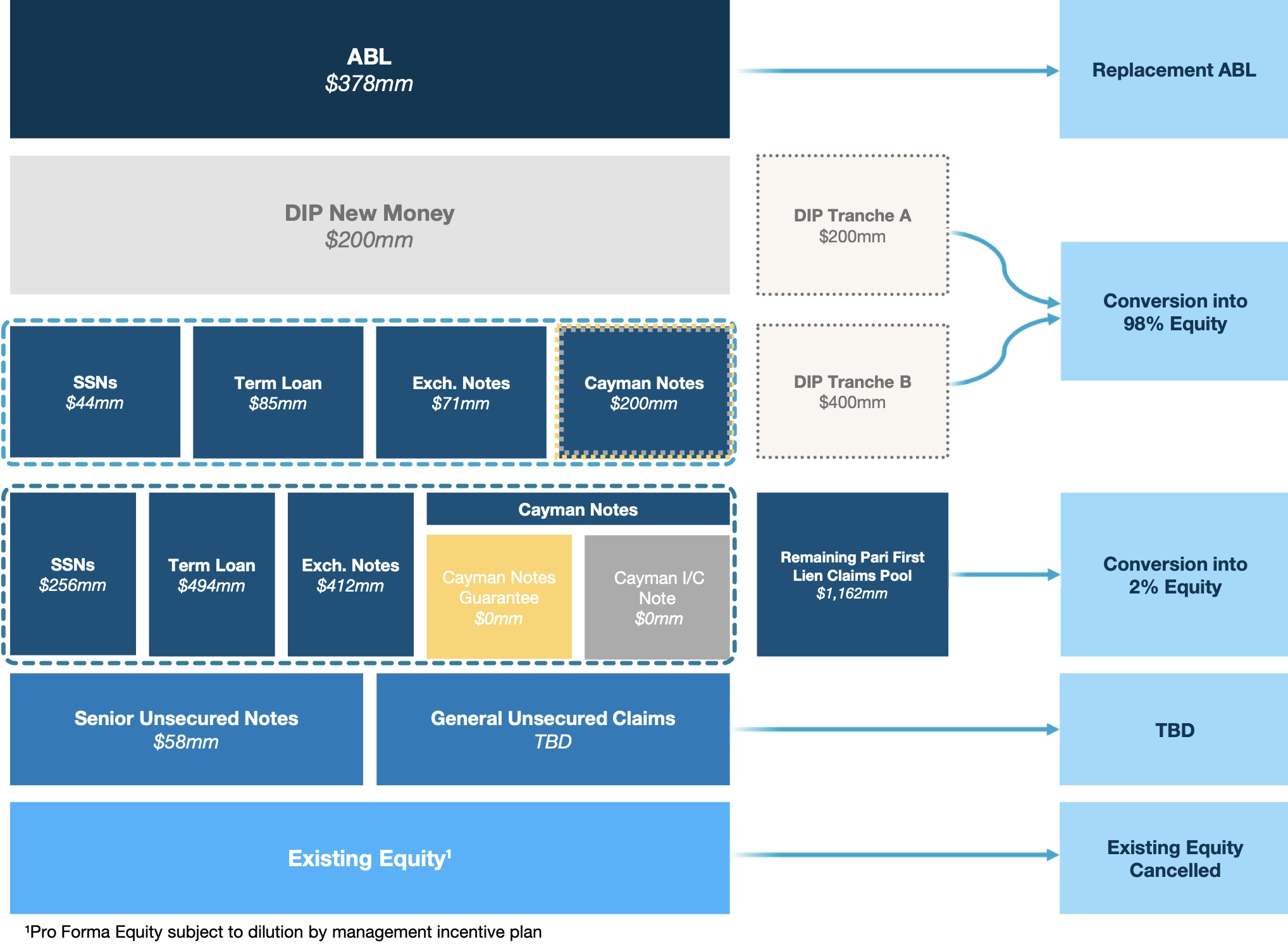

- The RSA, executed on June 16, 2025, provides a framework for a comprehensive deleveraging.

- The plan contemplates the DIP facility converting into 98% of the equity in the reorganized company, with the remaining 2% allocated to other prepetition first lien debt holders. Existing equity (over 99% held by H&F) is expected to be cancelled.

- The Prepetition ABL Facility is expected to be refinanced upon exit.

- To fund operations, the Court granted interim approval on June 17, 2025, for a $600 million DIP financing facility provided by members of the Ad Hoc Group, with GLAS USA LLC as DIP Agent.

- The DIP Facility consists of $200 million in new money (Tranche A) and a $400 million roll-up of existing Pari First Lien Obligations (Tranche B).

- An interim draw of $75 million in new money and $150 million in roll-up of Pari First Lien Obligations (prioritizing the Prepetition Cayman Notes) was authorized. The remaining $125 million new money and $250 million roll-up are subject to final approval.

- Key milestones include filing a Plan of Reorganization and Disclosure Statement by July 7, 2025, with a targeted effective date by October 28, 2025. A final hearing on the DIP financing is scheduled for July 14, 2025.

Advisors

- Debtors: Kirkland & Ellis LLP and Young Conaway Stargatt & Taylor, LLP (co-counsel); PJT Partners Inc. (investment banker); AlixPartners, LLC (financial advisor); Omni Agent Solutions (claims and noticing agent).

- Ad Hoc Group of DIP Lenders: Dechert LLP and Potter Anderson & Corroon LLP (legal counsel); Evercore Inc. (financial advisor).

- DIP Agent (GLAS USA LLC): Moses & Singer LLP (counsel).

- Prepetition ABL Agent (Bank of America, N.A.): Choate, Hall & Stewart LLP and Reed Smith LLP (legal counsel); Berkeley Research Group, LLC (financial advisor).

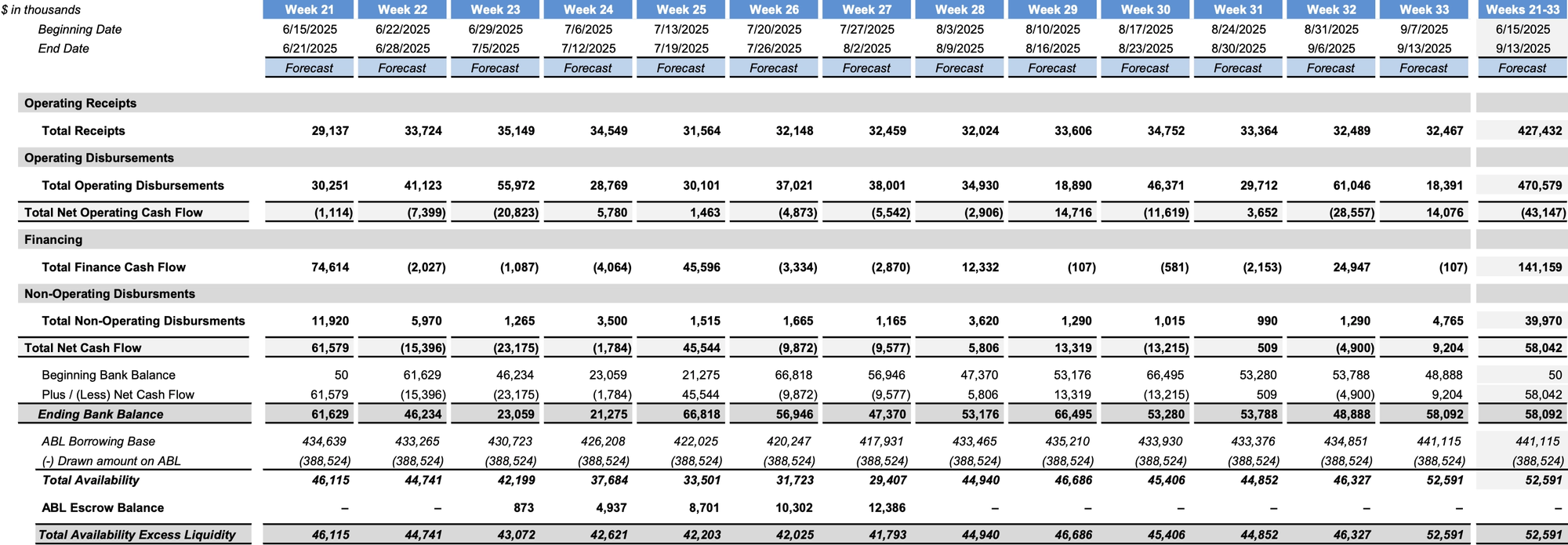

Initial Budget

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.