Filing Alert: At Home Chapter 11

At Home Files Chapter 11 in District of Delaware

At Home Group Inc. and its debtor affiliates⁽¹⁾, a Coppell, TX-based home décor and furnishings retail chain, filed for Chapter 11 protection on Jun. 16 in the U.S. Bankruptcy Court for the District of Delaware.

The filing aims to implement a deleveraging restructuring via an RSA with holders of approximately 96% of its first lien debt, supported by a $600 million multi-draw DIP term loan (including $200 million in new money) that will convert to equity upon emergence. The company, taken private by Hellman & Friedman in 2021, faced renewed liquidity constraints from post-COVID demand shifts, inflationary pressures, and significant disruption from U.S. tariff policies on foreign-sourced goods. In March 2025, the company engaged an ad hoc group of lenders—including Redwood Capital Management, LLC, Farallon Capital Advisors, L.L.C., and Anchorage Capital Advisors, L.P.⁽²⁾—which led to the RSA. The restructuring will eliminate approximately $1.62 billion of its $2 billion in existing debt and allow the company to emerge with a right-sized balance sheet and an exit ABL facility.

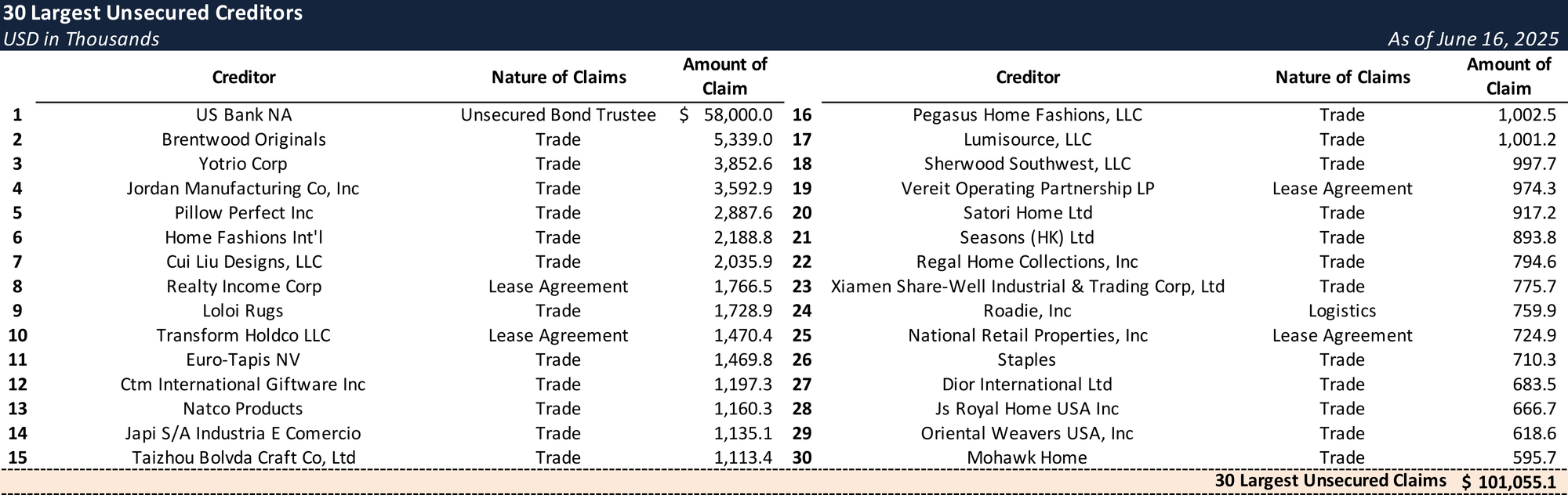

The company reports $1 billion to $10 billion in both assets and liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The case number is 25-11120.

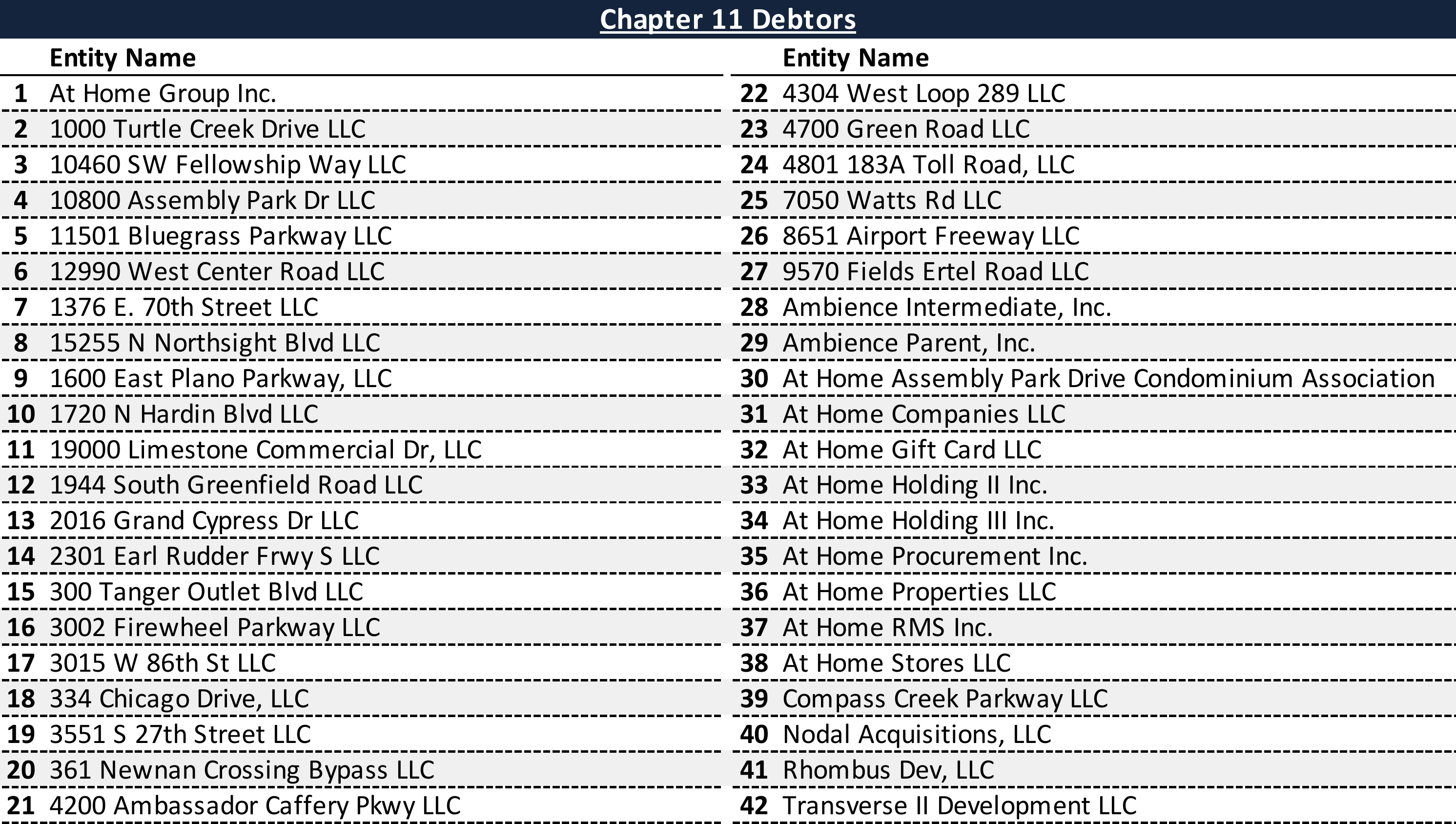

⁽¹⁾ For a complete list of debtor entities, see the Chapter 11 Debtors table. ⁽²⁾ In May 2025, the Ad Hoc Group expanded to include Silver Rock Financial LP, Aryeh Capital Management Ltd., Glendon Capital Management L.P., and five additional debt holders who signed the RSA.

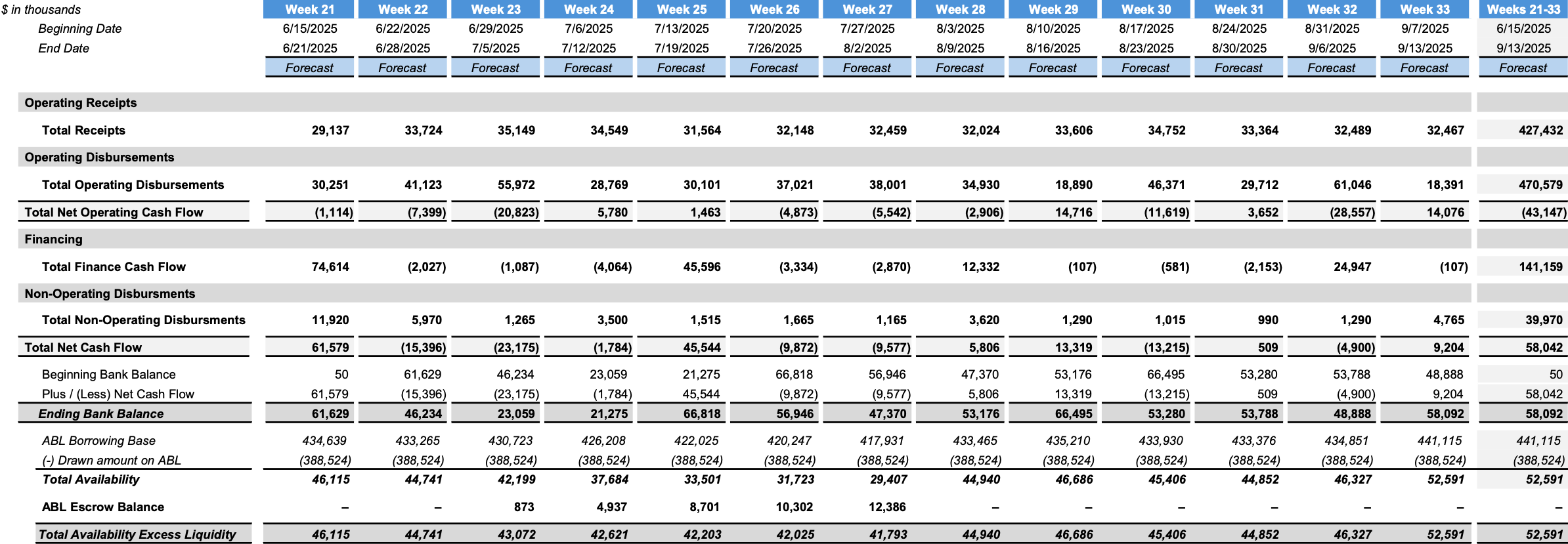

DIP Budget

Chapter 11 Debtors

Top Unsecured Claims

Key Parties

Local Counsel:

- Joseph M. Mulvihill

- Young Conaway Stargatt & Taylor, LLP

- Email: [email protected]

Restructuring Counsel:

- Kirkland & Ellis LLP and Kirkland & Ellis International LLP

Financial Advisor:

- AlixPartners LLP

Investment Banker:

- PJT Partners, Inc.

Signatories:

- Jeremy Aguilar – Authorized Signatory

Claims Agent:

Equity Security Holders:

- Ambience Intermediate, Inc. – 100% Equity Interest

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.