Case Summary: Avant Gardner Chapter 11

Avant Gardner, owner of The Brooklyn Mirage, filed for Chapter 11 bankruptcy to pursue a lender-led 363 sale after renovation delays disrupted peak-season operations and triggered a liquidity crisis, supported by $45.8 million in DIP financing.

Business Description

Headquartered in Brooklyn, NY, Avant Gardner, LLC, along with its Debtor affiliates⁽¹⁾ (collectively, "Avant Gardner" or the "Company"), operates an 80,000 square-foot indoor/outdoor entertainment complex, recognized as one of New York City’s largest nightlife destinations. The Company has established a strong brand and loyal following within the electronic dance music (EDM) community, regularly featuring world-class DJs and touring artists.

- The property comprises three distinct, integrated venues that can host events independently or simultaneously:

- The Brooklyn Mirage: An iconic open-air venue known for its immersive production, massive LED walls, and panoramic views of the Manhattan skyline, operating seasonally from May to October.

- The Great Hall: A year-round, industrial-chic indoor space with a capacity of approximately 2,800.

- Kings Hall: An intimate indoor club with a capacity of approximately 540, also operating year-round.

Avant Gardner’s diversified business model extends beyond traditional concerts to include festival promotion, nightlife hospitality, and corporate and private event hosting. Ancillary revenue is generated through VIP table service, food and beverage concessions, and merchandise sales.

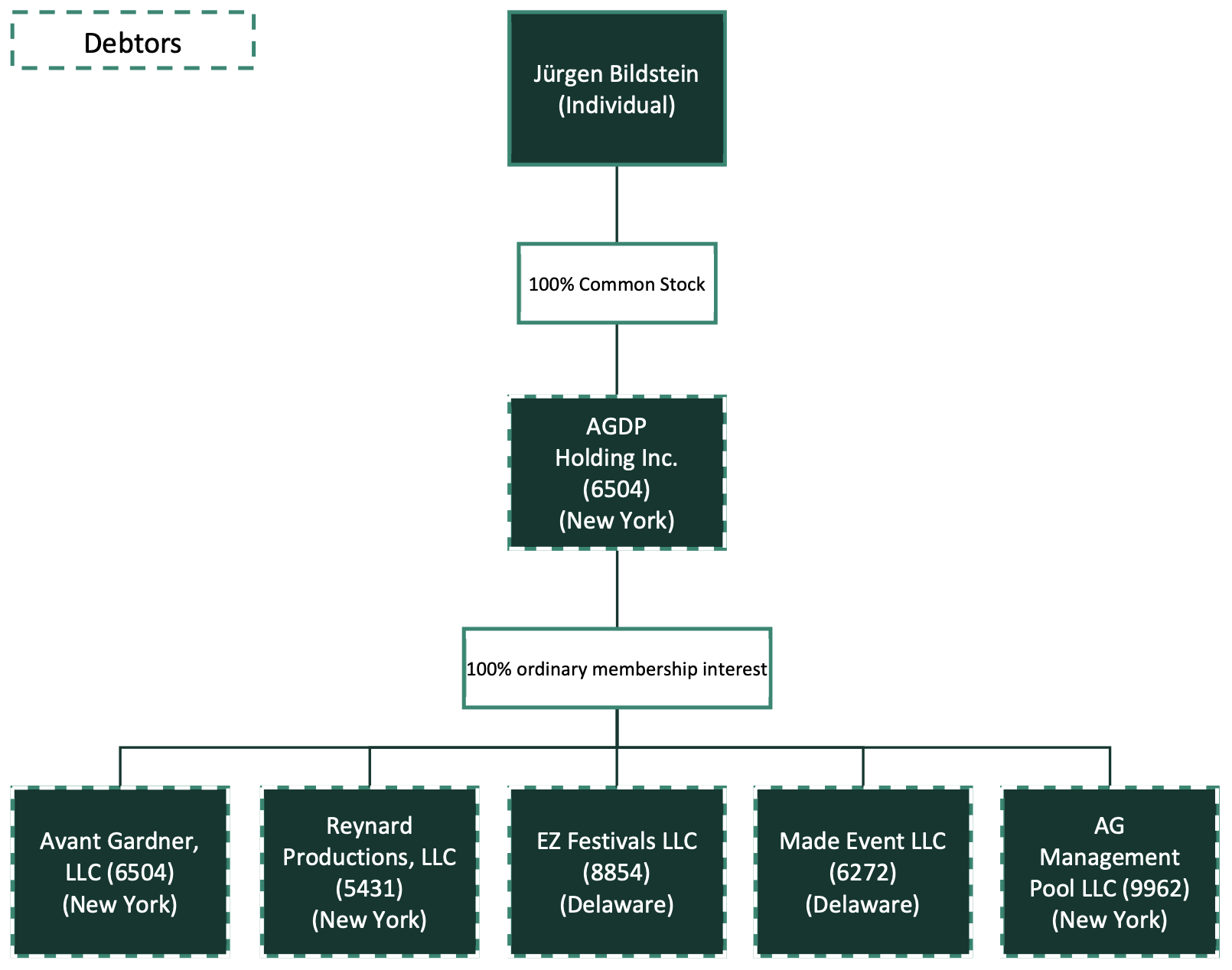

Avant Gardner, LLC and its five affiliates filed for Chapter 11 protection on August 4, 2025 (the "Petition Date"), in the U.S. Bankruptcy Court for the District of Delaware, reporting $50 million to $100 million in assets and $100 million to $500 million in liabilities.

⁽¹⁾ For a complete list of debtor entities, see the organizational structure chart below.

Corporate History

Avant Gardner was co-founded by Jürgen “Billy” Bildstein in 2017 with the official opening of the Brooklyn Mirage as a permanent venue, following a prior pop-up concept. The Company expanded its footprint in 2018–2019 by adding the adjacent Great Hall and Kings Hall, enabling year-round programming and establishing its reputation as a nightlife powerhouse known for cutting-edge production.

Expansion and Operational Challenges

- After a complete shutdown due to the COVID-19 pandemic from March 2020 to mid-2021, the Company reopened to significant pent-up demand.

- In May 2022, Avant Gardner acquired EZ Festivals LLC and Made Event LLC, the owners of Electric Zoo, New York's largest annual EDM festival, in a deal reportedly worth $15 million. That same year, the Brooklyn Mirage underwent significant technological upgrades, including the installation of a massive high-resolution LED video wall.

- The Company’s first full post-acquisition run of the Electric Zoo festival in 2023 was marred by significant operational failures, including overcrowding and last-minute cancellations. These issues resulted in a public relations crisis, multiple lawsuits from attendees and vendors, and allegations from the NYPD that the event was oversold by approximately 7,000 tickets.

- During this period, the Company also faced increased scrutiny from local authorities over safety incidents at its venues, including drug-related medical emergencies.

Leadership and Governance Changes

- In response to these challenges, Josh Wyatt was hired as the Company's first-ever CEO in October 2024 to professionalize operations and rehabilitate the brand. Concurrently, the Company launched a large-scale renovation of the Brooklyn Mirage in early 2025.

- As part of lender-agreed governance changes, the board was expanded in mid-2024 to include two independent members: veteran EDM promoter Gary Richards and Hooman Yazhari.

- Following significant delays and permitting issues with the 2025 renovation, CEO Josh Wyatt was fired on May 22, 2025. Gary Richards, then non-executive board chairman, stepped in as interim CEO.

- In July 2025, as restructuring discussions advanced, the board formed an independent Restructuring Committee, headed by Hooman Yazhari, to oversee strategic alternatives. Upon the Chapter 11 filing, Richards formally assumed the CEO role to lead the Company through its reorganization.

Corporate Organizational Structure

Operations Overview

Avant Gardner’s operations are centered around its versatile, three-venue complex, which allows for tremendous programming flexibility. The integrated campus can accommodate over 8,000 patrons simultaneously, making it the second-largest entertainment venue in Brooklyn after the Barclays Center.

Venue Details and Programming

- The Brooklyn Mirage: The seasonal, open-air flagship venue has a pre-renovation capacity of approximately 5,300, with potential expansion to 6,200. It features a modular roof and staging to accommodate large-scale productions.

- The Great Hall: A converted warehouse with a capacity of approximately 2,800, featuring a large main floor and a mezzanine level added in 2023.

- The Kings Hall: A smaller club room with a subterranean feel, accommodating roughly 500-540 guests.

- During its May-October high season, the Brooklyn Mirage is typically programmed several nights per week, while the indoor halls facilitate year-round events, ensuring the property remains active and generates revenue during the off-season.

Technology and Workforce

- The Company prides itself on cutting-edge production, investing heavily in technology such as the 200-foot video wall at the Mirage and a planned 2025 redesign featuring kinetic LED "shutters" and immersive 360° audio.

- As of the Petition Date, Avant Gardner employs approximately 465 workers, with a small core of 15 full-time salaried employees and a large contingent of ~450 hourly event staff, including bartenders, security, and technical crew.

- The operational strategy focuses on high-volume event nights supported by robust ancillary revenue streams, including upscale VIP table service, a cashless payment system, and membership programs designed to enhance customer loyalty.

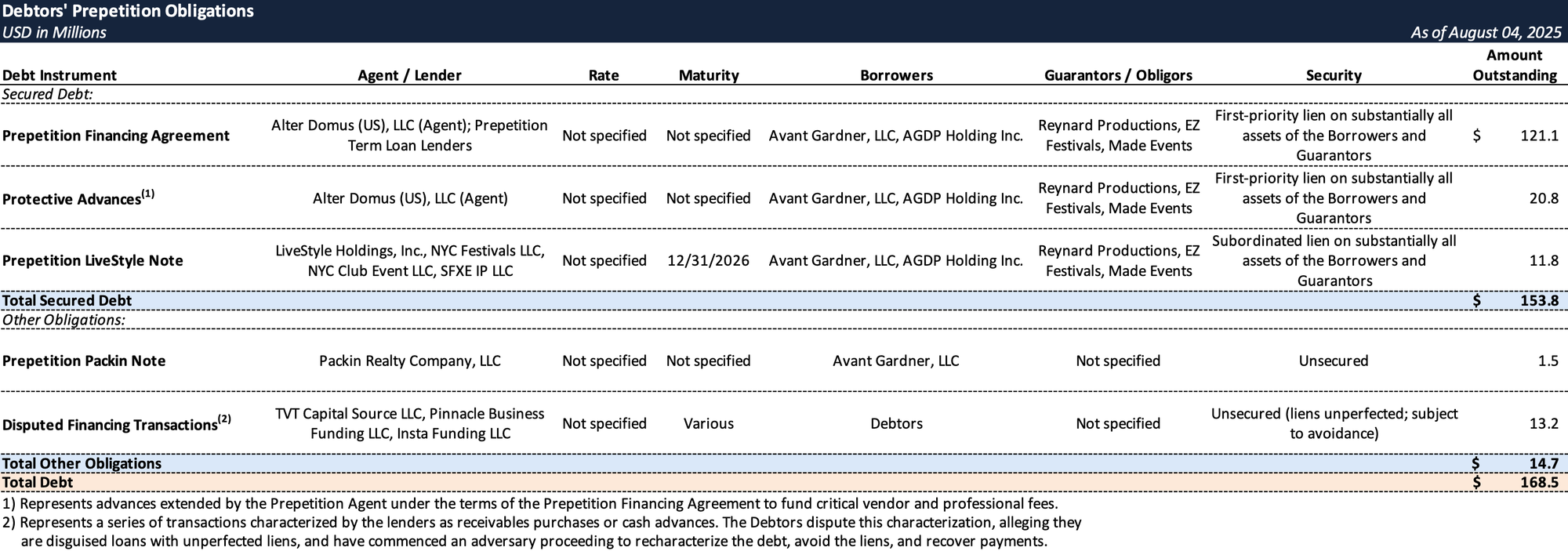

Prepetition Obligations

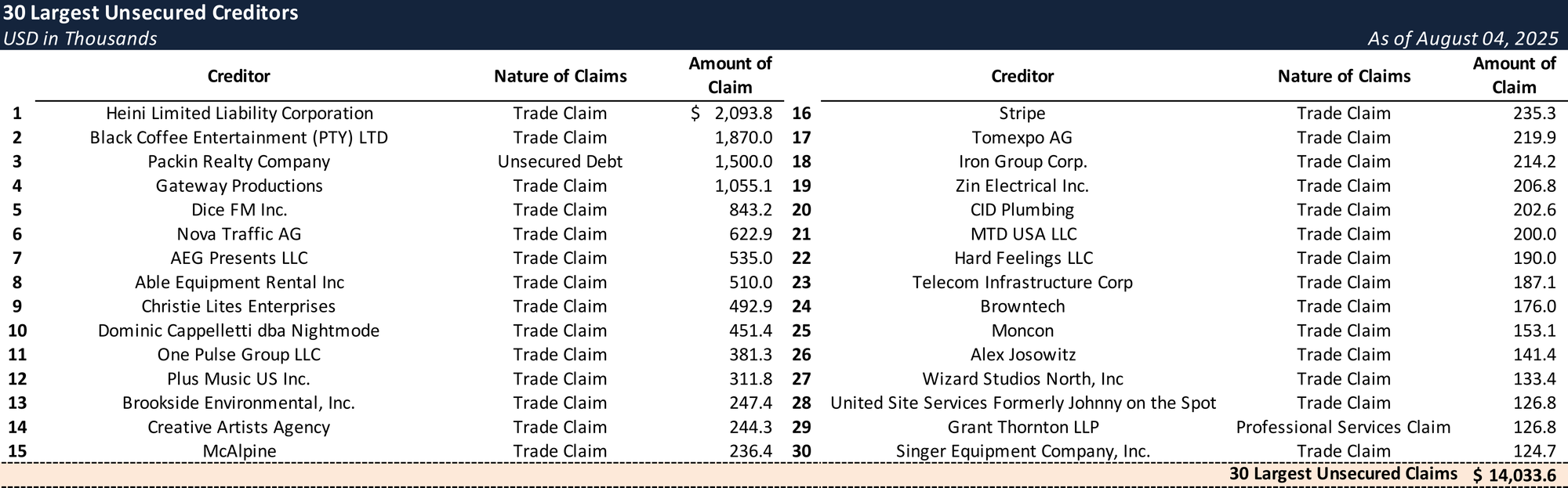

Top Unsecured Claims

Events Leading to Bankruptcy

Avant Gardner’s Chapter 11 filing was precipitated by an acute liquidity crisis stemming from a failed venue renovation, compounded by pre-existing financial, legal, and reputational pressures.

Failed 2025 Brooklyn Mirage Renovation

- The immediate trigger for the bankruptcy was the failure to reopen the Brooklyn Mirage for its Summer 2025 season. After investing significant capital in a large-scale renovation, the Company was denied an occupancy permit by the NYC Department of Buildings on the eve of its scheduled May 1 reopening, due to outstanding safety issues and disputes over structural designs.

- This forced the cancellation or costly relocation of at least ten weeks of marquee events, including sold-out Memorial Day weekend shows, decimating the Company's primary revenue stream during its peak season. The operational disarray led to widespread ticket refunds, drained cash reserves, and damaged customer goodwill.

Creditor Actions and Mounting Payables

- As the Company’s financial distress intensified, several merchant cash advance lenders attempted to sweep over $1 million from its bank accounts, freezing a substantial portion of its available cash and prompting Avant Gardner to file an adversary proceeding to contest the claims.

- Significant unpaid obligations to key partners further strained liquidity. Court filings revealed approximately $2.1 million owed to a construction firm for the renovation, along with substantial amounts due to various event production vendors, including $843,000 to ticketing platform DICE and $1.87 million to DJ/producer Black Coffee.

Pre-Existing Headwinds and Leveraged Balance Sheet

- The Company entered 2025 already weakened by the fallout from the disastrous Electric Zoo 2023 festival, which led to an ongoing class-action lawsuit, unpaid vendor claims, and the eventual cancellation of the 2024 festival.

- Regulatory pressure had also increased, with the New York State Liquor Authority citing the venues for "rampant" drug use and safety issues, imposing higher compliance costs and operational risks.

- Financially, the Company was heavily leveraged with approximately $155 million in pre-petition funded debt, including:

- A $121 million senior secured term loan.

- Roughly $21 million in "protective advance" bridge loans from senior lenders.

- An $11.8 million junior secured note owed to LiveStyle.

Chapter 11 Filing and Path Forward

- Facing a complete cash shortfall, the Company filed for Chapter 11 to obtain a "breathing spell" from creditor actions and execute a sale process.

- To fund operations, the senior term loan lenders agreed to provide a $45.8 million DIP financing facility, comprising $25 million in new money and a roll-up of $20.8 million in prior bridge loans.

- The lenders are slated to serve as the stalking horse bidder for the Company's assets, with a proposed sale timeline targeting a closing by early November 2025.

- During the proceedings, the indoor Great Hall and Kings Hall remain operational, while the Brooklyn Mirage is closed for the remainder of 2025.

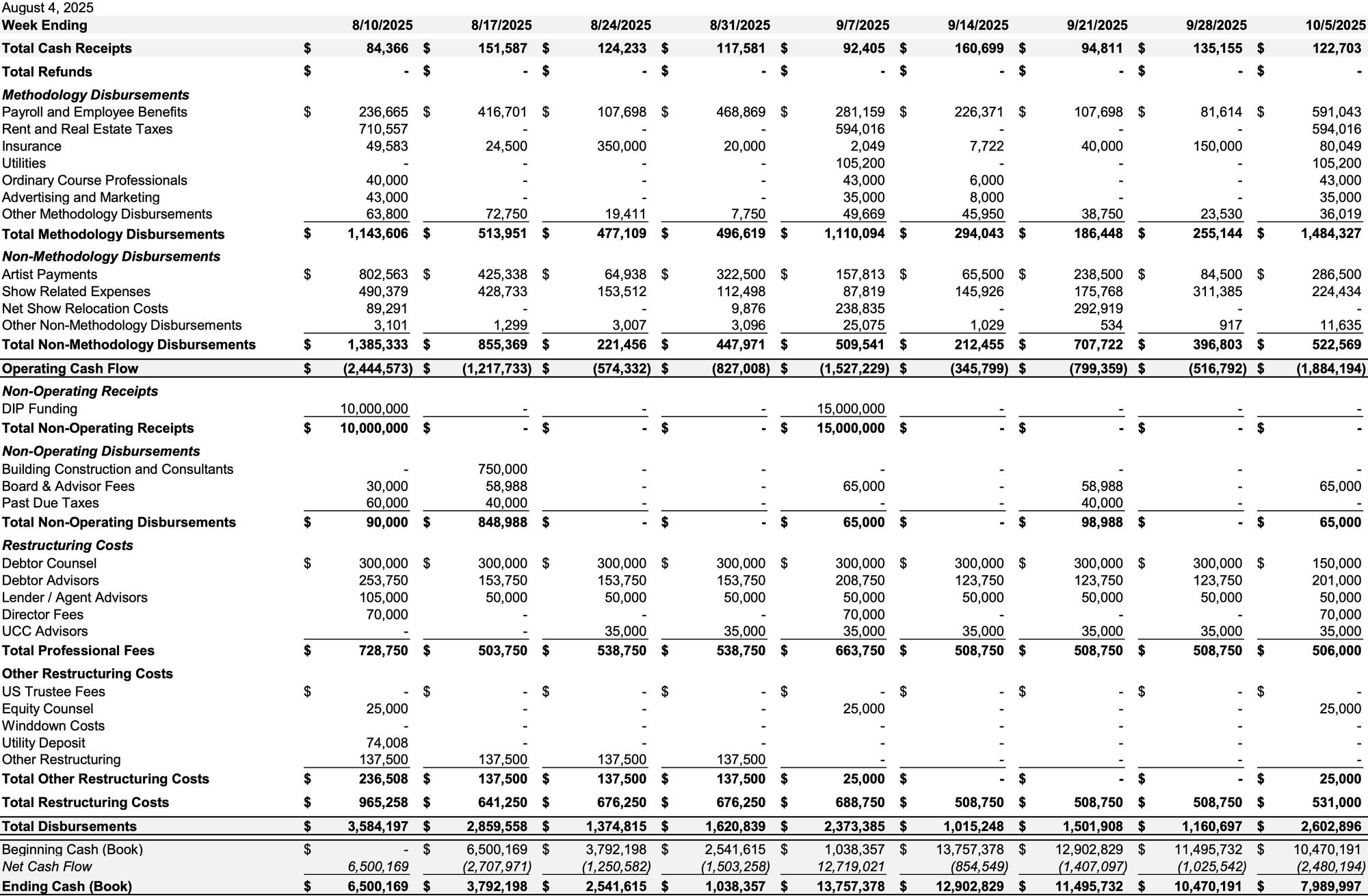

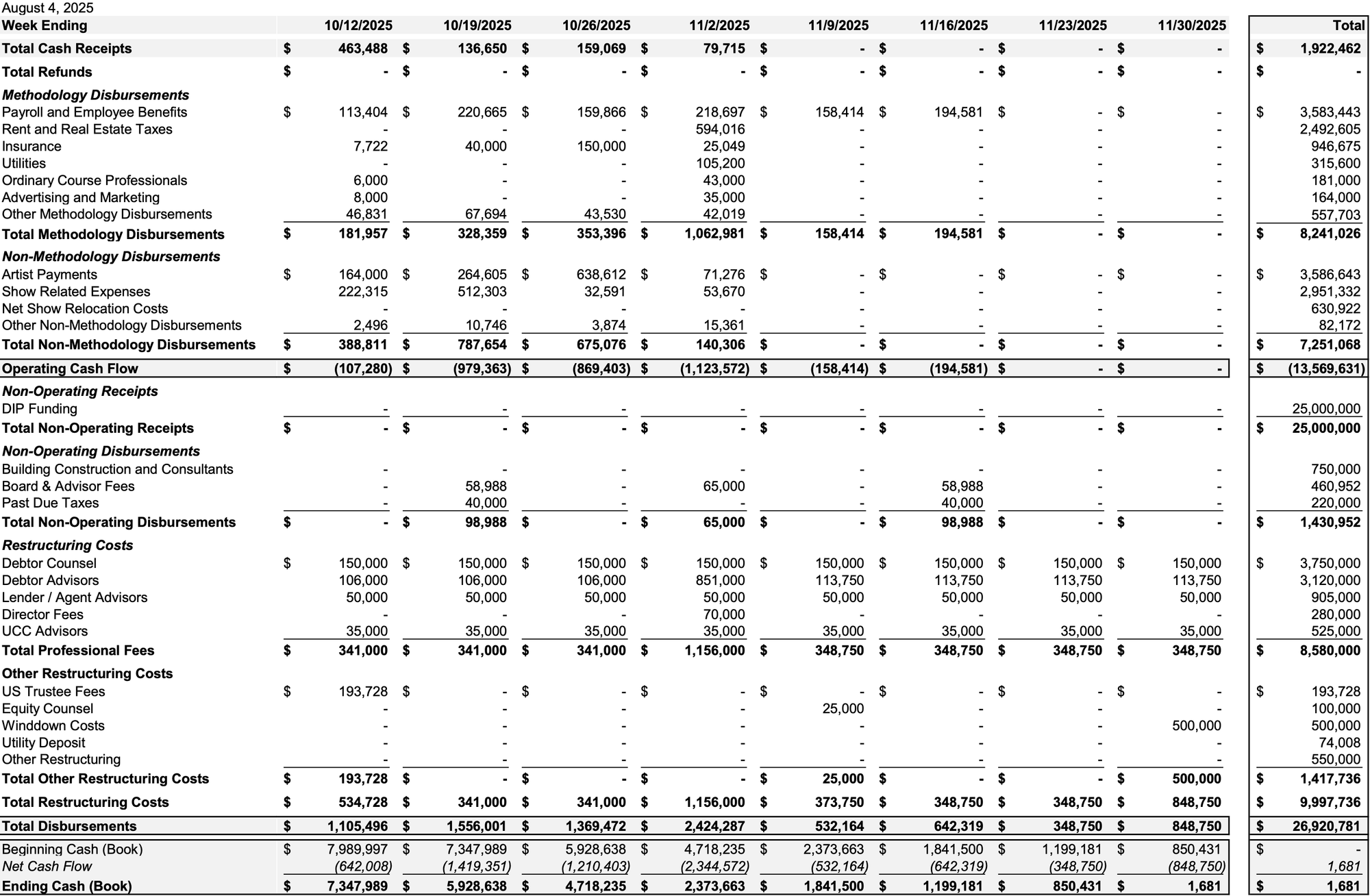

Initial DIP Budget

Key Parties

- Young Conaway Stargatt & Taylor, LLP (counsel); Triple P TRS, LLC (financial advisor); Triple P Securities, LLC (investment banker); Kurtzman Carson Consultants, LLC dba Verita Global (claims agent).

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.