Filing Alert: Azul Chapter 11

Azul Files Chapter 11 in Southern District of New York

Azul S.A. and its debtor affiliates⁽¹⁾, a São Paulo, Brazil-based airline, filed for Chapter 11 protection on May 28 in the U.S. Bankruptcy Court for the Southern District of New York.

The prepackaged Chapter 11 filing aims to implement a comprehensive financial restructuring supported by key financial stakeholders and strategic partners through three separate Restructuring Support Agreements (RSAs). The plan will reduce funded debt by over $2.0 billion and provide approximately $670 million in new capital during the restructuring, plus up to $950 million in new equity upon emergence.

The company, Brazil's largest airline by departures and cities served, faced compounded challenges since 2020 from the COVID-19 crisis, high foreign exchange volatility impacting its largely U.S. dollar-denominated debt and lease obligations, 2024 flooding in Southern Brazil, and increased litigation. These issues led to a need for $800 million in fresh capital, only partially met by $500 million in superpriority financing from noteholders and a significantly smaller-than-expected $8 million follow-on equity raise.

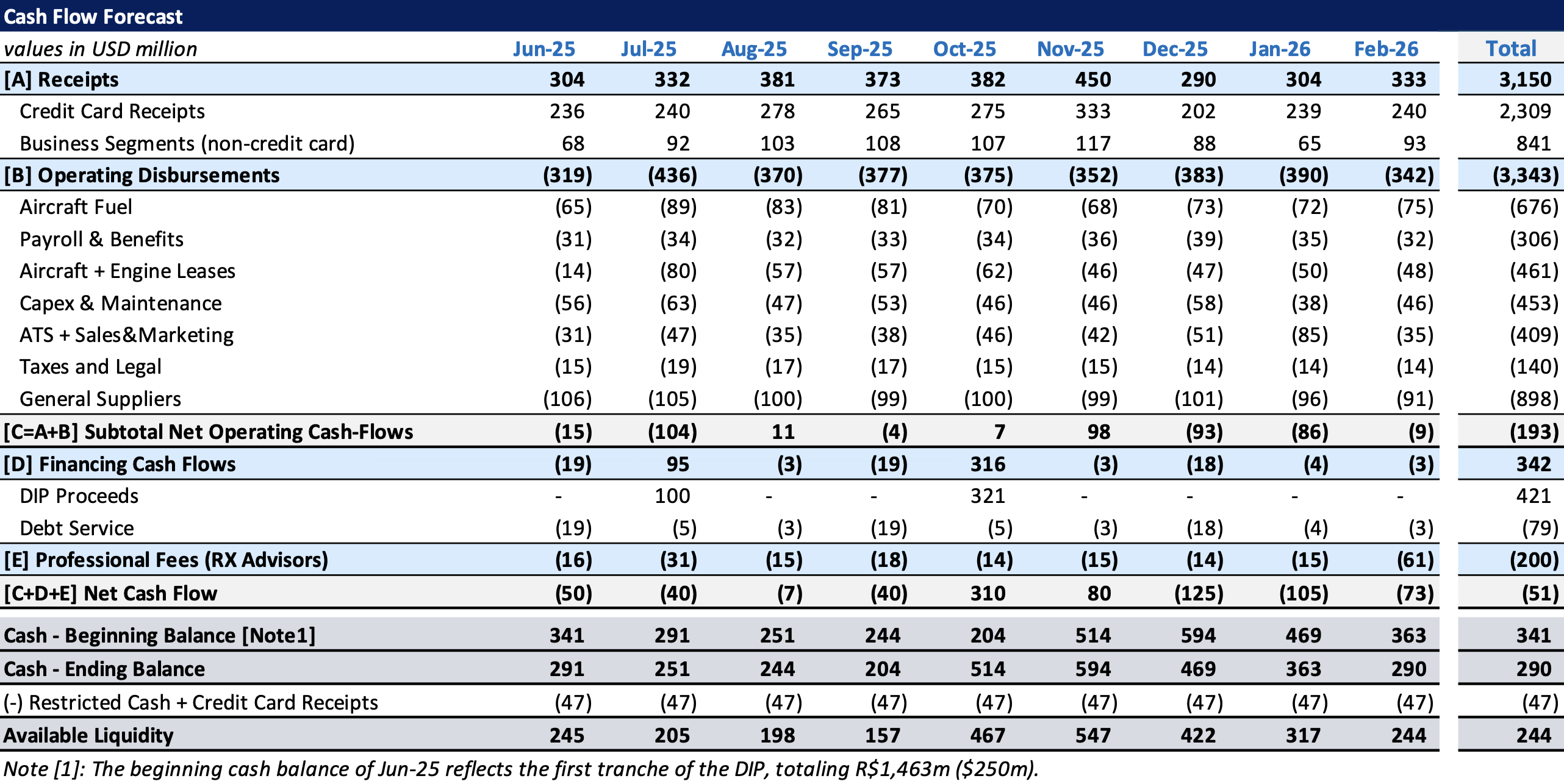

Emergence will be facilitated by a $650 million backstopped equity rights offering, with proceeds to repay the DIP, and a commitment from strategic partners United Airlines and American Airlines to invest $200 million to $300 million in new equity. The DIP facility is a $1.57 billion superpriority senior secured multi-draw term loan, including a $250 million initial new money draw.

Azul S.A. reports $4.5 billion in assets and $9.6 billion in liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The case number is 25-11176.

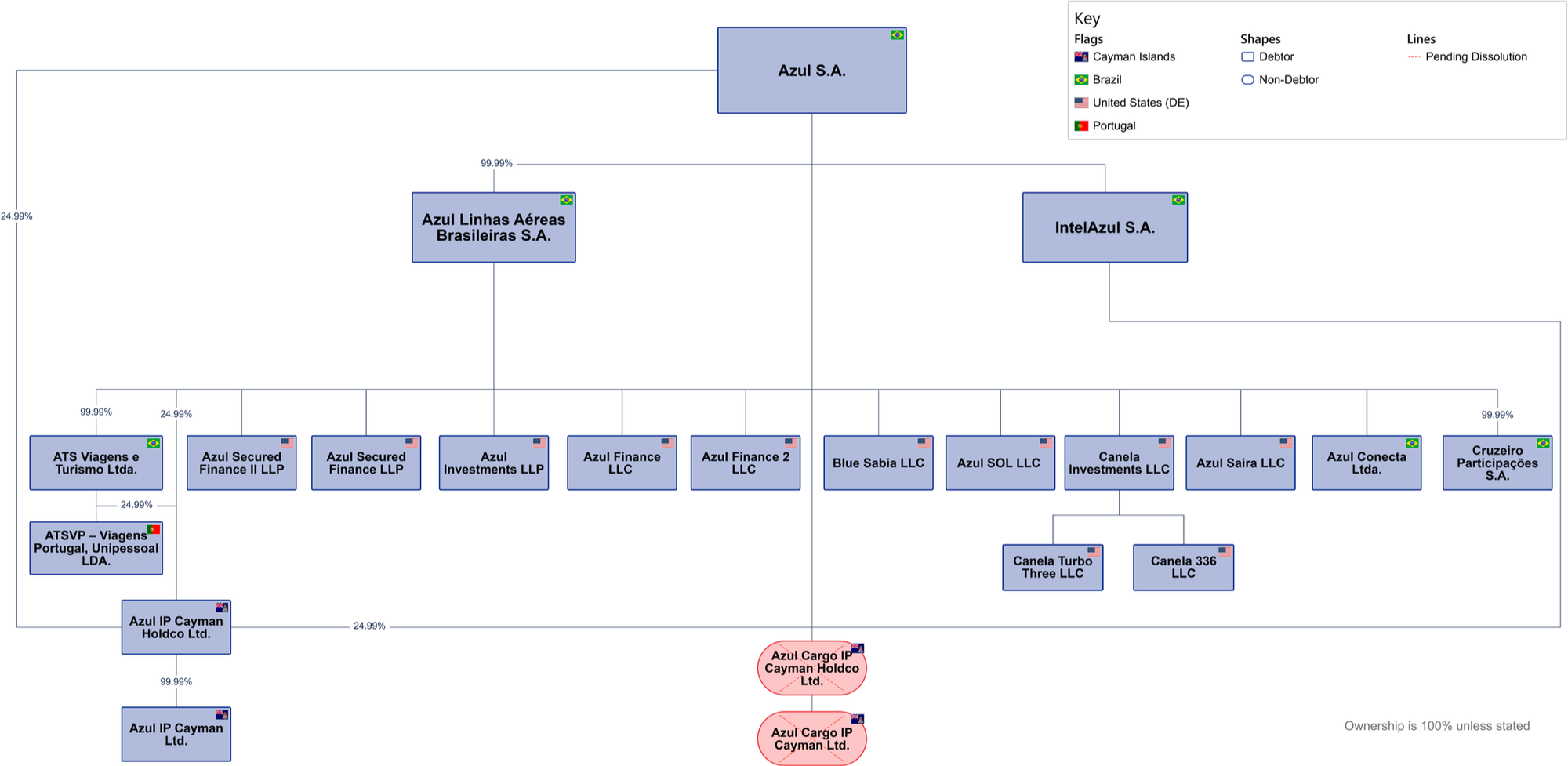

⁽¹⁾ For a complete list of Debtor entities, see organizational structure chart below.

Corporate Organizational Structure

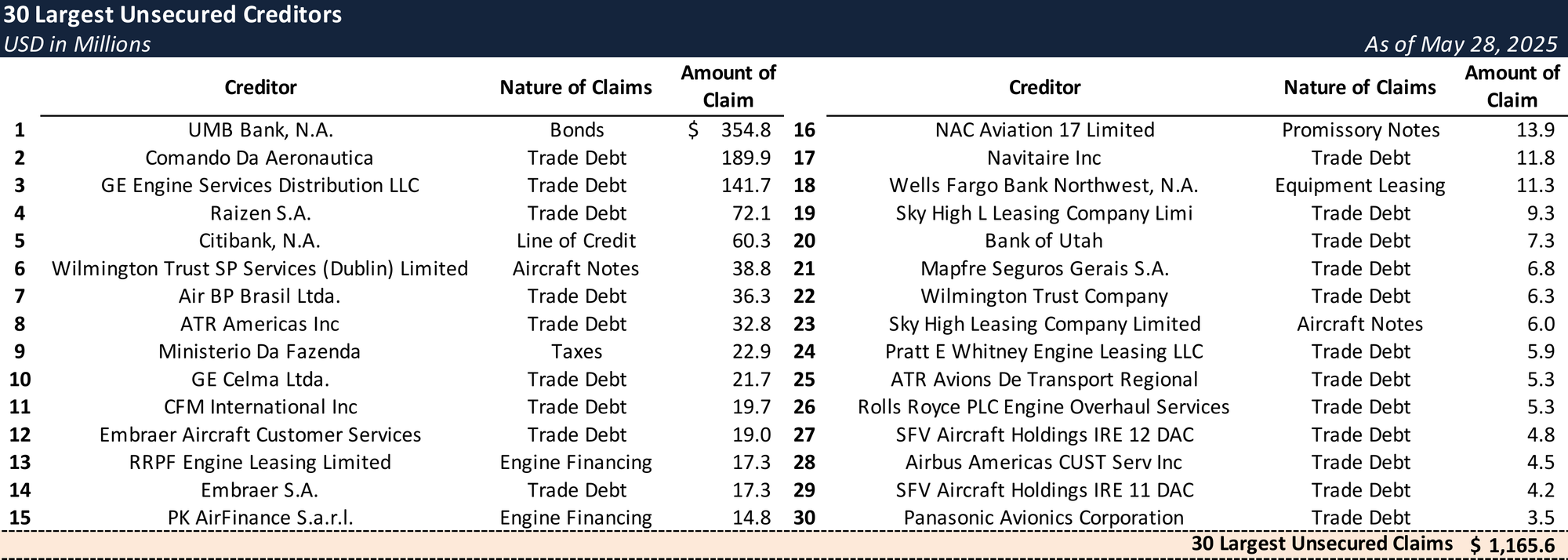

Top Unsecured Claims

Initial DIP Budget

Key Parties

Counsel:

- Timothy Graulich

- Davis Polk & Wardwell LLP

- Email: [email protected]

Financial Advisor / CRO:

- FTI Consulting Inc. (Samuel Aguirre)

Claims Agent:

Equity Security Holders:

- TRIP Participações S/A – 33% Equity Interest

- Other Minority Holders – 67% Equity Interest

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.