Case Summary: Azzur Group Chapter 11

Azzur Group has filed for Chapter 11 bankruptcy following underperformance of its pandemic-era Cleanrooms on Demand expansion, with plans to sell assets in bankruptcy.

Business Description

Headquartered in Philadelphia, PA, Azzur Group Holdings LLC, along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, "Azzur" or the "Company"), operates as a key service provider to the biotechnology and pharmaceutical sectors, offering a range of compliance and advisory solutions across the drug development lifecycle.

- Azzur supports clients through regulatory compliance, quality assurance, and other GxP-related services to navigate industry regulations.

The Company’s operations were historically divided into three primary business units⁽²⁾:

- Azzur Consulting – Specializes in regulatory, compliance, quality assurance, and other GxP advisory services.

- Azzur Labs – Provides analytical laboratory testing and training.

- Cleanrooms on Demand™ – Offers flexible cleanroom solutions catering to small and mid-sized biotech firms as well as large pharmaceutical companies.

The Debtors filed for Chapter 11 protection on Mar. 2 in the U.S. Bankruptcy Court for the District of Delaware. As of the Petition Date, the Debtors reported $100 million to $500 million in both assets and liabilities.

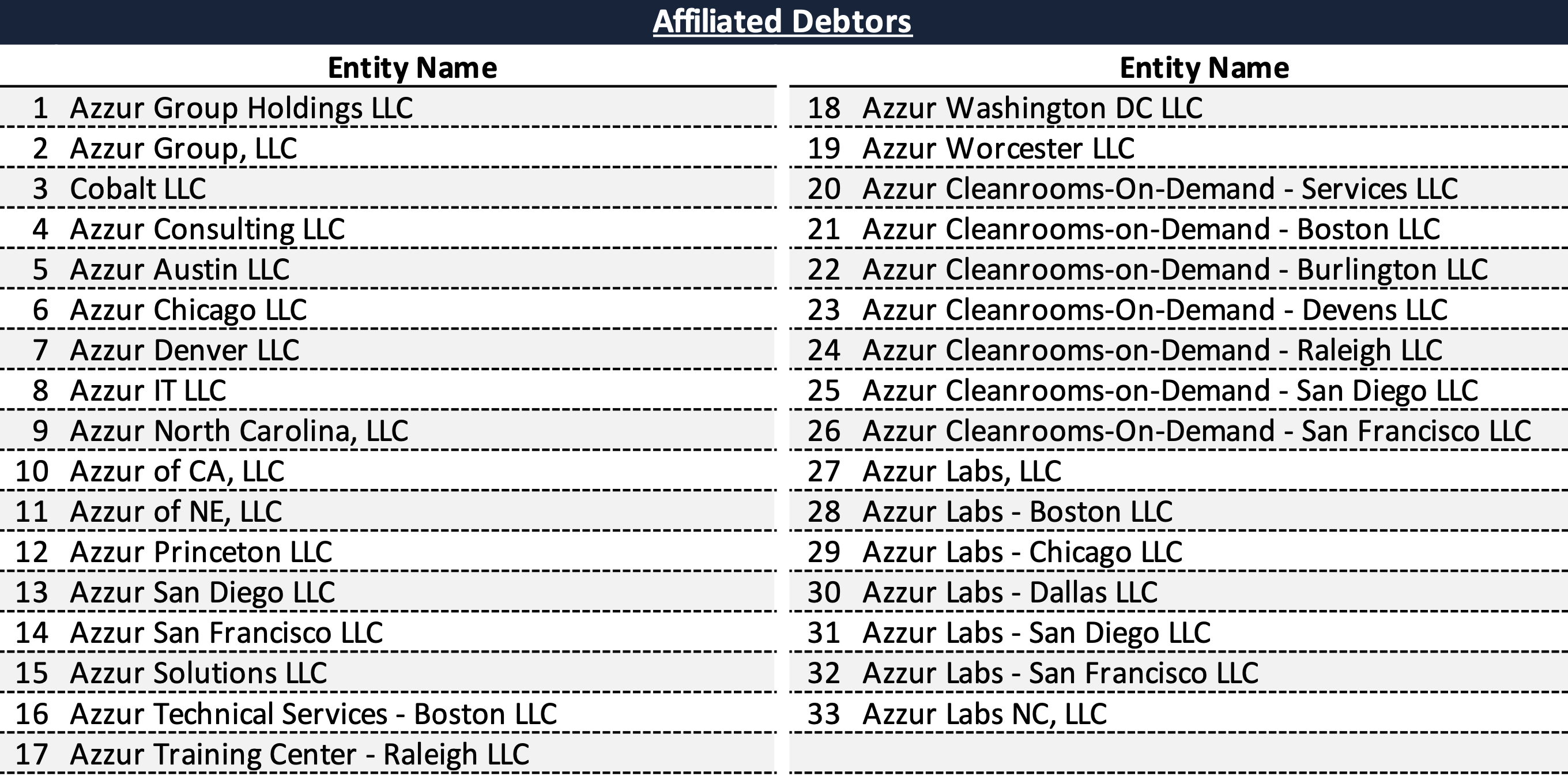

⁽¹⁾ A list of the Debtors is provided in the Affiliated Debtors table below.

⁽²⁾ Azzur Labs was sold prior to the Chapter 11 filing.

Corporate History

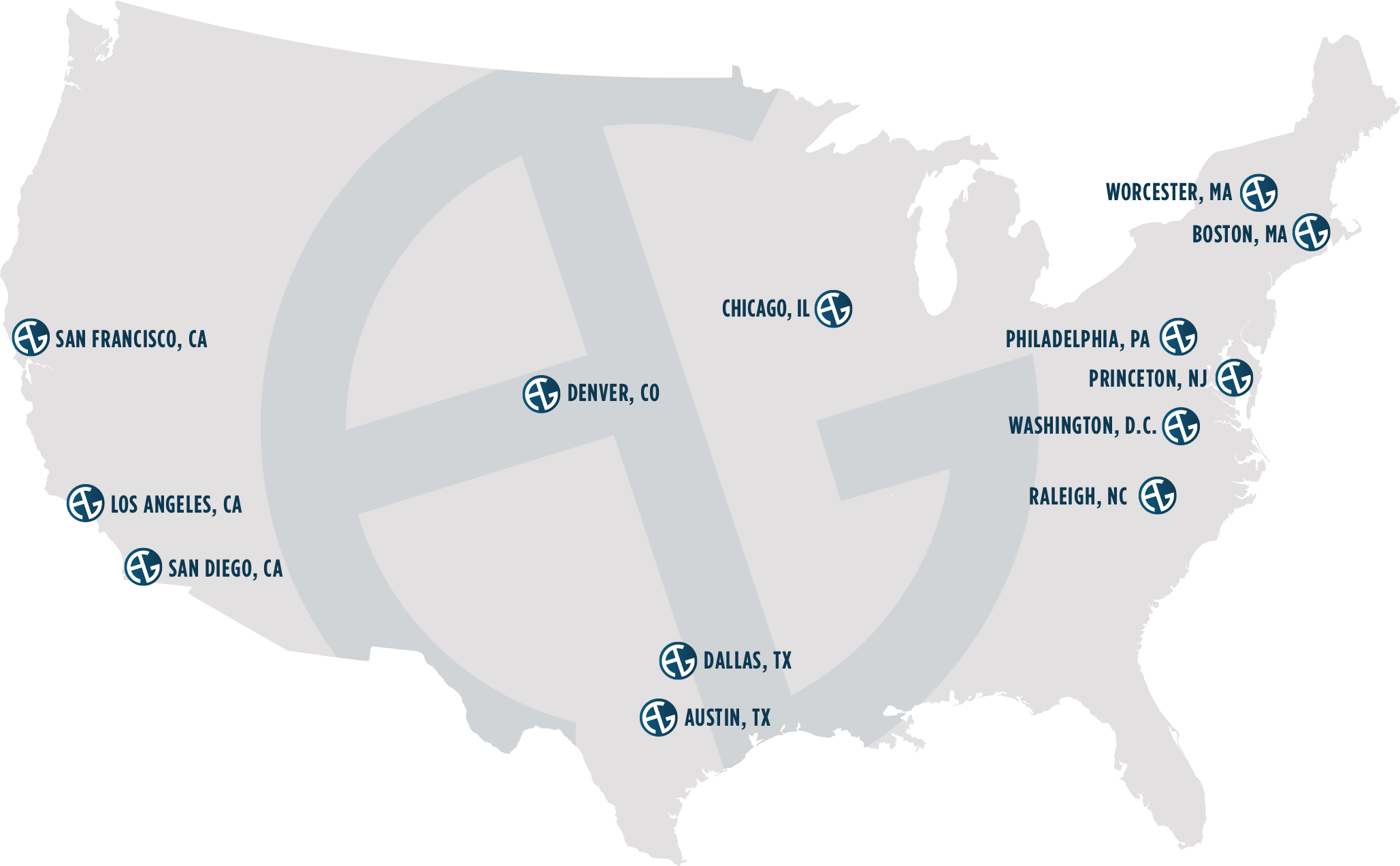

Founded in 2010, Azzur has expanded its operations to serve over 350 life science clients across 18 locations in nine states.

In April 2021, Baird Capital invested approximately $30.2 million to support the Company’s growth, specifically the expansion of its Cleanrooms on Demand™ ("COD") facilities and consulting services.

- Following this investment, Azzur launched new COD locations in North Carolina and Massachusetts.

Equity Ownership Structure

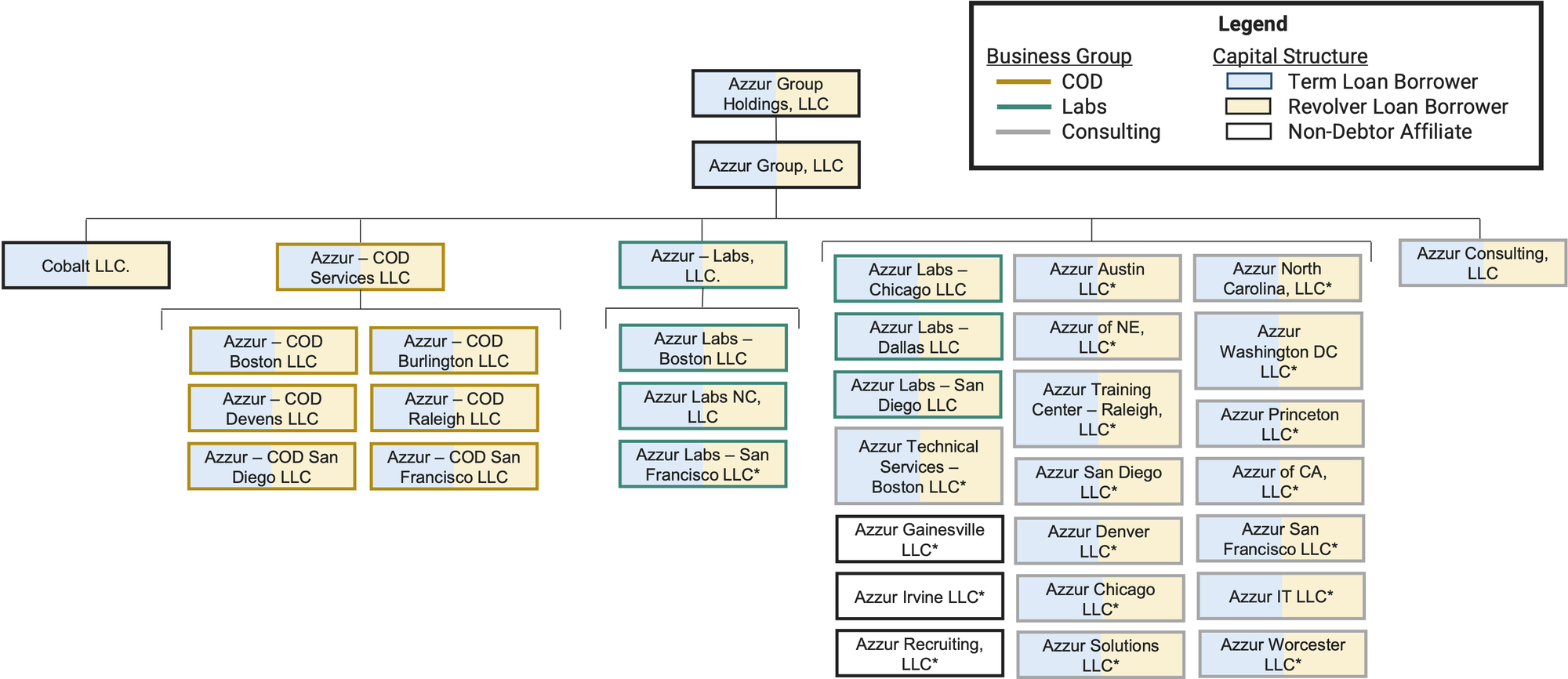

- Azzur Group Holdings LLC holds 100% ownership of Azzur Group, LLC.

- Class A Preferred Equity Units:

- Azzur Blocker, LLC – 27.8%

- BGL Azzur, LLC – 0.9%

- G. Knight Consulting Ltd. – 0.1%

- Class B Common Equity Units:

- Yotomatchi, LLC – 70.1%

- Class C Incentive Units:

- Gary Knight – 1.1%

Affiliated Debtors

Corporate Structure Chart

Operations Overview

Azzur Consulting

Azzur Consulting provides specialized services to the life sciences sector, backed by a team of over 260 cGMP consultants, engineers, and scientists. The business unit offers expertise in:

- Validation and qualification

- Quality and compliance assurance

- Controls and automation services

- Information technology advisory support

- Training and engineering services

Between 2021 and 2024, Azzur Consulting expanded its client base from approximately 135 to 160 unique clients, serving both established commercial entities and emerging sponsors.

Azzur Labs

Azzur Labs specializes in analytical laboratory testing, offering services such as:

- Chemistry and microbiological testing

- Microbial identification and environmental monitoring

- Cleaning validation and verification

- Critical systems and utilities testing

The business unit also provides on-site training and maintenance services tailored to client needs. From 2021 to 2024, Azzur Labs grew its client base from approximately 125 to 178 unique clients.

- This division was divested prior to the Chapter 11 filing.

Cleanrooms on Demand™

Azzur’s COD business unit provides flexible, cost-effective cleanroom solutions for biotechnology and pharmaceutical clients. By converting open warehouse spaces into controlled, sterile environments, COD eliminates the need for companies to build and manage in-house cleanrooms. Services include:

- Multi-tenant cGMP facilities with configurable cleanroom layouts

- Personnel support and sterility management

- Quality control testing and security measures

- Waste management and materials storage

- Raw material sampling and testing support

COD supports a range of applications, including gene therapy, cell banking, microbiome research, and novel therapeutics. It offers cost-effective manufacturing solutions, overflow capacity, and temporary cleanroom space for companies developing new infrastructure.

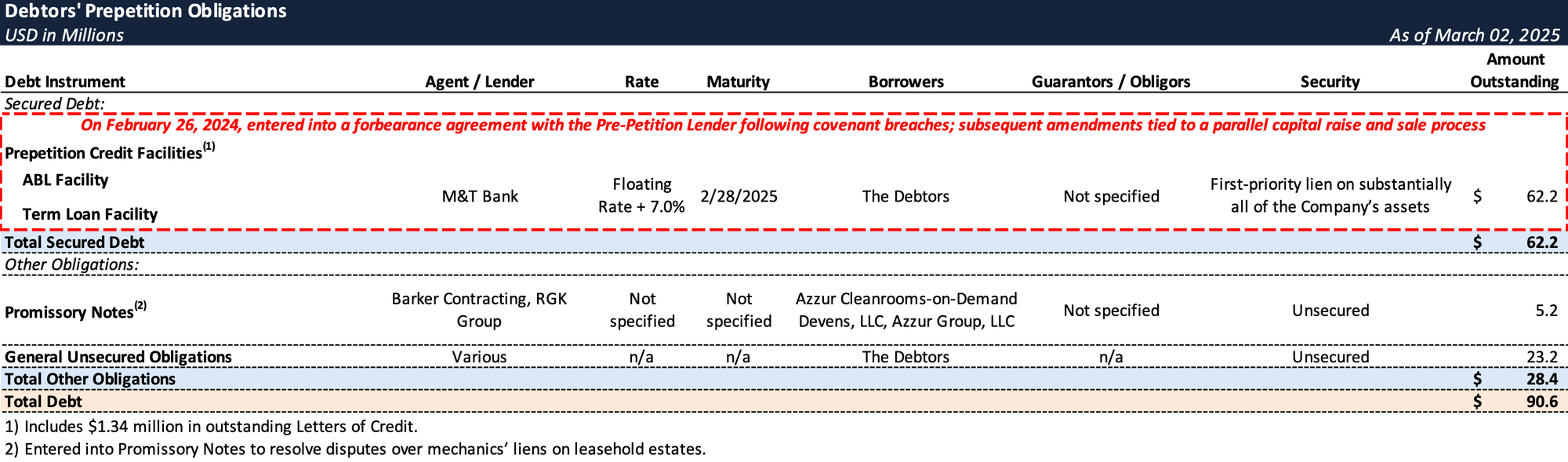

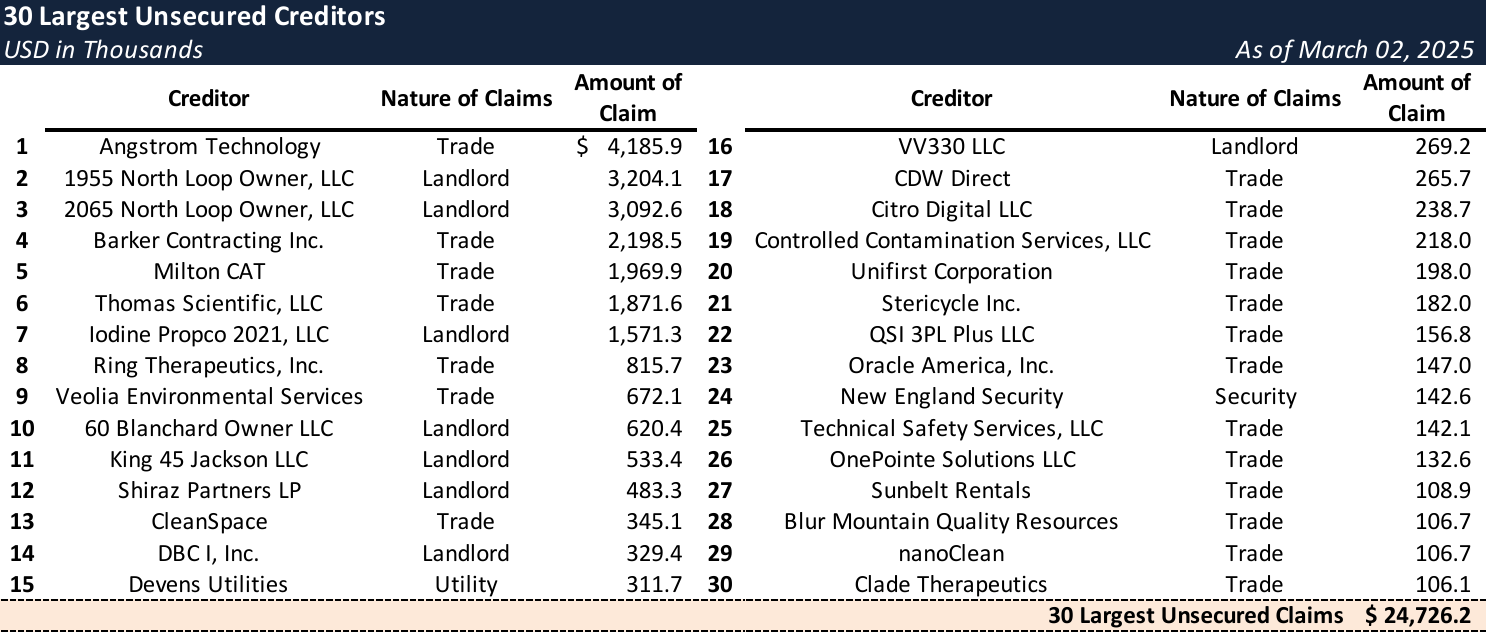

Prepetition Obligations

Top Unsecured Claims

Events Leading to Bankruptcy

Operational and Financial Challenges

- The Company’s aggressive expansion strategy in its COD business unit led to rising expenses that outpaced customer and revenue growth. Expansion efforts, driven by expectations of increased demand for pharmaceutical cleanroom services during the COVID-19 pandemic, resulted in high fixed costs.

- However, as pandemic-related demand failed to materialize, COD’s occupancy rates remained lower than projected. The high costs associated with operating these facilities—such as utilities and rent—made profitability unattainable.

Prepetition Restructuring Efforts

- In December 2023, Azzur engaged legal and financial advisors to negotiate with its prepetition lender, Manufacturers and Traders Trust Company ("M&T"), following breaches of multiple loan covenants, including failure to maintain the required Fixed Charge Coverage Ratio and minimum cash deposit levels.

- In February 2024, Azzur and M&T executed a forbearance agreement contingent on the Company securing capital or restructuring its debt within specified deadlines. Despite extensive marketing efforts, Azzur was unable to secure an initial capital investment or complete a recapitalization by the April 30, 2024, deadline.

- Between August 2024 and January 2025, Azzur and M&T entered into multiple amendments to extend the forbearance agreement and facilitate a sale process for certain business units.

Asset Sales and Restructuring

- In November 2024, Azzur entered into a letter of intent with Keystone Capital Management and Bluebirds Ventures to sell substantially all assets of its Azzur Labs unit to AL Holdings Inc. (a newly formed entity) for $16 million.

- The sale closed on January 3, 2025, with the proceeds used to reduce outstanding debt under the Prepetition Credit Facilities.

- The Company also entered into a stalking horse agreement with Eliquent Life Sciences, Inc. for the sale of its Azzur Consulting unit for $56 million, subject to higher or better bids during the auction process.

- Azzur Consulting employees are expected to transition to the Stalking Horse Bidder post-sale, with operations continuing uninterrupted.

DIP Financing and Path Forward

- The Debtors filed for Chapter 11 protection on March 2, 2025, aiming to utilize these proceedings to market their remaining assets, including the Azzur Consulting and COD businesses.

- To address its liquidity constraints, Azzur sought court approval for a $23.5 million DIP credit facility from M&T to support operations throughout the Chapter 11 process and facilitate the sale of its remaining assets.

- The proposed DIP facility included specific DIP Milestones tied to sale-related objectives. Failure to meet these milestones would constitute an Event of Default under the DIP Loan Documents.

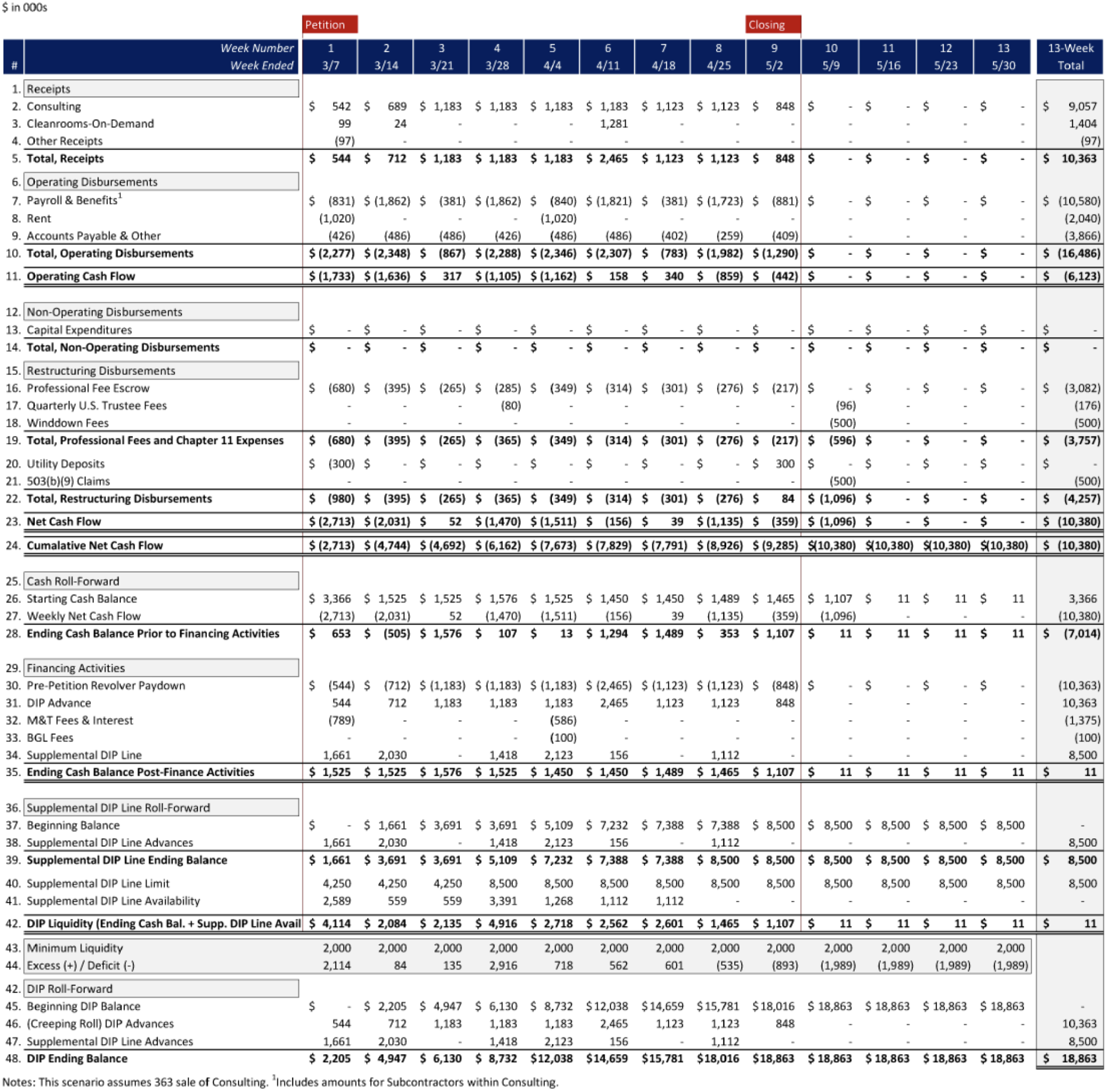

Initial Budget

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you’re already a subscriber and would like to receive timely filing alerts, please reach out and we’ll add you to the distribution list.