Case Summary: Bargain Hunt Stores Chapter 11

Bargain Hunt Stores has filed for Chapter 11 bankruptcy, citing competitive pressures, macroeconomic headwinds, and the loss of a key supplier, with plans to close all locations.

Business Description

Headquartered in Antioch, TN, Essex Technology Group, LLC, dba Bargain Hunt Stores ("Bargain Hunt" or the "Company"), operates 92 retail stores across ten states, including Alabama, Arkansas, Georgia, Indiana, Kentucky, Mississippi, North Carolina, Ohio, South Carolina, and Tennessee.

The Company specializes in closeout and reverse logistics inventory processing, purchasing and reselling goods from manufacturers. Its product offerings include fast-moving items such as household goods, packaged foods, and similar general store products.

- Historically, Bargain Hunt processed customer merchandise returns from vendors and sold the returned merchandise through wholesale channels and online websites.

In the fiscal year ending February 3, 2024, the Company reported net sales of approximately $340 million. For the ten months ended November 30, 2024, net sales were approximately $274 million.

Bargain Hunt filed for Chapter 11 protection on Feb. 3 in the U.S. Bankruptcy Court for the Middle District of Tennessee. As of the Petition Date, the Debtor reported $10 million to $50 million in assets and $50 million to $100 million in liabilities.

Corporate History

The Debtor is a successor in interest to Essex Technology Group, Inc. ("Essex"), originally a Tennessee corporation.

- On November 17, 2015, Essex merged with and into Essex Merger Sub, Inc., a Tennessee corporation.

- Following the merger, effective November 18, 2015, Essex was converted to a Delaware limited liability company, adopting its current name, Essex Technology Group, LLC.

ETGBH Holdings, LLC ("Holdings") is the sole member of the Debtor.

Organizational Structure

Equity Ownership and Corporate Governance

Bargain Holdings, L.L.C., a non-Debtor affiliate and the indirect parent of the Debtor, is majority owned by ACON BH Investors, L.L.C. ("ACON").

On January 13, 2025, Crystal Financial LLC dba SLR Credit Solutions, as administrative agent for the Debtor’s senior secured lenders (the "Prepetition Agent"), exercised proxy rights under a Pledge and Security Agreement, effectuating the following:

- The Prepetition Agent, as proxy and attorney-in-fact for Holdings, executed an amended and restated Limited Liability Company Agreement.

- Holdings’ membership interests in the Debtor were reclassified as non-voting.

- Crystal Financial SPV II LLC assumed all voting rights and appointed Matthew Kahn as the sole Independent Manager.

As a result, ACON retains an indirect economic interest in the Debtor, while governance and operational control have transitioned to the Independent Manager.

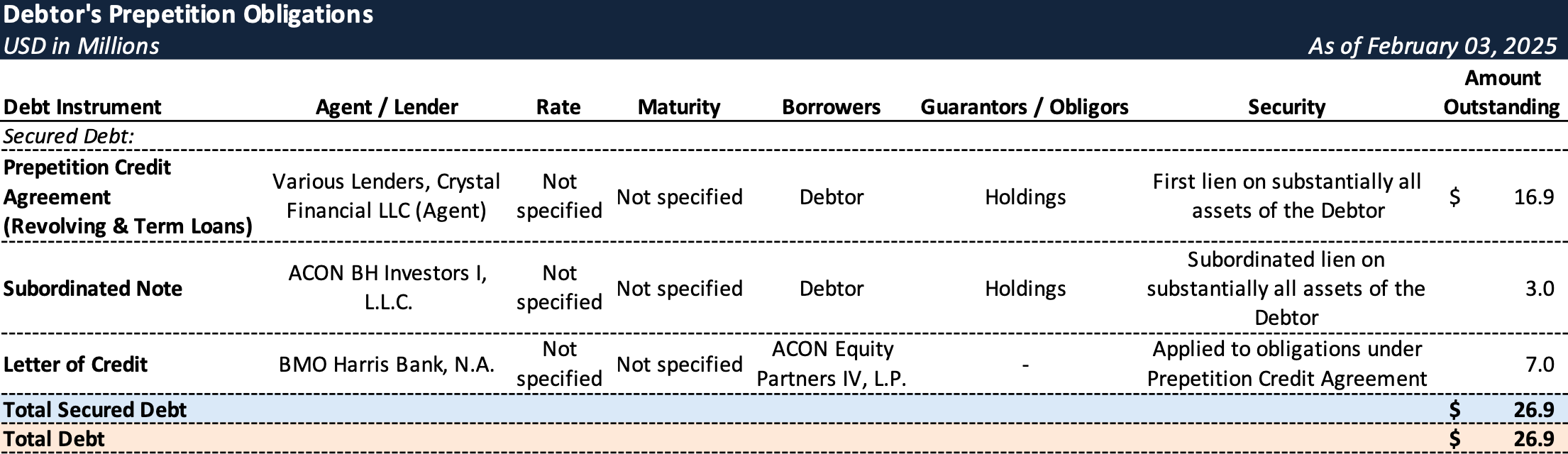

Prepetition Obligations

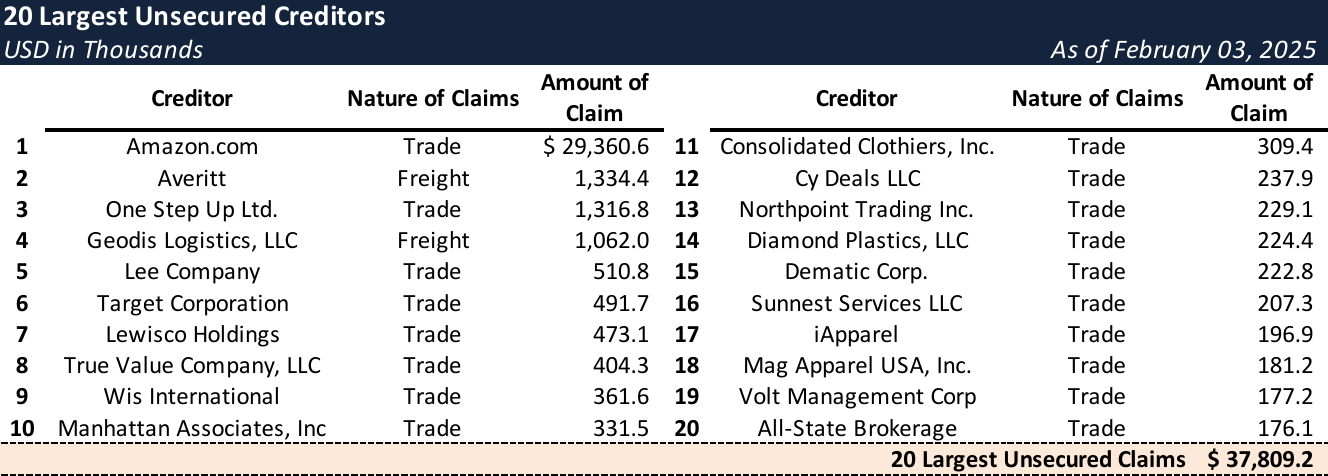

Top Unsecured Claims

Events Leading to Bankruptcy

Challenging Retail Environment and Operational Decline

- Bargain Hunt operates in a highly competitive retail landscape, facing competition from various channels including big box stores, local convenience stores, and e-commerce platforms.

- Additionally, macroeconomic factors such as increased interest rates, inflationary pressures, and supply chain disruptions have further intensified operational challenges.

Declining Performance and Liquidity Pressures

- The Company has experienced consistent financial difficulties, with net losses of approximately $25.4 million for the fiscal year ended January 28, 2023, and $21.8 million for the fiscal year ended February 4, 2024. This trend continued with a net loss of $19 million for the ten months ended November 30, 2024.

Loss of Major Business with Amazon

- A significant blow occurred when Amazon, the Company's largest supplier for its reverse logistics wholesale business, initiated a request for proposal process in 2024. This resulted in the loss of approximately 25% of Bargain Hunt's business with Amazon. Subsequently, Amazon terminated its relationship, effectively ending the Company's wholesale operations and severely impacting its profitability.

Failed Restructuring Discussions and Liquidity Challenges

- Bargain Hunt engaged in discussions with ACON and the Prepetition Agent regarding potential equity investments and restructuring options. However, these discussions were unsuccessful, leaving the Company with insufficient liquidity to sustain operations. Following multiple defaults under the Prepetition Credit Agreement, the Prepetition Agent took Proxy Action on January 13, 2025. Advised by professionals, the Independent Manager concluded that a Chapter 11 filing was the most viable option to address the Company's financial distress.

Chapter 11 Filing and Path Forward

- Bargain Hunt filed for Chapter 11 bankruptcy on February 3, 2025. It has initiated store liquidation sales and plans to engage an investment banker.

- While the primary focus is on asset liquidation, the Company remains open to a potential going-concern sale, exploring both avenues simultaneously.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you’re already a subscriber and would like to receive timely filing alerts, please reach out and we’ll add you to the distribution list.