Case Summary: Biora Therapeutics Chapter 11

Biora Therapeutics has filed for Chapter 11 bankruptcy, citing financial strain from legacy liabilities, cash flow challenges, and limited capital access.

Business Description

Headquartered in San Diego, CA, Biora Therapeutics, Inc. (“Biora” or the “Company”), is a preclinical stage biotechnology company developing oral biotherapeutics, specifically developing innovative smart pills designed to target drug delivery to the GI tract orally, eliminating the need for injections.

- Biora offers NaviCap, a targeted oral delivery platform for therapeutics in the gastrointestinal tract to enhance the treatment of inflammatory bowel diseases, and BioJet, a systemic oral delivery platform designed to replace injections with needle-free, oral delivery of large molecules for managing chronic diseases.

- The Company has successfully procured over 180 patents and has over 130 patent applications pending.

Biora's is publicly traded under the ticker symbol “BIOR,” with ~4.5 million outstanding shares of common stock.

As of the Petition Date, the Debtor reported $10-$50 million in assets and $100-$500 million in liabilities.

Corporate History

Biora was founded in 2010 as Ascendent MDx, Inc., a molecular diagnostics company specializing in developing solutions for the oral delivery of bio-molecules. In 2013, the Company rebranded as Progenity, Inc. (“Progenity”) and adopted a debt-funded growth strategy.

- Progenity achieved a major milestone in 2020 with a successful IPO, leveraging a record-breaking fiscal year in 2019, during which it generated over $140 million in revenue.

- By 2021, Progenity faced significant financial headwinds, with revenue contracting to approximately $60 million.

- The business experienced significant cash burn due to low payor reimbursement rates, legacy settlement costs, shareholder litigation, and substantial debt service requirements.

In June 2021, Progenity addressed liquidity challenges through operational restructuring, including shutting down lab operations, monetizing non-core assets, reducing workforce, and optimizing capital allocation.

- Progenity also restructured its leadership, eliminating several roles while appointing new senior management.

In April 2022, it relaunched under its current name, Biora, repositioning itself as an early-stage medical technology company specializing in drug-device therapeutics.

Operations Overview

Biora is at the forefront of developing smart pills for oral delivery of drug therapeutics, focusing on two patented platforms: BIOjet and NAVIcap.

- BIOjet: A swallowable autoinjector designed to deliver drugs directly into the small intestine, addressing challenges of injectable drugs while maintaining efficacy.

- The multivitamin-sized device navigates the digestive system, activating in the small intestine to deliver a liquid jet into intestinal tissue, enabling systemic absorption.

- NAVIcap: A targeted oral delivery system designed for localized drug release in the GI tract, particularly for inflammatory bowel disease.

- It maximizes drug concentration at the disease site while reducing systemic toxicity.

- Although FDA-approved for clinical trials with promising results, the program has been deprioritized due to limited financial resources.

Biora has sought to protect its proprietary position by pursuing and obtaining patent protection in various jurisdictions related to its proprietary technology, inventions, improvements, and platforms that are important to the development and implementation of its potential products.

- The Company secures its technology through a robust patent portfolio and collaborates with specialized suppliers and service providers for essential components, testing, clinical studies, and analysis.

- Given the regulated nature of its business, some critical components are sourced from a limited number of suppliers, including sole sources.

The Company employs 34 full-time staff and 5 contractors, covering key areas such as management, R&D, lab operations, finance, and IT.

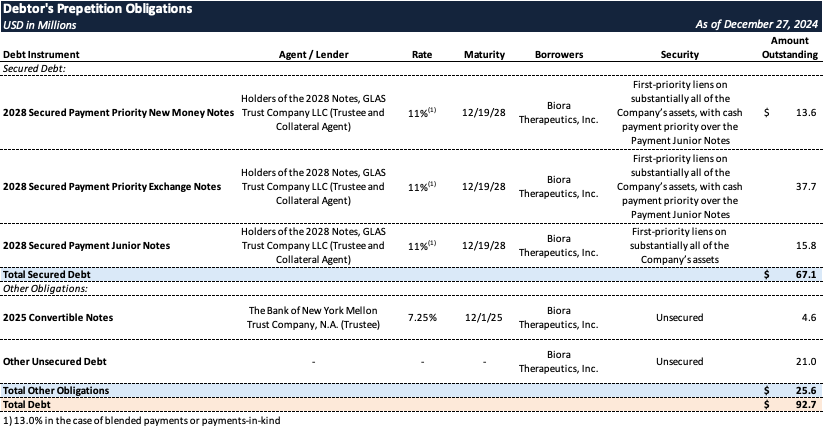

Prepetition Obligations

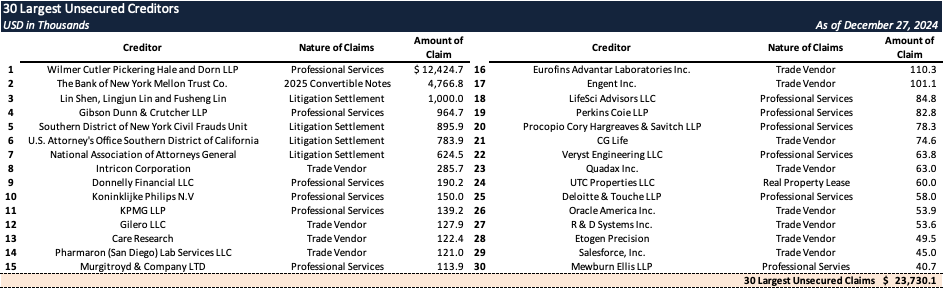

Top Unsecured Claims

Events Leading to Bankruptcy

Operational Challenges and Cost-Saving Measures

- Since its 2022 relaunch as Biora, the Company has prioritized financial resources on developing the BIOjet and NAVIcap programs.

- Developing and commercializing drug-device therapeutics, including preclinical studies and clinical trials, remains a capital-intensive, long-term process.

- The Company has been unable to secure the necessary funding to advance its product pipeline.

- In addition, the financial strain from legacy liabilities, litigation settlements, and penalties linked to the shutdown of Progenity lab operations has further challenged the Company.

- To address these operational and liquidity issues, Biora has implemented cost-reduction measures, including workforce reductions and streamlined operations.

Legacy Litigation and Financial Strain

- Biora has faced significant financial strain due to lawsuits and liabilities from its legacy business, including patent infringement claims, IPO-related litigation, and settlements with federal and state governments.

- These legacy costs have complicated the Company’s transformation efforts and continue to impact its financial health.

Cash Flow and Capital Challenges

- Following its strategic transformation in June 2021, Biora’s revenue sources were largely eliminated, leaving it reliant on equity or debt financing, collaborations, licensing, or asset sales for funding.

- Biora's weakened financial condition has limited access to public capital markets, and smaller equity transactions and its ATM facility have been insufficient.

- Efforts to secure alternative financing have also been unsuccessful.

Monetization of Intellectual Property

- Attempts to monetize Biora’s intellectual property through strategic partnerships for BIOjet and NAVIcap have faced challenges, as potential partners expressed concerns about the Company’s capital structure and financial stability, hindering licensing or collaboration opportunities.

Strategic Alternatives and Chapter 11 Filing

- In late November 2024, Biora engaged advisors to explore strategic alternatives, ultimately opting for Chapter 11 bankruptcy to maximize asset value for creditors.

- Advisors reached out to approximately 70 potential investors, aiming to secure proposals for cash-free, debt-free acquisitions through a structured sale process.

- The Company secured $1.25 million in incremental bridge funding under its prepetition A&R Indenture in December 2024, alongside $4.6 million in Payment Priority Notes issued in prior months.

- This funding supported payroll and financial obligations while facilitating the sale process.

- Additionally, Biora negotiated a $10.25 million DIP financing facility to fund operations, working capital, and administrative costs during the Chapter 11 process.

- The DIP facility, which includes a $35.9 million roll-up of prepetition debt, provides critical liquidity to stabilize operations, address vendor payables, and support the sale process.

Enjoyed this summary? Stay informed on new Chapter 11 filings over $10M in liabilities—subscribe to Bondoro for free and get insights delivered directly to your inbox.

Plus, explore our full archive for all past summaries.