Case Summary: Broadway Realty I Co. Chapter 11

Pinnacle Group's Broadway Realty I Co. and 81 affiliates filed for Chapter 11 bankruptcy amid rising interest on $564M in mortgage debt, restrictive NY rent laws that cut cash flow from 5,200 stabilized units, and foreclosure actions by secured lender Flagstar Bank.

Business Description

Broadway Realty I Co., LLC, along with its 81 affiliated Debtors⁽¹⁾ (collectively, the "Debtors" and, together with their non-Debtor affiliates, the "Company"), are property-holding companies that form a significant part of Joel Wiener’s Pinnacle Group, a major New York City multifamily landlord. The Debtors collectively own and operate a portfolio of 93 multifamily residential properties, comprising approximately 5,200 apartment units, predominantly located in Manhattan, Brooklyn, the Bronx, and Queens.

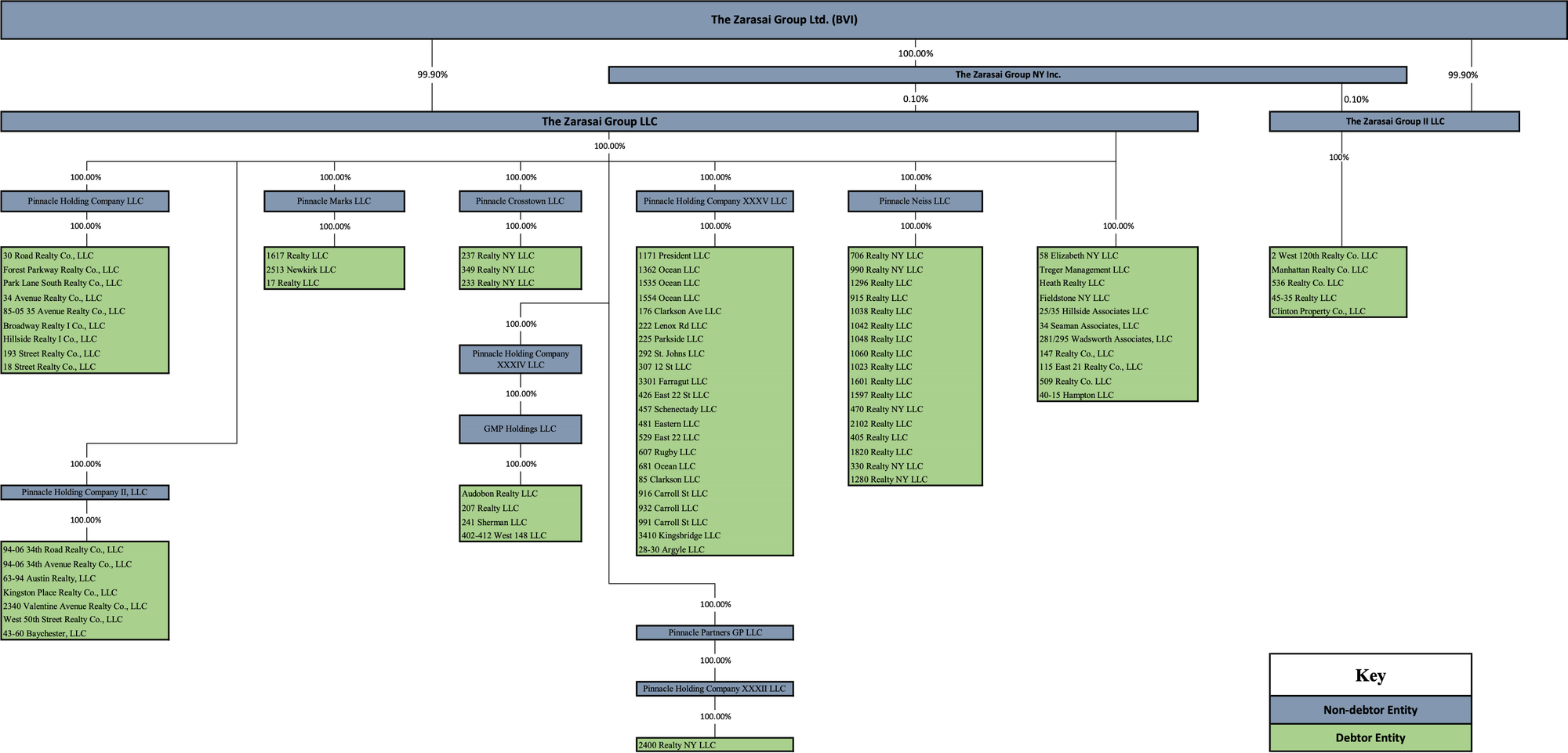

- All Debtor entities are indirect subsidiaries of non-Debtor The Zarasai Group Limited ("Zarasai"), a privately held company incorporated in the British Virgin Islands.

- The broader Company, including Zarasai and other non-Debtor affiliates, encompasses approximately 8,100 residential units distributed among more than 140 U.S.-based subsidiaries.

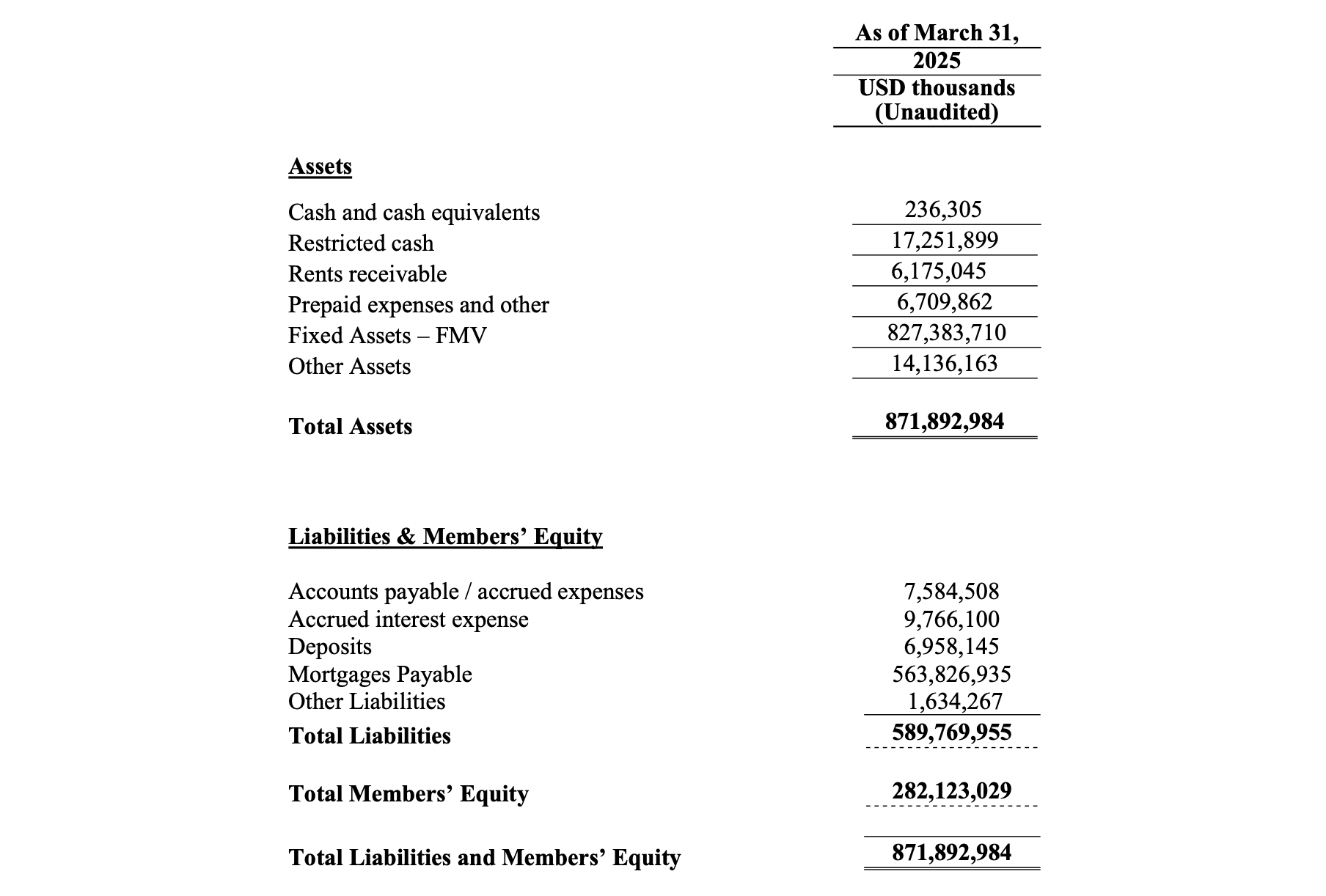

The Debtors’ 93 properties carried an aggregate book value of approximately $826 million as of December 2024, based on independent appraisals by Bowery Valuation. The Company's total portfolio is reported to have an aggregate net book value of approximately $1.4 billion as of December 2024.

The Debtors generate revenue primarily from residential rental income, supplemented by limited commercial rent from retail tenants.

- A defining characteristic of the Company’s tenant base is its high proportion of regulated units, with approximately 96% of tenants entitled to statutory rent stabilization protection and an additional 2% covered by statutory rent control.

- The Debtors also monetize select assets through condominium conversions and sponsor-unit sales, generating $26.3 million from 56 unit sales in 2024 and $65 million from 143 unit sales in the two years preceding the Petition Date.⁽²⁾

Broadway Realty I Co., LLC and its affiliates filed for Chapter 11 protection on May 21, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the Southern District of New York, reporting $500 million to $1 billion in both assets and liabilities.

⁽¹⁾ For a complete list of Debtor entities, see organizational structure chart below.

⁽²⁾ The ability to monetize properties through condominium conversions, a previously successful component of the Company's business plan, was significantly curtailed by the June 2019 amendments to the Tenant Protection Act (TPA), as detailed further below.

Corporate History

Joel Wiener began buying rent-regulated apartments in New York City in the late 1980s and established Pinnacle Group in 1997. Over the following two decades, the company pursued an aggressive expansion strategy, amassing sizable portfolios of rent-stabilized and value-add multifamily properties.

- A significant expansion occurred in the mid-2000s when Pinnacle, with backing from private equity investor Praedium Group, acquired nearly 3,000 Manhattan apartment units from landlord Baruch Singer for approximately $500 million.

- By the late 2000s, Pinnacle's holdings reportedly peaked at around 20,000 apartments citywide before being consolidated to approximately 10,000 units by the 2010s.

Reorganization and International Financing

- In the 2010s, Wiener reorganized the ownership of the U.S. properties under Zarasai, a British Virgin Islands-registered holding company, to facilitate international fundraising. Zarasai, through its New York subsidiaries, holds 100% equity in the property-owning entities, including the Debtors.

- As of the Petition Date, approximately $321 million in bonds issued by non-Debtor parent Zarasai remain outstanding, consisting of approximately $243 million of Series C bonds and $78 million of Series E bonds.⁽³⁾

Corporate Organizational Structure

⁽³⁾ Flagstar Bank, the Debtors’ sole secured lender, expressed concerns that rental income from the Debtor properties, which secure its loans, may have been consolidated and utilized at the non-Debtor upstream equity holder level, potentially to service these bond obligations.

Operations Overview

The Debtors own and manage a portfolio of 93 multifamily buildings comprising roughly 5,200 residential units located in Manhattan, Brooklyn, the Bronx, and Queens.

Property Portfolio Characteristics

- The vast majority of the Company’s units (of which the Debtors' units are a part) are subject to rent regulation, with approximately 96% being rent-stabilized and 2% rent-controlled.

- The tenant base primarily comprises low-to-middle-income residents, and the portfolio maintains a high occupancy rate, averaging approximately 95% as of the Petition Date for the broader Company.

Revenue Generation and Cash Flow Management

- The Debtors derive nearly all revenue from monthly apartment rents. Due to rent stabilization, annual rent increases are legally limited, resulting in a relatively steady but slow-growing income stream.

- Historically, substantially all Debtor Properties generated positive cash flow before debt service. In 2024, the Debtors collectively generated approximately $27 million in net cash flow before debt service (after operating expenses, capital expenditures, and overhead).

- Rental income is pooled⁽⁴⁾ to fund operating costs, including property maintenance, utilities, insurance, real estate taxes, and mortgage interest. Limited additional income is sourced from commercial leases.

Debtors’ Consolidated Balance Sheet (as of March 31, 2025)

Management and Workforce

- Pinnacle Managing Co. LLC (a non-Debtor affiliate) provides Zarasai with officers and renders management services to the Debtors for a monthly fee of approximately 3.0-4.0% of rental income from the respective properties.

- As of the Petition Date, the Debtors collectively employed approximately 130 individuals responsible for delivering various building-related services. These services include oversight and maintenance of vacant apartments, superintendent duties, lobby guard functions, engineering support, and other related operational tasks.

⁽⁴⁾ Flagstar alleges the pooling occurs in ‘HoldCo’ bank accounts controlled by non-Debtor insiders; it objects to cash continuing to flow through these accounts post-petition and asks that all rents be deposited in Debtor-controlled accounts at Flagstar for transparency.

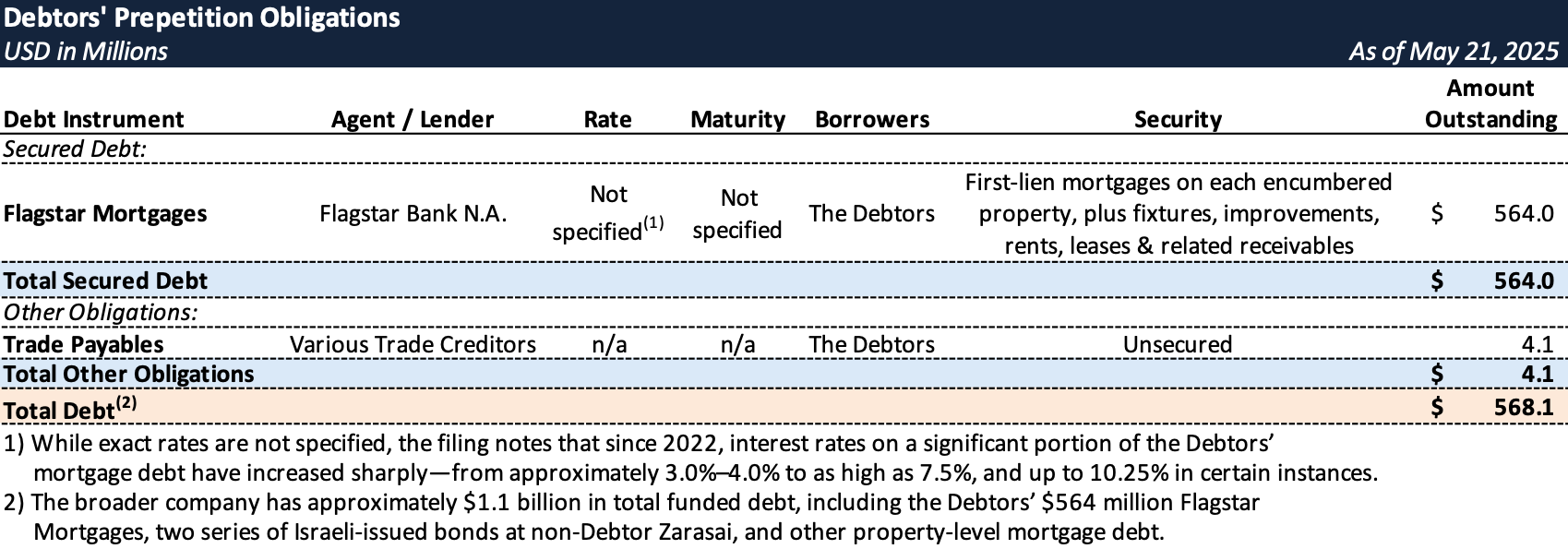

Prepetition Obligations

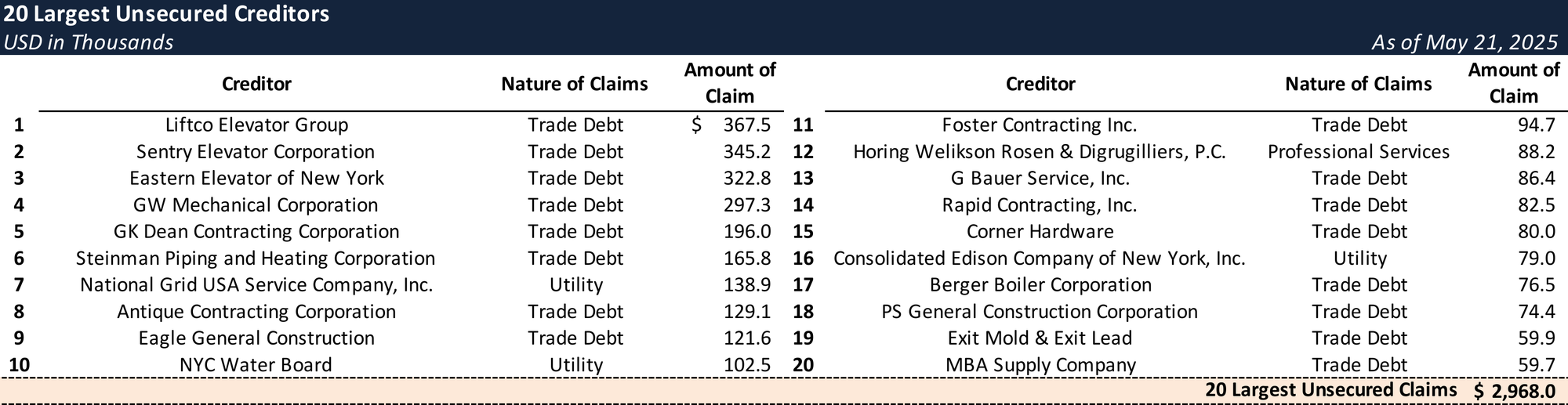

Top Unsecured Claims

Events Leading to Bankruptcy

Regulatory and Market Pressures

- New York Rent Regulation Changes: The enactment of the Housing Stability and Tenant Protection Act (HSTPA) in June 2019 severely restricted landlords' ability to increase rents on stabilized units. This legislation eliminated vacancy decontrol, limited rent increases tied to apartment renovations, and curtailed the ability to convert apartment buildings to condominiums, thereby stalling the Debtors' rental income growth.

- Surging Interest Rates: Beginning in 2022, a rapid increase in market interest rates significantly impacted the Debtors’ financial performance. A large portion of their mortgage debt with Flagstar Bank carried variable interest rates that "sky-rocketed" from a range of approximately 3.0-4.0% to as high as 7.5% and, in certain instances, 10.25%.

Escalating Debt Service and Cash Flow Deficit

- The rise in interest rates led to a substantial increase in the Debtors' annual debt service obligations.

- Total debt service (interest and principal) climbed from approximately $26 million in 2023 (with ~$20 million in interest) to approximately $36 million in 2024 (with ~$25 million in interest).

- Projections for 2025 indicated a further increase in debt service to approximately $45 million, with an interest component of around $35 million, representing a 75% increase in interest expense from 2023.

- This sharp increase in financing costs outpaced rental revenue, which could not be correspondingly increased due to rent stabilization. Consequently, the Debtors' revenues became insufficient to fully service the Flagstar debt and cover necessary operating expenses.

- Despite generating positive net operating income before debt service, the Debtors experienced negative net cash flows of approximately $12 million in fiscal year 2024, primarily driven by higher debt service expenses. Rising inflation also contributed to higher operational costs.

Loan Defaults and Lender Enforcement Actions

- According to Flagstar, the Debtors ceased making payments of interest or principal on the Flagstar Loans from January 1, 2025.

- Discussions with Flagstar regarding potential out-of-court solutions began in the fall of 2024, including an in-person meeting in December 2024.

- Despite these discussions, Flagstar delivered a notice of default on March 14, 2025, with respect to each of the Debtors’ properties and subsequently commenced foreclosure actions on March 24, 2025, in four New York state court counties.

- Flagstar also sought, on an ex parte basis, the appointment of a receiver to take possession of the Debtors' properties. On May 16, 2025, an order was entered in the New York County action appointing a receiver for 21 of the Debtors' Manhattan properties.

Chapter 11 Filing

- Faced with the imminent risk of receivership over a significant portion of their portfolio and unable to reach a consensual resolution with Flagstar on an expedited timeline, the Debtors commenced these Chapter 11 cases on May 21, 2025.

- The filings were made on an emergency basis to invoke the automatic stay, thereby halting foreclosure proceedings and preventing the potential value destruction and business disruption associated with a piecemeal receivership.

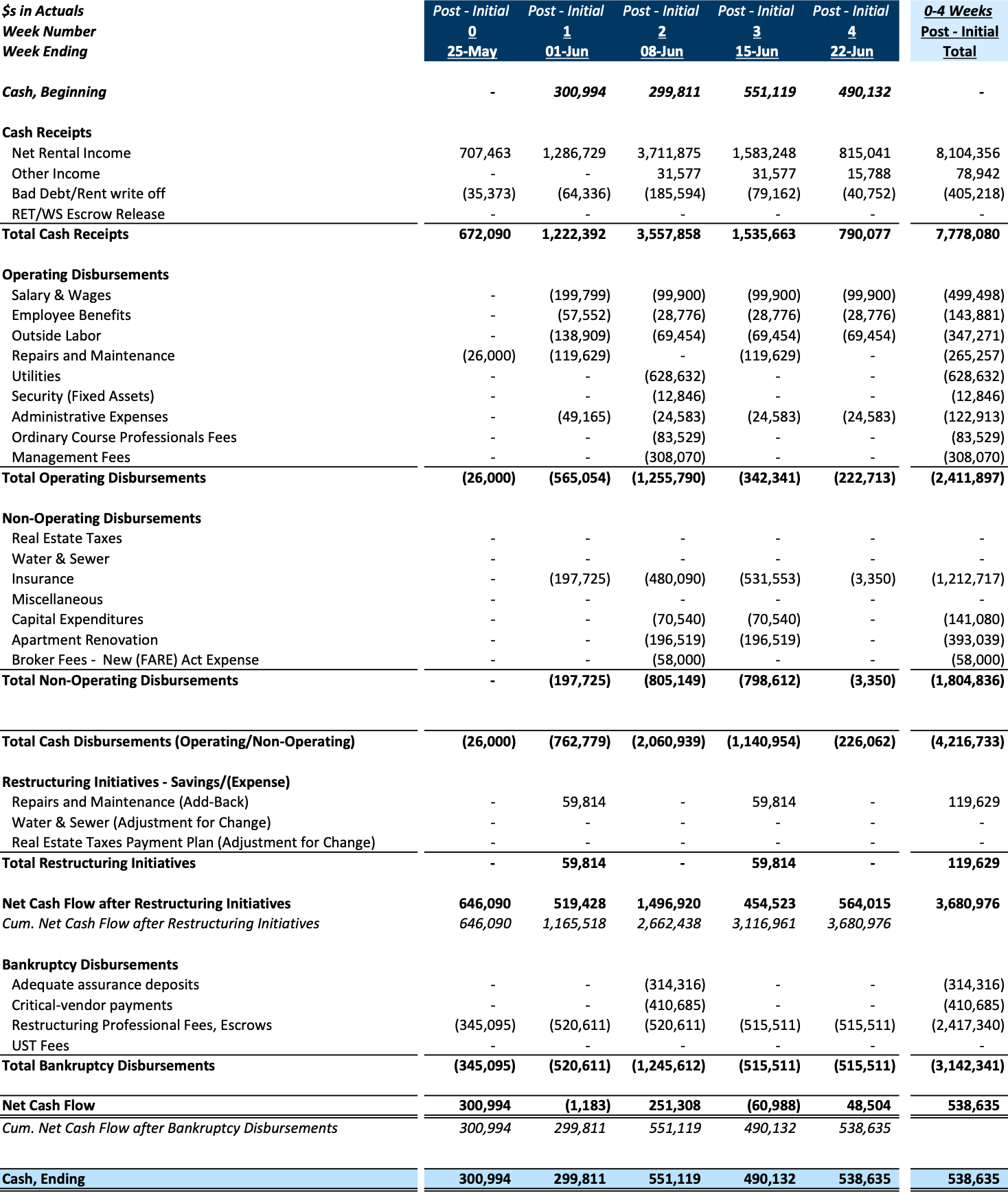

- On May 29, 2025, Judge David S. Jones entered an interim order authorizing the Debtors’ use of Flagstar Bank’s cash collateral [Doc 16]. The order permits usage in accordance with a four-week budget and includes a 10% cumulative variance cap (excluding professional fees), weekly variance reporting, and replacement-lien and escrow protections in favor of Flagstar.

- A final hearing on cash collateral is scheduled for June 25, 2025, at 10:00 a.m. ET. Objections are due by June 18, 2025, at 5:00 p.m. ET.

Key Parties

Counsel: Weil, Gotshal & Manges LLP

Financial Advisor: FTI Consulting, Inc.

Claims Agent: Stretto, Inc.

Initial Budget

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.