Case Summary: CBRM Realty Chapter 11

CBRM Realty has filed for Chapter 11 bankruptcy amid liquidity issues and an impending sheriff’s sale following founder misconduct, supported by $27M in DIP financing to stabilize key affordable housing assets.

Business Description

Headquartered in Somerset, NJ, CBRM Realty Inc. ("CBRM") is a private real estate investment firm established by real estate investor Moshe “Mark” Silber. Historically, CBRM has specialized in acquiring opportunistic garden-style apartment properties across the United States, with a primary focus on value-add opportunities.

- Through its subsidiaries, CBRM operates as a comprehensive real estate firm providing services that include due diligence, acquisition management, property maintenance, development, and construction. Additionally, CBRM managed thousands of residential units nationwide.

- As of September 30, 2023, SEC filings indicate that Silber's network of companies has collectively acquired approximately 25,000 multifamily residential units, valued at approximately $2.5 billion.

CBRM, through its wholly owned subsidiary Crown Capital Holdings LLC ("Crown Capital"), holds equity interests in what was described during a May 27, 2025, hearing as approximately four dozen low-income housing projects throughout the U.S., collectively comprising upwards of 10,000 affordable housing units ("Crown Capital Portfolio").

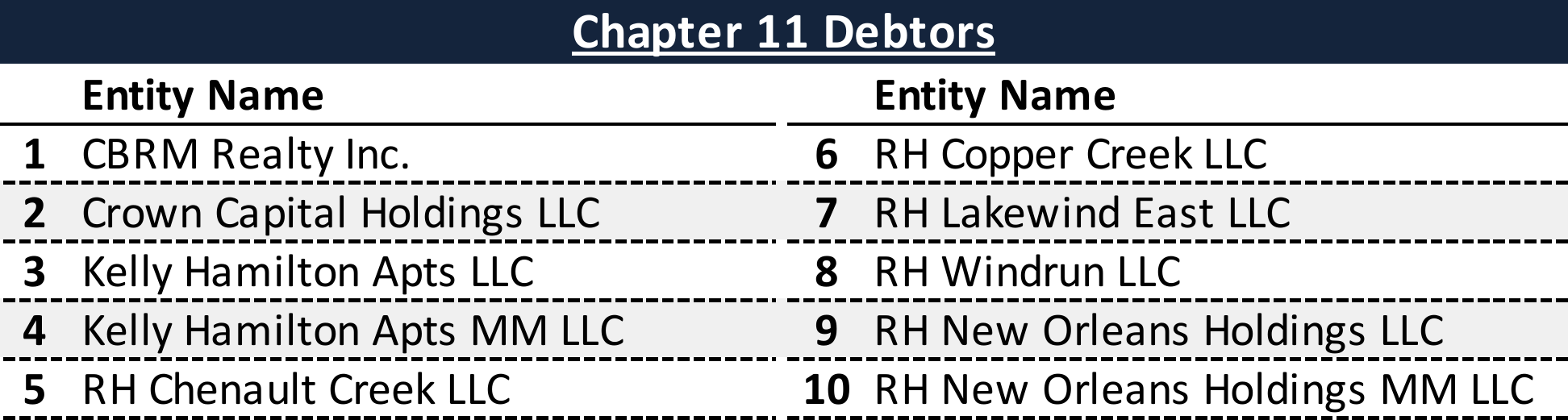

- Certain entities within the Crown Capital Portfolio are currently debtors⁽¹⁾ in associated Chapter 11 bankruptcy proceedings (collectively with CBRM and Crown Capital, the "Debtors").

CBRM and its affiliates filed for Chapter 11 protection on May 19, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the District of New Jersey, reporting $100 million to $500 million in both assets and liabilities.

⁽¹⁾ For a complete list of Debtor entities, see the Chapter 11 Debtors table.

Corporate History

CBRM Realty Inc. was established in 2012 when Silber consolidated his real estate holdings under a family office structure. Concurrently, Silber founded Rhodium Capital Advisors ("Rhodium"), a real estate syndicator created to facilitate capital raising for real estate investments.

- Frederick Schulman, CEO of affiliate NB Affordable LLC, has frequently partnered with Silber across multiple ventures and also serves as a managing member of Rhodium.

- Notably, public filings and media reports suggest NB Affordable LLC operates interchangeably under the Rhodium Capital Advisors name.

Expansion and Financing

- The Crown Capital Portfolio's growth relied heavily on debt, including over $200 million in Notes issued by Crown Capital (guaranteed by CBRM) and approximately $450 million in property-level mortgage loans.

- The Debtors also leveraged government programs, notably acquiring properties with federal Section 8 contracts.

- March 2023: Significant expansion through NB Affordable's acquisition of Pittsburgh’s AHRCO portfolio, consisting of 14 buildings with about 1,300 HUD-subsidized units, plus a committed $10 million upgrade investment.

Legal Issues and Governance Changes

- July 2024-August 2024: Silber and Schulman pleaded guilty to mortgage fraud conspiracy involving the 2019 acquisition and financing of the Williamsburg of Cincinnati apartment complex.

- The property at issue is not currently linked to the Debtors or their past or ongoing operations, according to court filings.

- August 2024: Noteholders entered into a Forbearance Agreement mandating an independent fiduciary, following Silber's conviction and in light of pending defaults.

- September 2024: Elizabeth A. LaPuma appointed Independent Fiduciary of CBRM and Crown Capital. Lynd Living hired to manage and stabilize the portfolio.

- December 2024: Federal court banned Silber from involvement with NB Affordable and real estate activities.

- February 2025: Silber and Schulman faced Pennsylvania state charges for diverting over $580,000 in HUD funds earmarked for the Mon View Heights complex and other subsidized housing projects.

- March 2025: Silber sentenced to 30 months federal prison for mortgage fraud; Schulman sentenced to 12 months and one day, plus home confinement.

Chapter 11 Debtors

Operations Overview

The Debtors own and operate a geographically diverse portfolio of multifamily real estate, with a primary focus on affordable and workforce housing. Many properties participate in federal housing assistance programs, such as Section 8, catering to low-income residents.

Notable Properties

- The current Chapter 11 proceedings and associated DIP financing are largely centered on the rehabilitation of the following key assets:

- Pennsylvania:

- Kelly Hamilton (Pittsburgh): Approximately 115-unit property owned by Debtor Kelly Hamilton Apts LLC.

- Louisiana ("NOLA Properties"): Four HUD-backed Section 8 properties in New Orleans, each fully owned by individual Debtor entities (collectively "NOLA Debtors"):

- Carmel Brook Apartments: Debtor RH Chenault Creek LLC.

- Carmel Spring Apartments: Debtor RH Windrun LLC.

- Laguna Creek Apartments: Debtor RH Copper Creek LLC.

- Laguna Reserve Apartments: Debtor RH Lakewind East LLC.

- Pennsylvania:

- CBRM is evaluating additional properties to determine viability and rehabilitation potential.

Management and Operational Deficiencies

- Under Silber and Schulman: Portfolio was reportedly run as "one integrated whole" but suffered from significant neglect. By 2023, many properties deteriorated significantly due to insufficient maintenance and funding, causing severe health and safety hazards, unpaid utilities, and declining occupancy.

- Post-Independent Fiduciary (September 2024): Elizabeth A. LaPuma, supported by Lynd Living, began stabilizing and rehabilitating operations, assessing conditions, managing litigation, and ensuring adequate funding for repairs and safety.

- Corporate Governance Issues: Prior to LaPuma's appointment, the portfolio notably lacked essential Director and Officer (D&O) insurance, highlighting significant governance failures.

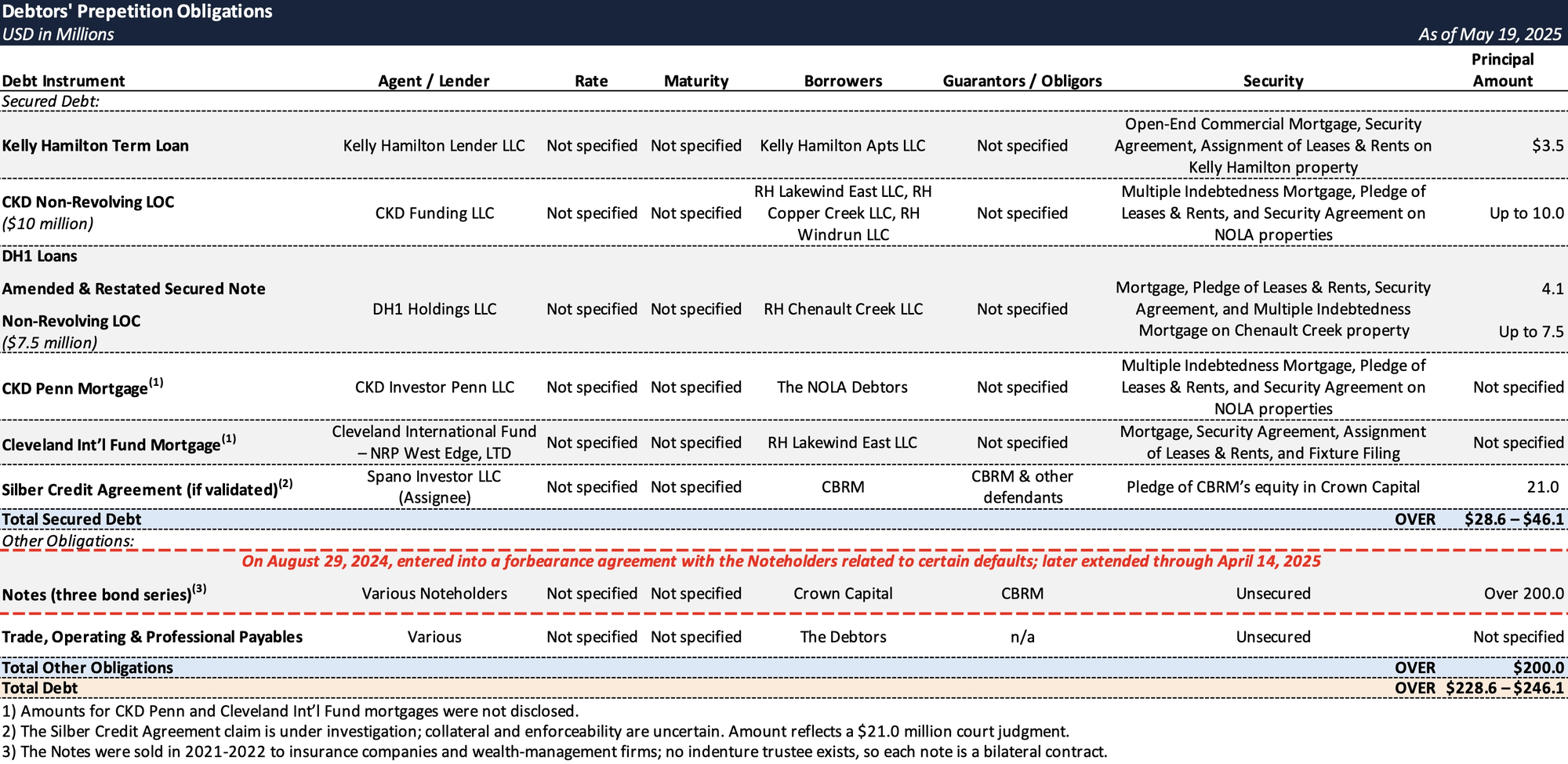

Prepetition Obligations

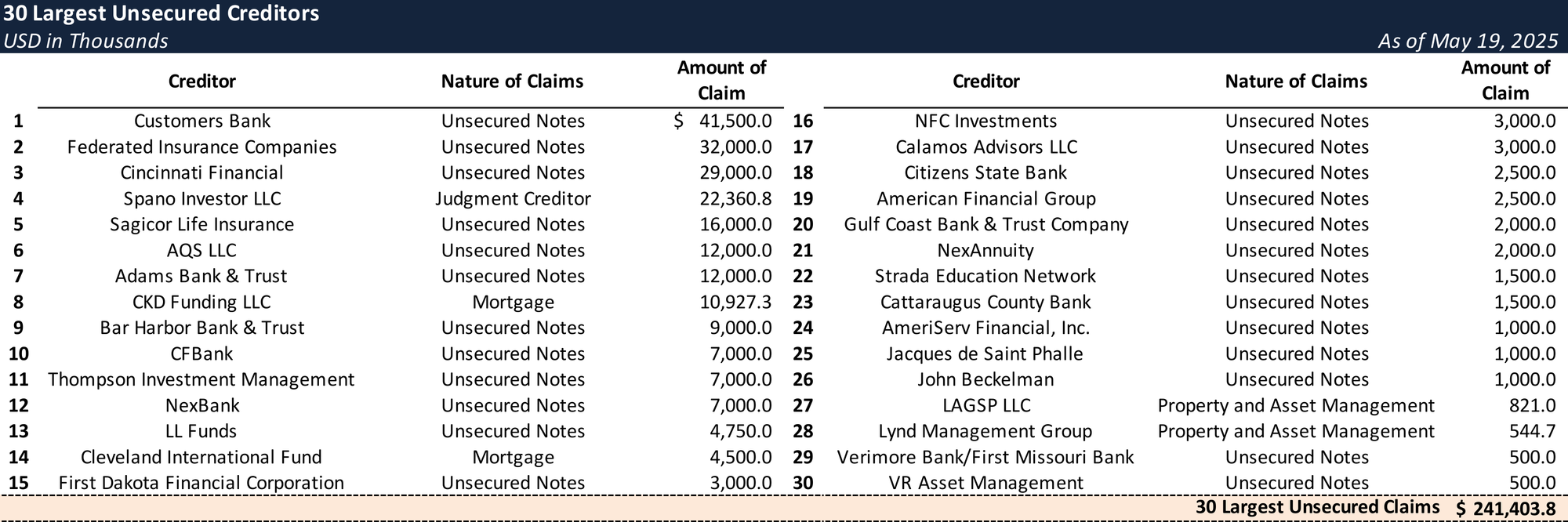

Top Unsecured Claims

Events Leading to Bankruptcy

The Chapter 11 filing was driven by an impending sheriff's sale, critical funding shortages threatening health and safety at housing projects, and inability to raise capital due to the equity owner's criminal conviction.

Founder Misconduct and Criminal Prosecution

- Fraud Scheme: Silber and Schulman were convicted for a $119 million multi-year mortgage fraud scheme (2018–2020) involving the Williamsburg of Cincinnati apartment complex. The scheme involved falsifying purchase contracts and using stolen identities to inflate the sale price from $70 million to $95.9 million, securing an inflated $74.3 million loan from a lender and Fannie Mae.

- Convictions and Impact: Silber pleaded guilty in July 2024 and received a 30-month prison sentence in March 2025. Schulman also pleaded guilty and received 12 months and one day, plus home confinement. Silber’s conviction severely hindered the Debtors’ ability to refinance.

- The Independent Fiduciary continues to investigate the relevance of this misconduct to the Debtors' properties.

Operational and Financial Deterioration

- Neglect and Mismanagement: Beginning in 2023 or earlier, Silber and Schulman neglected portfolio management, partly due to distractions from government investigations. This led to properties falling into “operational and/or physical disarray,” jeopardizing affordable housing program eligibility, lowering occupancy, triggering loan defaults, leaving maturing mortgages unrefinanced, and resulting in default judgments from undefended lawsuits.

- Depreciation of Property Values: Current property values are “likely worth much less” than the 2021-2022 appraisals that underpinned the Notes and certain mortgages, owing to:

- Physical deterioration from management neglect.

- Inflated appraisals from fraudulent practices.

- Multifamily sector market corrections driven by higher interest rates and reduced investor demand.

- Liquidity Crisis: The Debtors lacked critical funding to maintain operations and ensure health and safety at affordable housing projects in Pennsylvania and Louisiana. Refinancing efforts failed due to Silber’s involvement and the associated scandal.

Creditor Actions and Failed Restructuring Attempts

- Noteholder Concerns & Forbearance Agreement: Silber's guilty plea alarmed Noteholders (holding over $200 million in Notes issued by Crown Capital). A Forbearance Agreement was signed on August 29, 2024, leading to the appointment of LaPuma as Independent Fiduciary on September 26, 2024.

- Although extended several times, the Forbearance Agreement expired April 14, 2025. Noteholders told the Independent Fiduciary they would not extend it further, ending out-of-court restructuring efforts.

- Acquiom/Spano Judgment & Sheriff’s Sale Threat:

- In June 2022, Silber purportedly entered into a Credit Agreement with UBS O’Connor LLC, with Acquiom Agency Services LLC (“Acquiom”) as administrative agent, guaranteed by CBRM and secured by its equity in Crown Capital.

- A default was asserted in March 2024. Acquiom sued in May after no response.

- On August 2, 2024, a New York court granted Acquiom summary judgment for $19.2 million plus interest; a $21 million judgment followed on September 5.

- Acquiom assigned the judgment to Spano Investor LLC ("Spano") on September 9, 2024.

- On December 14, 2024, the court authorized Spano to foreclose on CBRM’s Crown Capital interest. A sheriff’s sale of these assets was scheduled for May 22, 2025.

The Chapter 11 Filing and Initial Objectives

- CBRM and its Debtor affiliates filed for Chapter 11 protection on May 19, 2025, primarily to halt the sale and pursue a comprehensive restructuring.

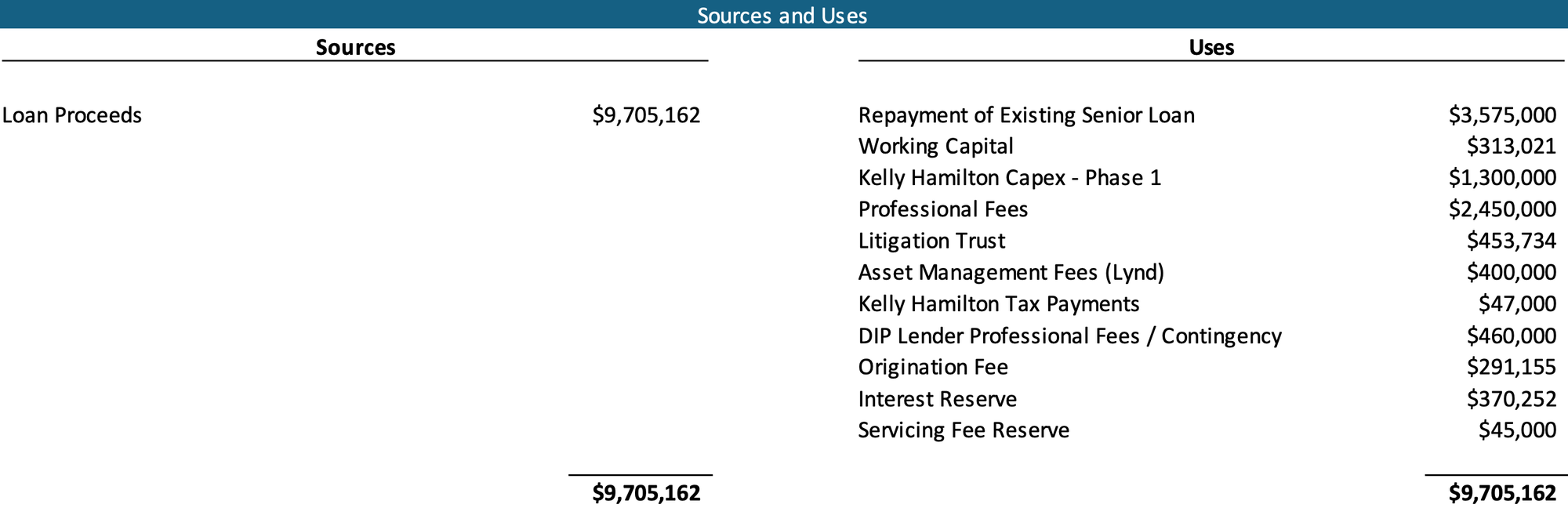

- DIP Financing: The Debtors secured commitments for two DIP facilities to fund operations and rehabilitation:

- Kelly Hamilton DIP Facility: Up to $9.7 million from 3650 SS1 Pittsburgh LLC.

- NOLA DIP Facility: Up to $17.4 million from prepetition mortgage lenders DH1 Holdings LLC, CKD Funding LLC, and CKD Investor Penn LLC, comprising new term loans (reportedly $8.5 million in new money) and a roll-up of prepetition debt.

- Approval hearing scheduled for June 2, 2025, at 1 p.m. ET, subject to objections.

- Property Rehabilitation: A core use of DIP proceeds is the physical and operational rehabilitation of affordable housing assets in Pennsylvania (Kelly Hamilton) and Louisiana (NOLA Debtors) to address deferred maintenance and health/safety issues.

- Pursuit of Claims via Litigation Trust: Approximately $1.4 million from DIP proceeds will be reserved to fund the investigation and prosecution of claims against Silber, Schulman, other insiders, and third parties, with plans to establish a litigation trust for creditor benefit.

- Maximizing Stakeholder Value: The Debtors intend to conduct a postpetition marketing process for the Kelly Hamilton and NOLA Debtors, potentially including an auction, and assess which other non-Debtor properties within the Crown Capital Portfolio might be salvageable.

Key Advisors

- General Bankruptcy Counsel: White & Case LLP

- Co-Counsel: Ken Rosen Advisors PC

- Financial Advisor: IslandDundon LLC

Initial DIP Budget (Kelly Hamilton)

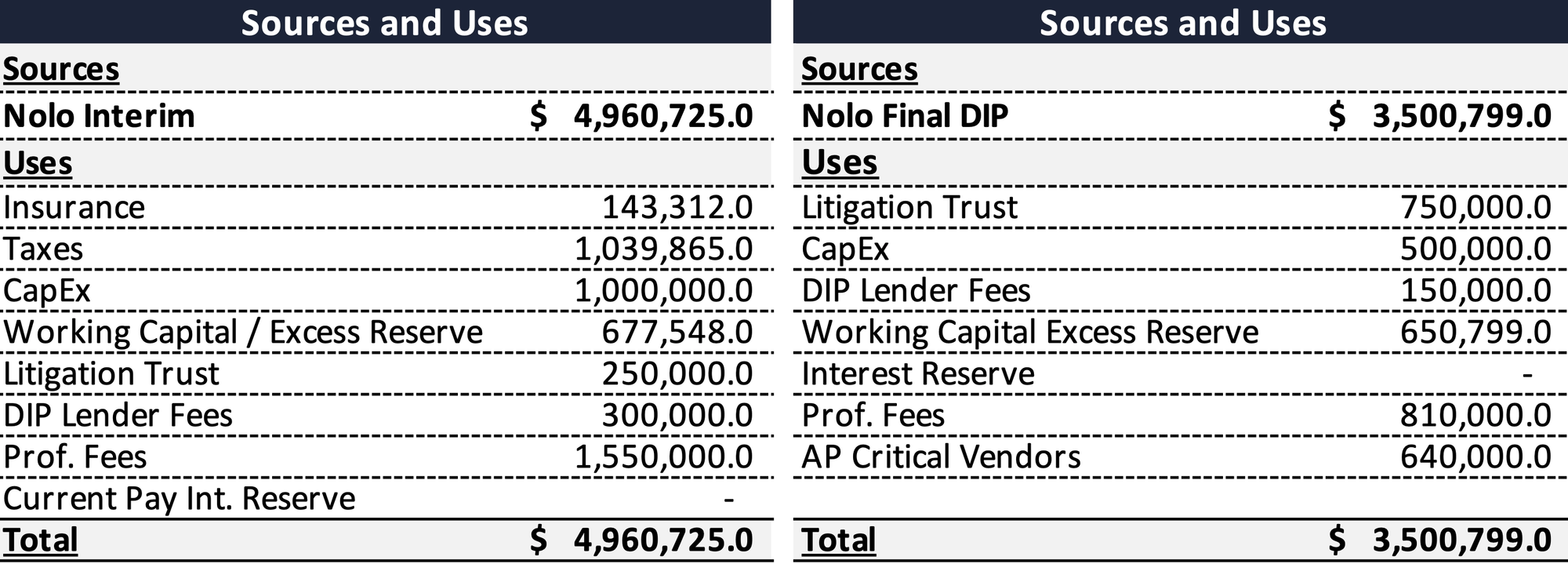

Initial DIP Budget (NOLA)

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.