Case Summary: Claire's Chapter 11

Claire’s has filed for Chapter 11 bankruptcy for the second time in seven years amid sustained brick-and-mortar headwinds and macroeconomic pressures, launching store-closing sales while pursuing a dual-track process for a going-concern sale or full-chain liquidation.

Business Description

Headquartered in Hoffman Estates, IL, Claire’s Holdings LLC, along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, “Claire’s” or the “Company”), is a global specialty retailer of fashion jewelry, accessories, and ear-piercing services. The Company primarily targets young girls, tweens, and teens through its two core brands:

- Claire’s®: The flagship brand, offering a fun and colorful in-store experience for the Gen Z and Gen Alpha demographic (ages 3–18). It is a recognized destination for ear piercing, having pierced over 100 million ears since 1978, establishing the service as a rite of passage for many young customers.

- Icing®: A brand catering to older teens and young women (ages 18-35) with more sophisticated jewelry, beauty products, and fashion accessories.

The Company’s product assortment includes a wide array of proprietary and private-label costume jewelry, hair accessories, cosmetics, and licensed merchandise, all designed to align with current youth fashion trends. Claire’s cultivates brand loyalty through its experiential in-store model and its “C-Club” loyalty program, which grew to over 8 million members in 2021.

Claire’s Holdings LLC and its affiliates filed for Chapter 11 protection on August 6, 2025 (the “Petition Date”) in the U.S. Bankruptcy Court for the District of Delaware, reporting $1 billion to $10 billion in both assets and liabilities. Concurrently, its Canadian affiliate commenced proceedings under Canada’s Companies’ Creditors Arrangement Act (CCAA).

⁽¹⁾ For a complete list of debtor entities, see the Chapter 11 Debtors table below.

Corporate History

Founded in 1961 as a wig retailer named Fashion Tress Industries, the Company pivoted to accessories in 1973 with the acquisition of Claire’s Boutiques, a 25-store jewelry chain, and subsequently adopted the Claire’s name. The Company introduced its signature ear-piercing services in 1978, a key driver of its brand identity. Strategic expansion continued with the acquisitions of The Icing in 1996 and Afterthoughts in 1999, which were merged to form the Icing® brand.

Leveraged Buyout and First Bankruptcy

- In 2007, Apollo Global Management took the Company private in a $3.1 billion leveraged buyout, which saddled Claire’s with a substantial debt burden.

- Amid declining mall traffic and strained by its debt, the Company attempted an IPO in 2013 but later withdrew the offering.

- In March 2018, Claire’s filed for Chapter 11 protection for the first time, successfully restructuring approximately $1.9 billion of its LBO-related debt. Following its emergence, ownership transferred to its former creditors, with Elliott Management and Monarch Alternative Capital becoming the controlling equity holders.

Post-Restructuring and Second IPO Attempt

- Following the 2018 restructuring, Claire’s experienced a strong financial rebound, particularly in 2021, with sales and EBITDA surpassing pre-pandemic levels.

- Leveraging this momentum, the Company filed for a second IPO in September 2021 to fund growth and provide an exit for its sponsors. However, amid shifting market conditions, the IPO was formally withdrawn in June 2023.

- Persistent operational and financial challenges ultimately led the Company to file for Chapter 11 for the second time in seven years on August 6, 2025.

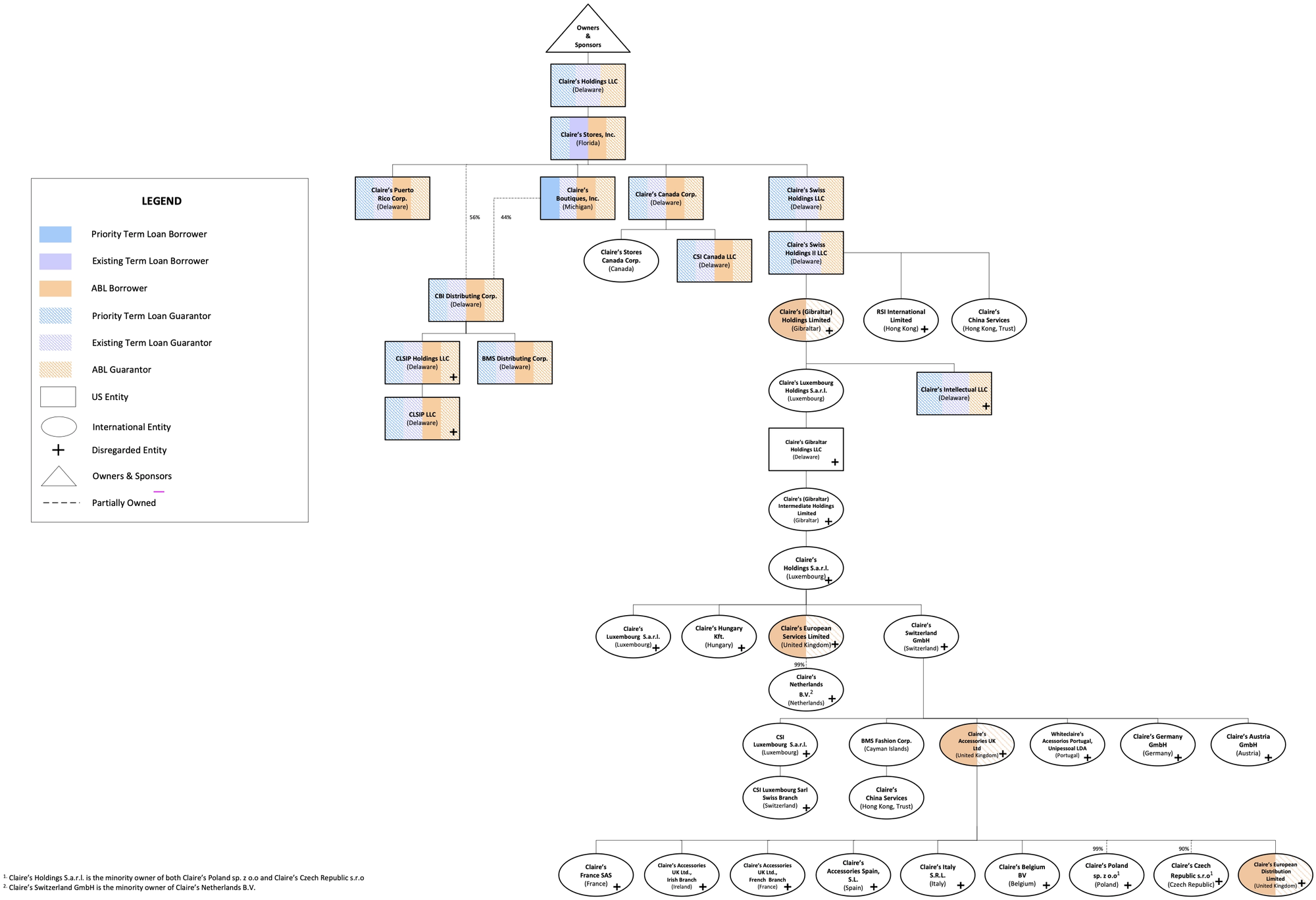

Corporate Organizational Structure

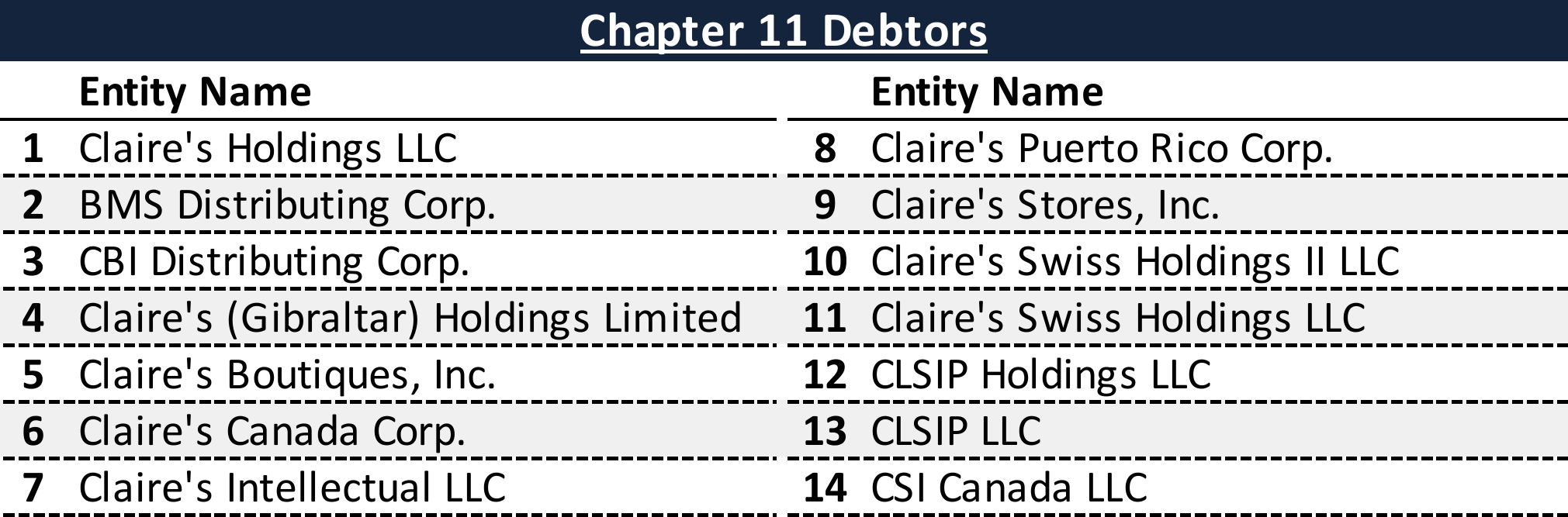

Chapter 11 Debtors

Operations Overview

Claire’s operates a global retail network with approximately 13,000 employees. As of the Petition Date, the Company’s physical footprint includes over 2,300 company-operated stores across 17 countries and more than 230 franchised stores in markets such as the Middle East and South Africa.

Sales Channels and Store Formats

- Brick-and-Mortar (~$75M Adj. EBITDA, FY2024): The core of the business, generating the vast majority of revenue. The Company operates:

- Approximately 1,970 Claire’s® stores in North America and Europe.

- Approximately 120 Icing® stores in North America, all of which the Company intends to close.

- Approximately 210 Claire’s® store-in-store (SiS) locations within Walmart stores, which are also slated for closure.

- Concessions (~$16M Adj. EBITDA, FY2024): The Company manages over 9,000 store-within-a-store displays in partner retailers like CVS and Kohls. This channel has been significantly scaled back from a peak of over 20,000 locations due to operational and profitability challenges.

- E-commerce (~$9M Adj. EBITDA, FY2024): Digital sales platforms for the Claire’s® and Icing® brands. This channel remains a smaller part of the business, as the Company’s young customer base prefers the tactile, in-person shopping experience.

- Franchise Operations (~$3M Adj. EBITDA, FY2024): Primarily located in the Middle East and South Africa, this channel provides a steady, albeit small, source of earnings.

Merchandising and Supply Chain

- Claire’s does not own or operate manufacturing facilities, instead sourcing its merchandise from approximately 250 vendors. A substantial majority of its products are sourced from outside the U.S., with over half originating from China.

- The Company focuses on a high-diversity, trend-oriented product mix, with an average store carrying approximately 7,500 different SKUs.

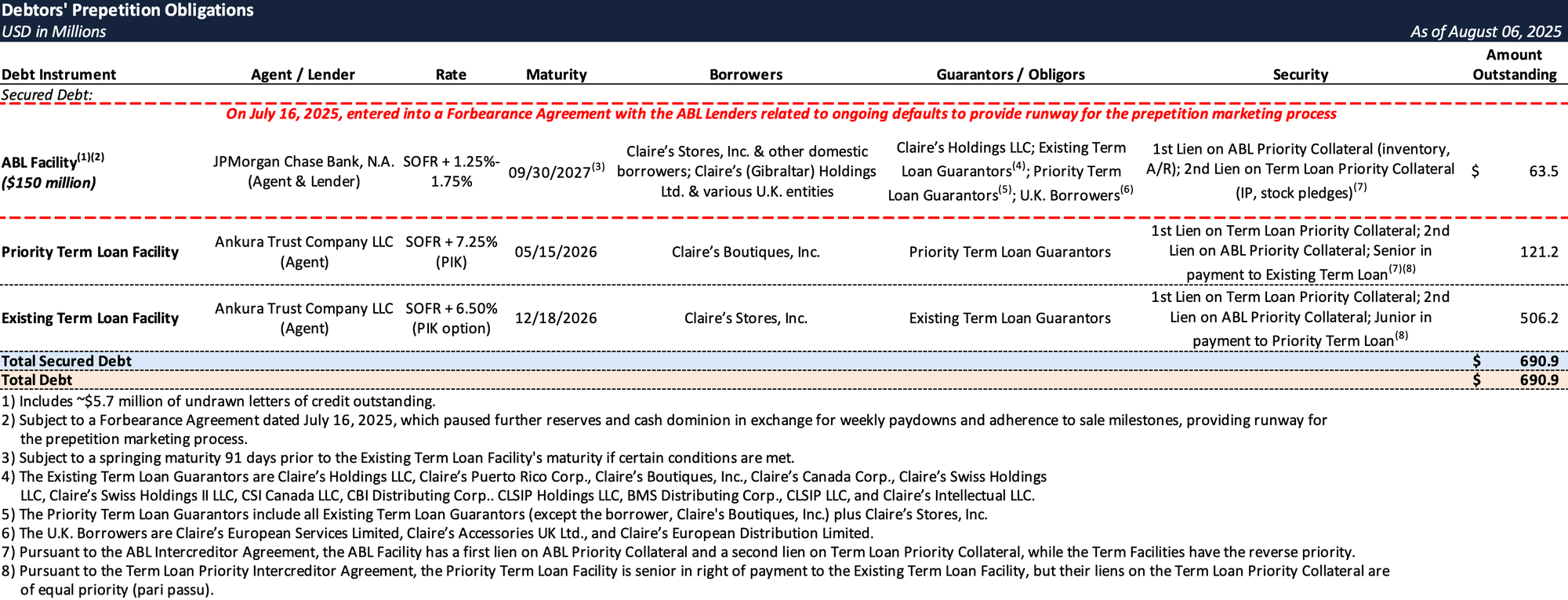

Prepetition Obligations

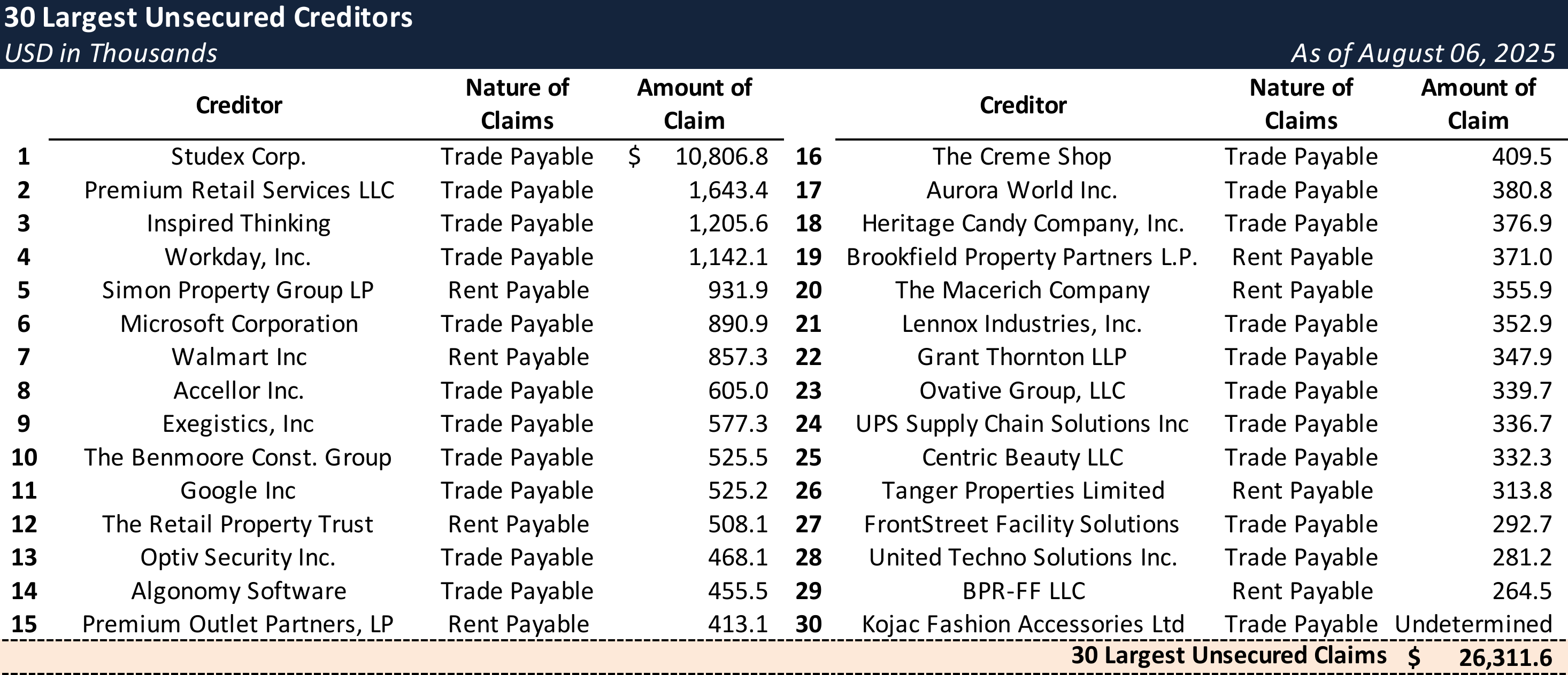

Top Unsecured Claims

Events Leading to Bankruptcy

After emerging from its 2018 bankruptcy, Claire’s returned to profitability and experienced a strong rebound in 2021, driven by pent-up consumer demand post-COVID-19 lockdowns. This success prompted an expansion strategy and a second IPO attempt. However, from 2022 onward, a confluence of macroeconomic headwinds, operational missteps, and industry shifts eroded the Company's financial health.

Macroeconomic and Industry Headwinds

- Declining Mall Traffic and E-commerce Shift: A persistent industry-wide decline in mall foot traffic structurally weakened sales. The Company’s efforts to grow its e-commerce channel were constrained by its young demographic, which relies on in-person, experiential shopping.

- Intensifying Competition: Claire’s faced mounting pressure from fast-fashion jewelry retailers like Lovisa, online marketplaces such as SHEIN and Temu, and other retailers like Ulta and Five Below that began offering competing ear-piercing services.

- Inflation and Rising Costs: Soaring inflation drove up freight, import, and labor costs, while rising interest rates increased the expense of servicing its floating-rate debt.

- Punitive Tariffs: In April 2025, the U.S. implemented sweeping tariffs on imported goods, significantly impacting Claire’s, which sources approximately 70% of its inventory from foreign vendors. The tariffs drove up its cost of goods sold by as much as 55% on certain products, severely compressing margins.

Operational Missteps

- Failed Pricing Strategy: Price increases implemented in 2021-2022 to offset costs were poorly received by a price-sensitive customer base, damaging the brand's value perception and leading to a decline in sales and traffic for three consecutive years.

- Inventory and Merchandising Issues: A strategic shift to stock more "core" non-seasonal merchandise left stores with an unexciting product assortment that failed to resonate with trend-focused customers. This led to stagnant sales and required heavy discounting to clear excess inventory.

- Systems Disruption: A costly, multi-year implementation of Blue Yonder’s supply chain software, while ultimately necessary, caused significant operational disruption during its rollout. Glitches during the "go-live" period just before the 2023 holiday season contributed to disappointing sales.

Unsustainable Capital Structure and Prepetition Actions

- Debt Burden: The Company’s balance sheet remained burdened by a substantial debt load, including an ABL facility, a ~$121 million Priority Term Loan, and a ~$506 million Existing Term Loan, both with maturities looming in 2026.

- Turnaround Efforts and Advisor Retention: A new management team implemented a comprehensive turnaround plan in 2024 that began to stabilize customer traffic. However, these efforts were insufficient to overcome the compounding financial pressures. In April-May 2025, the Company retained restructuring advisors, including Kirkland & Ellis, Alvarez & Marsal, and Houlihan Lokey.

- Dual-Track Process: In the months before filing, the Company initiated a dual-track process to maximize value. It launched a marketing effort to find a going-concern buyer while simultaneously preparing for a potential liquidation by executing a standby agency agreement with Hilco Merchant Resources on July 24, 2025.

- Global Insolvencies: The Company's financial distress was global, with its French subsidiary entering receivership in July 2025 and its UK and Canadian divisions pursuing parallel restructuring or insolvency processes.

With liquidity dwindling and no out-of-court solution materializing, Claire's filed for Chapter 11 to access court-supervised sale procedures and either consummate a value-maximizing sale or conduct an orderly liquidation of its assets.

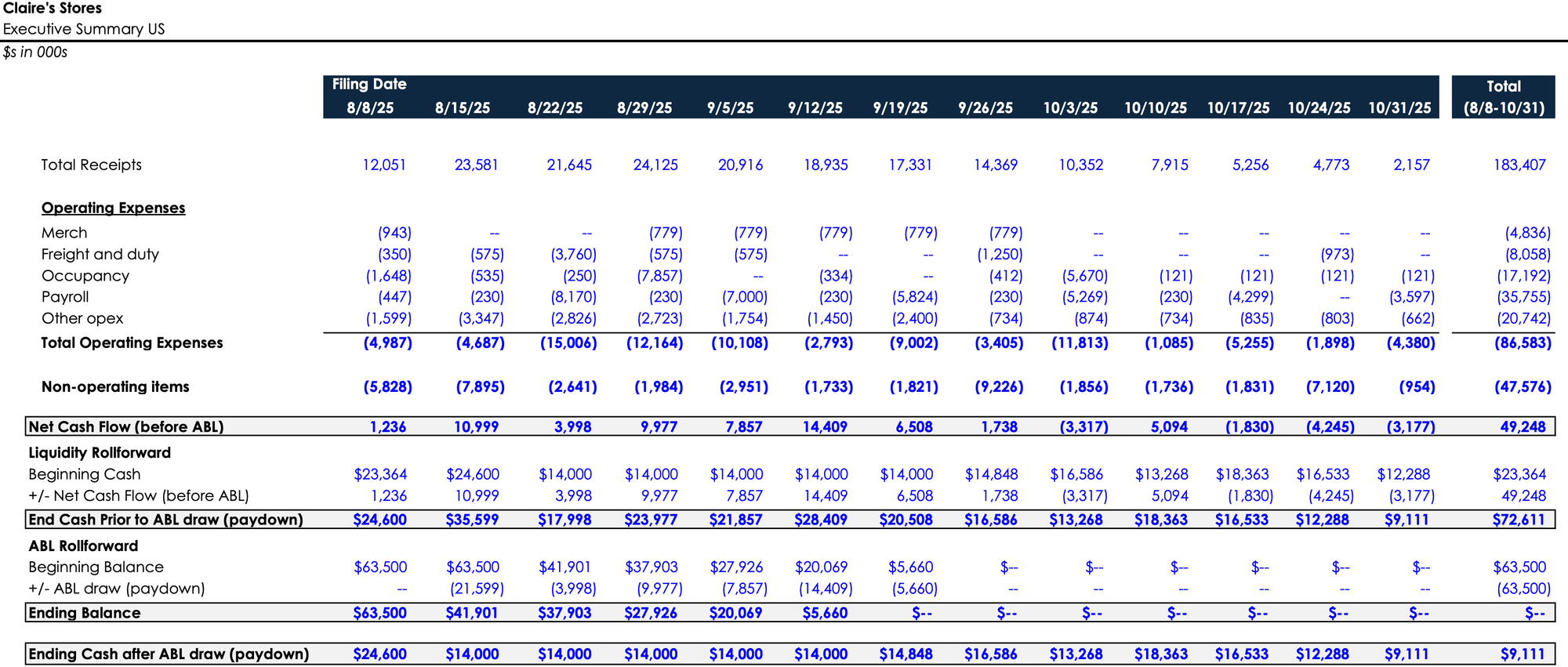

Initial Budget

Key Parties

- Richards, Layton & Finger, P.A. (local bankruptcy counsel); Kirkland & Ellis LLP and Kirkland & Ellis International LLP (bankruptcy counsel); Houlihan Lokey, Inc. (investment banker); Alvarez & Marsal North America, LLC (financial advisor); Omni Agent Solutions, Inc. (claims agent).

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.