Case Summary: Cold Spring Hills Chapter 11

Cold Spring Hills Center for Nursing & Rehabilitation has filed for Chapter 11 bankruptcy, citing financial instability from pandemic-related operational strain, ongoing legal challenges, and labor disputes.

Business Description

Cold Spring Acquisition, LLC, doing business as Cold Spring Hills Center for Nursing & Rehabilitation ("Cold Spring Hills" or the "Company"), operates a skilled nursing and rehabilitation facility (the “Senior Care Facility”) in Woodbury, NY.

Cold Spring Hills employs approximately 500 personnel and generated approximately $75.5 million in annual gross revenue in 2023.

As of the Petition Date, the Debtor reported $1-$10 million in assets and $50-$100 million in liabilities.

Corporate History

Cold Spring Hills is a New York limited liability company, formed in July 2014, and serves as the manager of the Senior Care Facility.

Operations Overview

The Senior Care Facility offers a comprehensive range of services to meet the unique needs of senior patients, including long-term care, rehabilitative services, and more.

Services Offered:

- Hospice care.

- Dementia care.

- Medical support.

- Short- and long-term rehabilitation.

Additionally, the Senior Care Facility runs a dedicated senior day program to further support the community.

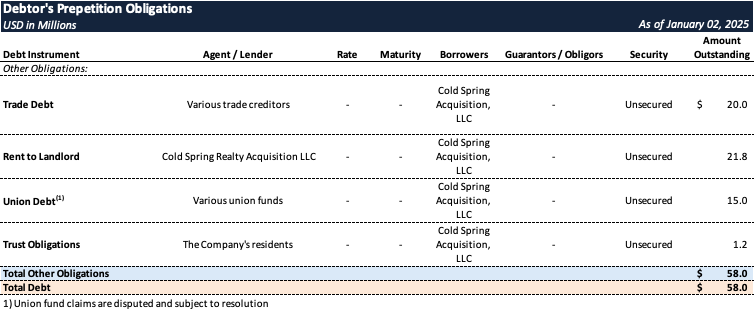

Prepetition Obligations

The Company’s capital structure comprises only unsecured obligations, with no secured or public debt, including payables to landlords, vendors, employees, unions, tax authorities, and professionals.

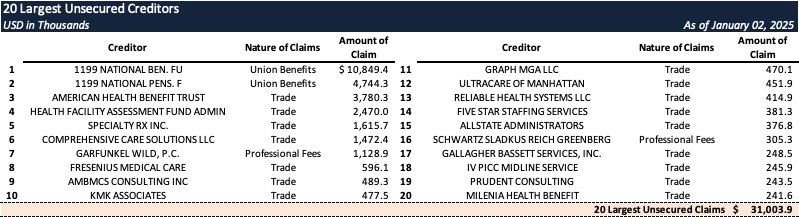

Top Unsecured Claims

Events Leading to Bankruptcy

Covid-19 Impact and Regulatory Challenges

- The COVID-19 pandemic severely affected nursing homes in New York, including Cold Spring Hills, due to state mandates requiring facilities to admit COVID-positive patients, coupled with a high mortality rate among the elderly population.

- This drastically reduced the nursing home population, straining operations and financial stability.

- After navigating the pandemic, Cold Spring Hills faced an investigation by the Medicaid Fraud Control Unit of the New York State Attorney General’s ("AG") office. This investigation targeted for-profit nursing homes and led to substantial legal expenses for the Company.

- The investigation escalated into multiple lawsuits, including a high-profile petition filed on December 22, 2022, in the New York State Supreme Court, Nassau County, alleging fraud, financial improprieties, and neglect of residents.

- Accompanying the lawsuit, a widespread smear campaign, involving press releases, public announcements, and media leaks, significantly damaged the Company’s reputation and financial position.

- Despite these challenges, the court ruled on March 15, 2024, dismissing most of the AG's claims, citing insufficient evidence to support allegations of fraud or financial mismanagement, and appointing an Independent Health Monitor as the sole relief.

Decline in Admissions and Financial Stability

- The legal challenges and negative publicity resulting from the AG's actions severely impacted the Company's ability to attract and retain residents, particularly high-reimbursement Medicare patients.

- By April 2024, the resident census had dropped to 423, a level deemed unsustainable for continued operations without incurring significant losses.

- In response, Cold Spring Hills filed a closure plan with the New York Department of Health ("DOH") while simultaneously seeking a buyer to take over operations.

- Although the closure plan was approved by mid-May 2024, the Company delayed implementation in hopes of transferring the facility to a new operator.

- By September 2024, the resident census had fallen below 350, worsening the Senior Care Facility’s financial strain and increasing the urgency to find a resolution.

- A potential buyer was identified in September 2024, leading to the submission of a receivership application to the DOH.

- However, the DOH informed Cold Spring Hills that it would not review the receivership application concurrently with an ongoing closure plan.

- On September 26, 2024, the DOH unilaterally declared the closure plan withdrawn, adding to operational uncertainties.

Labor and Benefits Disputes

- The Company's strained financial position led to disputes with the 1199SEIU National Benefits Funds (the "Fund"), resulting in mounting unpaid obligations.

- By August 2023, the Fund had issued a termination notice for health benefits due to unpaid contributions.

- While negotiations temporarily resolved the matter, the underlying financial issues persisted.

- By August 2023, the Fund had issued a termination notice for health benefits due to unpaid contributions.

- Following arbitration, the Fund obtained judgments against Cold Spring Hills totaling $6.36 million.

- In April 2024, the Fund terminated the Company’s health benefits.

- To reduce costs, Cold Spring Hills transitioned to private market insurance, obtaining equivalent health benefits at a fraction of the cost.

- Nevertheless, the Fund continued invoicing the Company for benefits, and according to the Company, appears to be seeking additional arbitration awards for health benefits not provided.

- In October 2024, the Fund issued a series of nine restraining notices on the Company’s Medicaid receivables, limiting the facility’s ability to access critical funds necessary for payroll and operational expenses.

- Efforts to secure court relief were only partially successful, exacerbating liquidity challenges.

Operational Crisis and Emergency Measures

- By late 2024, Cold Spring Hills faced an operational crisis as financial constraints escalated, prompting emergency measures.

- On December 16, 2024, the Company notified the DOH of its intent to conduct an emergency evacuation and over 500 employees were issued termination notices.

- In response, the Nassau County Supreme Court issued a temporary restraining order on December 20, 2024, preventing the evacuation and mandating the transfer of funds to meet payroll obligations.

- The Company lacked sufficient resources to comply with the court’s directives.

Chapter 11 Filing

- On January 2, 2025, Cold Spring Hills initiated Chapter 11 proceedings to secure breathing room, unlock restrained cash flow, and evaluate its strategic path forward.

- The Company is seeking prompt approval from the DOH for the appointment of a temporary receiver.

- Without such approval, the Company asserts that it may be compelled to initiate an orderly evacuation of the facility, while attempting to comply with the December 20, 2024, court order.

- Given the urgency, bankruptcy counsel was engaged less than two weeks prior to the filing to assist with the case and forthcoming motions.

- The Company acknowledges that it has not yet fully evaluated all strategic alternatives but emphasizes its commitment to exploring options that ensure uninterrupted, safe care for its residents and patients while maximizing value for its stakeholders.

Enjoyed this summary? Stay informed on new Chapter 11 filings over $10 million in liabilities—subscribe to Bondoro for free and get insights delivered directly to your inbox.

Plus, explore our full archive for all past summaries.