Case Summary: Compass Coffee Chapter 11

Compass Coffee has filed for Chapter 11 bankruptcy to pursue a sale of its business to a strategic buyer, following sustained traffic declines and the closure of its distribution division, supported by $450,000 in DIP financing from an existing stakeholder.

Business Description

Headquartered in Washington, D.C., Compass Coffee, LLC ("Compass," the "Company," or the "Debtor") is a vertically integrated specialty coffee company operating a network of retail cafés and an in-house roasting platform. Founded in 2014 by two former U.S. Marine officers, Michael Haft and Harrison Suarez, the Company is built around a brand identity emphasizing quality, consistency, and a "Made in DC" narrative.

- The Company’s mission centers on serving “Real Good Coffee,” leveraging its patriotic origin story to establish significant local equity and political capital within the D.C. metropolitan area.

- As of the Petition Date, Compass operated 25 Company-owned, leased cafés across the District of Columbia, Northern Virginia, and Southern Maryland. The core business model involves neighborhood coffee shops serving brewed coffee, espresso-based beverages, and specialty food items, supported by the sale of packaged coffee beans through in-store, online, and wholesale channels.

Compass Coffee’s ownership structure is led by CEO Michael Haft, who holds a majority equity stake (just over 52%). The remaining equity is distributed among approximately 22 minority holders, including co-founder Harrison Suarez (who retains slightly above 10%).

Compass Coffee, LLC filed for Chapter 11 protection on January 6, 2026 (the "Petition Date") in the U.S. Bankruptcy Court for the District of Columbia, reporting $1 million to $10 million in assets and $10 million and $50 million in liabilities.

Corporate History

Compass Coffee rapidly scaled its operations from a single location in 2014 to a regional chain, characterized by distinct periods of aggressive expansion, crisis adaptation, and internal conflict.

Founding and Initial Expansion (2014–2019)

- The first café opened in D.C.’s Shaw neighborhood in September 2014. By late 2019, the Company operated a dozen cafés and expanded into the Northern Virginia market.

- The expansion included opening several locations in the central business district (downtown D.C.), targeting the high foot traffic associated with federal employees and office workers.

Pandemic Crisis and Strategic Pivot (2020–2021)

- In March 2020, the COVID-19 pandemic caused an abrupt crisis, with the Company reporting the loss of approximately 90% of its business and laying off 150 of 189 employees soon thereafter.

- Compass utilized significant federal relief funding (totaling ~$10 million, including $3.1 million in PPP loans and an RRF grant) to survive, using idle staff to construct a new 50,000 sq. ft. industrial roastery and packaging facility in Ivy City, D.C., which opened in May 2021.

- Concurrently, co-founder Harrison Suarez was terminated and exited the Company following internal disputes, including over ownership.

Internal Turmoil and Financial Decline (2022–2025)

- The Company continued to expand post-pandemic, opening its first drive-through café in Arlington, VA, in October 2022, and reaching 25 cafés by mid-2025. Despite this growth, downtown locations were severely underperforming, with core sales down more than 50% from pre-COVID levels, according to industry reporting.

- Governance Rupture and Litigation:

- In November 2021, Company funds (including RRF grant money) were allegedly used to make a $2.1 million investment in Bitcoin via MicroStrategy.

- In January 2025, Harrison Suarez filed a federal lawsuit against Michael Haft and Robert Haft, alleging breach of contract, fraud, and RICO violations regarding the wrongful dilution of his equity and the misappropriation of federal relief funds. The case was permitted to proceed to trial in November 2025.

- Labor Conflicts: A unionization drive by baristas (Compass Coffee United) began in May 2024, leading to contested elections and allegations of management "unit packing" and union-busting tactics, creating ongoing operational distractions and legal liabilities.

Faced with mounting financial and legal pressures, Compass entered exclusive negotiations with a strategic buyer (an undisclosed global coffee chain) in late 2025, reaching an agreement in principle for a sale contingent upon a court-supervised auction in Chapter 11.

Operations Overview

Compass Coffee operates through a vertically integrated model, although its strategic focus has narrowed significantly in the face of financial distress, retrenching from industrial-scale production and distribution ventures.

Production Ecosystem and Real Estate Footprint

- The core operation involves running neighborhood coffee shops supported by in-house roasting capabilities. Green coffee beans are sourced from three primary suppliers, which are critical vendors to the Debtor.

- The real estate strategy relies exclusively on leased storefronts, which created a rigid fixed-cost structure.

- Until December 2025, the Company’s central production hub was the 50,000 sq. ft. roastery in Ivy City, D.C., intended to support wholesale distribution. This facility proved financially unsustainable, leading the Debtor to vacate the site and relocate roasting operations back to a smaller setup adjacent to its original Shaw café.

- While Compass vacated its former Ivy City headquarters, it retains ownership of substantial coffee roasting equipment located at that facility.

- The Company’s 25-store footprint is biased toward high-density urban corridors, a strategy undermined by the persistent telework policies of the federal workforce.

Strategic Retrenchment and Asset-Light Model

- Due to liquidity pressures, the Company has actively exited non-core operations that were initiated during the pandemic pivot.

- The wholesale distribution and grocery channel venture was wound down, and associated inventory/equipment were sold to raise cash, allowing the Company to refocus on its core café business.

- The small, in-house construction services team was disbanded, with no new projects planned.

- As of the Petition Date, there is one remaining active project involving the construction of a bar for an unaffiliated restaurant, which is nearing completion.

- Compass intends to pay necessary subcontractors to finish the project, allowing the Company to collect final payment from the project owner.

- The Debtor relies on third-party logistics, notably partnering with Odeko (a creditor owed $413,000), for ordering and delivery of supplies to its cafés.

Workforce and Technology

- As of the Petition Date, Compass employed 166 individuals (23 salaried, 143 hourly). The labor force is central to business continuity, though management faces ongoing conflicts with the unionization drive by "Compass Coffee United," including pending Unfair Labor Practice (ULP) charges before the NLRB.

- The Company utilizes a technology stack that includes a proprietary mobile app for ordering and a "Compass Rewards" loyalty program. To raise immediate working capital in 2025, Compass engaged in a financing arrangement with inKind, resulting in a current liability of approximately $100,000 in unredeemed customer credits.

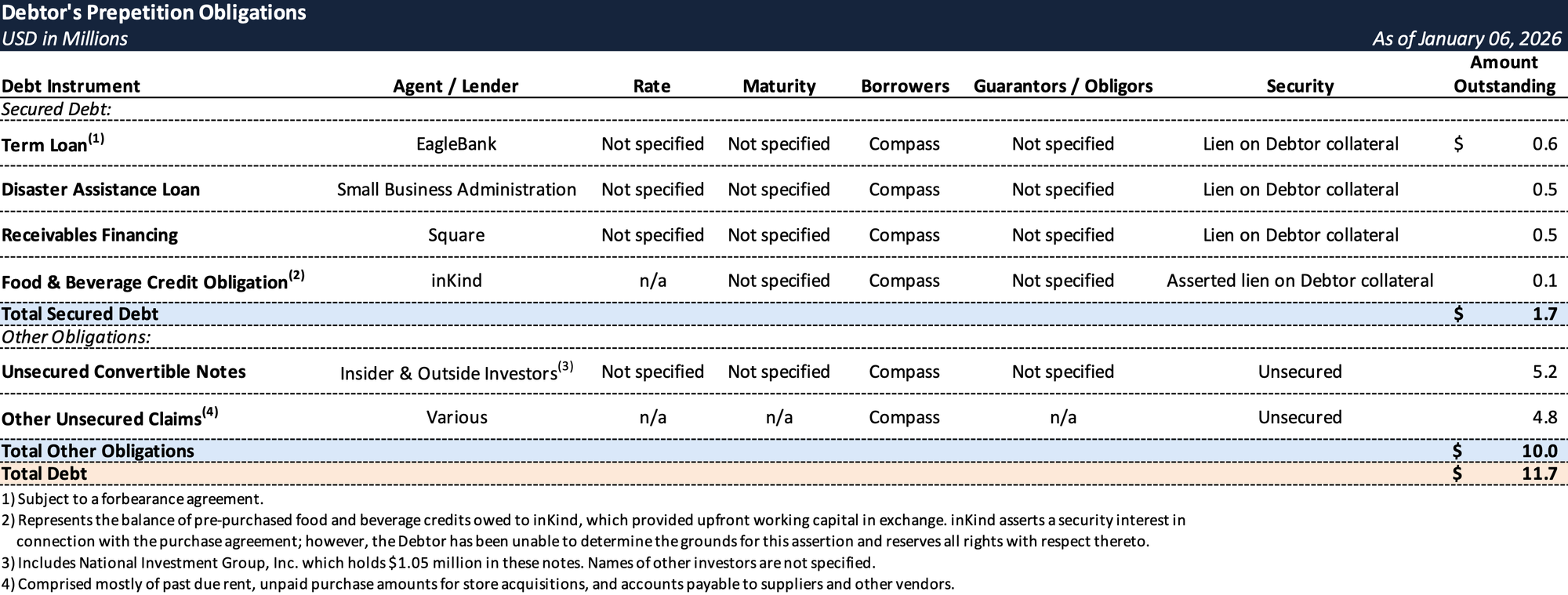

Prepetition Obligations

Top Unsecured Claims

Events Leading to Bankruptcy

The Chapter 11 filing was precipitated by a confluence of structural macroeconomic shifts, severe liquidity constraints arising from strategic miscalculations, and a multitude of governance and legal conflicts.

Macroeconomic Structural Shift

- The enduring impact of the COVID-19 pandemic structurally altered the D.C. market, primarily due to sustained federal employee telework policies. This reduced daily commuter traffic, the key captive audience for Compass’ urban-centric locations.

- Simultaneously, the Company faced severe inflationary pressures, driving up costs which further eroded profit margins in a period of weak sales volume.

Strategic Miscalculations and Burdensome Liabilities

- The Company’s expansion to 25 stores and the Ivy City facility, fueled by long-term leases in high-rent districts, proved catastrophic when revenue evaporated. The resulting fixed-cost structure became unsustainable.

- By late 2025, the Debtor owed at least $2 million in past-due rent across its portfolio, including a $1.3 million liability to the landlord of the abandoned Ivy City roastery.

- DC entity records list AAFMAA Property LLC as a beneficial owner of AP DC Tomato’s LLC (Debtor’s largest unsecured creditor); separately, public reports describe an AAFMAA property affiliate as the buyer of 1401 Okie St. NE (former Ivy City roastery).

Corporate Governance Breakdown and Legal Turmoil

- The federal RICO lawsuit filed by co-founder Harrison Suarez alleges that millions in federal COVID relief funds, including $2.1 million, were improperly diverted to speculative assets like Bitcoin.

- The ongoing high-profile conflict with the union, including allegations of "unit packing" and Unfair Labor Practice charges before the NLRB, creates an assessment of complex labor liability for any potential acquirer.

- The confluence of lawsuits—from landlords seeking eviction, vendors seeking payment, and the co-founder’s claims—drained resources, rendering an out-of-court restructuring unviable.

Chapter 11 Filing

- Compass Coffee filed for Chapter 11 protection on January 6, 2026, to facilitate a sale of its core business.

- The Debtor has negotiated a stalking horse asset purchase agreement with a strategic buyer that has a substantial global retail coffee presence. The process seeks to sell assets as a going concern, free and clear of all claims, while ensuring secured lenders are paid in full.

- An asset purchase agreement and formal sale procedures are expected to be filed within days of the Petition Date.

- To fund the sale process, National Investment Group, Inc., a prepetition investor with disclosed familial ties to the Debtor’s majority owner, has committed $450,000 in junior DIP financing.

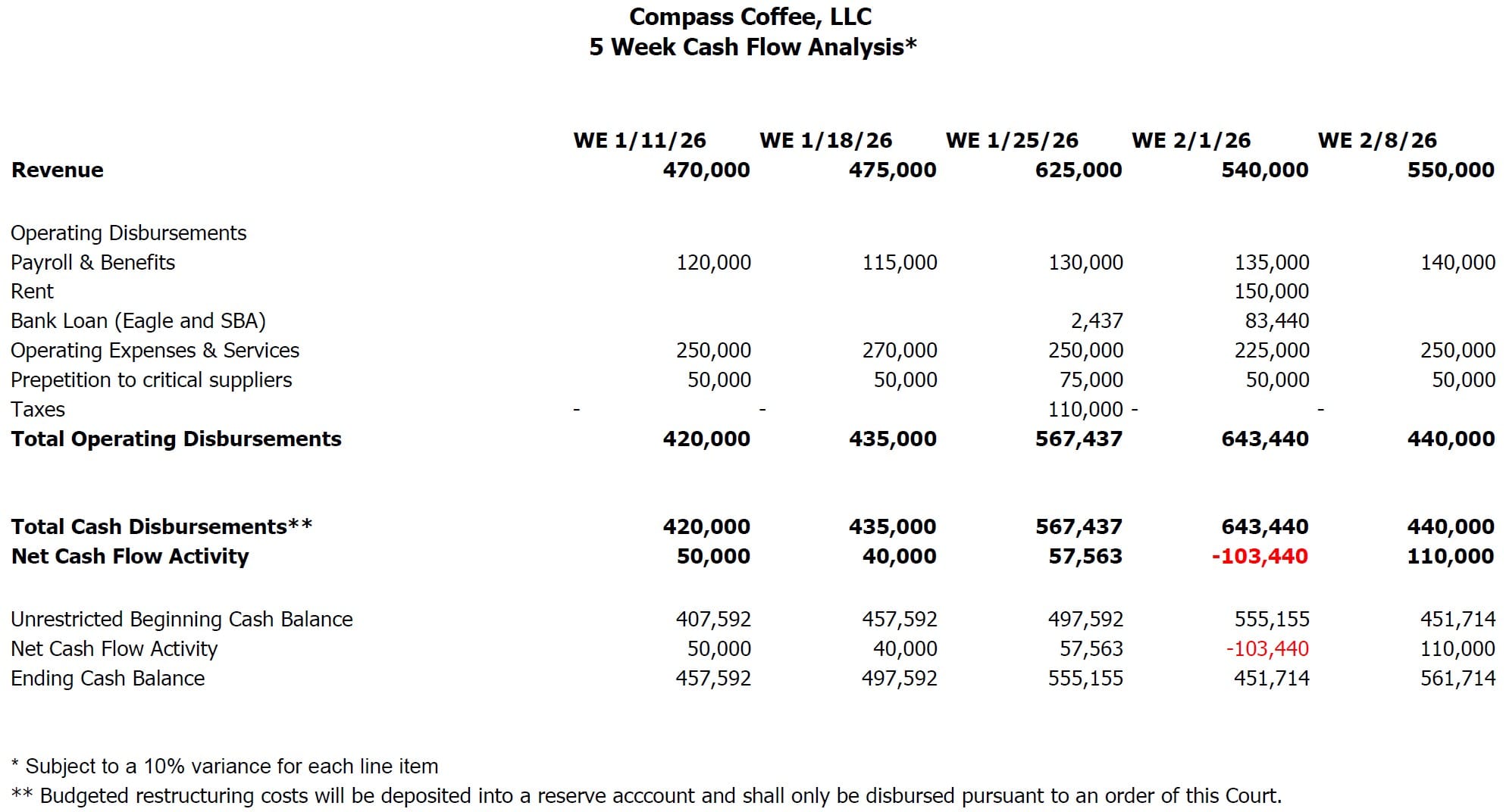

- The Debtor projects it can cover ordinary-course operating expenses and debt service (with cash collateral authority) but lacks sufficient liquidity to fund the restructuring/sale-process costs without DIP financing.

Cash Flow Analysis

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.