Case Summary: Consolidated Burger Holdings Chapter 11

Burger King franchisee Consolidated Burger Holdings has filed for Chapter 11 bankruptcy amid operating losses and a costly dispute with the franchisor over remodels, aiming for a court-supervised sale of its 57 locations backed by $1.6 million in DIP financing.

Business Description

Headquartered in Destin, FL, Consolidated Burger Holdings, LLC, along with its Debtor affiliates Consolidated Burger A, LLC and Consolidated Burger B, LLC (collectively, "CBH", the "Company" or the "Debtors"), is a privately-held franchisee of Burger King restaurants operating primarily in Florida and southern Georgia.

- As of the Petition Date, the Company operated 57 Burger King locations, comprising 53 traditional stand-alone units and four outlets within Walmart stores.

- Operations adhere to standard Burger King franchise agreements, menu, and brand standards.

For FY 2024, CBH reported approximately $67.0 million in revenue and a net operating loss of $12.5 million, compared to $76.6 million in revenue and a $6.3 million net operating loss in FY 2023.

The Debtors filed for Chapter 11 protection on April 14, 2025, in the U.S. Bankruptcy Court for the Northern District of Florida. As of the Petition Date, the Debtors reported $50 million to $100 million in both assets and liabilities.

Corporate History

CBH was formed in 2018 to acquire and turnaround a portfolio of underperforming Burger King restaurants.

Formation and Acquisition

- In June 2018, CBH acquired 66 Burger King locations in Florida and Georgia for $45.5 million, facilitated by Burger King's parent, Restaurant Brands International, to transition struggling units.

- New franchise agreements included initial commitments for light refreshes (approx. $30,000 per location by late 2024) and full remodels for 14 specific locations by 2020.

Post-Acquisition Investment and Performance

- Acquired units required significant unexpected repairs (approx. $4 million initially). CBH invested roughly $30 million total since 2018 in acquisition costs, improvements, and remodels (including 7 new builds and 9 full renovations).

- Despite operational improvements earning "top-tier" status within the Burger King system based on metrics, the Company struggled with overall financial profitability.

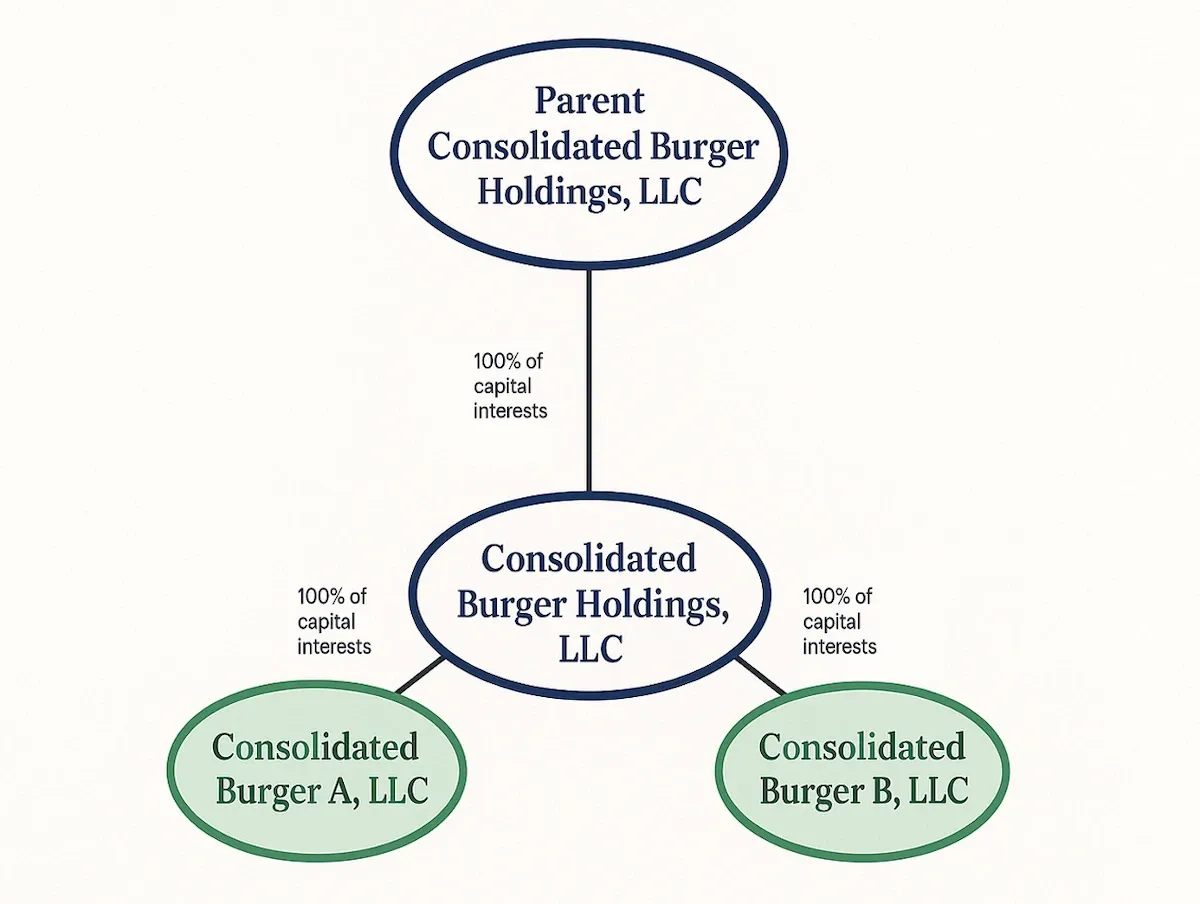

Ownership and Structure

- CBH is privately held by experienced restaurant operators/investors via non-Debtor Parent Consolidated Burger Holdings, LLC, which owns Debtor Consolidated Burger Holdings, LLC.

- Debtor Consolidated Burger Holdings, LLC owns operating subsidiaries Consolidated Burger A, LLC (39 restaurants at filing) and Consolidated Burger B, LLC (18 restaurants at filing).

- Joseph J. Luzinski of Development Specialists, Inc. was appointed Chief Restructuring Officer in March 2025.

Operations Overview

The Company's 57 Burger King restaurants are located across Florida (Panhandle, South Florida) and southern Georgia, managed in three informal geographic clusters (Tallahassee/S. Georgia - 18 restaurants; South Florida - 19 restaurants; FL Panhandle - 20 restaurants).

Store Portfolio and Operating Model

- The portfolio consists of 53 traditional free-standing units and 4 units inside Walmart stores.

- Each restaurant operates under individual Franchise Agreements with Burger King Corporation ("BKC") or Burger King Company ("BKCo"), requiring royalty/advertising payments and adherence to brand standards. BKC was owed approx. $2.4 million in accrued fees at filing.

- Locations are subject to individual Lease Agreements.

Workforce

- Employs approx. 773 people (748 restaurant-level, 25 support/management).

- Comprises 76 full-time and 697 part-time, non-union employees.

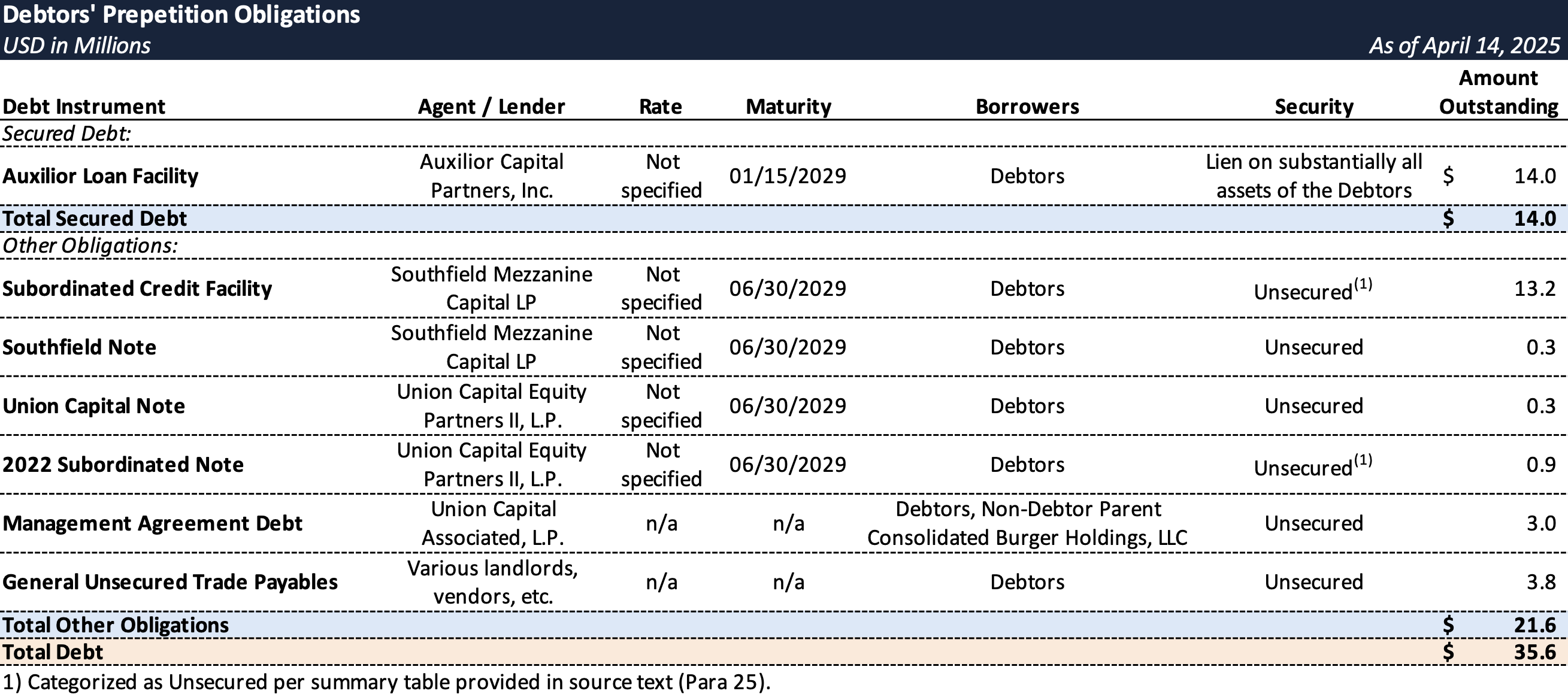

Prepetition Obligations

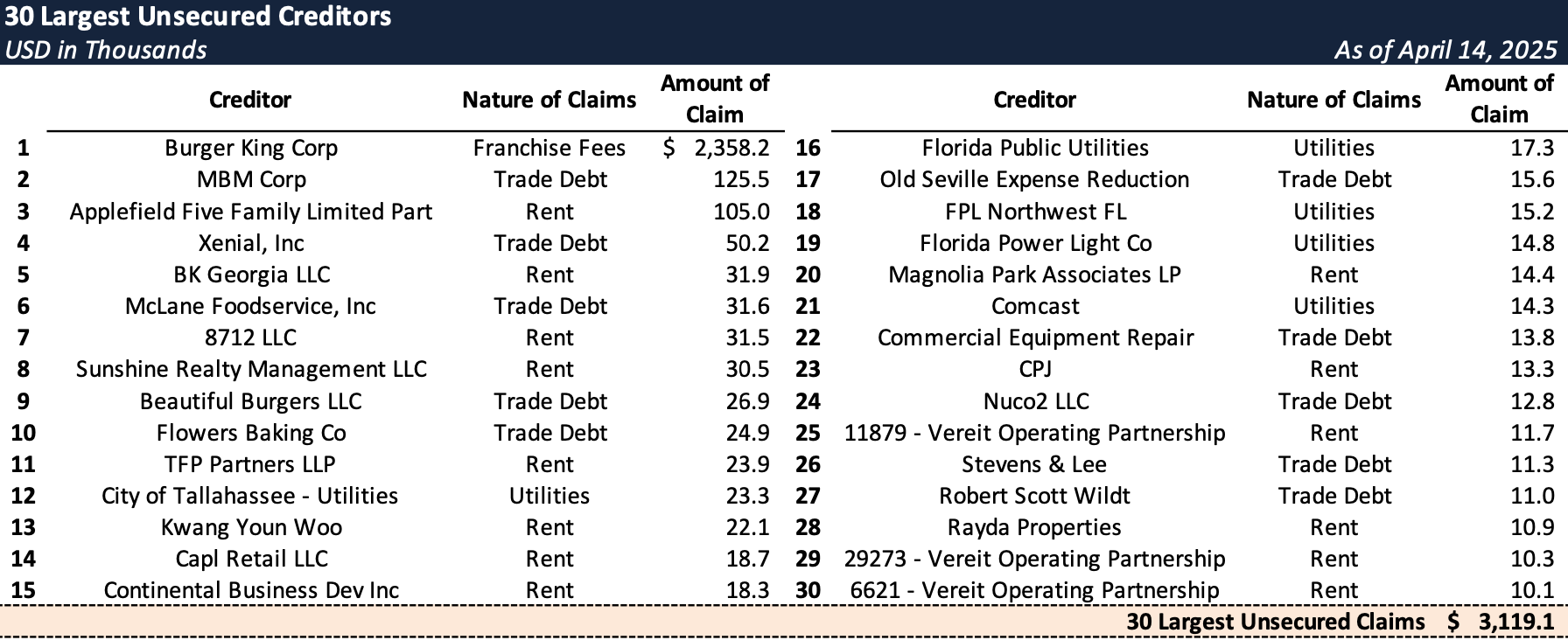

Top Unsecured Claims

Events Leading to Bankruptcy

CBH's Chapter 11 filing stemmed from high leverage from its 2018 acquisition, persistent operating losses driven by soft sales and rising costs, and an escalating dispute with franchisor Burger King over required capital expenditures, culminating in a severe liquidity crisis.

Financial Deterioration and High Leverage

- The Company carried significant debt from the 2018 acquisition and subsequent investments.

- Revenue declined post-pandemic and failed to cover the highly leveraged cost structure, exacerbated by rising food, labor, and operating costs from 2021-2024.

- Mounting net operating losses ($12.5M in FY 2024, $6.3M in FY 2023) depleted liquidity, leaving only $179,000 in unrestricted cash by the Petition Date.

- The balance sheet reflected assets and liabilities of approx. $77.9 million each as of YE 2024.

Franchise Dispute over Remodels

- BKC's increasing demands for costly restaurant remodels created conflict, despite initial agreements, extensions (2019), and pandemic-related pauses (2020).

- In September 2023, BKC issued default notices for missed remodel deadlines and non-renewal notices for five locations, threatening closures.

- CBH sued BKC in November 2023, alleging breach of prior agreements; BKCo filed its own suit in January 2024. The parties reached a confidential settlement in September 2024.

- Despite the settlement, CBH remained non-compliant. BKCo declared new defaults in February 2025 but agreed to temporary forbearances through April 14, 2025, allowing CBH time to pursue a restructuring or sale.

Failed Prepetition Sale Process

- The Company engaged Peak Franchise Capital in July 2024 to market its assets.

- Despite outreach to 235 potential buyers and diligence by 32 parties over seven months, no executable transaction was achieved prior to filing.

Chapter 11 Filing and Objectives

- Facing imminent expiration of BKC's forbearance and depleted cash, CBH filed for Chapter 11 protection on April 14, 2025.

- The primary goal is a court-supervised sale of substantially all assets as a going concern to maximize value.

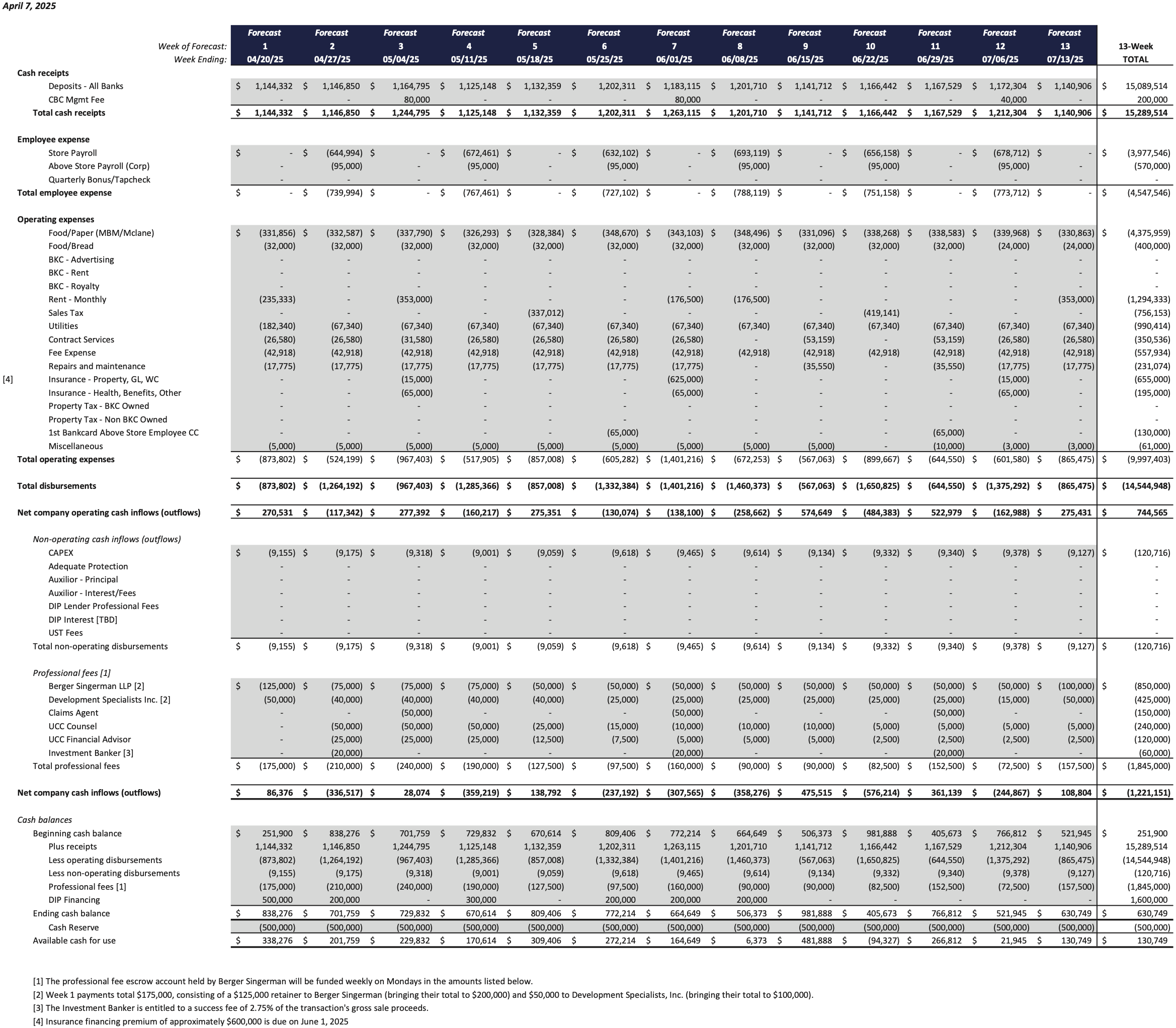

- The Company secured $1.6 million in DIP financing from senior lender Auxilior Capital Partners, plus use of cash collateral, to fund operations during the sale process and avoid immediate liquidation.

Initial Budget

Key Advisors & Parties

- Legal Counsel: Berger Singerman LLP

- Financial Advisor: Development Specialists, Inc. (DSI)

- Investment Banker: Peak Franchise Capital LLC

- CRO: Joseph J. Luzinski

- Claims Agent: Omni Agent Solutions

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.