Case Summary: Corsa Coal Chapter 11

Corsa Coal Corp. and affiliates, including Wilson Creek Energy, have filed for Chapter 11 bankruptcy to enable a sales process after failed attempts at refinancing or strategic alternatives amid operational and market challenges.

Business Description

Headquartered in Somerset, PA, Wilson Creek Energy, LLC, along with its Debtor affiliates, including its ultimate parent company, Corsa Coal Corp. ("Corsa") (collectively, the "Company"), operates as a metallurgical coal producer.

The Company focuses on mining and producing metallurgical coal, which is sold to both domestic and international steel and coke producers.

- Coal is sourced either through the Company’s own mining operations or purchased from third parties.

As of the Petition Date, the Company employed approximately 365 employees.

Corsa Coal Corp., domiciled in Canada, is publicly traded on the TSX Venture Exchange under the symbol “CSO” and on the OTCQX Best Market under the symbol “CRSXF”.

For the twelve months ended September 30, 2024, Corsa reported revenue of $158.9 million and a net loss of $32.6 million, representing a 17.7% decline in revenue and a shift from a net income of $13 million in the same period the previous year.

As of the Petition Date, the Debtors reported assets totaling $50-$100 million and liabilities totaling $10-$50 million.

Corporate History

Founded in 2007, Corsa Coal Corp. began operations as a coal mining company focused on metallurgical coal production.

- In December 2010, Corsa acquired Wilson Creek Energy, LLC, marking its first significant expansion.

- In April 2011, the Company purchased the Alumbaugh expansion of the Acosta Deep Project (29.5 million ton).

- In May 2011, Corsa acquired Maryland Energy Resources, LLC, including the Casselman Mine, which began operations in July 2011.

The Company expanded its asset base and operational capacity through strategic acquisitions and development projects.

- In December 2011, Corsa acquired the Keyser property.

- In July 2013, Corsa purchased the Kopper Glo mine from Quintana with a $40 million investment from Quintana.

- In August 2014, the acquisition of PBS Coals Unlimited for $53.6 million further strengthened its portfolio.

Focused on growth and operational excellence, Corsa launched new projects and divested non-core assets.

- In June 2017, production commenced at the Acosta Deep Mine.

- In February 2018, Corsa began production at the Horning Mine.

- In March 2018, the Company divested its Central Appalachia division comprised of thermal and industrial operations to focus on metallurgical coal.

- In March 2019, production started at the Schrock Run Extension Mine.

Operations Overview

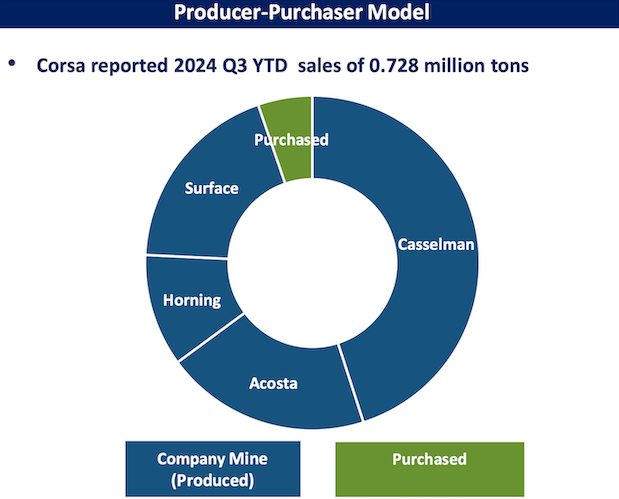

Corsa’s metallurgical coal sales consist of two primary categories: (i) coal produced from the Company’s owned and operated mines and (ii) coal purchased from third parties, which may undergo value-added services such as storage, washing, blending, or loading to make it saleable.

Production and Assets

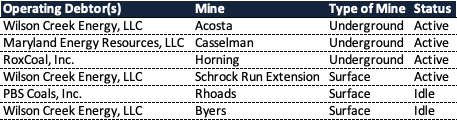

The Company produces and sells approximately one million tons of coal annually. Its operations include six mines, comprising both underground and surface mines.

- All of these mines are located in Somerset County, Pennsylvania, except for the Casselman mine, which is situated in Garrett County, Maryland.

- These assets are owned, leased, and/or operated directly by the Company.

Coal Reserves

Corsa reports total coal reserves of approximately 23 million clean and recoverable tons across its active mines and approximately 38 million clean and recoverable tons across all properties.

Mining Equipment and Techniques

The Company’s operations are supported by an extensive portfolio of mining machinery and equipment. Corsa employs the room and pillar method for underground mines, while surface mining utilizes contour and auger mining or contour and highwall mining, depending on site-specific conditions.

- According to Company estimates, the combined value of personal property assets and real property and mineral rights holdings materially exceeds pre-petition secured debt.

Coal Preparation Facilities

Corsa owns two coal preparation plants in Somerset County, PA:

- Shade Creek Preparation Plant:

- Processing capacity: 450 tons of raw coal per hour.

- Storage capacity: 75,000 tons of clean coal and 170,000 tons of raw coal.

- Cambria Preparation Plant (currently idle as of the Petition Date):

- Processing capacity: 325 tons of raw coal per hour.

- Storage capacity: 130,000 tons of clean coal and 55,000 tons of raw coal.

Raw coal is transported to these preparation plants, where it is washed, stored, and prepared for shipment. Loadout facilities adjacent to rail lines enable distribution by rail or truck to customers.

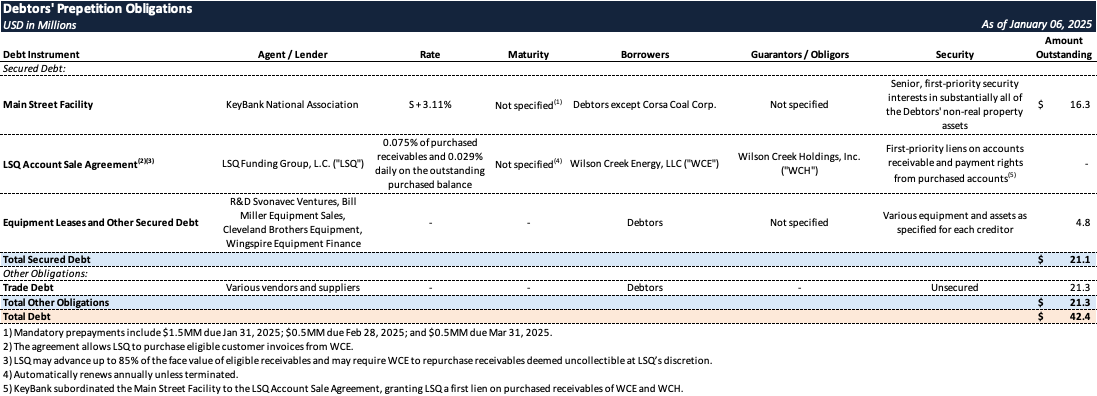

Prepetition Obligations

Corsa operates under extensive state and federal regulation, requiring bonded permits for reclamation, water treatment, and performance obligations.

- The Company has environmental liabilities, including reclamation, water treatment, and possible mine closure.

- To address long-term water treatment, the Company entered into three separate Consent Order & Agreements with the Pennsylvania Department of Environmental Protection, establishing $34 million in trust funds to cover costs for 18 perpetual water treatment sites.

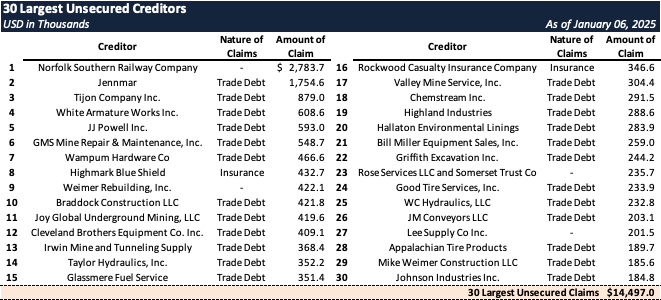

Top Unsecured Claims

Events Leading to Bankruptcy

Operational Challenges and Financial Strain

- Corsa encountered significant operational challenges beginning in the fourth quarter of 2023 and continuing throughout 2024:

- The development of new mining areas across its underground mines revealed challenging geological conditions, reducing output and increasing mining costs.

- Inadequate access to capital constrained the Company’s ability to repair or replace aging mining equipment or invest in necessary infrastructure, impairing its ability to lower costs and improve profitability.

Bank Covenant Relief and Milestones

- During this period of increased costs and reduced productivity, Corsa sought financial covenant relief from KeyBank under its Main Street Facility:

- KeyBank granted partial relief but imposed a mandatory prepayment schedule, further straining liquidity.

- Additional milestones required Corsa to either refinance the Main Street Facility or sell the Company by a specified deadline if refinancing was unsuccessful.

Refinancing Efforts

- In response to the milestone requirements, Corsa engaged a debt refinancing consultant in March 2024:

- On June 6, 2024, the Company executed a term sheet with Madison One CUSO, LLC (“M1”) for a $25 million USDA-backed loan to refinance the Main Street Facility.

- M1’s acquisition by Ready Capital Corporation on June 11, 2024, delayed the submission of the USDA guarantee application, which remains under review.

- The Company initially anticipated USDA approval in early November 2024, but M1 did not submit the application until November 8, 2024, further delaying the process.

Sale and Merger Exploration

- Corsa retained an investment banker in mid-2024 to explore potential merger or sale opportunities:

- The investment banker reached out to numerous U.S. and international investors and operators in the mining sector.

- No material progress was made toward a transaction despite extensive efforts.

Market Deterioration

- Macroeconomic factors negatively impacted the metallurgical coal market in 2024:

- Economic uncertainty, inflationary pressures, and restrictive monetary policies contributed to reduced demand for metallurgical coal.

- Coal prices fell below mining costs, compounding the Company’s financial challenges.

- Although the Company secured 2025 sales contracts at higher price levels, liquidity constraints and mounting debt prevented Corsa from benefiting from these agreements.

Decision to File for Chapter 11

- The Company determined that filing for Chapter 11 was necessary to preserve value for stakeholders and maintain operations:

- The Chapter 11 process will enable a more structured sale and marketing effort for Corsa’s assets compared to pre-petition attempts.

- The Company intends to file a motion to establish bidding and sale procedures for substantially all of its assets shortly after the Petition Date, aiming to maximize value for stakeholders and preserve employment for approximately 365 employees.

DIP Financing and Operational Support

- Corsa entered Chapter 11 with a $15 million DIP financing commitment from KIA II, LLC:

- Upon court approval, the financing, combined with cash flow from ongoing operations, is expected to sustain the business through the Chapter 11 process.

- The DIP financing will support day-to-day operations and facilitate the asset sale process while the Company works to address its financial challenges.

Enjoyed this summary? Stay informed on new Chapter 11 filings over $10 million in liabilities—subscribe to Bondoro for free and get insights delivered directly to your inbox.

Plus, explore our full archive for all past summaries.