Case Summary: Cutera Chapter 11

Cutera has filed for Chapter 11 bankruptcy to eliminate $400 million in debt amid operational setbacks, intensifying competition, and the loss of a key distribution partnership.

Business Description

Headquartered in Brisbane, CA, Cutera, Inc., along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, "Cutera" or the "Company), is a prominent global provider of aesthetic and dermatology solutions tailored for medical practitioners.

- Cutera designs, manufactures, and markets innovative technologies for treating acne, skin resurfacing, hair removal, tattoo removal, body contouring, and other aesthetic and dermatologic conditions.

- The Company’s key product platforms include AviClear, enlighten, excel V/V+, excel HR, truSculpt, truFlex, Secret, and xeo.

- Beyond its core devices, Cutera offers service and support, along with consumables integral to its product platforms.

In fiscal year 2024, Cutera recorded revenue of $138.5 million, a substantial decrease from $212.4 million in the previous year.

- The Company maintains direct sales and service operations across 11 countries outside the U.S. and distributes products in over 30 additional international markets.

- In 2023, approximately 50% of total revenue came from customers outside North America.

As of the Petition Date, Cutera employs approximately 350 individuals globally.

- 251 employees are based in the U.S., including 186 salaried and 65 hourly workers, with no union affiliations.

The Debtors filed for Chapter 11 protection on Mar. 5 in the U.S. Bankruptcy Court for the Southern District of Texas. As of the Petition Date, the Debtors reported $100 million to $500 million in both assets and liabilities.

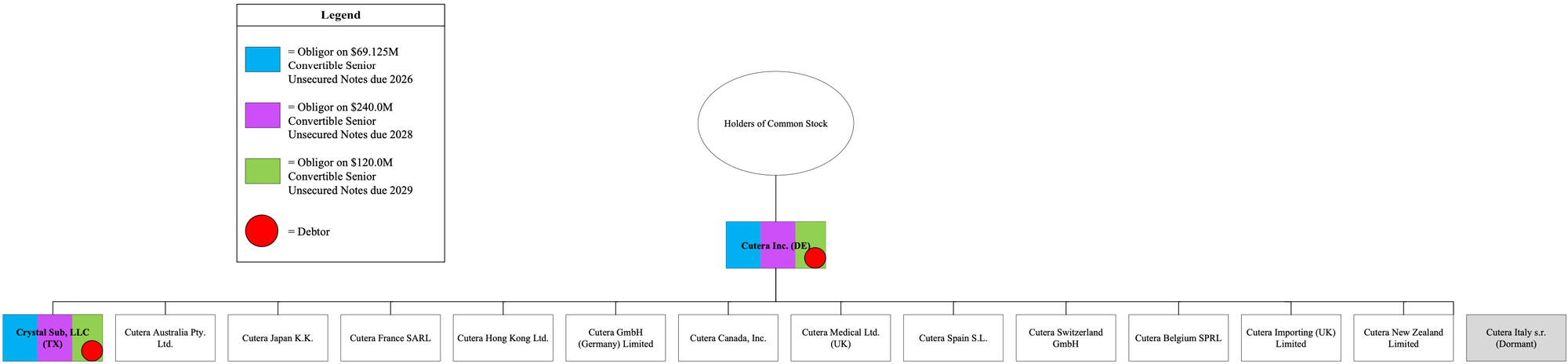

⁽¹⁾ Crystal Sub, LLC.

Corporate History

Founded in 1998, Cutera has grown into a leading provider of aesthetic and dermatology solutions for medical professionals worldwide.

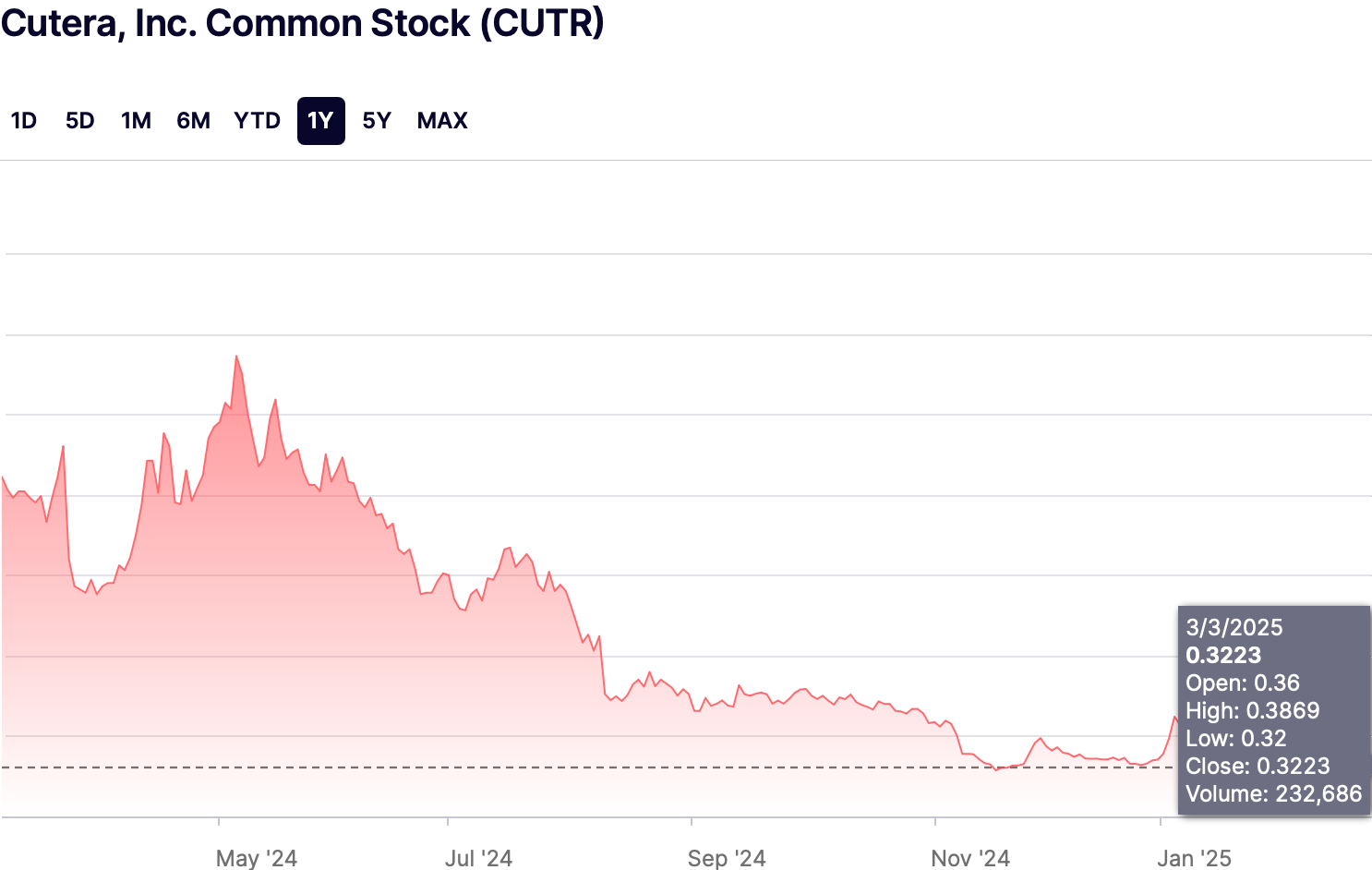

The Company’s common stock is publicly traded on the NASDAQ Stock Market under the ticker symbol “CUTR.”

- As of March 3, 2025, Cutera had 20,185,926 shares of common stock outstanding, closing at $0.32 per share (52-week range: $0.28 – $3.00).

Corporate Structure Chart

Operations Overview

Cutera’s operations integrate manufacturing, research & development, sales, marketing, and administrative functions, all centralized at its Brisbane headquarters.

- The Company primarily sells its products to physicians and aesthetic practitioners, complemented by extended service contracts that support system performance and ongoing consumable demand.

- Comprehensive training and marketing support are provided to enhance clinical outcomes and foster customer loyalty.

Global Sales Network

Cutera maintains direct sales and service teams across:

- North America, Australia, New Zealand, Austria, France, Belgium, Germany, Japan, Hong Kong, Switzerland, the United Kingdom, and Ireland.

- In markets outside these regions, sales and service are handled through a global distributor network covering 30+ countries.

Product Portfolio

Cutera’s product suite focuses on four primary dermatology and aesthetic treatment categories:

- Skin Resurfacing & Revitalization: The Cutera Skin Suite (excel V/V+, Xeo/Xeo+, enlighten, Secret) targets vascular lesions, skin revitalization, and resurfacing.

- Acne Treatment: AviClear, an FDA-cleared solution for mild to severe inflammatory acne, utilizes selective photothermolysis to target sebaceous glands.

- Body Sculpting & Muscle Stimulation: truFlex and truSculpt provide muscle toning and fat reduction treatments, supported by recurring consumable sales.

- Other Aesthetic Conditions: Cutera also offers platforms for tattoo and hair removal treatments.

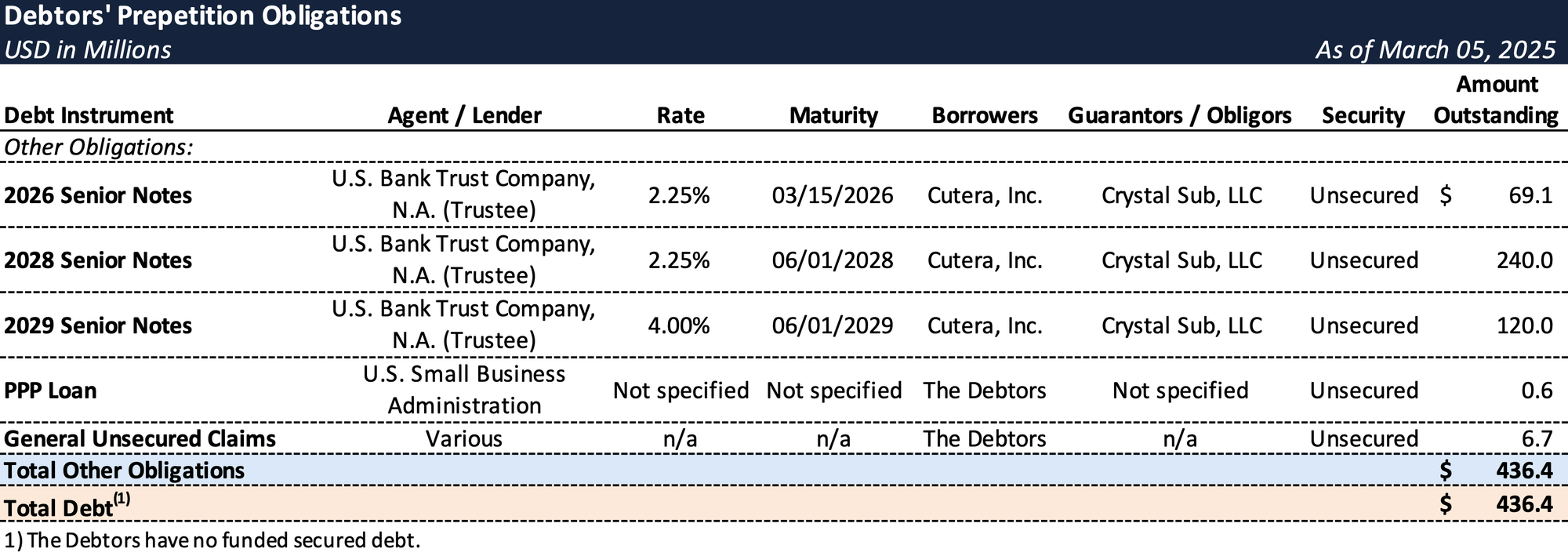

Prepetition Obligations

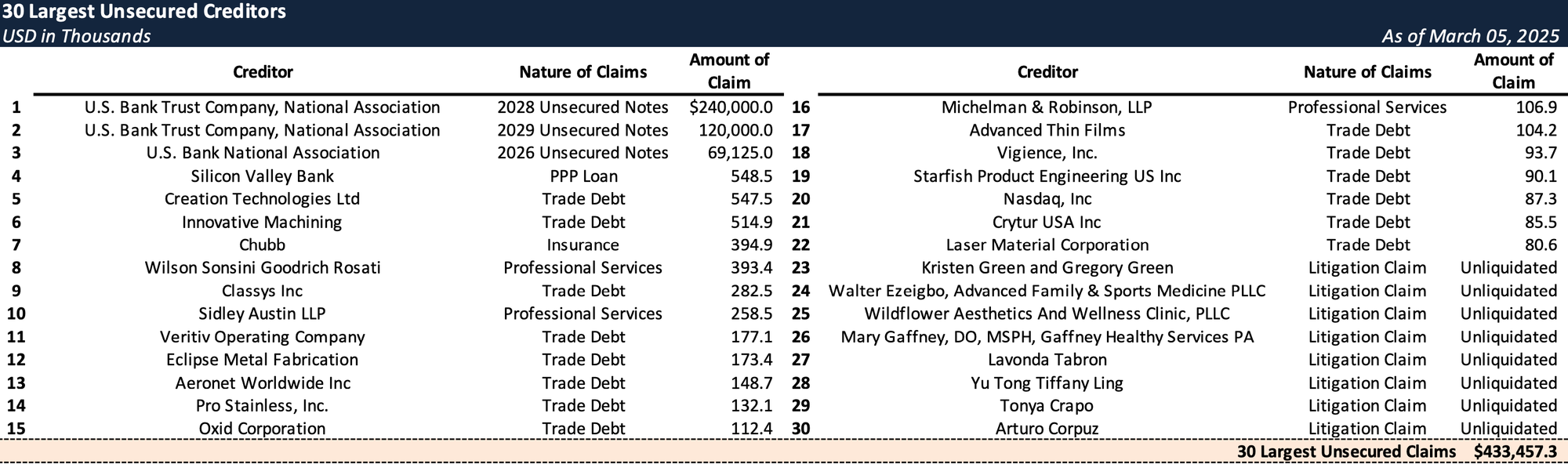

Top Unsecured Claims

Events Leading to Bankruptcy

Operational Challenges and Macroeconomic Pressures

- In recent years, Cutera experienced a series of operational and market-driven challenges, significantly impacting its financial performance:

- Operational issues included unsuccessful product launches, high executive and board turnover, and the termination of a critical skincare distribution partnership in Japan.

- Increased competition in the aesthetic medical device market, coupled with macroeconomic factors—including rising interest rates and reduced customer willingness or ability to finance equipment purchases—further exacerbated the Company's financial pressures.

- These challenges were intensified by the Company's burdensome capital structure, characterized by annual debt service obligations of approximately $12 million and looming maturities, notably the $69 million Senior Notes due in March 2026.

Flawed AviClear Launch and Outsourced Manufacturing Issues

- The unsuccessful North American launch of Cutera's marquee AviClear product in 2022 created substantial operational setbacks:

- An ineffective rental model for AviClear placed approximately 1,300 devices in customer locations—over half of which were medical spas not specialized in acne treatment, leading to significantly underutilized systems and impaired cash flow.

- Reliance on a costly third-party manufacturing relationship resulted in commitments to purchase an unsustainable level of machines (1,500 annually), greatly exceeding market demand.

- The outsourced manufacturing partnership incurred higher costs compared to internal production and overwhelmed customer support teams with increased volume, leading to service delays and reliability concerns.

- Upon the appointment of a new CEO in August 2023, the Company discontinued new placements under the rental model, terminated the outsourced manufacturing relationship, and settled outstanding obligations with the manufacturer for $19.5 million.

Leadership Turnover and Strategic Realignment

- Throughout 2023, significant executive leadership and board changes took place, including:

- The appointment of a new interim CFO in May 2023, election of a new board of directors in July 2023, and a new CEO in August 2023.

- Although these leadership shifts are expected to strengthen long-term performance, the transitional period created short-term uncertainty and operational disruption, adversely affecting execution efficiency and institutional knowledge retention.

Loss of Key Distribution Partnership in Japan

- The termination of the Company's decade-long skincare distribution agreement with ZO Skin Health ("ZO"), effective February 2024, severely impacted revenue streams:

- Historically, ZO product distribution accounted for approximately 16%-17% of the Company's consolidated annual revenue.

- ZO's decision to establish a direct commercial presence in Japan resulted in reduced revenue and profitability, despite the Company establishing a new but less lucrative distribution partnership.

Declining Demand and Intensified Competition

- From 2023 onward, Cutera faced heightened industry competition, downward pricing pressures, and reduced demand for key product offerings:

- The aesthetics market witnessed rapid innovation, industry consolidation, and entry of lower-cost international competitors, compressing profit margins.

- Additionally, the market for body contouring devices such as TruSculpt and TruFlex experienced significant declines due to emerging pharmaceutical obesity treatments, further dampening demand.

Cost Reduction Initiatives and Operational Improvements

- In response to these financial pressures, the Company initiated multiple strategic actions aimed at improving operational efficiency and reducing expenses:

- An internal global restructuring program implemented between Q4 2023 and Q2 2024 generated annualized savings of approximately $20 million, with further cost reduction measures expected to yield an additional $10 million annually by 2025.

- Total headcount decreased substantially, from approximately 525 employees in mid-2023 to roughly 350 currently.

- Other initiatives included improved inventory management, revamped warranty return policies, renegotiated shipping rates, consolidation of warehouses, and restructuring of sales and customer support functions.

- The North American launch strategy for AviClear was extensively revised, transitioning from a rental model to upfront system sales with lower per-treatment costs, better aligning incentives and targeting aesthetic dermatology practices.

Engagement with Stakeholders and Prepetition Negotiations

- Beginning mid-2024, Cutera engaged in extensive discussions with an ad hoc committee of Senior Noteholders to restructure its capital structure and address looming debt maturities:

- Efforts included exploring various strategic alternatives, such as out-of-court public exchanges and third-party capital raises, involving 50 potential lenders, though none proceeded beyond initial discussions.

- These negotiations culminated in the execution of a Restructuring Support Agreement in March 2025 with holders of approximately 74% of the Senior Notes.

Chapter 11 Filing and Proposed Restructuring Plan

- The Company commenced Chapter 11 proceedings to implement a prepackaged restructuring plan that addresses its unsustainable capital structure and positions it for long-term stability:

- The restructuring plan will eliminate approximately $400 million of debt—over 90% of its prepetition funded indebtedness—and provide new capital, including a $25 million DIP facility, a $30 million equity rights offering, and an exit facility featuring additional liquidity upon emergence.

- This deleveraging will enable the Company to reinvest capital in essential research and development, enhance profitability, and maintain competitiveness in the highly regulated aesthetic medical device industry.

- Under the Plan, general unsecured claims will be reinstated in full, all executory contracts and leases assumed, and employee positions preserved, maximizing creditor recoveries and preserving enterprise value.

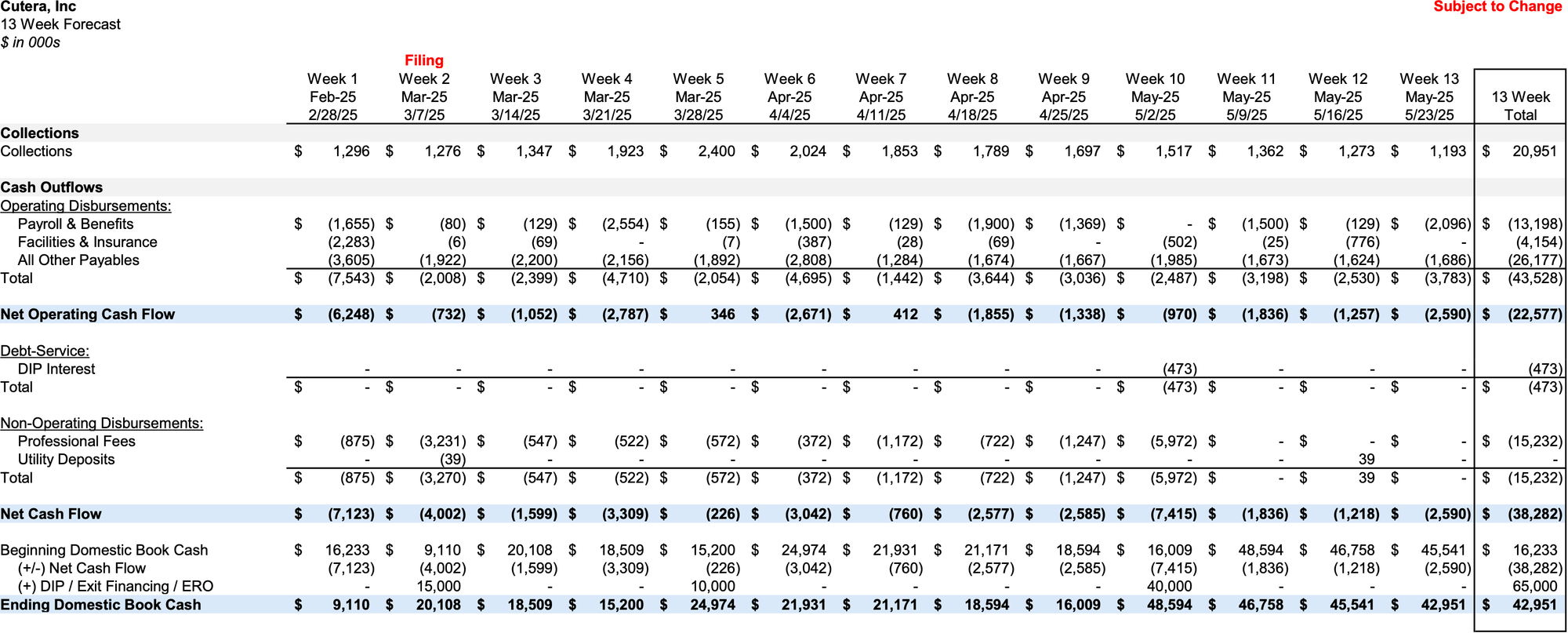

Initial Budget

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you’re already a subscriber and would like to receive timely filing alerts, please reach out and we’ll add you to the distribution list.