Case Summary: DCA Outdoor Chapter 11

DCA Outdoor has filed for Chapter 11 bankruptcy to restructure $96M in debt, citing the loss of a large customer, supply chain issues, weak landscaping demand, and lender actions revoking credit.

Business Description

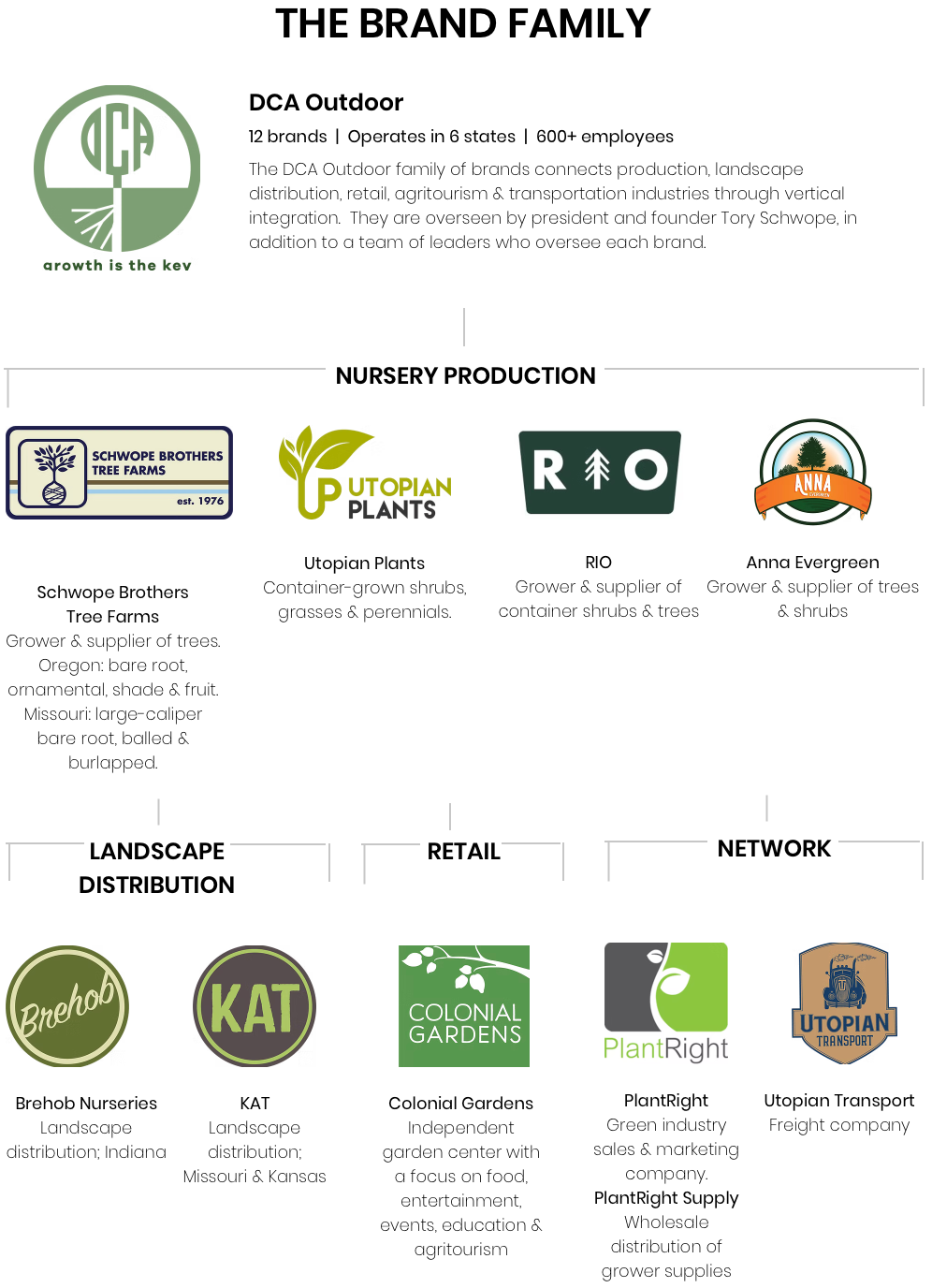

Headquartered in Kansas City, MO, DCA Outdoor, Inc. ("DCA"), along with its Debtor affiliates⁽¹⁾ (collectively, the "Company"), operates as one of North America’s leading landscape supply companies.

- The Company is the largest U.S. producer of balled and burlapped trees, supplying a broad range of trees, shrubs, plants, and grasses to the landscape industry.

- It serves key markets in Missouri, Kansas, Illinois, Colorado, and Indiana, with sales extending across more than 20 U.S. states and Canada.

Each of the Debtor entities comprises a portfolio of 12 interconnected brands that integrate nursery stock production, landscape distribution, and retail garden center operations.

The Company reported approximately $63 million in net sales for 2024. As of the Petition Date, it employs more than 300 full-time staff and 200 seasonal workers across six states.

DCA filed for Chapter 11 protection on Feb. 20 in the U.S. Bankruptcy Court for the Western District of Missouri. As of the Petition Date, the Debtors reported $0 to $50 thousand in assets and $50 million to $100 million in liabilities.

⁽¹⁾ Anna Evergreen, LLC, Brehob Nurseries, LLC, Colonial Farms, LLC, Colonial Gardens Developments, LLC, Colonial Gardens, LLC, DCA Land Holding Company, LLC, DCA Land Illinois, LLC, DCA Land Indiana, LLC, DCA Land Kansas, LLC, DCA Land Kentucky, LLC, DCA Land Missouri, LLC, DCA Land Oregon, LLC, KAT Nurseries, LLC, PlantRight Supply, LLC, Schwope Brothers Tree Farm, LLC, Schwope Brothers West Coast, LLC, Utopian Plants Indiana, LLC, Utopian Transport, LLC, Utopian Trees, Inc., and Valley Hills Trees Farm, LLC.

Corporate History

DCA is a family-owned business founded in 2016 by CEO Tory Schwope. Through strategic asset acquisitions and organic growth, the Company has evolved into a vertically integrated and geographically diverse operation.

- Tory Schwope owns 100% of DCA and approximately 99% of the remaining Debtor affiliates, with his brother, Cody Schwope, holding the balance of the interests.

Strategic Acquisitions and Growth

- Between 2016 and 2018, DCA acquired key assets from Brehob Nurseries, Anna Evergreen, Valley Hill Tree Farm, Schwope Brothers West Coast, and Colonial Gardens, which operates a retail garden center, nursery, café, and event space.

- Additionally, the Company established Debtor Utopian Transport, LLC, a transportation subsidiary designed to streamline operations and maintain consistency from production to point of sale.

Operations Overview

The Company’s operations are vertically integrated, covering the full lifecycle of nursery stock production—from plant development to final distribution. Recognized as the largest balled and burlapped tree producer in the United States, the Company’s core goal is producing high-quality trees, shrubs, plants, and grasses.

Core Operational Areas

Plant Development:

- Utilizes techniques such as seed germination, rooting cuttings, grafting, and tissue culture.

- Cultivates a diverse portfolio of plant varieties, ranging from ornamental trees to grasses.

Production Processes:

- Prepares plants for viability in both field and container production systems.

- Specializes in producing balled and burlapped, prefinished, and container-grown plants.

Quality Control:

- Conducts thorough inspections to ensure uniformity, health, and adherence to industry standards.

- Grades, tags, and prepares plants for shipment to maintain consistent quality.

Distribution Channels

The Company's products are distributed through a combination of direct-to-grower, wholesale, and direct-to-consumer channels. To support these channels, the Company has invested in:

- Diversifying product lines and driving new product development to meet evolving market demands.

- Adopting innovative growing, packaging, and transportation processes to boost efficiency and consistency.

Inventory Growth and Strategic Investments

Over the past five years, the Company has prioritized strategic investments to support long-term growth.

- Inventory increased from ~$50 million in 2019 to ~$127 million in 2024.

- Property and equipment investment grew by ~$29 million, rising from $17.5 million in 2019 to ~$46.5 million in 2024.

- As of October 2024, the Company had 1.5 million plants ready for sale, including 500,000 pre-sold, securing $16.7 million in confirmed revenue for FY 2025.

- An additional 1 million plants remain available, representing $52.5 million in potential pre-markup revenue.

With a strong inventory position and favorable historical demand trends, the Company anticipates a significant ramp-up in sales beginning in March 2025 and continuing through the summer and fall.

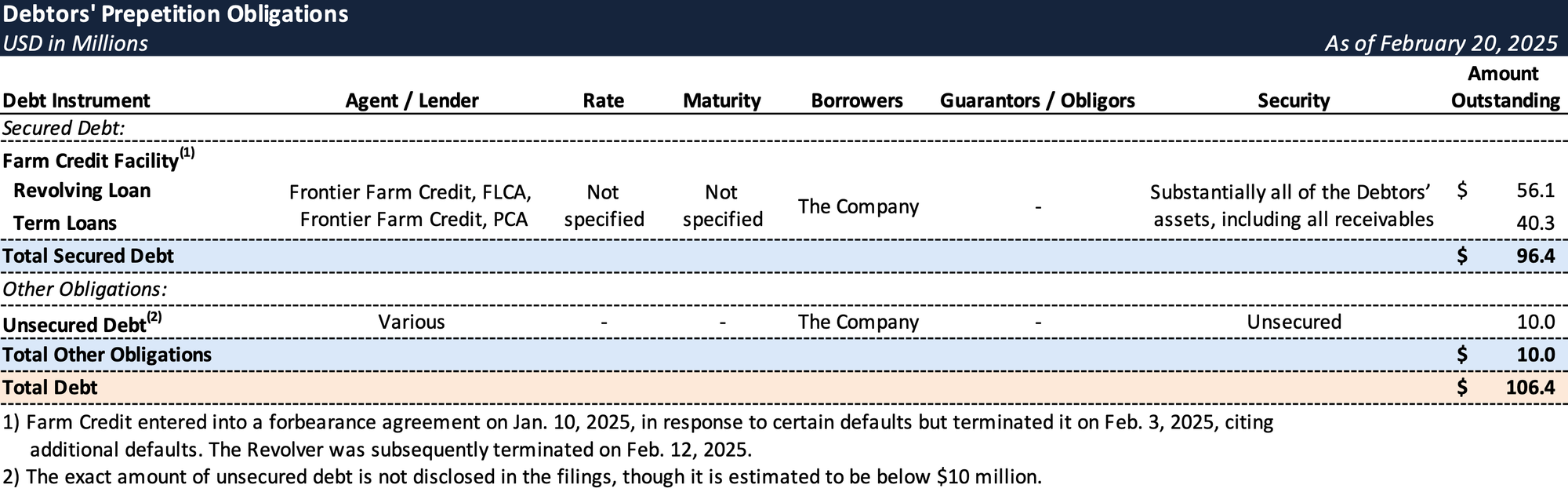

Prepetition Obligations

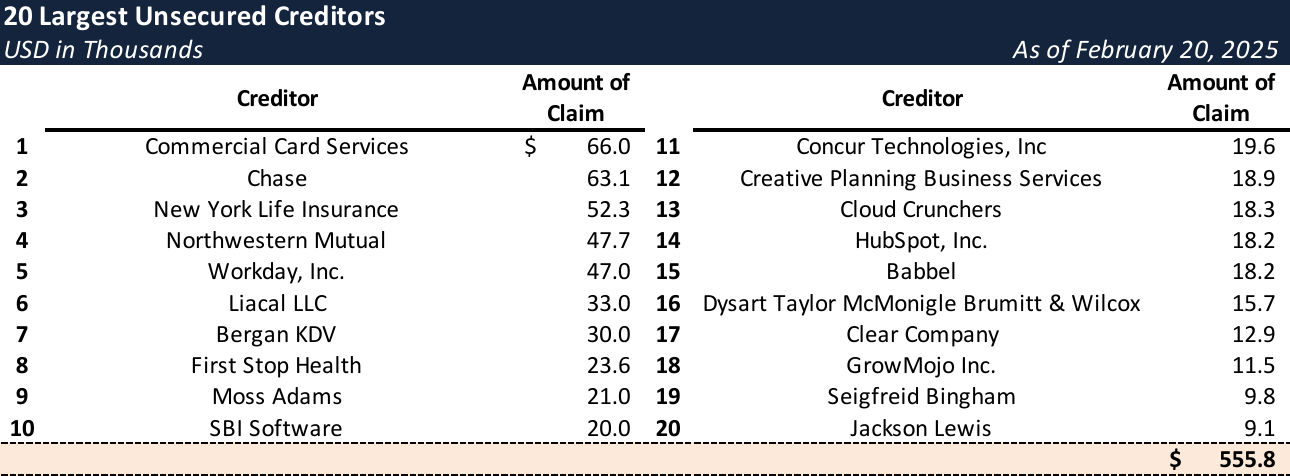

Top Unsecured Claims

Events Leading to Bankruptcy

Revenue Declines and Macroeconomic Pressures

- In 2024, the Company’s financial results were adversely impacted by several factors:

- A major customer’s refusal to pay for spring shipments resulted in an uncollectible receivable of approximately $3 million.

- A plant disease at a key supplier’s Oregon facility led to inventory impairments.

- Softer economic conditions and weakened demand for landscaping products further reduced revenues below 2023 levels.

- As a result, gross revenue for 2024 declined to approximately $63 million, a $2 million YoY decrease, while net losses increased by $400,000 to roughly $3.1 million.

Lender Enforcement Actions and Forbearance Termination

- Under mounting financial strain, the Company’s primary secured lender group, Frontier Farm Credit, FLCA and Frontier Farm Credit, PCA (together, “Farm Credit), initiated enforcement measures:

- The Company’s forbearance arrangement with Farm Credit was terminated on February 3, 2025.

- On February 12, 2025, Farm Credit issued a Notice of Acceleration and Reservation of Rights. All remaining availability under the Company’s credit facilities was revoked, effectively cutting off access to liquidity.

- Farm Credit asserted outstanding principal and interest obligations of approximately $96 million.

- As a condition for any further accommodation, Farm Credit demanded the installation of a chief restructuring officer (CRO) to assume control of the Company’s operations—a condition the Company rejected.

Decision to File for Chapter 11

- Facing these challenges, the Company determined that a Chapter 11 filing was necessary to preserve value and implement a reorganization strategy. DCA commenced Chapter 11 proceedings on February 20, 2025, with additional Debtors joining soon after.

- The Company asserts that immediate access to cash collateral is vital to maintaining business continuity and avoiding significant disruption, particularly with the critical spring and summer selling seasons ahead.

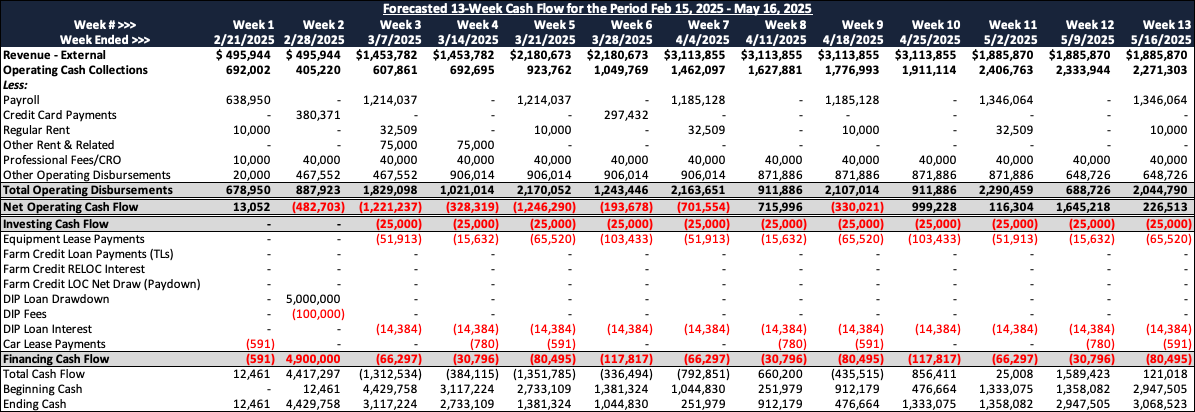

13-Week Cash Budget

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you’re already a subscriber and would like to receive timely filing alerts, please reach out and we’ll add you to the distribution list.