Case Summary: Desktop Metal Chapter 11

Desktop Metal has filed for Chapter 11 bankruptcy following multiple note defaults, sustained cash burn, and a value-destructive merger, with the case initially funded by a $10 million foreign asset sale and a court-supervised auction in progress for its U.S. business.

Business Description

Headquartered in Burlington, MA, Desktop Metal, Inc., along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, “Desktop Metal” or the “Company”), is a technology company focused on additive manufacturing, more commonly known as 3D printing. The Company pioneered what it termed “Additive Manufacturing 2.0,” a strategic shift from using 3D printing for prototyping to enabling the mass production of end-use parts.

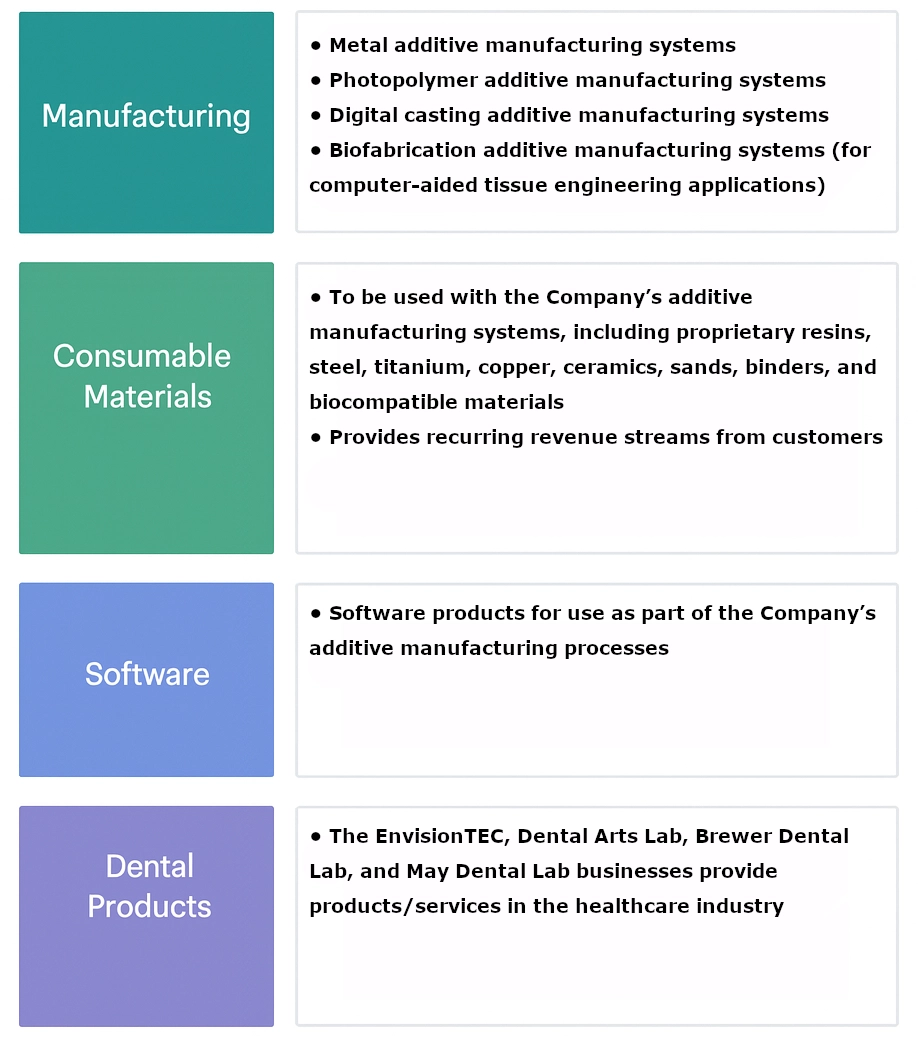

- Desktop Metal developed a broad portfolio of 3D printing solutions spanning hardware, software, materials, and services, designed to provide end-to-end support for customers across the product lifecycle.

- Its diverse hardware lineup includes:

- High-speed metal AM systems, featuring its proprietary binder-jetting technology (e.g., the Production System P-50).

- Photopolymer printers for the dental and medical markets, acquired via EnvisionTEC.

- Sand 3D printers used by foundries to create digital casting molds.

- Advanced biofabrication systems for tissue engineering applications.

- The Company’s revenue model combines one-time equipment sales with recurring revenue from proprietary consumables (e.g. metal powders, photopolymer resins, and binding agents) and service contracts.

Desktop Metal serves a wide range of industries, including automotive, aerospace, heavy machinery, consumer products, healthcare, and dental. As of the Petition Date, the Company employed approximately 780 staff worldwide.

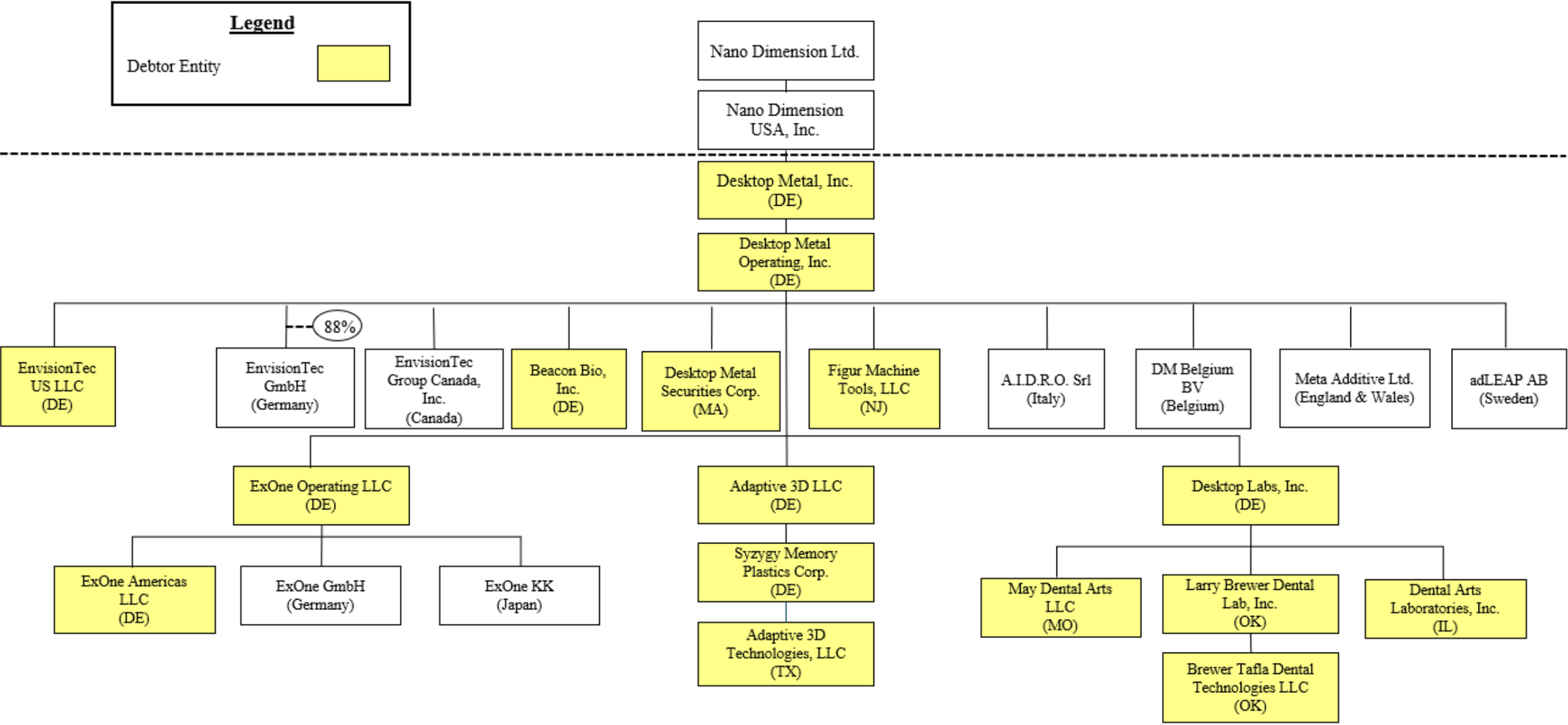

On July 28, 2025 (the “Petition Date”), Desktop Metal, Inc. and 15 of its U.S. affiliates filed for Chapter 11 protection in the U.S. Bankruptcy Court for the Southern District of Texas. The Company’s eight foreign subsidiaries did not file for bankruptcy.

⁽¹⁾ For a complete list of debtor entities, see the organizational structure chart below.

Corporate History

Desktop Metal was founded in October 2015 by a team of entrepreneurs and prominent MIT professors, including CEO Ric Fulop. The Company quickly attracted significant venture capital, raising approximately $438 million by early 2019 and achieving a “unicorn” valuation of $1.5 billion based on its promise to make metal 3D printing more accessible.

Going Public and Aggressive Expansion

- In December 2020, Desktop Metal went public via a merger with Trine Acquisition Corp., a special-purpose acquisition company (SPAC). The transaction provided the Company with substantial capital for expansion, listing it on the NYSE under the ticker “DM” at an implied valuation of approximately $2.5 billion.

- Armed with fresh capital and a highly valued stock, the Company embarked on an aggressive acquisition spree in 2021 to broaden its technology portfolio and market reach. Key acquisitions included:

- EnvisionTEC: A leader in photopolymer 3D printing, acquired for approximately $300 million. This deal formed the foundation of the Company’s Desktop Health division.

- The ExOne Company: A pioneer in binder jet 3D printing, acquired in a $575 million transaction that consolidated the leading binder jet technologies under one roof.

- Other Strategic Buys: The Company also acquired Adaptive3D (high-performance elastomers), Aerosint (multi-material printing technology), A.I.D.R.O. (AM for hydraulic components), and several dental labs to support its vertical integration strategy.

Operational Strain and Strategic Pivots

- By 2022, the rapid expansion, coupled with macroeconomic headwinds such as supply chain disruptions and inflation, created significant operational and financial strain. The Company struggled with a bloated cost structure from its many un-integrated acquisitions and consistently operated at a loss.

- In response, Desktop Metal initiated a series of cost-reduction plans, beginning in June 2022, which included multiple rounds of layoffs.

- In May 2023, Desktop Metal announced a merger with Stratasys Ltd. in an all-stock deal. However, the deal collapsed in September 2023 after Stratasys shareholders voted to reject it, dealing a significant blow to the Company and causing its stock price to fall below $1 per share.

The Nano Dimension Saga and Forced Acquisition

- In July 2024, Desktop Metal agreed to be acquired by Nano Dimension Ltd., an Israeli electronics 3D printing company, for approximately $183 million in cash.

- The merger encountered significant turbulence after an activist-led leadership change at Nano Dimension, whose new board became hostile to the deal. After Nano delayed the closing, Desktop Metal filed a lawsuit in the Delaware Court of Chancery in December 2024 to enforce the agreement.

- In March 2025, the court ruled in Desktop Metal’s favor, ordering Nano Dimension to complete the acquisition. The transaction closed in April 2025, and Desktop Metal became a wholly-owned subsidiary.

- Immediately following the merger, Nano Dimension provided a $12 million bridge loan but informed Desktop Metal that it would not provide any further funding. Nano installed a new independent board at Desktop Metal and hired restructuring advisors, effectively positioning the subsidiary for a sale or restructuring.

Corporate Organizational Structure

Operations Overview

Desktop Metal established a global operational footprint with facilities across North America, Europe, and Asia. The Company’s headquarters in Burlington, MA, serves as its corporate hub and houses R&D labs and pilot production.

Business Lines

Financial Performance

- For FY 2024, Desktop Metal reported preliminary unaudited revenue of $148.8 million, down ~22% YoY from $189.7 million, driven by merger-related disruption and ongoing litigation headwinds.

- GAAP gross margin contracted to (16.9%), reflecting non-cash charges tied to accelerated depreciation and amortization, while non-GAAP gross margin improved to 30%, up 300 bps YoY.

- Operating expenses declined materially to $185.7 million (vs. $313.1 million in FY 2023), reflecting strategic integration and cost-optimization initiatives initiated in 2022.

- GAAP net loss narrowed to $(219.5 million) (vs. $(323.3 million)), while adjusted EBITDA came in at $(49.4 million), an improvement from $(69.1 million) YoY.

Manufacturing and R&D

- The Company’s operations integrated research, product development, and manufacturing. It invested heavily in R&D, with expenditures reaching approximately $85.1 million in FY 2023 (FY 2024 figure not disclosed), to drive innovation in print speeds, new materials, and proprietary software, including advanced sintering simulation tools.

- This focus on innovation resulted in a substantial intellectual property portfolio comprising hundreds of patents across printer mechanics, materials science, and software.

Workforce and Governance

- As of the Petition Date, the Company employed approximately 780 individuals, including independent contractors, temporary workers, and international staff. No employees are unionized or covered by collective bargaining agreements.

- Following the acquisition by Nano Dimension, governance and leadership were restructured. Nano installed a new board with a majority of independent directors to oversee restructuring decisions. FTI Consulting’s Andrew Hinkelman was appointed Chief Restructuring Officer (CRO), taking charge of financial management and turnaround efforts while founder Ric Fulop stepped back from active management.

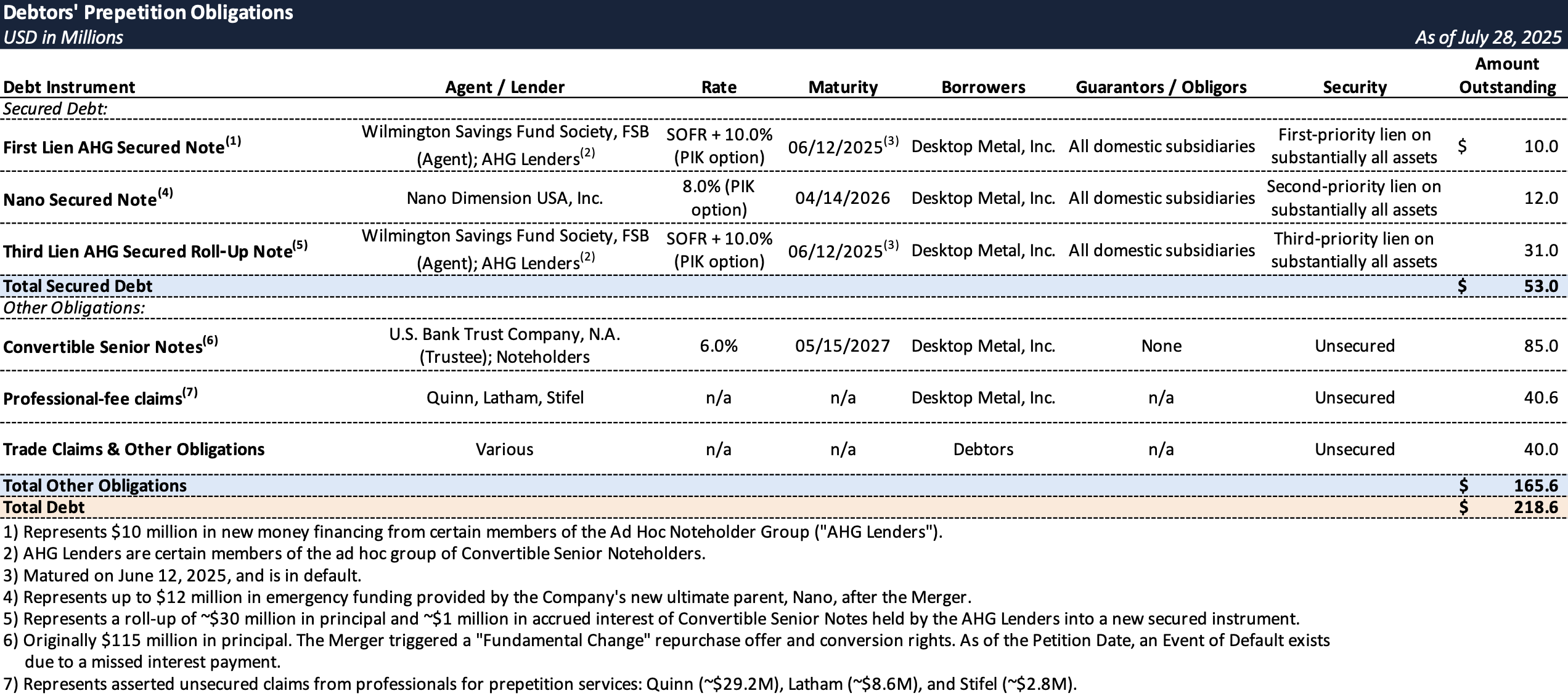

Prepetition Obligations

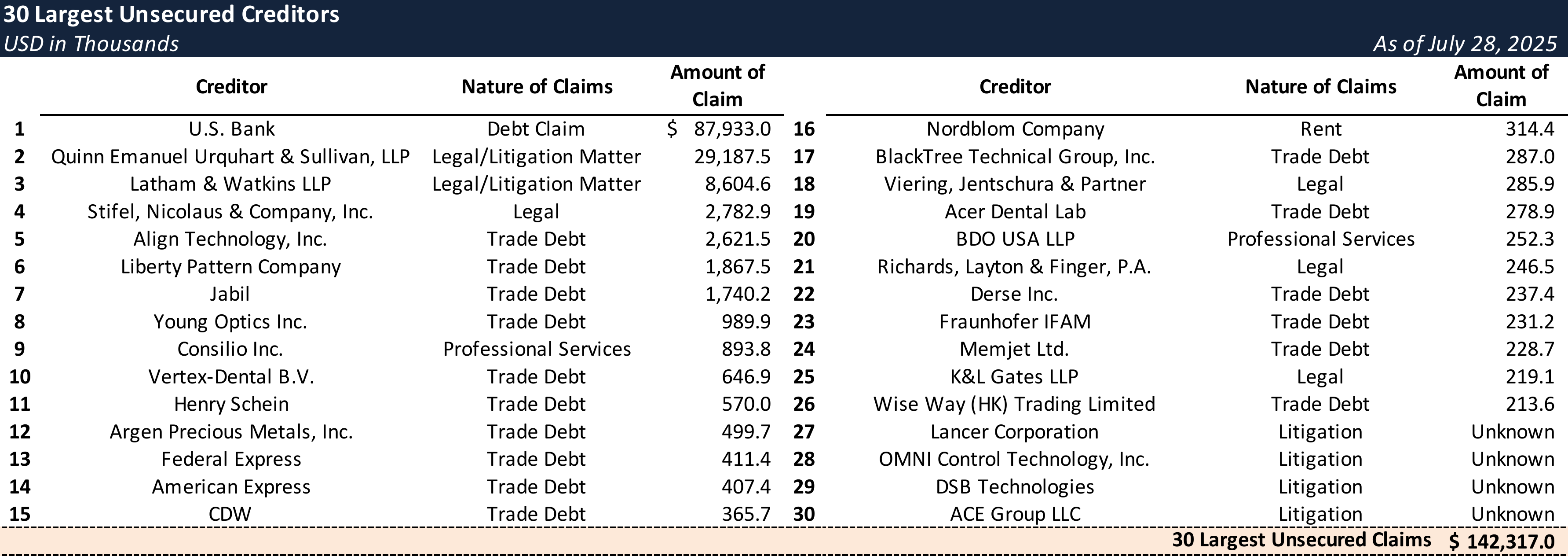

Top Unsecured Claims

Events Leading to Bankruptcy

Structural Unprofitability and Macroeconomic Pressures

- The Company’s Chapter 11 filing was driven by a long history of unprofitability. Despite growing revenue, its cost structure, bloated by high R&D spending and a series of un-integrated acquisitions, resulted in continuous and unsustainable cash burn. The Company recorded a $499 million goodwill impairment in 2022 and wrote off the remaining $113 million in 2023, citing sustained market-driven valuation declines that lowered the fair value of its acquisition-derived reporting unit.

- Desktop Metal’s financial struggles were compounded by a challenging macroeconomic environment. Pandemic-related supply chain disruptions, rising inflation and interest rates, and a broader market shift away from cash-burning technology companies squeezed margins and severely limited access to capital.

Crippling Debt and a Contentious Merger

- A key financial burden was the Company’s $115 million in 6% Convertible Senior Notes due 2027. The acquisition by Nano Dimension triggered a “Fundamental Change” event under the notes’ indenture, which required Desktop Metal to offer to repurchase them, an obligation it lacked the liquidity to meet.

- The impending default on the notes led to an emergency financing deal with an ad hoc group of noteholders, who provided $10 million in new first-lien debt. This, combined with a $12 million second-lien bridge loan from Nano, created a complex secured debt structure but only provided a few weeks of liquidity.

- The merger with Nano Dimension, rather than providing a lifeline, directly precipitated the bankruptcy. It not only triggered the debt default but also saddled the Company with over $40 million in unpaid legal fees from the contentious litigation required to force the deal’s closing. Upon closing, Nano immediately signaled it would provide no further funding, putting Desktop Metal on a fast track to restructuring.

Failed Go-Forward Efforts and Last-Minute Sale

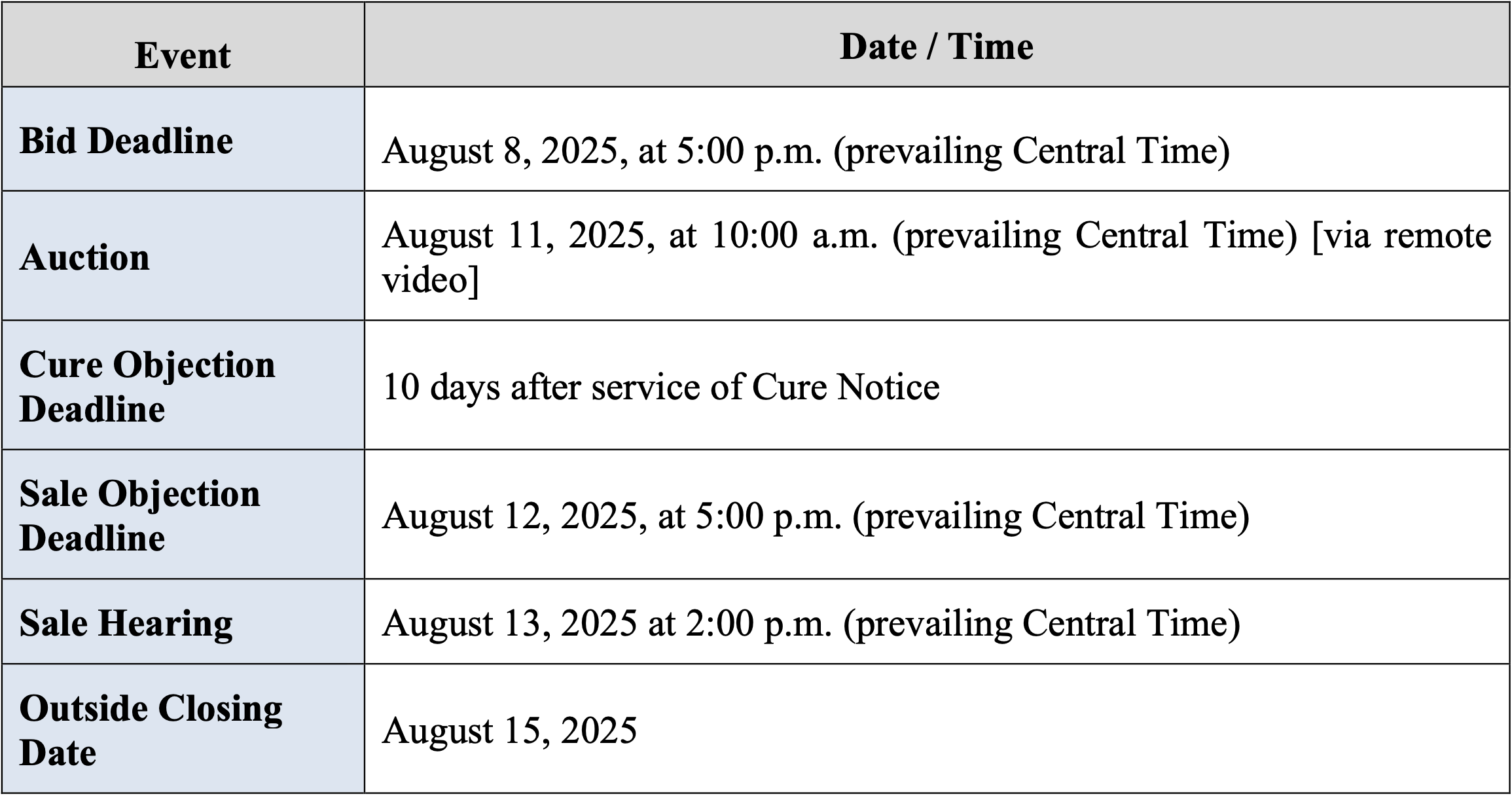

- In the second quarter of 2025, the Company’s advisors ran an expedited sale process. While several parties expressed interest, offers were fragmented or required timelines beyond the Company’s limited liquidity horizon.

- A potential stalking horse bidder for the entire company emerged in July 2025 but withdrew its proposal at the eleventh hour, citing the significant DIP financing required to fund Desktop Metal’s high cash burn through a bankruptcy case. This left the Company on a “liquidity cliff,” just days from running out of cash.

- Facing imminent shutdown, the Company orchestrated an emergency private sale of its non-Debtor foreign subsidiaries (in Germany, Italy, and Japan) to technology investment firm Anzu Partners for $10 million. This transaction was critical to prevent the collapse of the foreign units and provide the Debtors with their only available source of DIP financing.

Chapter 11 Filing and Path Forward

- On July 28, 2025, Desktop Metal and its U.S. affiliates filed for Chapter 11 protection. On July 31, 2025, the Court approved the private sale to Anzu, deeming it necessary to preserve value and fund the initial stages of the bankruptcy case.

- With the foreign operations sold, the Court established bidding procedures for an auction of the Company’s remaining U.S. assets and intellectual property. Nano Dimension, the Company’s parent, has not participated in the bidding process and has effectively walked away from its investment, leaving the future of Desktop Metal’s technology to be determined through the court-supervised sale.

Sale Process Timeline

Key Parties

Pachulski Stang Ziehl & Jones LLP (counsel); Piper Sandler & Co. (investment banker); FTI Consulting, Inc. (financial advisor / CRO, Andrew Hinkelman); Kroll Restructuring Administration LLC (claims agent).

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.