Case Summary: Diamond Comic Distributors Chapter 11

Diamond Comic Distributors has filed for Chapter 11 bankruptcy, citing lost publisher exclusivity and margin pressures, with plans for a $41M DIP-backed Section 363 sale.

Business Description

Headquartered in Hunt Valley, MD, Diamond Comic Distributors, Inc. (“DCD”), along with its Debtor affiliates (collectively, the “Debtors” or the “Company”), is a leading global distributor of comics, graphic novels, toys, games, and other pop-culture merchandise.

- Since its inception in 1982, the Company has grown from a single warehouse operation serving 17 retail customers to a global enterprise distributing products to thousands of retailers from five warehouses encompassing over one million square feet of distribution space.

The Company operates through four divisions: Alliance Game Distributors (“Alliance”), Diamond Comic Distributors (“Diamond”), Collectible Grading Authority (“CGA”), and Diamond Comic Distributors UK (“DUK”).

- Alliance specializes in distributing gaming products, including collectible card games, role-playing games, and board games, with distribution centers across the U.S. and a diverse customer base spanning independent retailers, mass market chains, and wholesalers.

- Diamond focuses on distributing comics, graphic novels, and related merchandise, representing major publishers such as Marvel, Image Comics, and Viz Media, with operations in over 85 countries and a primary distribution hub in Olive Branch, MS.

- CGA provides grading, authentication, and preservation services for collectibles, enhancing their value and appeal in the marketplace.

- DUK serves as a non-Debtor affiliate, catering to markets in the United Kingdom, Europe, the Middle East, and Australia, and is the dominant distributor for leading comic book publishers in the region.

As of the Petition Date, the Debtors reported assets and liabilities totaling $10-$50 million.

Corporate History

Founded in 1982, DCD initially provided wholesale, non-returnable comic books and related merchandise to independent comic retailers. Over the decades, the Company expanded significantly through organic growth and strategic acquisitions:

- Early Years: Starting with a single warehouse, the Company rapidly grew its distribution footprint, eventually operating five facilities across the United States.

- Alliance Acquisition: In 2001, DCD acquired Alliance, a premier distributor of gaming and hobby products, further diversifying its offerings.

- Establishment of CGA: The creation of CGA allowed DCD to tap into the growing collectibles market, enhancing its service portfolio with grading and preservation capabilities.

DCD's international expansion was solidified through DUK, which focuses on markets outside North America, including Europe and the Middle East.

The consolidation of its U.S. operations included the transfer of inventory and services from its Plattsburgh, NY, facility to a larger distribution center in Olive Branch, MS.

Throughout its history, DCD has maintained strong relationships with major publishers, securing access to exclusive and limited-edition products, which has been pivotal to its sustained industry leadership.

Operations Overview

DCD operates through a vertically integrated model designed to meet the diverse needs of its customers across multiple market segments:

- Alliance: A leader in distributing gaming products, such as Dungeons & Dragons, Magic: The Gathering, Warhammer 40k, and Pokémon trading cards. The division also publishes Game Trade Magazine, the industry's only monthly publication serving both retailers and consumers, spotlighting new products and generating engagement within the gaming community.

- Alliance's distribution network ensures nationwide coverage, with rapid delivery options enabling competitive service levels for retailers.

- Diamond: Serves as the primary channel for comic book distribution in the U.S. and beyond, accounting for 59% of its revenue through sales of comic books and graphic novels. It caters to a mix of mass market retailers, specialty comic shops, and bookstores.

- Key distribution partners include Walmart, Target, Amazon, and Barnes & Noble, as well as over 2,500 specialty comic stores.

- CGA: Grades and preserves a wide range of collectible items, including action figures, video games, and die-cast vehicles. Its grading services enhance the value and appeal of these items for collectors.

- DUK: Operating out of Runcorn, England, DUK focuses on distributing comic books and collectibles to the UK and European markets. It represents leading publishers and maintains a dominant market share in its regions.

- Diamond Select Toys & Collectibles ("DST"): This division designs and manufactures licensed collectible toys and statues for brands such as Disney, Marvel, and Warner Bros.

- Over 95% of its products are distributed through DCD’s channels.

Supply Chain and Customer Relationships

- The Company emphasizes close partnerships with major publishers and content producers, enabling access to exclusive and limited-edition products. These relationships are a critical differentiator in the competitive distribution landscape.

- Distribution operations are supported by five facilities strategically located across the U.S. to ensure efficiency and reliability in serving its extensive customer base.

DCD’s vertically integrated model, coupled with its longstanding industry relationships, positions it as a cornerstone distributor in the pop-culture and collectibles sectors.

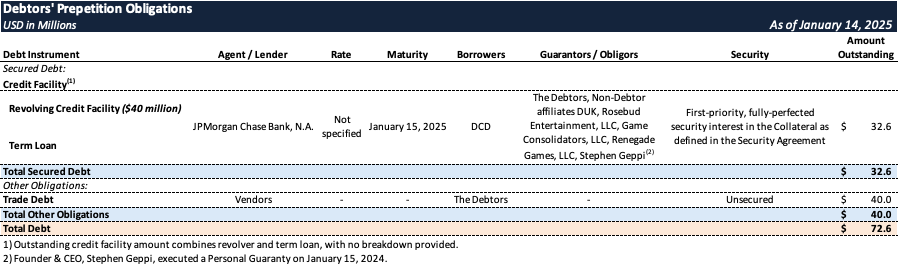

Prepetition Obligations

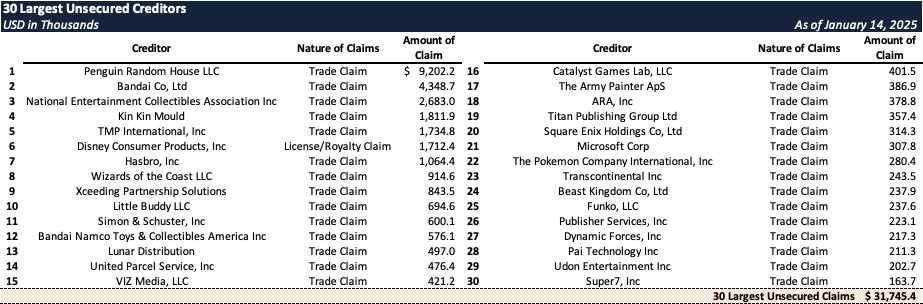

Top Unsecured Claims

Events Leading to Bankruptcy

Declining Diamond Division Sales and Macroeconomic Headwinds

- Since 2019, and especially throughout the COVID-19 pandemic, the Company's Diamond division has faced a persistent decline in comic book and graphic novel sales, attributable to:

- The loss or conversion of exclusive distribution agreements with key publishers (DC Entertainment, Marvel, and Image).

- Macroeconomic pressures, including rising interest rates on secured debt and increased wage and freight costs.

- Although growth in the Alliance division—from $85.5 million in 2020 to $149.1 million in 2023—partially offset the Diamond division’s decline, it was insufficient to sustain overall business operations in the long term.

Loss of Exclusive Distribution Agreements

- Historically, the Debtors served as the exclusive distributor for DC Entertainment, Marvel, and Image, but this changed when:

- DC Entertainment terminated its exclusivity in 2020, transitioning to a new distributor.

- Marvel and Image converted their agreements to non-exclusive in 2021 and 2023, respectively.

- The resulting reduction in volume materially affected the Company's top line, accelerating the revenue decline in Diamond’s business.

Rising Operating Expenses and Liquidity Strain

- The Debtors’ operating expenses rose from 5.44% of sales in 2019 to 8.73% in 2023, driven by:

- Smaller order quantities from existing customers, requiring similar overhead (labor, rent, and freight thresholds) despite lower volume.

- Inflationary pressures and wage increases, further elevating labor costs.

- This expense escalation, coupled with declining revenue, created a severe liquidity shortfall.

Prepetition Marketing and Strategic Efforts

- To address liquidity challenges, the Debtors explored refinancing and sale options:

- In late 2023, DCD retained an investment banker to market some or all of its assets.

- In March 2024, the Debtors engaged Getzler as financial advisor and appointed Robert Gorin as Chief Restructuring Officer.

- While the Debtors pursued prepetition marketing efforts, structural complexities hindered the consummation of any meaningful transaction.

- The Debtors subsequently engaged Saul Ewing LLP as restructuring counsel and Raymond James & Associates, Inc. as investment banker to evaluate and execute strategic alternatives, including a potential Chapter 11 filing.

- Independent restructuring committees were formed for both DCD and DST, delegating key decisions related to any Chapter 11 filing.

Chapter 11 Filing for Section 363 Sale

- After contacting over 110 potential bidders and receiving six indications of interest, the Company—working with Raymond James—selected an affiliate of Universal Distribution, Inc. as the $39 million stalking horse bidder for Alliance Game Distributors.

- The Debtors plan a competitive postpetition sale process within eighty-five days of the Petition Date, with additional non-binding offers under negotiation (including an LOI for Diamond UK), and strong interest in other business units (Diamond Book Distributors, Collectible Grading Authority, Diamond Select Toys).

DIP Financing and Path Forward

- The Debtors secured up to $41 million in DIP financing from JPMorgan Chase with an interim draw of $5.5 million and consensual use of cash collateral.

- This funding ensures working capital to meet operational obligations—payroll, benefits, and supplier commitments—while supporting a going-concern sale process.

- These measures aim to preserve estate value and maximize stakeholder recoveries.

Enjoyed this summary? Stay informed on new Chapter 11 filings over $10 million in liabilities—subscribe to Bondoro for free and get insights delivered directly to your inbox.

Plus, explore our full archive for all past summaries.