Filing Alert: Eddie Bauer Chapter 11

Eddie Bauer Files Chapter 11 in District of New Jersey

Update (Feb. 9, 2026): A comprehensive case summary is now available for the Chapter 11 bankruptcy filing of Eddie Bauer LLC.

Eddie Bauer LLC and its debtor affiliates⁽¹⁾, a Bellevue, WA-based apparel and outdoor gear retailer, filed for Chapter 11 protection on Feb. 9 in the U.S. Bankruptcy Court for the District of New Jersey.

The filing aims to implement a dual-track strategy pursuant to a Restructuring Support Agreement (RSA) backed by 100% of the company's prepetition lenders: pursuing a going-concern sale of the remaining retail operations while simultaneously conducting an orderly wind-down of any unsold assets.

The debtors have already commenced store closing sales at all locations and terminated their e-commerce and wholesale rights (transferring them to non-debtor Outdoor 5, LLC) to eliminate fixed licensing fees owed to IP owner Authentic Brands Group. The RSA contemplates distributing net proceeds primarily to ABL lenders, with a contingent recovery pool for general unsecured creditors. The debtors intend to fund the case through consensual use of cash collateral and store closing proceeds, without DIP financing, and are targeting a sale hearing by March 12, 2026.

Eddie Bauer LLC reports $100 million to $500 million in assets and $1 billion to $10 billion in liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The case number is 26-11422.

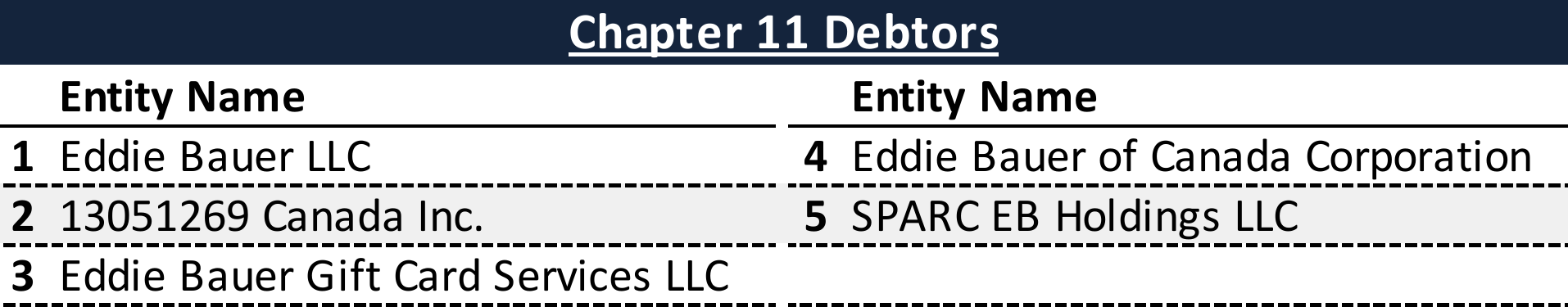

⁽¹⁾ For a complete list of debtor entities, see the Chapter 11 Debtors table.

Chapter 11 Debtors

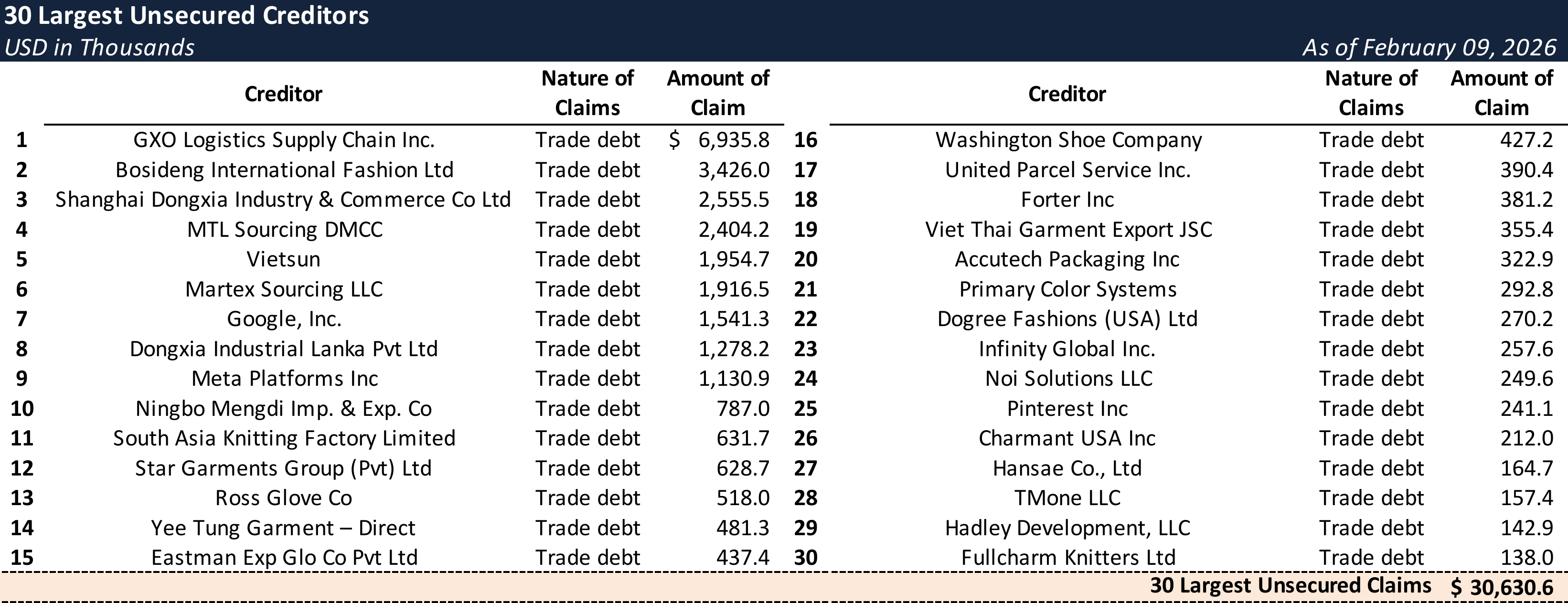

Top Unsecured Claims

Key Parties

Counsel:

- Michael D. Sirota

Cole Schotz P.C.

Email: [email protected]

Restructuring Counsel:

- Kirkland & Ellis LLP

- Kirkland & Ellis International LLP

Investment Banker:

- GBH SOLIC Holdco, LLC

Financial Advisor / CRO:

- Berkeley Research Group, LLC (Stephen Coulombe)

Real Estate Consultant:

- Retail Consulting Services, Inc.

Claims Agent:

Equity Security Holders:

- SPARC EB Holdings LLC – 100% Equity Interest

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.