Case Summary: Everde Growers Chapter 11

Everde Growers has filed for Chapter 11 bankruptcy amid operational challenges from extreme weather impacts and failed refinancing efforts, with plans to sell its assets.

Business Description

Headquartered in Houston, TX, TreeSap Farms, LLC ("TreeSap Farms," dba Everde Growers), along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, "TreeSap" or the “Company”), is a leading U.S. horticultural producer specializing in shade trees, shrubs, and ornamental plants.

- The Company owns or operates 15 farms across California, Texas, Florida, and Oregon, spanning more than 6,700 acres of production.

- TreeSap also maintains a West Coast office in Orange, CA.

The Company grows over 33 million plants annually, serving a diverse customer base that includes retail consumers, landscape contractors, and landscape architects. Its portfolio features 5,000+ plant varieties across 15 categories, with more than 70% of revenue derived from shrub evergreen, tree evergreen, edible, and tree deciduous plants.

- In FY 2024, the Company reported EBITDA of $11.6 million on revenue of $170.6 million, down from $23 million and $179.2 million, respectively, in FY 2023.

TreeSap filed for Chapter 11 protection on Feb. 24 in the U.S. Bankruptcy Court for the Southern District of Texas. As of the Petition Date, the Debtors reported $100 million to $500 million in both assets and liabilities.

⁽¹⁾ TSH Opco, LLC, TSV Opco, LLC, TSV Reco, LLC, and TreeSap Florida, LLC.

Corporate History

TreeSap's origins trace back to 2001, when it was founded as TreeTown USA with the opening of its first farm in Glen Flora, TX.

- In 2015, a management/ownership group acquired TreeTown USA, with the CEO assuming leadership upon closing of the transaction.

Over the next six years, the Company strategically expanded its footprint through significant acquisitions, including Village Nurseries (2017) and Hines Growers (2018), both based in California.

- These acquisitions solidified TreeSap's position as one of the largest growers of outdoor nursery plants in the U.S.

- Today, TreeSap benefits from several competitive advantages, including a large and varied nationwide selection of plants, multiple plant categories, and strong customer partnerships.

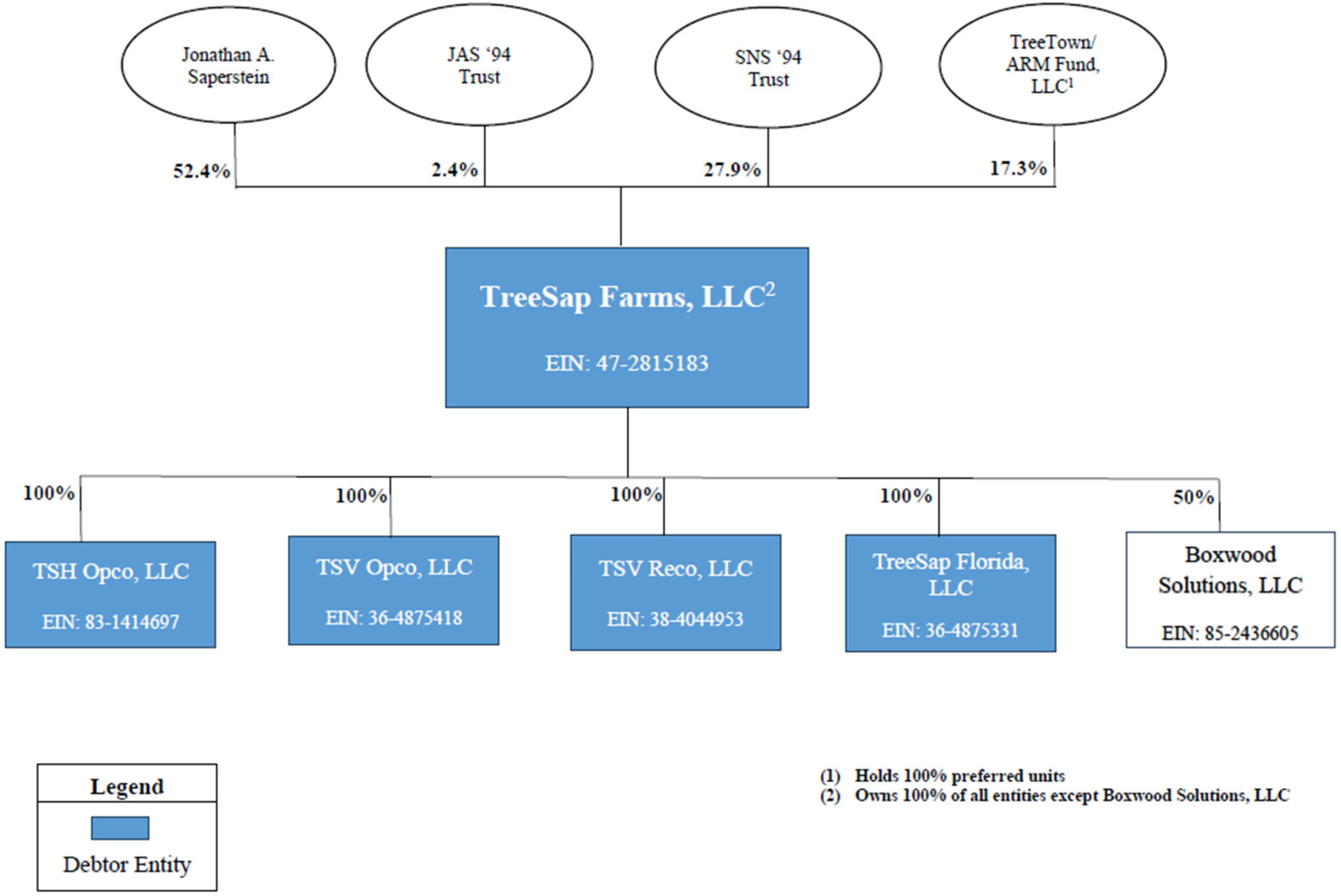

Organizational Structure

TreeSap Farms is the primary operating entity, owning or leasing substantially all assets and employing all workers. Key subsidiaries include:

- TreeSap Florida: Formed in 2015 as the acquisition vehicle for the Oasis Nursery business. Holds certain Florida assets and is a guarantor under certain financing obligations.

- TSV Reco: Formed in 2017 to acquire Village Nurseries' real property assets. Holds certain California assets and is a guarantor under certain financing obligations.

- TSV Opco: Formed in 2017 to acquire Village Nurseries' personal property assets. Holds certain California assets and is a guarantor under certain financing obligations.

- TSH Opco: Formed in 2018 to acquire Hines Growers' assets. Holds certain California assets and is a guarantor under certain financing obligations.

TreeSap Farms' common equity is owned by its CEO and trusts controlled by the CEO and immediate family members. Preferred equity units are held by TreeTown/ARM Fund LLC.

Non-Debtor Boxwood Solutions, a joint venture with an unaffiliated entity, seeks to monetize specific plant intellectual property. TreeSap Farms owns 50% of Boxwood, which currently has minimal operations and assets.

- TreeSap estimates the value of its stake in Boxwood at about $50,000.

Operations Overview

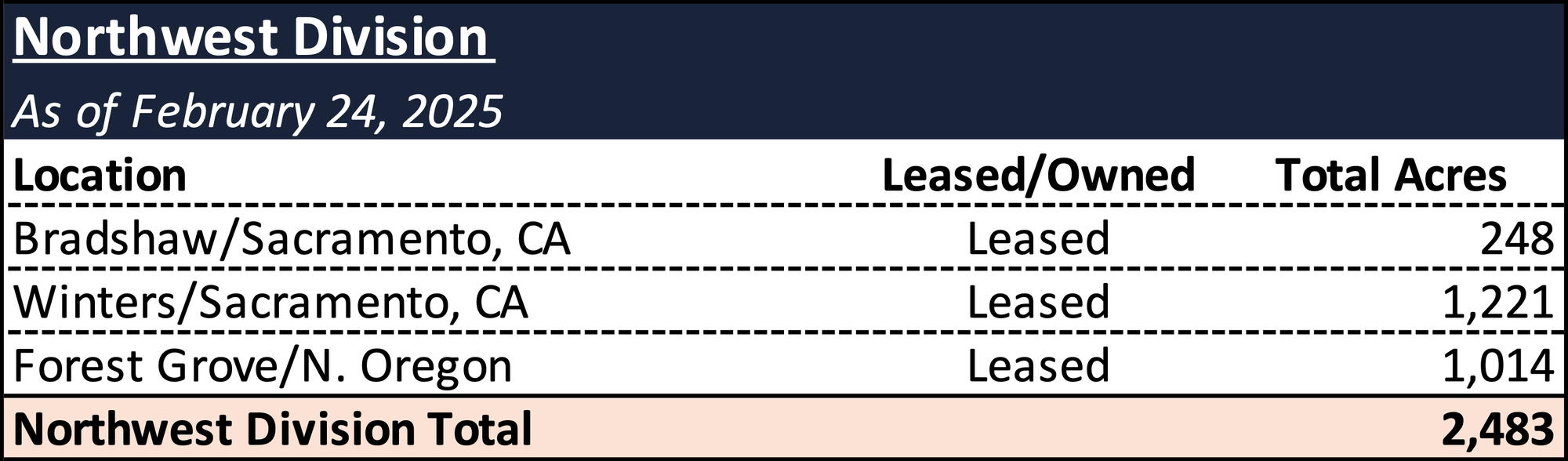

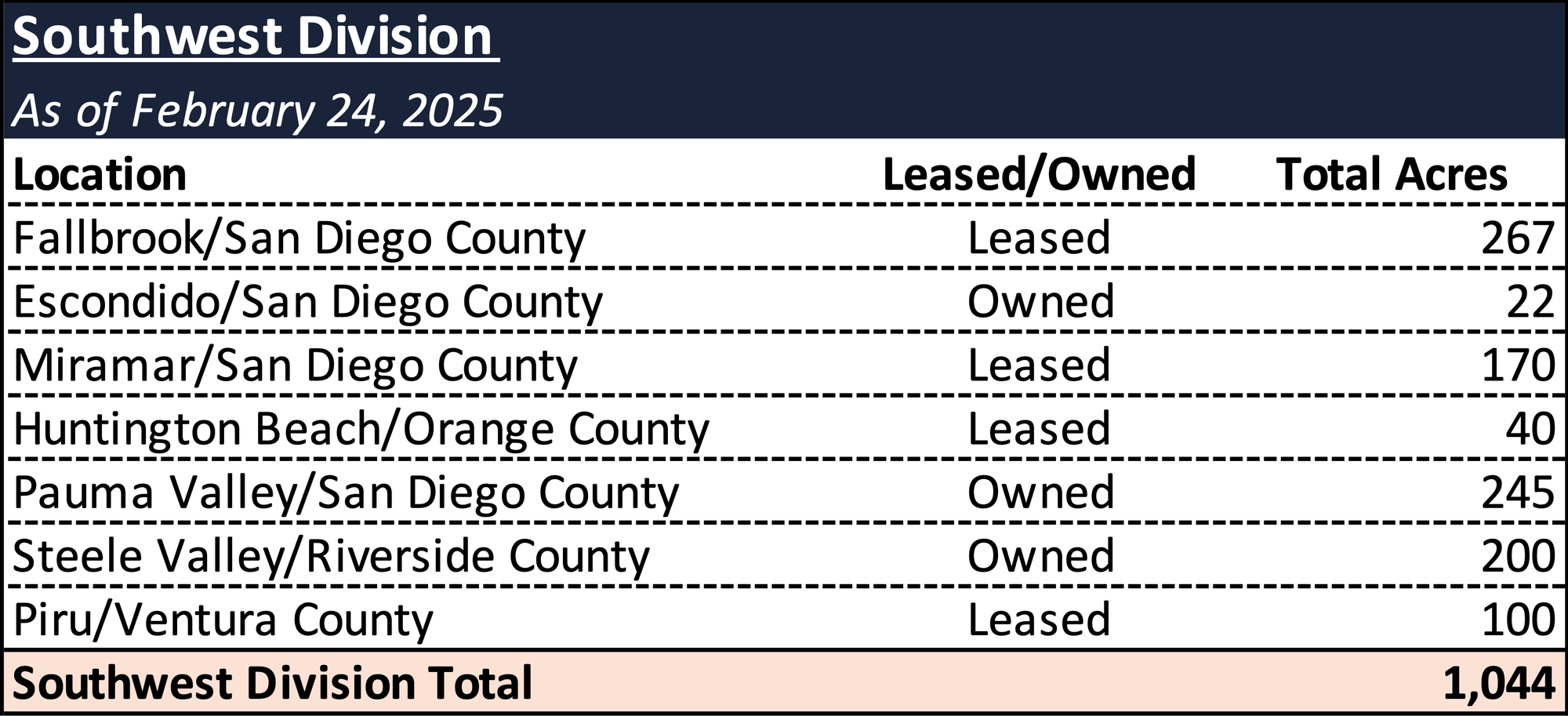

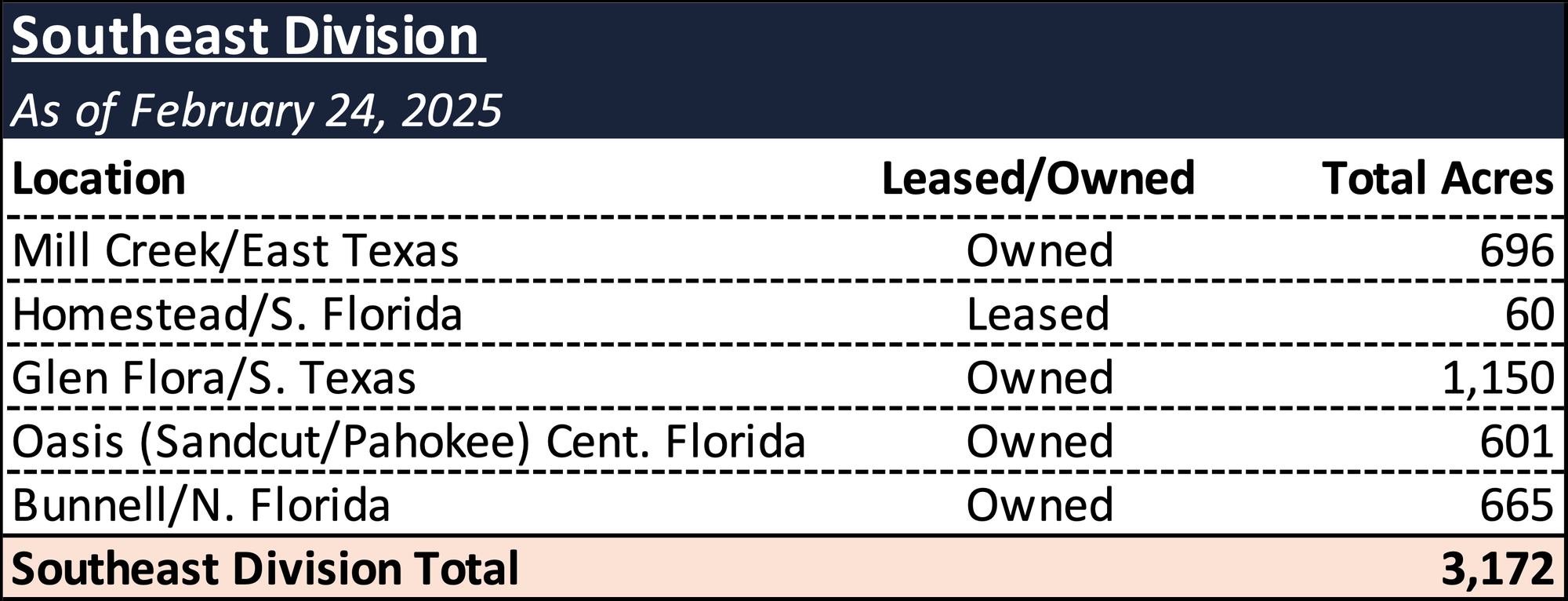

TreeSap operates through three divisions: Northwest, Southwest, and Southeast U.S., with farms strategically positioned for coast-to-coast coverage. The Company owns seven of its 15 farm locations and leases the remaining eight, covering more than 6,700 acres.

Northwest Division

Southwest Division

Southeast Division

Seasonal Business Model

TreeSap’s operations are highly seasonal, with peak sales occurring from mid-March through June. Production ramps up in January to meet demand, though sales volumes remain low until spring.

- Monthly revenue can reach $27 million during peak months but falls below $10 million in December and January.

- This seasonality impacts production planning, inventory management, and workforce allocation.

Production Model

TreeSap utilizes a production planning model to optimize its product mix based on customer demand. Certain crops are subject to third-party intellectual property rights and royalty obligations under licensing agreements.

Diversified Customer Base

The Company benefits from a diversified retail and wholesale customer mix developed over its 24‑year history. Revenue is historically split nearly evenly between:

- Retail channels that include many of the nation’s largest home improvement and general merchandise retailers.

- Wholesale channels serving a broad range of prominent regional landscape contractors.

Workforce

The Company employs approximately 1,444 full-time employees, comprising 1,280 hourly workers and 164 salaried staff.

- Employees perform key functions across agricultural operations, equipment maintenance, quality control, plant healthcare, and marketing/sales.

- Due to the seasonality of operations, TreeSap also relies on contract and temporary employees to support peak demand periods.

TreeSap’s labor force is essential to maintaining inventory quality and business continuity.

- The Company's inventory consists of live plants that require daily care and would rapidly perish without adequate staffing.

- According to the Company, delayed employee compensation during the Chapter 11 Cases could destabilize the workforce, increasing the risk of inventory deterioration and enterprise value impairment.

Prepetition Obligations

Footnotes

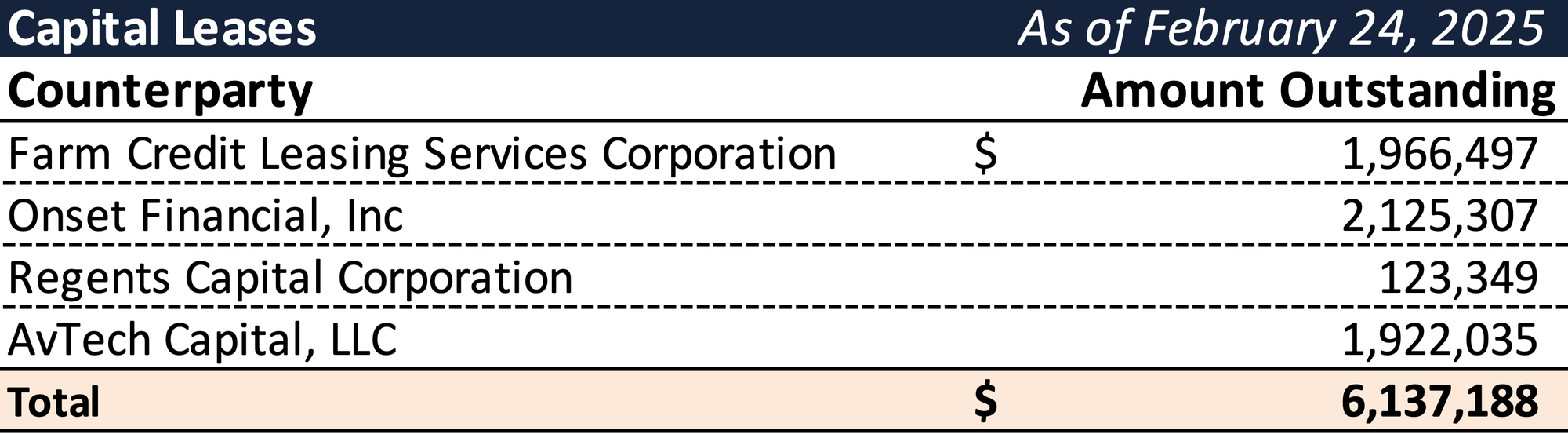

- The Debtors maintain multiple capital leases or equipment finance agreements, each secured by the underlying equipment or personal property financed. Approximate outstanding balances as of the Petition Date are shown below:

- The Debtors also have contingent earn-out obligations from the June 2022 LaVerne Nursery acquisition and a 2015 business combination that remain unquantified as of the Petition Date.

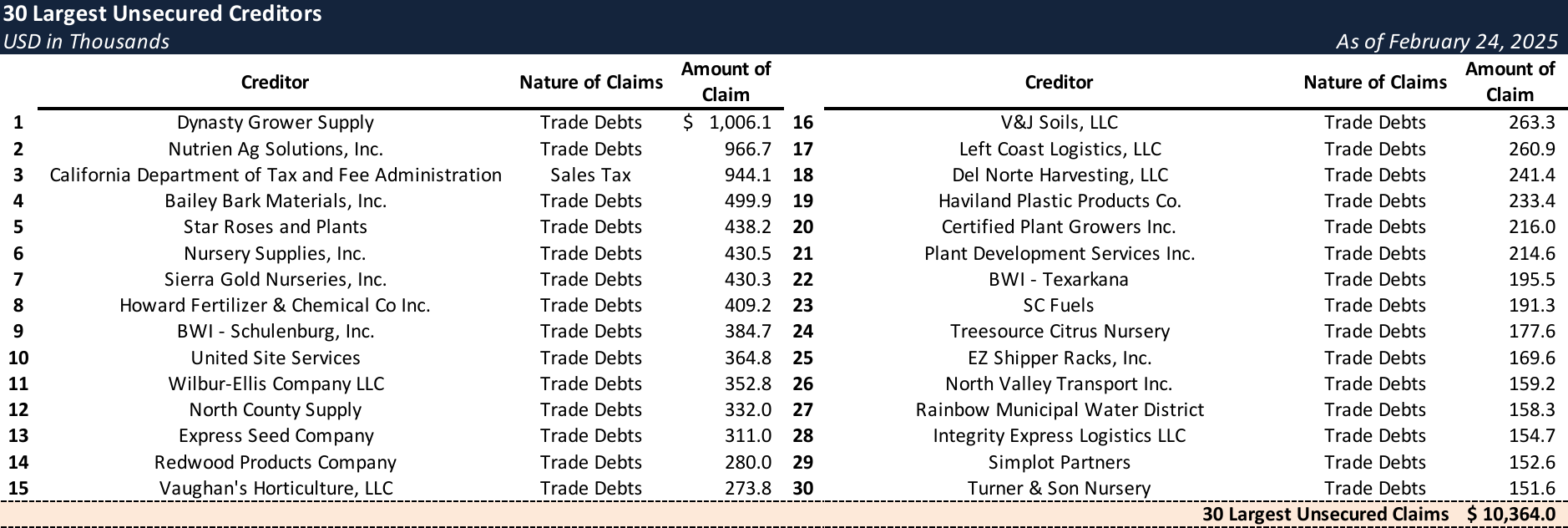

Top Unsecured Claims

Events Leading to Bankruptcy

Macroeconomic and Operational Challenges

For several years, TreeSap has confronted a range of operational and financial obstacles that ultimately precipitated the Chapter 11 filing. Notably, significant losses in the Southern California operations, driven by weather-related disruptions, more than offset the profitability achieved in other regions.

These losses, combined with liquidity strains from the Company’s highly seasonal business cycles and cash flows, escalating debt burdens, and looming maturities under the Prepetition Facilities, overwhelmed the Company.

- Despite numerous initiatives that improved profitability, including a dramatic turnaround in Southern California, the Company was not afforded the runway or support necessary to sufficiently reduce its debt obligations.

Geographic Variability and Weather Impacts

The Company operates across various geographies and climates. In 2022, the Southern California region experienced drought conditions, which were followed by an unusually high number of wet weather days in 2023 and 2024.

- These extremes led to reduced sales, prompting the Company to reduce production and headcount.

- However, due to the long growth cycles inherent in the industry, the benefits of these adjustments were slow to materialize.

Additionally, from 2022 to 2024, the Company’s debt load increased by $22.5 million, driven by higher working capital needs, lower-than-forecasted profits, and a doubling of interest expenses that culminated in an extra $25.3 million in interest costs.

- During the same period, TreeSap managed to cut annual expenses by $30.1 million, including a reduction of roughly 240 positions.

While operations in regions outside Southern California remained consistently profitable, the financial pressures underscored the challenges of managing a geographically diverse portfolio amid adverse weather conditions.

Operational Turnaround Initiatives

In response to financial pressures, TreeSap launched multiple operational initiatives in 2024, including a strategic turnaround of its Southwest division. The Company aimed to increase division revenue by $5 million, leveraging normalized weather conditions and traffic patterns. Additional actions included:

- Workforce Optimization: Reduced labor costs through a Q4 2024 workforce reduction in the Southwest division.

- Operational Consolidation: Streamlined operations by exiting facilities and consolidating at the Fallbrook location.

- Inventory Efficiency: Implemented SKU rationalization with major retail partners to optimize inventory, increase turnover, and cut costs.

The Company stated that while these initiatives were expected to generate meaningful financial improvements, they did not have the necessary capital and time to fully execute them.

Advisor Engagement and Prepetition Negotiations

In July 2024, TreeSap retained Armory Securities to explore refinancing alternatives and engage with its Prepetition Lenders.

- Despite extensive negotiations, third-party financing proposals stalled due to the Prepetition Lenders' opposition to extensions or concessions.

By late 2024, the Company shifted its focus toward securing direct funding and maturity extensions from its Prepetition Lenders.

- On December 31, 2024, TreeSap and the Prepetition Lenders agreed to a $3 million funding arrangement and appointed Bret Jacobs as Chief Restructuring Officer (CRO).

- Jacobs and his firm, The Keystone Group, were tasked with assessing the Company’s financial position, preparing forecasts, and engaging with stakeholders.

DIP Financing and Chapter 11 Process

Facing an imminent liquidity shortfall, and at the direction of its Prepetition Lenders, TreeSap pivoted to securing postpetition financing. At the same time, the Company sought additional time to explore strategic alternatives to maximize stakeholder recoveries.

On January 28, 2025, the Prepetition Lenders agreed to provide an additional $3.2 million in critical funding. However, this funding was contingent on TreeSap filing for Chapter 11 by February 3, 2025.

- Subsequent negotiations led the Prepetition Lenders to extend the February 3 filing deadline, allowing more time for TreeSap to pursue its strategic alternatives.

- According to the Company, despite third-party expressions of interest in transactions or refinancing options during this period, increasing liquidity pressures ultimately forced the Prepetition Lenders to refuse any further extension of the filing deadline.

The Debtors filed for Chapter 11 protection on February 24, 2025, in the U.S. Bankruptcy Court for the Southern District of Texas. On February 25, 2025, the Court approved an interim DIP Order that allows TreeSap to secure up to $51 million in postpetition financing through a delayed multiple-draw term loan facility. The facility consists of:

- Up to $22 million in new money and $29 million in roll-up loans (converting prepetition obligations into DIP obligations).

- An immediate draw of $14 million available, split equally between new money and roll-up loans.

- The Prepetition Lenders serving as the DIP Lender.

Upon entry of the Final Order, an additional $22 million in prepetition loans will convert into DIP obligations, fully effectuating the roll-up. The DIP financing is intended to provide necessary liquidity to sustain operations throughout the Chapter 11 process while preserving the Debtors' asset base for a potential sale or restructuring.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you’re already a subscriber and would like to receive timely filing alerts, please reach out and we’ll add you to the distribution list.