Filing Alert: Everstream Chapter 11

Everstream Files Chapter 11 in Southern District of Texas

Everstream Solutions LLC and its debtor affiliates⁽¹⁾ (collectively, the "Company" or the "Debtors"), a Cleveland, OH-based business-only fiber network provider, filed for Chapter 11 protection on May 28 in the U.S. Bankruptcy Court for the Southern District of Texas.

The filing is intended to facilitate the sale of substantially all of its operations to stalking horse bidder Bluebird Midwest, LLC—an affiliate of Bluebird Fiber, a regional internet and data service provider and data center operator—for $285 million in cash plus assumed liabilities, and to wind down its Pennsylvania Assets. This follows an extensive prepetition sale process which saw the Company divest its Missouri assets in September 2024 and Illinois assets in May 2025.

Despite these sales and a 2023 recapitalization that included an $83.6 million liquidity enhancement from lenders under its OpCo credit agreement (the "OpCo Lenders") and a $100 million equity contribution from its sponsor (DigitalBridge-managed InfraBridge Funds), the Company continued to face liquidity constraints due to the capital-intensive nature of fiber network expansion, operational losses, and industry headwinds.

The Debtors have secured commitments for up to $186 million in DIP financing, including $55 million in new money backstopped by certain OpCo Lenders, and will use cash collateral and proceeds from the Illinois Sale to fund the cases.

Everstream Solutions LLC reports $500 million to $1 billion in assets and $1 billion to $10 billion in liabilities. The filing indicates that no funds will be available for distribution to unsecured creditors after administrative expenses are paid. The case number is 25-90144.

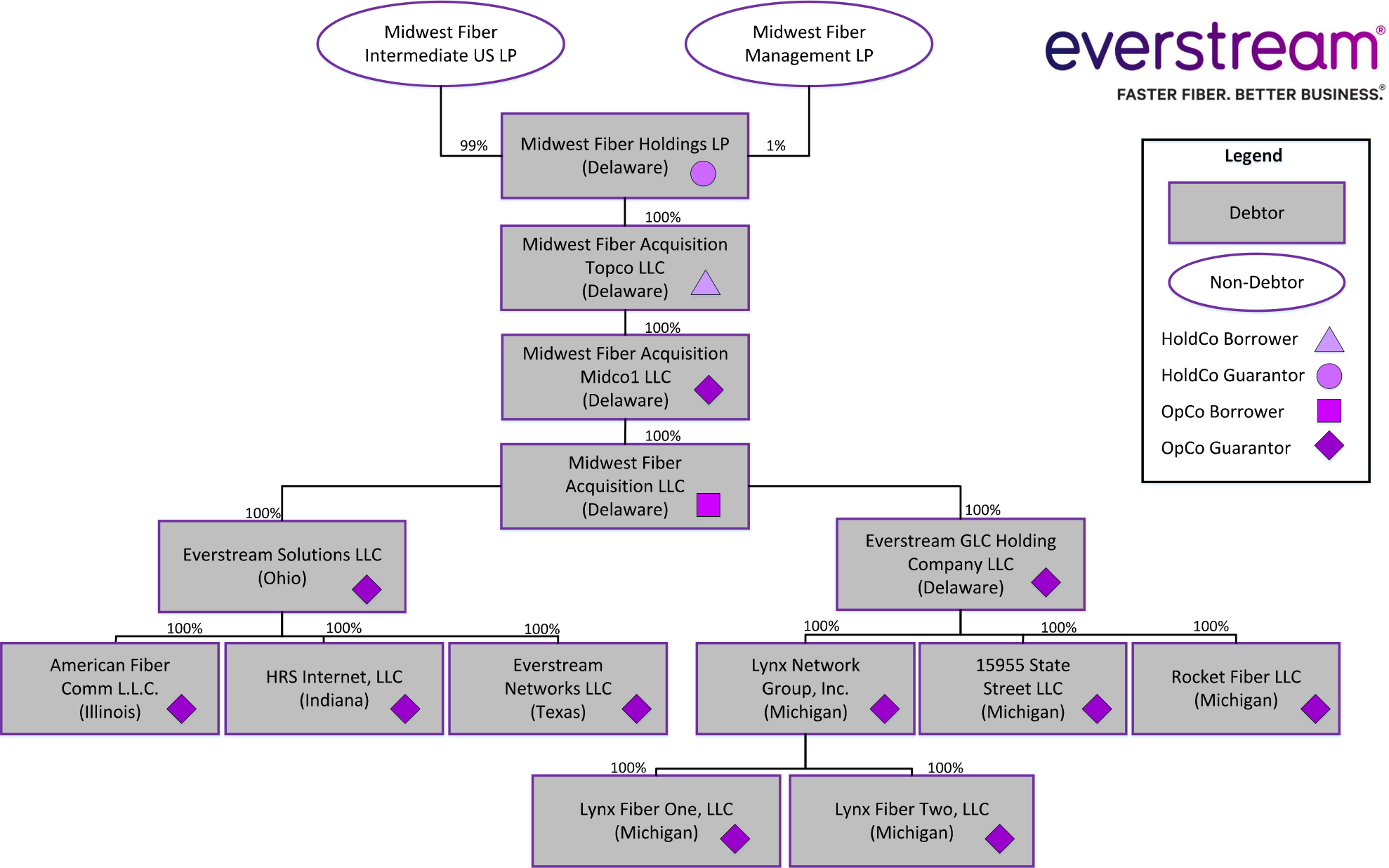

⁽¹⁾ For a complete list of Debtor entities, see organizational structure chart below.

Corporate Organizational Structure

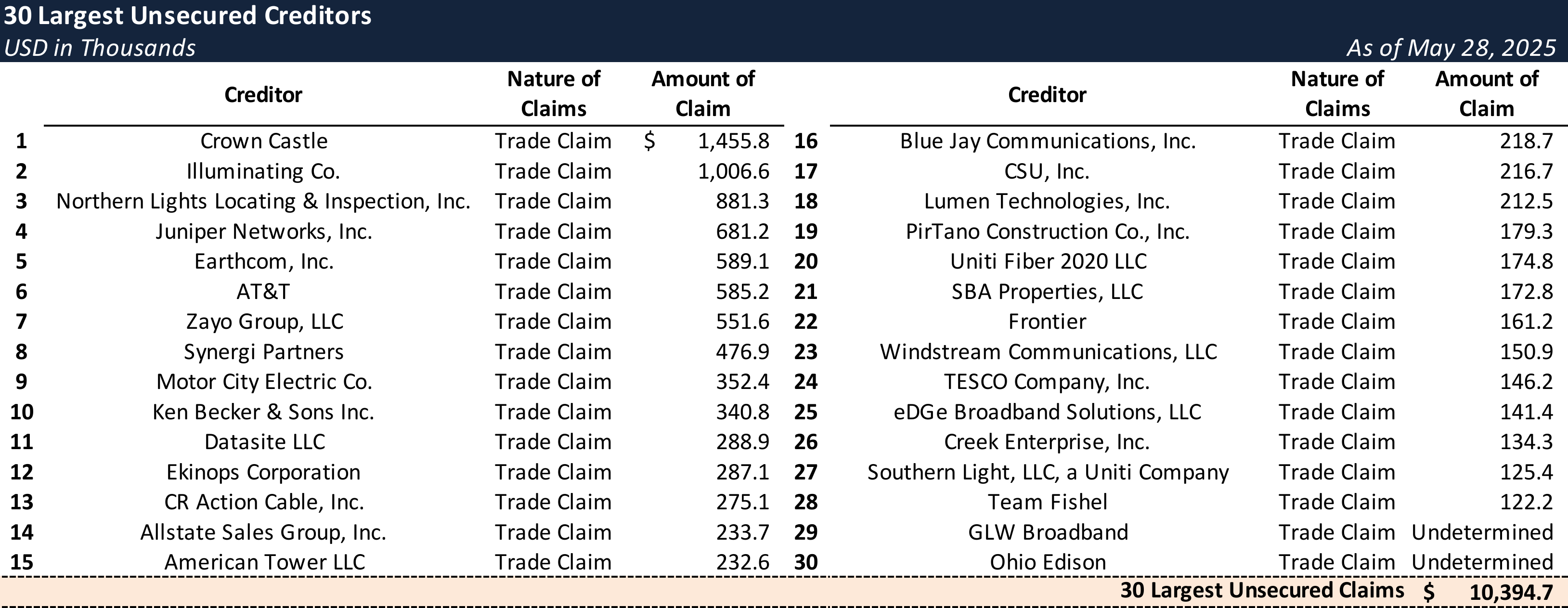

Top Unsecured Claims

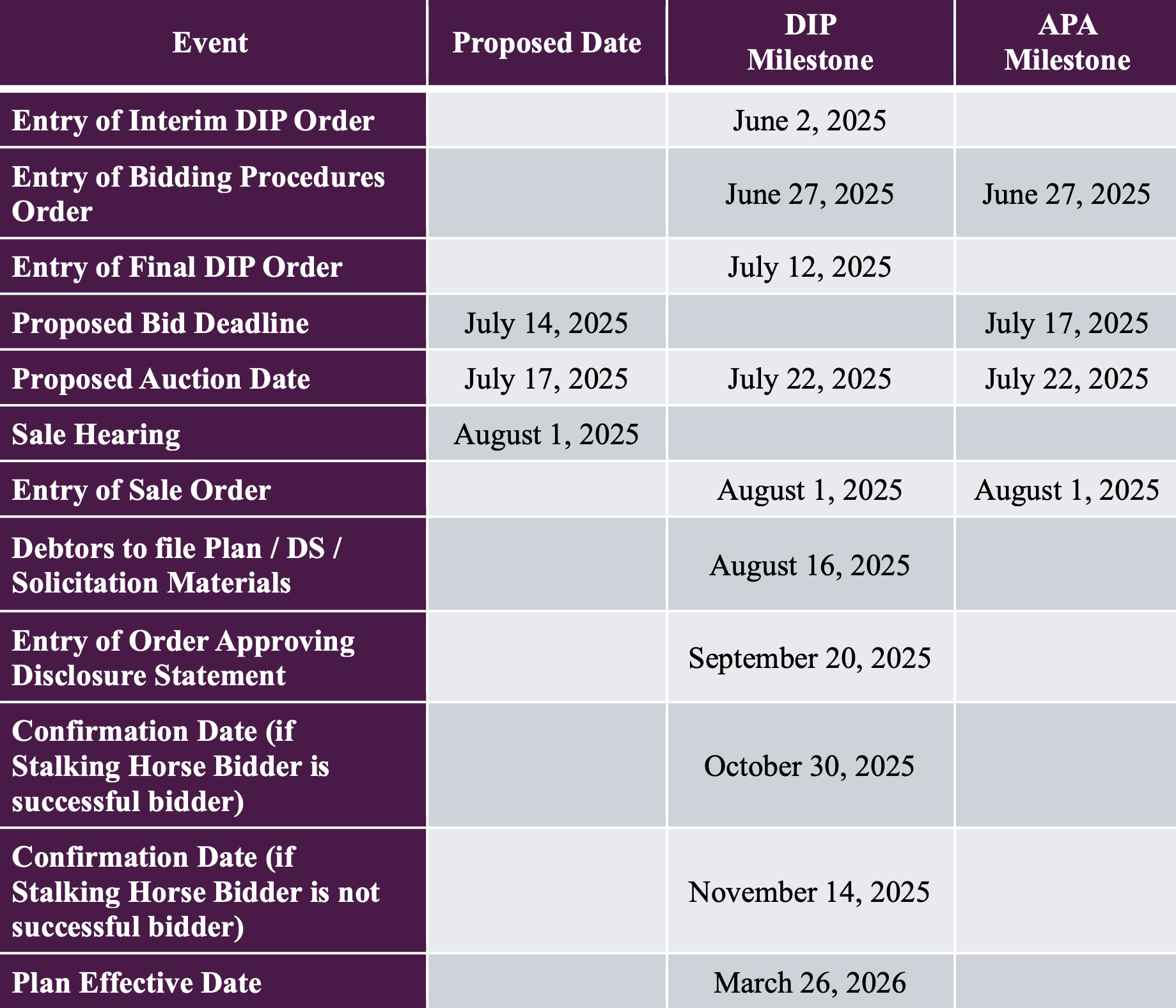

Proposed Timeline

Key Parties

Counsel:

- Gabriel A. Morgan / Matthew S. Barr

- Weil, Gotshal & Manges LLP

- Email: [email protected] / [email protected]

Special Counsel:

- Richards, Layton & Finger, P.A.

M&A Advisor:

- Bank Street Group LLC

Investment Banker:

- PJT Partners LP

Financial Advisor:

- Alvarez & Marsal North America, LLC

Signatories:

- Ken Fitzpatrick – Chief Executive Officer

Claims Agent:

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.