Case Summary: Exela Subsidiaries Chapter 11

Exela Technologies’ subsidiaries have filed for Chapter 11 bankruptcy to restructure debt amid liquidity constraints and high leverage, with key creditor support for a prearranged plan.

Business Description

Headquartered in Irving, TX, DocuData Solutions, L.C., along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, "Exela" or the "Company"), is a global provider of business process automation services, leveraging its proprietary technology and international footprint to deliver mission-critical solutions across multiple industries.

- Exela operates across the Americas and Asia, employing over 11,000 individuals and serving approximately 1,550 customers, including more than 60% of Fortune 100 companies.

- The Company’s suite of solutions is designed to drive operational efficiency and cost savings for clients across the banking, financial services, healthcare, and corporate sectors.

Core Services:

- Finance & Accounting Solutions: Streamlining financial operations, including billing, payments processing, and treasury management.

- Payment Technologies & Services: Supporting seamless multi-channel payment transactions.

- Healthcare Payers & Revenue Cycle Management: Managing claims processing, adjudication, and payment operations to enhance efficiency.

- Work-from-Anywhere Solutions: Deploying automation and digital workflow tools to support remote work.

- Enterprise Information Management: Providing cloud-enabled data organization, storage, and retrieval solutions.

- Integrated Communications & Marketing Automation: Delivering omnichannel customer engagement tools.

- Digital Enterprise Solutions: Enabling end-to-end digital transformation.

In FY 2024, the Company reported approximately $856 million in revenue, down from $1.1 billion the prior year.

The Debtors filed for Chapter 11 protection on Mar. 3 in the U.S. Bankruptcy Court for the Southern District of Texas. As of the Petition Date, the Debtors reported $500 million to $1 billion in assets and $1 billion to $10 billion in liabilities.

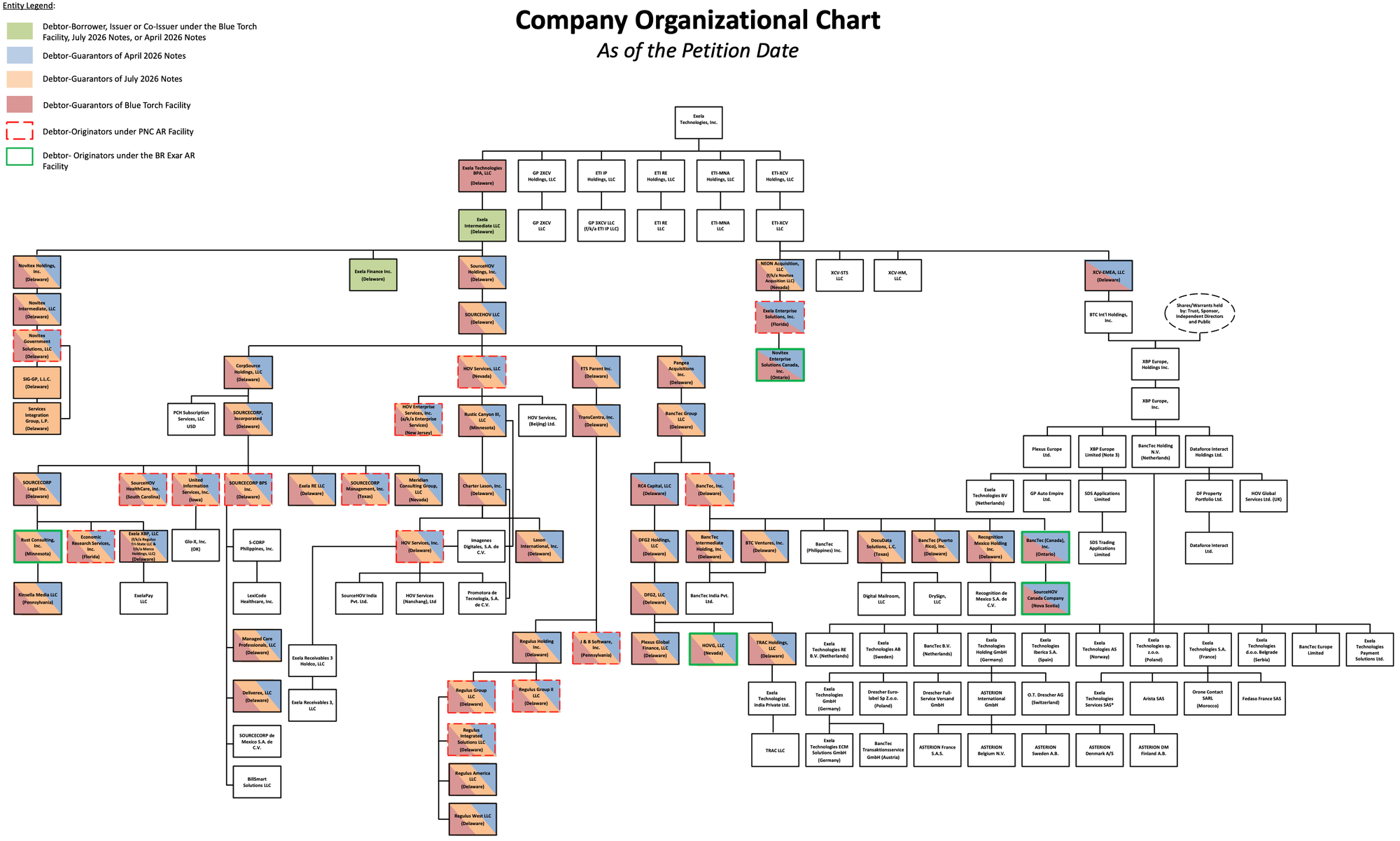

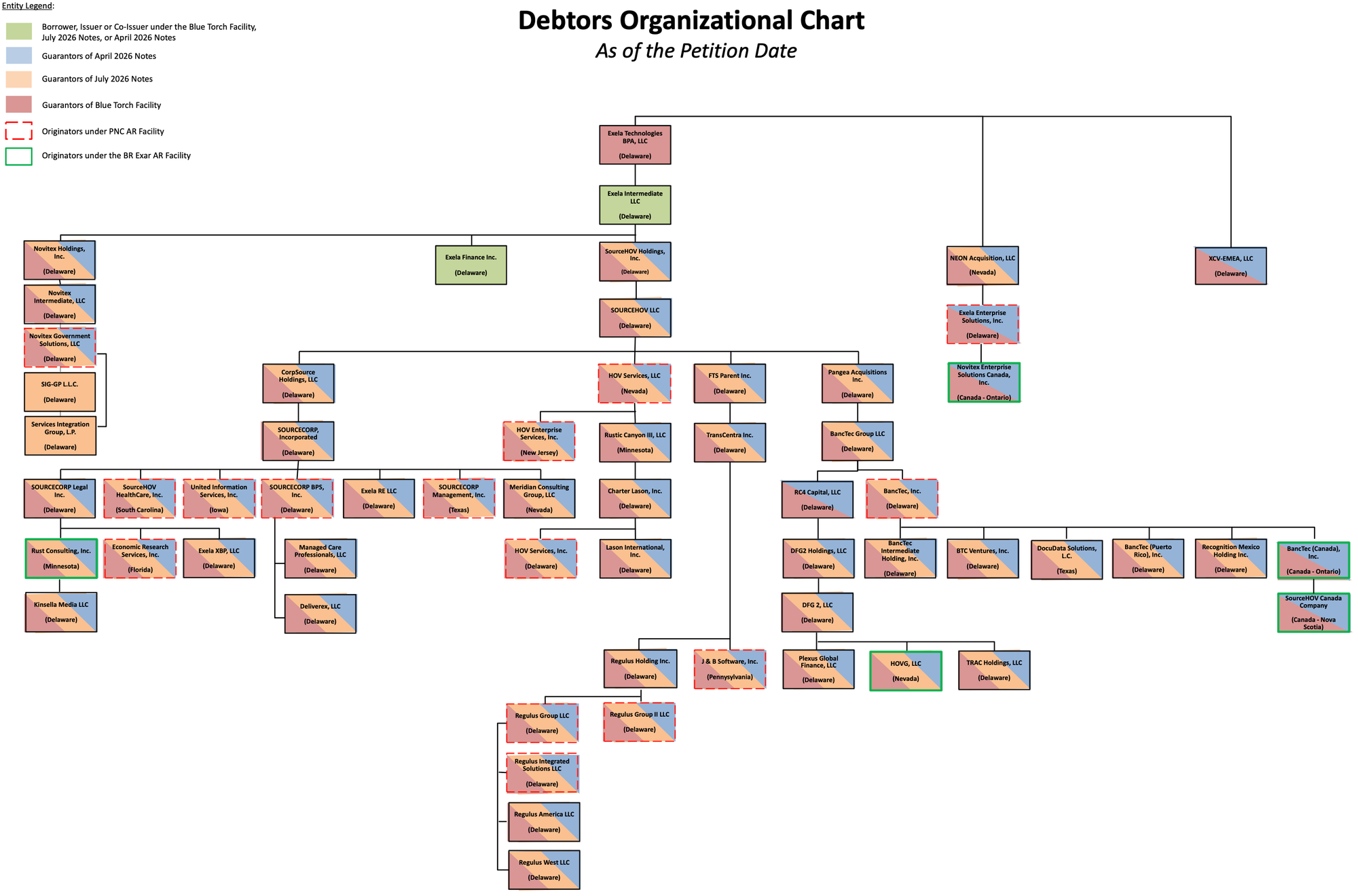

⁽¹⁾ A list of the Debtors is provided in the Debtors’ Organization Chart below. All Debtors are subsidiaries of non-Debtor Exela Technologies Inc.

Corporate History

The Company operates as part of a broader enterprise controlled by non-Debtor Exela Technologies, Inc. ("Exela Technologies" or the “Parent”), which was listed on NASDAQ under the ticker symbol XELA until its delisting in late 2024.⁽¹⁾

- Exela’s corporate structure comprises approximately 134 entities, with 60 entities included in these Chapter 11 cases.

Formation & Evolution

- The Parent was originally formed as Quinpario Acquisition Corp. 2, a SPAC, in 2014 and completed its IPO in January 2015.

- In July 2017, Exela Technologies was formed through the merger of:

- SourceHOV Holdings, Inc. – A global transaction processing firm.

- Novitex Holding, Inc. – A document outsourcing provider.

- The combined company began trading on NASDAQ under XELA on July 13, 2017.

Company Organizational Chart

- Exela Technologies owns a 71.8% stake in XBP Europe Holdings, Inc. ("XBP Europe")⁽²⁾, a publicly traded entity listed on NASDAQ under XBP.

Debtors’ Organizational Chart

⁽¹⁾ Exela Technologies, Inc. was delisted in late 2024 after failing to meet NASDAQ’s minimum market value requirement and began trading on the OTC Pink market. In early 2025, it filed Forms 25 and 15 with the SEC to voluntarily deregister its securities.

⁽¹⁾ Non-Debtor XBP Europe Holdings, Inc. and its subsidiaries are excluded from the definition of the Company.

Operations Overview

Exela’s operations are organized into three primary segments:

- Information & Transaction Processing Solutions (ITPS) – 64.1% of total revenue

- The Company’s largest segment, ITPS delivers automation solutions across financial services, legal, commercial, and public sectors.

- 2024 revenue: $548.7 million.

- Healthcare Solutions (HS) – 27.1% of total revenue

- Focuses on payer and provider markets, offering claims processing, adjudication, and revenue cycle management.

- Processes ~900,000 claims daily, generating $231.9 million in 2024 revenue.

- Legal & Loss Prevention Services (LLPS) – 8.8% of total revenue

- Manages class action administration, claims adjudication, and labor-related legal services.

- 2024 revenue: $75.3 million.

Key Technology & Platforms

- Finance & Accounting Solutions – The XBP platform automates Procure-to-Pay (P2P) and Order-to-Cash (O2C) workflows.

- Payment Technologies & Services – Proprietary technology streamlines transactions for banking clients.

- Healthcare Revenue Cycle Management – The PCH Global platform reduces claims denials and inefficiencies.

- Work-from-Anywhere Solutions –

- EON™ – Robotic process automation.

- ExelaBEATS™ – Project management software.

- DrySign™ – Digital signature platform.

- Enterprise Information Management – Cloud-enabled systems managing billions of records.

- Marketing Automation – The XME™ platform powers omnichannel marketing and analytics.

- Digital Enterprise Solutions – Digital Mailroom (DMR) enhances document processing and workflow automation.

Workforce & Infrastructure

- Headquarters in Irving, TX, with additional operations in Troy, MI, and Santa Monica, CA.

- ~11,000 employees across five countries, including ~4,700 within Debtor entities.

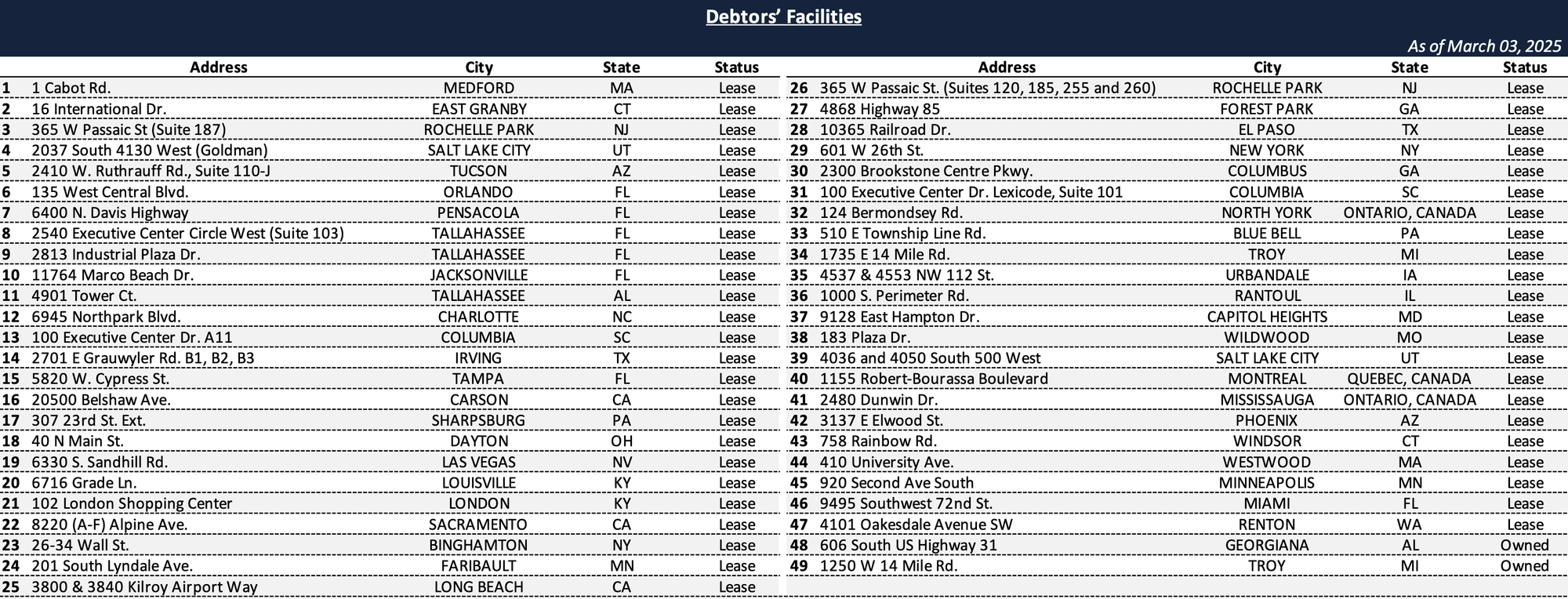

Facilities

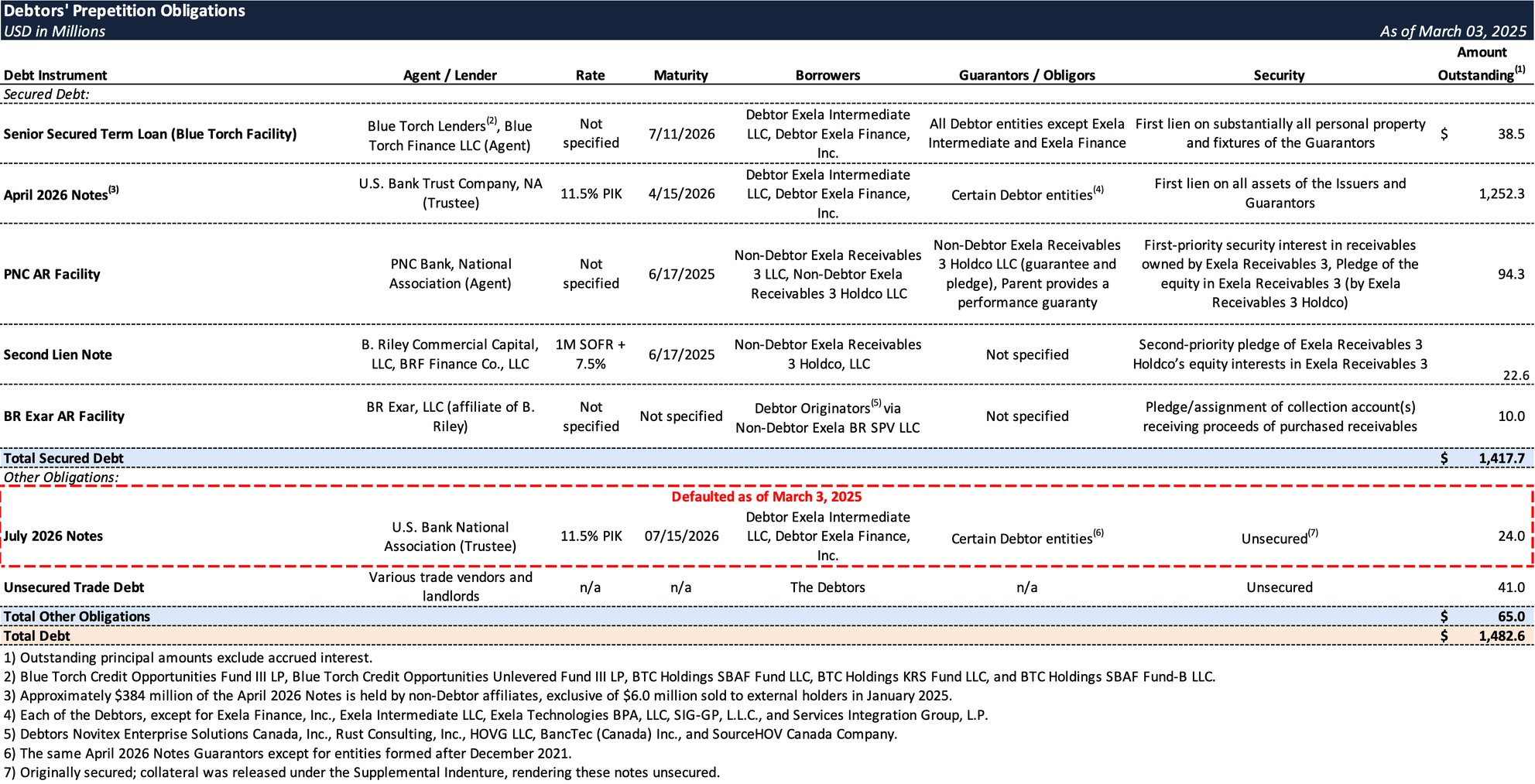

Prepetition Obligations

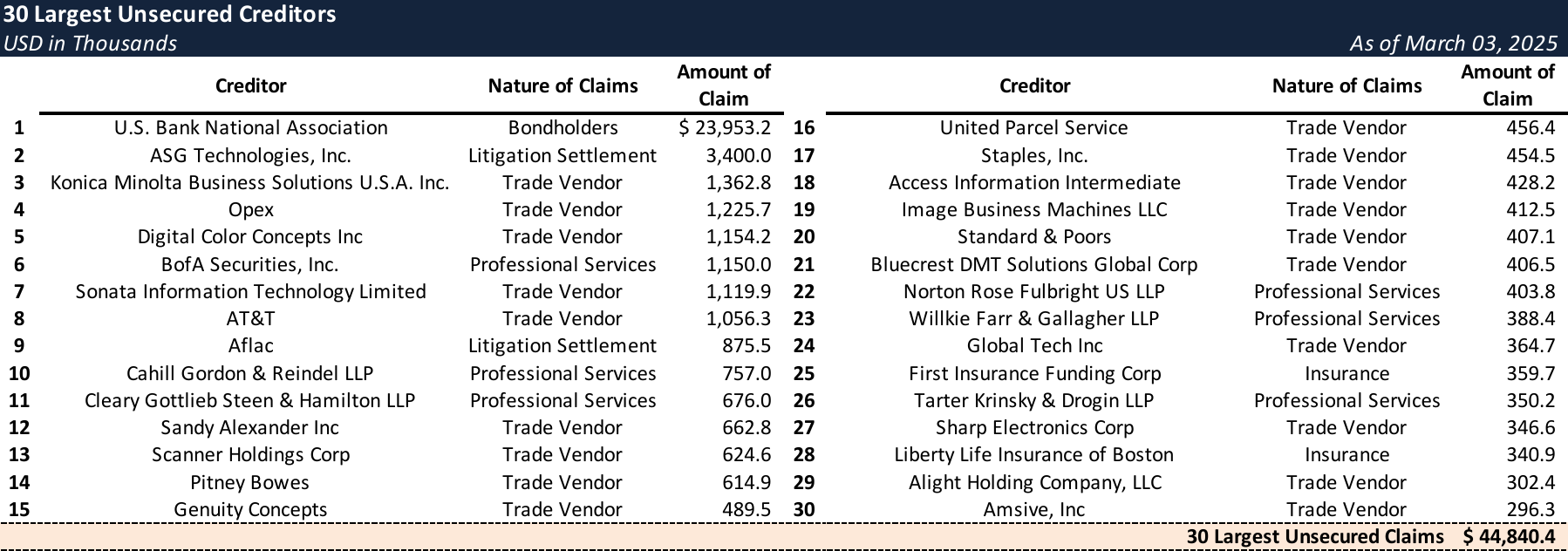

Top Unsecured Claims

Events Leading to Bankruptcy

Macroeconomic & Industry Headwinds

Exela operates in a highly competitive and fragmented sector within the broader information and payment technology industry, facing pricing pressures from national, regional, and multinational competitors, as well as emerging firms with lower cost structures. Despite investments in innovation, the Company encountered persistent structural and operational challenges.

- Following the 2017 Novitex Business Combination, the Company struggled under a debt structure that required performance levels it couldn’t maintain due to weaker-than-anticipated customer retention. Efforts to integrate SourceHOV technology into Novitex’s offerings failed to drive expected cross-sell synergies.

- A 2019 ratings downgrade by Moody’s and S&P constrained the Parent’s ability to use stock for financing, increasing borrowing costs. Suppliers imposed stricter terms, and some customers suspended work mandates.

- The COVID-19 pandemic disrupted operations, forcing a shift to remote work for ~22,000 employees while adding complexity and cost. Although Exela’s essential services designation allowed some on-site work, healthcare-related revenues declined as payers suspended elective procedures, impacting results for nearly two years.

- In June 2022, a network security incident disrupted operations, leading to lost revenue, profits, and remediation expenses.

- The Company filed a $44.7 million business interruption claim, with ~$20 million in outstanding claims still unpaid.

Operational & Financial Constraints

Exela’s high leverage and liquidity constraints exacerbated operational challenges, limiting its ability to reinvest in the business.

- The Company carried ~$1.32 billion in secured and unsecured funded debt, with cash flow heavily allocated to debt servicing rather than growth initiatives.

- High leverage limited the Company’s ability to invest in technology and automation, worsening competitive pressures.

- In late 2019, Exela Technologies’ Board launched a debt-reduction strategy aimed at improving liquidity by $125–$150 million and reducing debt by $150–$200 million over two years, but the plan failed to deliver sustainable results.

- A 2023 debt exchange was executed to reduce the debt burden, and an independent director was appointed on October 1, 2023.

- By late 2024, Exela Technologies was delisted from NASDAQ. Its securities now trade on OTC Pink under “XELA” and “XELAP”.

- In August 2024, the PNC AR Facility became over-advanced, triggering mandatory monthly paydowns and further straining liquidity.

Refinancing & Restructuring Efforts

Amid deteriorating liquidity, Exela explored restructuring alternatives but faced challenges accessing capital markets due to high leverage and unfavorable conditions.

- The Company engaged in refinancing efforts but was unable to secure viable transactions.

- In early 2025, Exela entered restructuring discussions with the Ad Hoc April 2026 Group, represented by Ropes & Gray LLP.

- Jan. 15, 2025: The Company entered the grace period for its April and July 2026 Notes.

- Feb. 14, 2025: Exela and the Ad Hoc Group executed the First Supplemental Indenture, extending the April 2026 Notes’ grace period for missed interest payments from 30 to 60 days.

- Negotiations accelerated, culminating in a deal in principle on March 3, 2025, outlined in a non-binding Restructuring Term Sheet.

- The Ad Hoc April 2026 Group holds 73.7% of unaffiliated bonds, while Affiliated Bondholders hold 30.7%, bringing total support for the restructuring to 81.7% of the April 2026 Notes.

Chapter 11 Process & Path Forward

Exela is moving forward with a prearranged Chapter 11 restructuring on an accelerated timeline, aiming to finalize a Restructuring Support Agreement (RSA) and Plan of Reorganization within 10 business days of filing, with an option for a 10-day extension if needed.

Key Financing & Debt Restructuring Details

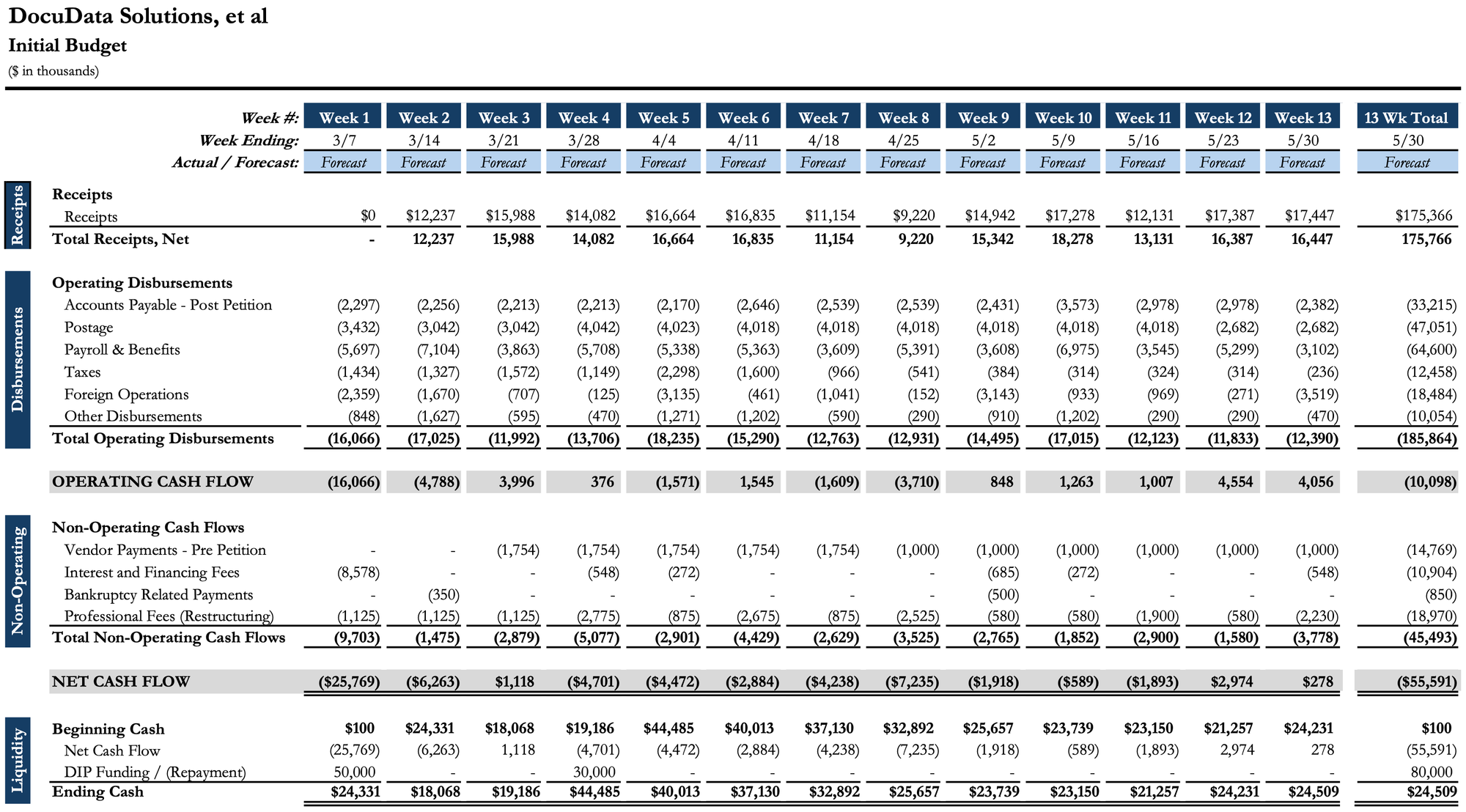

- DIP & Exit Financing: Exela has secured an $80 million DIP facility, which will convert into a $245 million exit facility. The exit financing includes $60 million in new money and a $105 million roll-up of April 2026 Note obligations. Proceeds from the exit financing will fully repay the DIP facility upon emergence.

- Equity & Asset Transfers: Exela Technologies will consolidate its subsidiaries Exela Enterprise Solutions, Inc. and Novitex Enterprise Solutions Canada, Inc. under Exela Intermediate by transferring 100% of NEON Acquisition, LLC’s equity to the entity. Additionally, equity in XBP Europe will be reallocated to April 2026 Noteholders (split 25% to affiliates, 75% to non-affiliates).

- Debt Treatment & Repayment:

- July 2026 and April 2026 Notes will be discharged.

- Blue Torch Facility will be fully repaid in cash using exit financing proceeds.

- New Equity Issuance & Warrants:

- Debtor Exela Technologies BPA, LLC ("BPA") equity will be canceled, and new BPA equity will be issued to April 2026 Noteholders (25% to affiliates, 75% to non-affiliates).

- BPA will issue warrants for 7.5% of reorganized BPA equity to affiliated holders.

- XBP Europe will acquire 100% of reorganized BPA equity, issuing common stock pro rata to new BPA equity holders and granting five-year XBP Europe warrants to BPA warrant holders.

- Debtor Exela Technologies BPA, LLC ("BPA") equity will be canceled, and new BPA equity will be issued to April 2026 Noteholders (25% to affiliates, 75% to non-affiliates).

Liquidity Challenges & Importance of DIP Financing

- As of the Petition Date, Exela holds just $0.1 million in cash, leaving it unable to cover operating expenses, vendor payments, or bankruptcy-related costs.

- The company stresses that without access to the DIP Facility, it lacks the liquidity to sustain operations or remain in compliance with the PNC AR Facility. The financing package is positioned as critical to ensuring stability and enabling an orderly restructuring.

DIP Budget

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you’re already a subscriber and would like to receive timely filing alerts, please reach out and we’ll add you to the distribution list.