Case Summary: Float Alaska Chapter 11

FLOAT Alaska has filed for Chapter 11 bankruptcy to liquidate its assets after ceasing all operations, following the collapse of its transpacific strategy due to Russian airspace closures, regional competitive pressures, and the subsequent failure of its domestic and charter pivots.

Business Description

Headquartered in Anchorage, AK, FLOAT Alaska LLC ("FLOAT Alaska"), along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, "FLOAT" or the "Company"), is a multi-modal aviation holding company that operated regional Alaskan air service, domestic and charter airline operations, an urban air mobility venture, and a blockchain-based airline loyalty platform.⁽²⁾

- New Pacific Airlines, Inc. (f/k/a Northern Pacific Airways, f/k/a Corvus Airlines Inc.) held a Part 121 Air Carrier Certificate and operated regional turboprop service in Alaska under the "Ravn Alaska" brand and Boeing 757-200 jet operations for domestic and charter flights.

- FLOAT Shuttle Inc., the Company's original venture, was a Southern California-based urban air mobility startup offering subscription-based commuter flights designed to "FLy Over All Traffic."

- FlyCoin, Inc. developed a blockchain-based loyalty rewards platform that issued cryptocurrency tokens (FLY) in lieu of traditional frequent-flyer miles, allowing customers to own, trade, and redeem their rewards.

The Company's business lines were designed as an integrated aviation ecosystem: Ravn Alaska provided essential air service and cargo transport to remote Alaskan communities; New Pacific Airlines pursued transpacific, domestic, and charter operations; and FlyCoin served as the loyalty program across the group's carriers.

- At its peak, Ravn Alaska's network spanned 12 Alaskan destinations, from its hub in Anchorage to hard-to-reach Alaskan communities. Cargo and medical related travel historically comprised roughly half of Ravn's revenue.

- New Pacific Airlines operated three Boeing 757-200s, initially intended for transpacific routes connecting Asia and North America via Anchorage before pivoting to domestic service and ultimately charter operations for professional sports teams.

- FlyCoin raised $33 million in seed funding and minted a fixed supply of tokens on the Ethereum blockchain, with $28 million lent to New Pacific Airlines (then Northern Pacific Airways) to support the transpacific launch.

The Company's operations were funded significantly by insider capital. Josh Jones, a board member and reportedly the Company’s largest shareholder, as well as his affiliated entities, provided ongoing financing throughout the enterprise's lifecycle.

FLOAT Alaska LLC and certain affiliates filed for Chapter 11 protection on January 26, 2026 (the "Petition Date") in the U.S. Bankruptcy Court for the District of Delaware, reporting $1 million to $10 million in assets and $10 million to $50 million in liabilities⁽³⁾.

⁽¹⁾ For a complete list of debtor entities, see the Chapter 11 Debtors table.

⁽²⁾ As of the Petition Date, the Debtors had ceased all operations. Ravn Alaska suspended flights in August 2025, and New Pacific Airlines ceased charter operations on or about November 26, 2025, after which approximately 115 remaining employees were laid off. The Debtors reported approximately $184,200 in cash on hand at filing.

⁽³⁾ Debtor affiliate New Pacific Airlines, Inc. reports liabilities of $100 million to $500 million.

Corporate History

FLOAT Shuttle Inc. was founded in 2019 by Arnel Guiang, Tom Hsieh, and Rob McKinney and provided urban air mobility services in Southern California. The startup partnered with Southern Airways Express to operate 9-seat Cessna Caravans on 15- to 30-minute hops between regional airports in the Los Angeles basin, targeting commuters enduring three-plus-hour daily drives.

- Operations commenced in late February 2020, with monthly subscriptions priced at approximately $1,250 for unlimited weekday flights.

- Two weeks after launch, COVID-19 stay-at-home orders eliminated commuter traffic, forcing FLOAT Shuttle to suspend operations indefinitely.

Acquisition of Ravn Air Group Assets

While FLOAT Shuttle's operations were paused, its founders identified an opportunity in the concurrent bankruptcy of Ravn Air Group, Inc., Alaska's largest regional airline. Ravn Air Group had filed for Chapter 11 in April 2020, burdened by over $90 million in debt and unable to survive the pandemic-induced demand collapse. Its operations had historically served over 100 Alaskan communities, with approximately 50% of revenue derived from medical-related travel and cargo.

- FLOAT formed FLOAT Alaska LLC as the acquisition vehicle and successfully bid for the stock of Corvus Airlines Inc. (d/b/a Ravn Alaska) through a Section 363 sale that closed on August 5, 2020, securing the Part 121 operating certificate and a small number of aircraft.

- The acquisition also provided access to federal CARES Act funding allocated to Ravn, offering a financial lifeline to restart operations.

- CEO Rob McKinney and President Thomas Hsieh relocated to Alaska, rehired approximately 350 former Ravn employees, and resumed operations as "Ravn Alaska" by late 2020, delivering COVID-19 vaccines to remote communities and restoring essential air service.

Expansion into Transpacific Aviation

With Ravn Alaska stabilized, FLOAT Alaska developed plans for a transpacific passenger airline modeled after Icelandair's transatlantic stopover concept, leveraging Anchorage International Airport's position on great circle routes between major Asian and North American cities.

- FLOAT Alaska renamed Corvus Airlines to "Northern Pacific Airways" and acquired its first Boeing 757-200 in October 2021, taking advantage of depressed post-pandemic aircraft pricing. The Company ultimately assembled a fleet of three 757s.

- The Company invested $6 million to renovate part of the Anchorage International Airport, constructing a dedicated lounge and terminal facility.

- Concurrently, FLOAT Alaska established FlyCoin, Inc. as a blockchain-based loyalty subsidiary, raising $33 million in seed funding and lending $28 million to Northern Pacific Airways to accelerate the transpacific launch.

Trademark Dispute and Rebranding

In 2022, BNSF Railway filed a trademark infringement lawsuit over the use of "Northern Pacific," associated with BNSF's predecessor railway. A federal court granted a preliminary injunction, and the airline rebranded to "New Pacific Airlines, Inc.," retaining the "N" logo to minimize costs of rebranding.

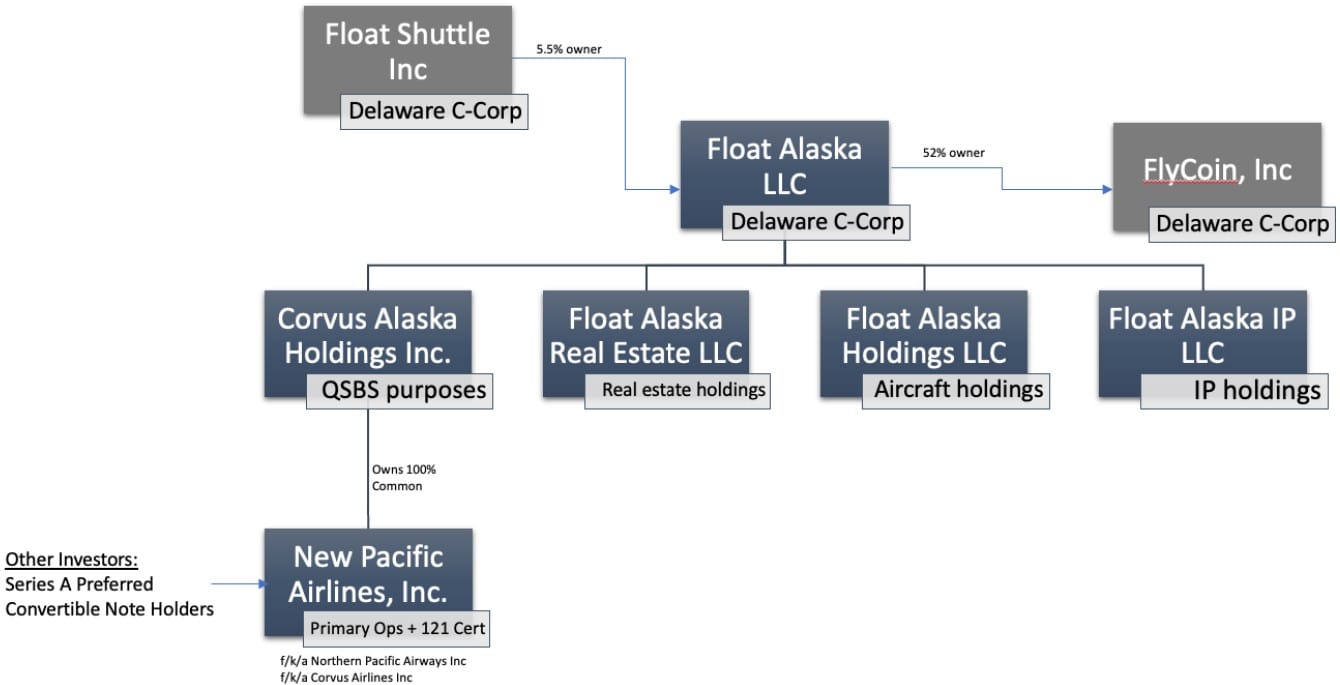

Corporate Organizational Structure

FLOAT Alaska LLC is the parent entity of the Debtor group. Key subsidiaries include:

- Corvus Alaska Holdings Inc.: Formed for qualified small business stock (QSBS) purposes; wholly owned by FLOAT Alaska LLC.

- FLOAT Alaska Holdings LLC: Holds title to the Boeing 757 aircraft and engines; wholly owned by FLOAT Alaska LLC.

- FLOAT Alaska IP LLC: Holds intellectual property assets; wholly owned by FLOAT Alaska LLC.

- New Pacific Airlines, Inc.: The primary operating entity holding the Part 121 Air Carrier Certificate; wholly owned through the subsidiary structure.

- FlyCoin, Inc.: The blockchain loyalty subsidiary; 52.818% owned by FLOAT Alaska LLC, with the remainder held by individual and non-public investors.

- FLOAT Shuttle Inc.: The original urban mobility entity; holds a 5.5% ownership interest in FLOAT Alaska LLC.

FLOAT Alaska Real Estate LLC, a non-Debtor subsidiary, holds real property assets including a facility at 4700 Old International Airport Road, Anchorage, AK. This entity serves as guarantor under the DIP facility and has pledged real estate collateral to support the Chapter 11 process.

Operations Overview

Regional Alaskan Air Service (Ravn Alaska)

Ravn Alaska operated as the Company's foundational cash-flow engine, providing scheduled passenger service, charter flights, and cargo transport to remote Alaskan communities under Part 121 and Part 135 certificates. The network was a hub-and-spoke system centered on Anchorage, connecting to regional hubs and rural destinations including Kenai, Homer, Valdez, St. Mary's, Unalakleet, and the fishing port of Dutch Harbor/Unalaska.

- Fleet: De Havilland DHC-8 "Dash-8" turboprops, primarily the Dash-8-100 (37 seats) and Dash-8-300 (50 seats) variants, suited for short-field performance and reliability in extreme Alaskan weather.

- Revenue Streams: Scheduled passenger service (highly seasonal, peaking during summer tourism and fishing seasons); Essential Air Service (EAS) federal subsidies for routes to communities lacking commercial air access; and cargo and mail transport, providing steadier year-round revenue. Ravn held EAS contracts for locations such as St. Mary's and Unalakleet and served as a critical logistics lifeline for villages without road access.

- Workforce: From December 2024 to August 2025, Ravn Alaska employed approximately 245 people across flight operations, maintenance, and station services. Following cessation of regional operations in August 2025, the workforce was reduced to 120-130 employees.

Transpacific, Domestic, and Charter Operations (New Pacific Airlines)

New Pacific Airlines represented the Company's high-growth ambition. Originally conceived to operate transpacific routes connecting second-tier U.S. cities (e.g., Nashville, Las Vegas, Ontario) with major Asian destinations via an Anchorage stopover, the segment underwent multiple strategic pivots as external conditions shifted.

- Fleet: Three Boeing 757-200 aircraft, acquired at favorable post-pandemic pricing. The 757 was chosen for its range capability (sufficient to reach Tokyo from Anchorage).

- Domestic Scheduled Service: After securing its FAA Air Operator Certificate in July 2023, New Pacific launched scheduled service from Ontario International Airport to Las Vegas, with subsequent routes to Reno and Nashville. The Nashville route reached 90% load factor during spring break periods. However, breakeven required expansion into at least five additional markets, each requiring approximately six months of loss-leader investment—capital the Debtors did not possess.

- Charter Operations: In August 2024, New Pacific signed an exclusive agreement with Private Jet Services (PJS) to fly six NHL teams and ad hoc charters, reconfiguring three 757s from 181-seat high-density layouts to 78-seat VIP configurations. The contract proved financially unsustainable as PJS passed through incidental and extraordinary costs—including extra handling fees, repositioning costs, airport special event fees, and de-icing charges—resulting in losses on every flight. The Debtors negotiated a May 2025 amendment to the contract to address the ongoing losses; however, with the NHL season concluding, demand softened and limited charter flights were booked during summer 2025.

- beOnd Partnership: In 2025, New Pacific announced a partnership with beOnd, a Maldives-based premium leisure airline, to launch "beOnd America" offering all-business-class leisure flights. The venture did not reach operational maturity before cessation of operations.

Blockchain Loyalty Platform (FlyCoin)

FlyCoin operated as a fintech and software platform serving as the loyalty program for both Ravn Alaska and New Pacific Airlines. The platform minted the FLY token on the Ethereum blockchain, with tokens deposited into custodial wallets that allowed users the ability to trade, hold, or redeem them—marking a departure from traditional airline miles controlled by the issuing carrier.

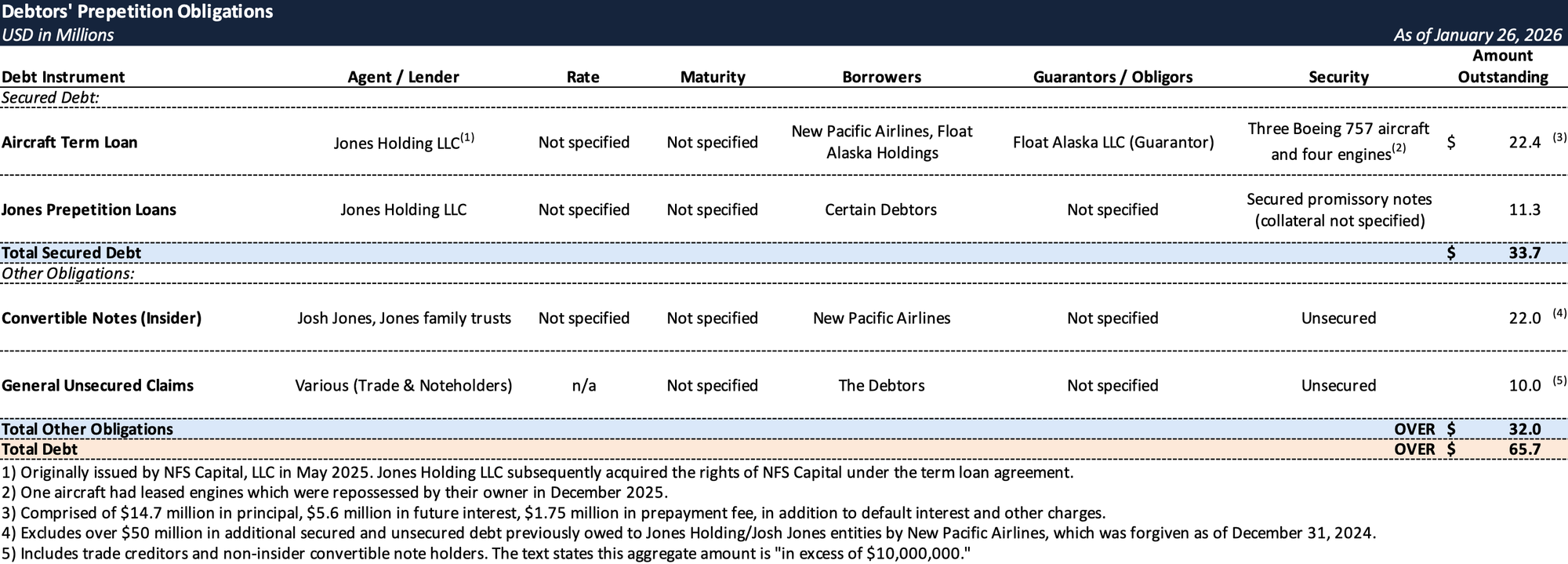

Prepetition Obligations

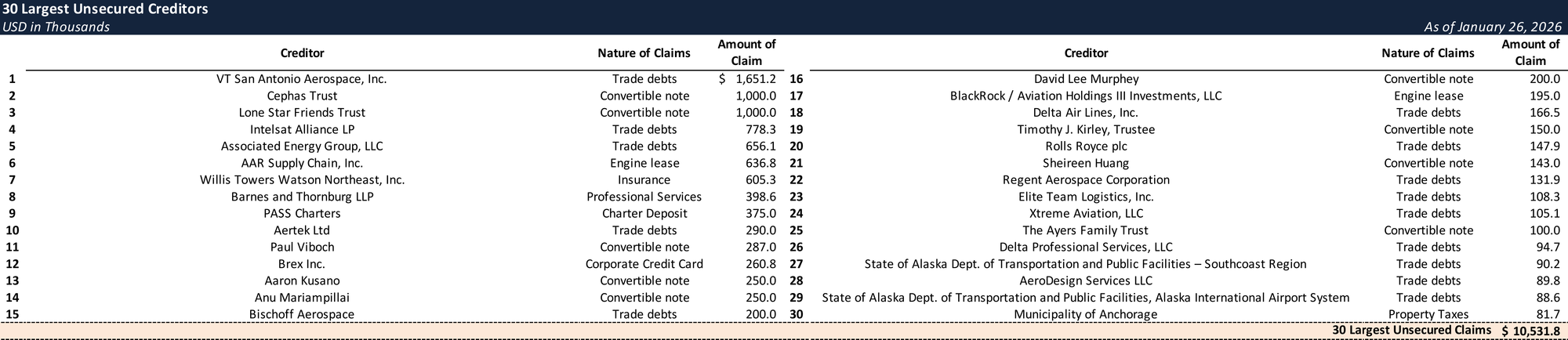

Top Unsecured Claims

Events Leading to Bankruptcy

Geopolitical Disruption: Closure of Russian Airspace

On February 24, 2022, Russia's full-scale invasion of Ukraine triggered the closure of Russian airspace to U.S. commercial carriers, delivering an existential blow to the Company's transpacific strategy.

- Great circle routes from Anchorage to key Asian hubs like Tokyo and Seoul pass directly through Russian airspace. Without access to these corridors, the Boeing 757-200 fleet lacked range for commercially viable alternative routings.

- Alternative over-water routes required Extended-range Twin-engine Operations Performance Standards (ETOPS) certification, which demands a minimum of 24 months of operational history.

- The transpacific model was rendered operationally infeasible, leaving the Company with expensive long-haul aircraft and no corresponding market.

Cryptocurrency Market Collapse and FlyCoin Stagnation

The year 2022 proved turbulent for cryptocurrency as several major platforms collapsed. Despite FlyCoin's utilitarian use of blockchain technology, prospective airline partners withdrew from negotiations, unwilling to associate with blockchain-based products.

- The failure of crypto-serving financial institutions, including banks with which FlyCoin maintained accounts, further disrupted operations.

- With the industry downturn and inability to secure external customers, FlyCoin executed a reduction in force and retained only a small team supporting software development and support needs of New Pacific Airlines and Ravn Alaska.

Pilot Shortage and Labor Market Pressures

Between 2022 and 2024, the U.S. aviation industry experienced an acute pilot shortage as major carriers aggressively recruited from regional airlines, and in some cases offering the Debtors’ pilots signing bonuses of up to $150,000 and 100% salary increases.

- The Debtors lost approximately 80% of their pilot positions, including unfilled vacancies, in a single year.

- By summer 2023—typically the most profitable season—Ravn operated only one-quarter of originally planned flights on the key Anchorage-Kenai route.

- In fall 2023, the Company closed its Kenai and King Salmon routes and implemented reductions in force totaling 106 employees plus 49 vacant positions.

Competitive Erosion in Alaska

In fall 2022, Aleutian Airways, a joint venture backed by Wexford Capital and Alaska Seaplanes, launched service targeting Ravn Alaska's most lucrative market, Dutch Harbor/Unalaska.

- Aleutian Airways operated newer Saab 2000 turboprops, offering a faster, quieter cabin experience than Ravn's aging Dash-8 fleet, quickly capturing high-yield fishing industry and corporate traffic.

- In October 2024, Aleutian Airways aggressively pursued Ravn's Essential Air Service routes, offering to fly certain segments without subsidy.

- Each route withdrawal further shrank Ravn's customer base, ultimately contributing to complete cessation of regional operations in August 2025.

- By November 2025, Aleutian Airways had secured DOT EAS contracts for three of the four final communities served by Ravn prior to its closure.

Failed Domestic Pivot and Unsustainable Charter Economics

With the transpacific model foreclosed, New Pacific launched domestic scheduled service from Ontario, California in summer 2023. While certain routes showed promise, breakeven required expansion into five additional markets with six months of loss-leader investment each.

- The Debtors were losing approximately $5 million per month operating both Ravn Alaska and New Pacific Airlines, requiring continuous cash infusions.

- In early 2024, New Pacific ceased scheduled operations and pivoted to charter flights. The Company further reduced Ravn Alaska's route map and ceased flights to the Aleutian Islands, triggering additional closures and workforce reductions.

- The August 2024 PJS charter agreement proved financially ruinous. New Pacific lost money on every flight under the contract. On November 25, 2025, PJS failed to remit a payment of $315,187.50, leaving the Debtors unable to meet payroll. The following day, the Debtors ceased all operations and laid off approximately 115 remaining employees.

- As of the Petition Date, the Debtors had not received the final PJS payment due.

Leadership Changes and Operational Retrenchment

In 2024, CEO Rob McKinney departed and Thomas Hsieh was appointed Chief Executive Officer.

In early 2025, the Canadian lessor of several Dash-8 aircraft repossessed the planes, further constraining Ravn Alaska's ability to maintain regional service.

During summer 2025, the Debtors furloughed employees and executives took voluntary pay cuts. The Company attempted to fund operations by liquidating Alaska-based assets, including remaining Dash-8 aircraft.

Failed Sale Negotiations

Throughout 2024 and 2025, the Debtors explored numerous strategic alternatives, including a potential transfer of the regional Alaska business to Aleutian Airways.

- In October 2024, the Debtors entered an agreement with Aleutian Airways for transfer of leased Dash-8 aircraft, routes, and certificates in exchange for a minority membership interest. However, Aleutian Airways ultimately did not follow through on the assumption.

- The Debtors engaged in M&A discussions resulting in multiple executed NDAs, but no actionable proposals materialized.

Advisor Retention and Governance Enhancements

In late November 2025, the Debtors appointed Thomas Allison as an independent director with over 40 years of financial and restructuring advisory experience, serving as sole member of a special committee with exclusive authority over insider transactions.

- On December 1, 2025, the Debtors retained Sherwood Partners, Inc. as financial advisor for pre-bankruptcy planning and postpetition financing.

- Debtors’ management introduced Sherwood to 27 interested parties. Twenty-four executed NDAs and were granted access to a virtual data room. Despite approximately five weeks of engagement, no actionable proposals were received.

DIP Financing and Path Forward

To fund the Chapter 11 administration and asset sale process, the Debtors secured a DIP financing facility from Jones Holding LLC.

- Facility Terms: Up to $3.23 million in new liquidity, with funding in tranches: $250,000 upon entry of the interim order, an additional $400,000 upon delivery of a deed of trust on the Anchorage real property, and full commitment upon entry of the final order.

- Structure: The DIP includes a dollar-for-dollar roll-up of prepetition secured debt to super-priority administrative claim status, secured by priming liens on all Debtor assets and a pledge of real estate collateral from non-Debtor affiliate FLOAT Alaska Real Estate LLC.

- Alternative Financing: Sherwood contacted 10 potential DIP lenders; none submitted proposals, citing the capital structure, insufficient unencumbered collateral, and aviation industry challenges. The Special Committee approved the DIP facility as the only alternative to Chapter 7 liquidation.

The Chapter 11 case is structured as a liquidating reorganization with an aggressive sale timeline:

- Bidding procedures filed January 28, 2026; qualified bids due by March 16, 2026; sale hearing set for March 25, 2026; final closing scheduled for March 27, 2026.

- Primary Assets: Three VIP-configured Boeing 757-200 aircraft (marketed by Sage-Popovich, Inc.) and the Part 121 Air Carrier Certificate.

- While the Debtors remain hopeful a going-concern buyer may emerge to restart operations utilizing the Part 121 certificate, the filing is primarily focused on a Section 363 sale to maximize creditor recoveries.

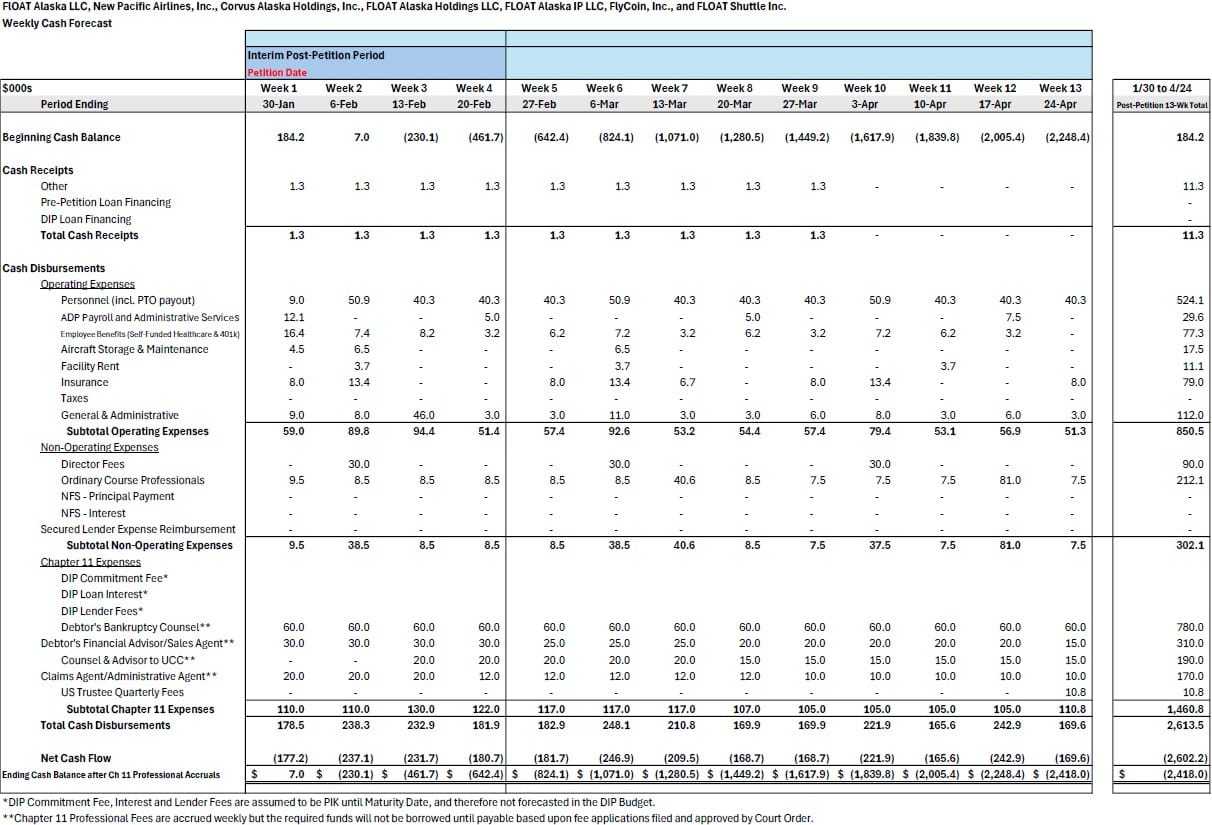

Initial Budget

Key Parties

- Saul Ewing LLP (general bankruptcy counsel); Sherwood Partners, Inc. (financial advisor); Sage-Popovich, Inc. (sales agent); Stretto, Inc. (claims agent).

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.