Case Summary: FMI Aerostructures Chapter 11

FMI Aerostructures has filed for Chapter 11 bankruptcy, citing quality-control issues, inflation-driven inventory costs, and unprofitable contracts, with plans to sell itself through the process.

Business Description

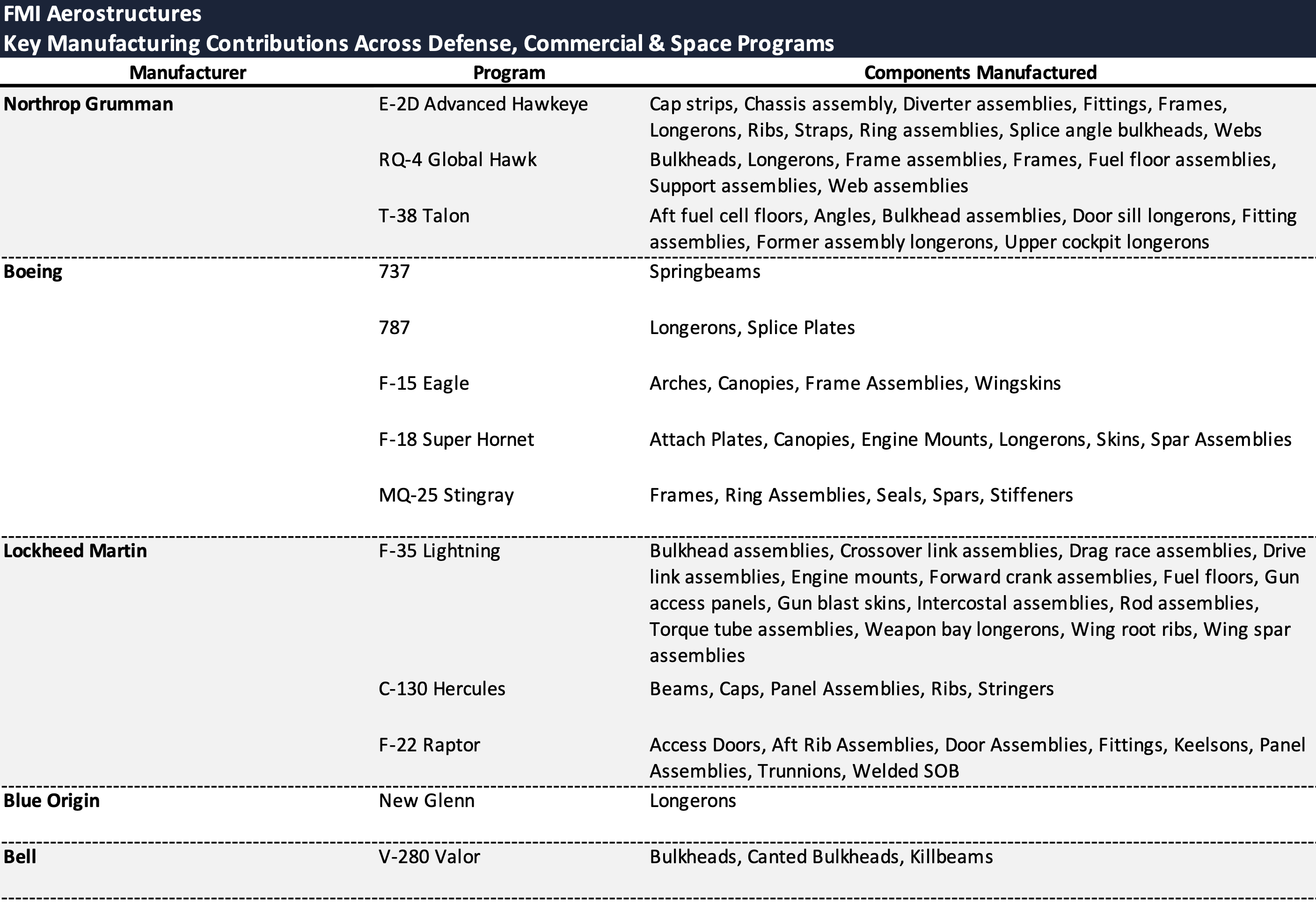

Headquartered in Valencia, CA, Dynamic Aerostructures LLC, along with its Debtor affiliates Forrest Machining LLC (dba FMI Aerostructures) and Dynamic Aerostructures Intermediate LLC (collectively, “FMI” or the “Company”), is a manufacturer and supplier of parts and assemblies for the aerospace and defense industries.

- The Company supplies mission-critical airframe and wing components to leading defense contractors, including Lockheed Martin, Northrop Grumman, and Boeing, as well as commercial aerospace and space exploration firms such as Blue Origin and SpaceX.

With a facility spanning approximately 226,000 square feet in Valencia, CA, FMI operates one of the largest independent aerospace and defense manufacturing sites in North America.

In 2024, the Company reported revenue of $52 million, reflecting a modest increase from $51 million in 2023.

- Approximately 85% of its revenue stems from long-term agreements with core defense contractors.

FMI filed for Chapter 11 protection on Feb. 25 in the U.S. Bankruptcy Court for the District of Delaware. As of the Petition Date, the Debtors reported $10 million to $50 million in assets and $50 million to $100 million in liabilities.

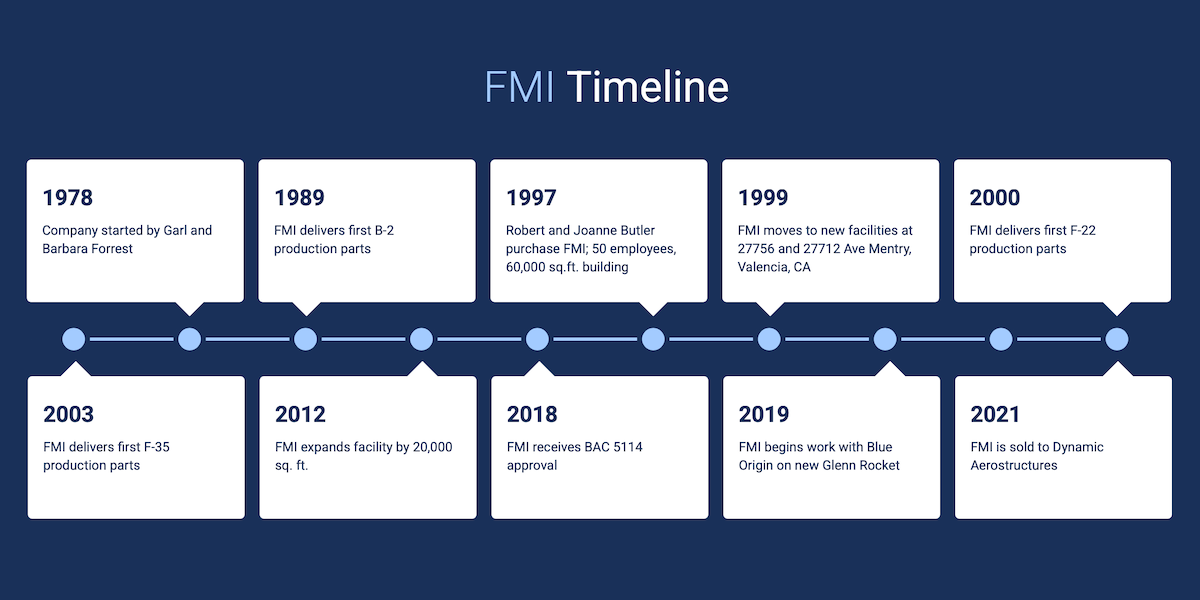

Corporate History

Founded in 1978 by Garl and Barbara Forrest, FMI established itself as a trusted aerospace manufacturer, securing its first major defense contracts in the late 1980s.

Key Milestones

- 1989: Delivered first production parts for Northrop Corporation’s B-2 Spirit (Stealth Bomber).

- 1997: Robert and Joanne Butler acquired FMI, relocating it in 1999 to its current Valencia, CA facility.

- 2000: Began production of components for Lockheed Martin’s F-22 Raptor.

- 2003: Expanded production to include Lockheed Martin’s F-35 Lightning aircraft.

- 2012: FMI expanded its manufacturing footprint to its current size.

- 2018: Attained BAC 5114 certification, demonstrating compliance with Boeing’s stringent quality standards for aerospace components.

- 2019: Partnered with Blue Origin to manufacture key structural components for the New Glenn rocket.

- July 2021: Acquired by Endeavour Capital through Dynamic Aerostructures LLC, integrating into a broader aerospace manufacturing platform.

Organizational Structure

The Company is majority owned and controlled by Endeavour Capital or its managed funds. Dynamic Aerostructures LLC serves as the parent company, overseeing Forrest Machining LLC under its subsidiary, Dynamic Aerostructures Intermediate LLC.

Operations Overview

FMI specializes in manufacturing large, complex structural components used in military and commercial aircraft. Its capabilities include:

- Precision Machining & Assembly: Expertise in multi-axis machining for aircraft structural components, including bulkheads, wing skins, engine mounts, and longerons.

- Advanced Fabrication & Tooling: In-house rapid prototyping, numerical control programming, complex tooling design, and laser calibration for quality assurance.

- Material Versatility: Works with high-performance materials such as titanium, stainless steel, aluminum, and ceramics.

The Company is a key supplier for critical defense programs, including the F-35 Lightning, F-15 Eagle, C-130 Hercules, and E-2D Advanced Hawkeye.

Strategic Supply Chain & Market Position

- Positioned within Southern California, a major aerospace hub, the Company benefits from proximity to key customers, enhancing efficiency and supply chain integration.

- Long-term contracts with major defense contractors account for a significant portion of annual revenue, with FMI serving as a sole-source supplier for multiple critical aircraft programs.

With over 180 employees, FMI continues to support key military and commercial programs, leveraging its specialized manufacturing expertise to sustain and expand its presence in the aerospace and defense sectors.

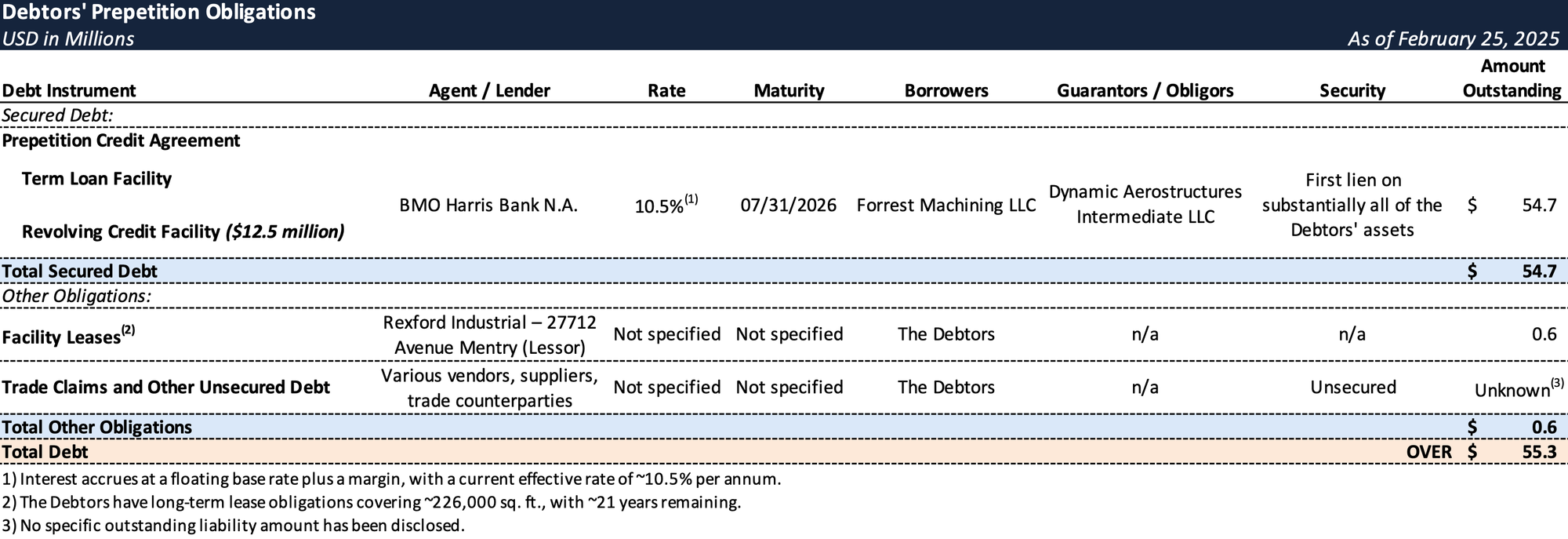

Prepetition Obligations

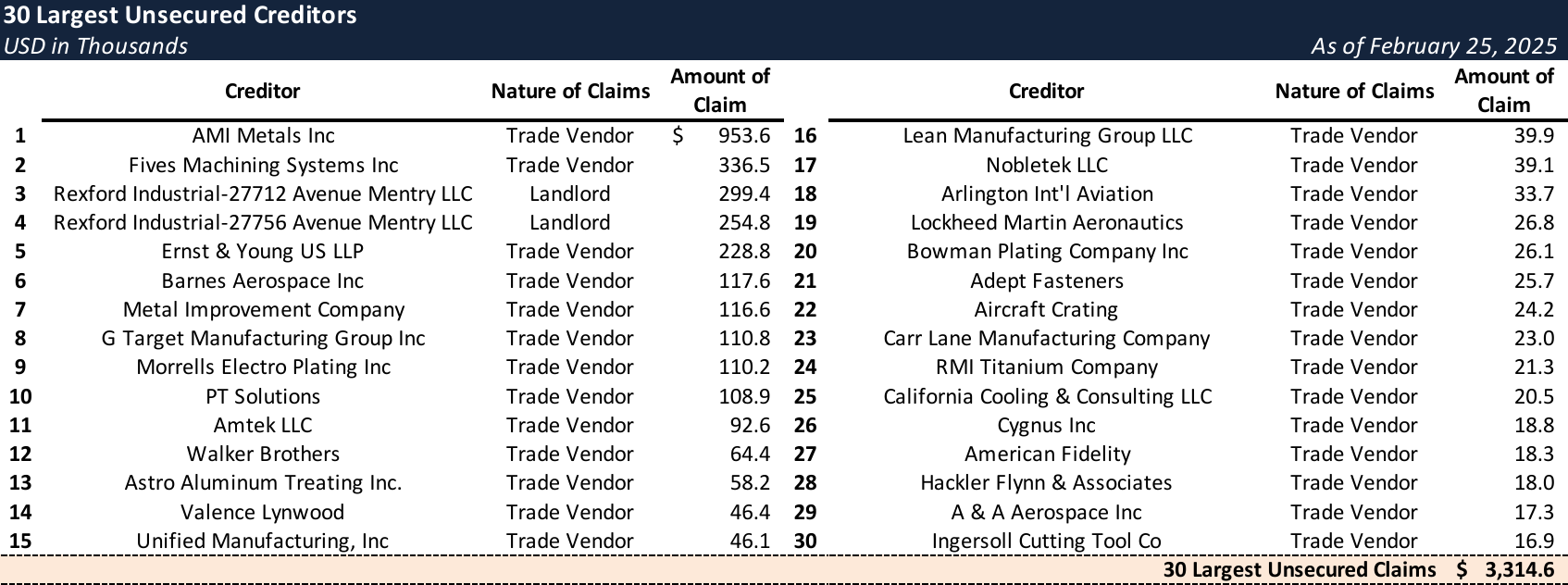

Top Unsecured Claims

Events Leading to Bankruptcy

Operating Challenges and Financial Deterioration

- FMI’s financial distress stems from years of operational setbacks and rising costs, exacerbated by inflation-driven margin compression and customer disruptions:

- Manufacturing and Quality Control Issues: Following its July 2021 acquisition by Endeavour Capital, FMI discovered legacy quality control issues tied to certain manufacturing practices. After self-reporting to customers, temporary stop-work orders were imposed, leading to sales disruptions and margin erosion.

- Inflationary Cost Pressures: FMI’s cost base rose sharply due to global inflation, particularly for key aerospace materials and outside processing costs. Existing long-term agreements lacked inflation protections, limiting its ability to pass price increases onto customers and further squeezing margins.

- Customer Production Halt: In 2023, an industry-wide stop-work order affecting a key aircraft program delayed revenue and earnings, adding to the financial strain.

- By late 2023, FMI defaulted on its debt obligations, missing interest payments and breaching covenants under its Prepetition Credit Agreement. In February 2024, its Prepetition Lender accelerated obligations, making all debt immediately due and payable, cutting off access to liquidity and forcing a restructuring.

Prepetition Restructuring Efforts and Sale Process

- In response to persistent cash flow challenges, FMI pursued cost-cutting and operational efficiency initiatives in 2024:

- Efforts included reducing machine downtime, reprogramming production processes, expanding business development efforts, and enhancing quality control measures.

- A reduction-in-force was implemented in November 2024, and discussions were initiated with major customers regarding potential pricing adjustments to offset rising costs.

- With its high debt burden and liquidity constraints persisting, FMI retained Configure Partners, LLC in April 2024 to explore strategic alternatives and run a sale process:

- FMI contacted 73 potential bidders, provided due diligence materials to 45 parties that executed NDAs, and received nine proposals or indications of interest.

- After evaluating the proposals, FMI determined that a section 363 sale under the Bankruptcy Code would maximize value for stakeholders. It entered into a stalking horse agreement with FMI Holdco LLC, an entity formed by Avem Partners, for a $16 million asset sale, subject to adjustments. This transaction represents the culmination of a nine-month marketing process.

DIP Financing and Bankruptcy Proceedings

- To fund operations during Chapter 11, FMI secured a $12.5 million DIP loan from CRG Financial LLC, structured as follows:

- $4 million is available upon entry of the Interim Order.

- The remaining funds will be accessible upon entry of the Final Order.

- The facility includes priming liens over Prepetition Lender collateral and superpriority administrative expense status, as well as limited consensual use of cash collateral.

Expedited Sale Timeline

- FMI has proposed a fast-tracked sale process aimed at ensuring business continuity while maximizing recoveries:

- Bid Deadline: April 7, 2025

- Auction (if necessary): April 9, 2025

- Sale Approval Hearing: April 11, 2025

- Transaction Close: April 15, 2025

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you’re already a subscriber and would like to receive timely filing alerts, please reach out and we’ll add you to the distribution list.