Case Summary: Food52 Chapter 11

Food52 has filed for Chapter 11 bankruptcy to pursue a sale of its assets after a failed expansion and sudden lender cash sweep triggered a liquidity crisis, supported by a $6.5 million stalking horse bid from America's Test Kitchen and $3.4 million in DIP financing.

Business Description

Headquartered in Brooklyn, NY, Food52, Inc. (the "Debtor" or "Company") is a diversified digital media and e-commerce platform operating at the intersection of food, home, and lifestyle. Founded as a community-centric recipe website, Food52 pioneered the "content-to-commerce" model by integrating editorial content, user-driven community, and curated product sales into a singular user experience.

- The Company’s core asset is its digital hub, which reaches an audience of approximately 37 million consumers monthly across its web and social channels.

- The platform drives high engagement through continuous content production, generating over 2,500 minutes of original video in 2025 and hosting thousands of community-submitted recipes.

The Commerce Model

The Food52 Shop, launched in 2013, fundamentally altered the Company's revenue profile by featuring shoppable links within content, creating a smooth funnel "from inspiration to action."

- Logistics: The marketplace predominantly utilizes an asset-light dropshipping model, partnering with over 100 artisanal makers and brands to minimize inventory holdings and risk.

- Assortment: The Company focuses on discovery, with 70% of the product mix sourced from small or underrepresented brands.

- Private Label: Food52 also develops and sells its own higher-margin, private-label products (branded "Five Two"), often using community input for crowdsourced R&D.

Brand Architecture and Financial Profile

By 2025, Food52’s business encompassed three distinct brand verticals: Food52 (the core platform), Schoolhouse, and Dansk Designs.

- Food52 (Marketplace): The flagship e-commerce vertical generated approximately $21.5 million in revenue in 2024.

- Food52 (Advertising Partnerships): The Company’s high-margin in-house creative studio generates sponsored content and marketing campaigns for blue-chip partners, contributing approximately $5.1 million in 2024 revenue.

- Schoolhouse: A vertically integrated manufacturer and retailer of premium home furnishings and lighting, acquired in 2021 for approximately $48 million.

- Schoolhouse operates an asset-heavy, manufacturing-centric model from its 125,000 sq. ft. factory in Portland, Oregon, complete with a skilled, unionized workforce.⁽¹⁾

- Schoolhouse was the Debtor’s largest revenue contributor in 2024, generating approximately $44.7 million in sales.

- Dansk Designs: A heritage tabletop and cookware brand established in 1954, acquired in 2021.

- Dansk functions primarily as an intellectual property play, valued for its mid-century Danish-inspired designs (e.g., Købenstyle cookware).

- Dansk is the smallest vertical, contributing approximately $3.4 million in revenue in 2024.

The Company generated ~$74.7 million of revenue in 2024, down materially from ~$160 million in 2021 (last comparable year available), and continued to burn cash amid high fixed costs and operational complexity.⁽²⁾

Food52, Inc. filed for Chapter 11 protection on December 29, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the District of Delaware, reporting $1 million to $10 million in assets and $10 million to $50 million in liabilities.

⁽¹⁾ In May 2025, the building was listed for sale or lease following the Company’s issuance of an 18-month notice to vacate for a planned operational relocation.

⁽²⁾ As of the Petition Date, the Company had terminated the majority of its workforce, retaining only a skeleton crew to maintain core operations through the Chapter 11 sale process.

Corporate History

Food52 was founded in 2009 by Amanda Hesser (former New York Times food editor) and Merrill Stubbs (food writer). The platform quickly established itself, launching its e-commerce shop in 2013 and securing seed and venture capital funding throughout the 2010s to expand its content studio and operations.

The TCG Era and Expansion

- A pivotal turning point occurred in September 2019 when The Chernin Group (“TCG”), a Los Angeles-based private equity firm, acquired a majority stake in Food52 for $83 million.

- As of the Petition Date, TCG affiliates owned approximately 73% of Food52’s equity on a fully-diluted basis, with the remaining interest held by approximately 78 other stockholders, none of whom maintain a stake of 10% or more.

- Backed by TCG and fueled by pandemic-era e-commerce growth, Food52 embarked on an ambitious acquisition spree in 2021 to accelerate its presence in home goods:

- In May 2021, it acquired Dansk Designs from Lenox Corporation.

- In December 2021, it acquired Schoolhouse Electric Co. (Schoolhouse) for $48 million in cash and stock, funded by an incremental $80 million investment from TCG, expanding the addressable market beyond the kitchen and briefly supporting an approximately threefold increase in valuation.

Leadership and Strategic Instability

The period following the acquisitions was marked by significant executive turnover and strategic drift, compounding operational challenges:

- Co-founder Amanda Hesser transitioned out of the CEO role in 2023.

- Alex Bellos, appointed CEO in late 2022 to professionalize retail operations, departed abruptly in late 2023.

- In April 2024, Erika Ayers Badan (former CEO of Barstool Sports) was appointed CEO.

- By mid-2025, co-founder Hesser formally stepped away entirely (outside of a board role), marking the end of the founders' active involvement.

Operations Overview

Food52’s operational structure is defined by fragmentation and high complexity, resulting from the integration of an asset-light digital platform with an asset-heavy manufacturing entity (Schoolhouse), exacerbated by outdated systems and high fixed costs.

Real Estate and Production Footprint

- Brooklyn, NY Headquarters: The Company's primary corporate office and production hub is a 41,000 sq. ft. studio located at Dock 72 in the Brooklyn Navy Yard, housing test kitchens, photo/video studios, and event space. This facility was leased in 2021 for a period of rapid expansion.

- Portland, OR Schoolhouse Facility: Inherited through the Schoolhouse acquisition, this 125,000 sq. ft. facility serves as the manufacturing plant, administrative offices, and showroom for the Schoolhouse brand, requiring management of raw material supply chains and a unionized labor force (IBEW Local 48). The facility was listed for sale in May 2025.

Bifurcated Logistics Network

The Debtor manages two fundamentally different supply chain models which prevented economies of scale and integration efficiencies:

- Dropship Model (Food52): Capital efficient and offers a broad catalog, but relies on third-party vendors for fulfillment, resulting in variable shipping speeds and customer experience issues.

- Manufacturing/Inventory Model (Schoolhouse/Dansk): Requires holding significant finished goods inventory, demanding detailed raw material procurement and demand planning, thereby creating a large cash conversion cycle drag that proved highly vulnerable to the liquidity crisis.

Technology and Operational Deficiencies

Despite heavy investment between 2020 and 2022, the Company’s custom technology platform was described in court filings as "outdated" and lacking "scalable systems."

- The lack of integration and technical debt led to significant friction in the user experience, including issues with login functionality, loss of saved user data (recipe boxes), and slow processing of orders/refunds for acquired brands like Schoolhouse.

Workforce Reduction (RIFs)

The Company’s workforce was drastically reduced following attempts to right-size the cost structure and subsequent liquidity pressures:

- A major restructuring in March 2025 cut 40% of the staff (from ~140 to ~90).

- Following a cash sweep by the Debtor’s secured lender, Avidbank ("Avid"), on December 15, 2025, the Debtor implemented immediate workforce reductions, terminating approximately 60% of employees on December 17, 2025 and an additional 20% on December 26, 2025, leaving only a minimal workforce to sustain limited operations and avoid an immediate shutdown.

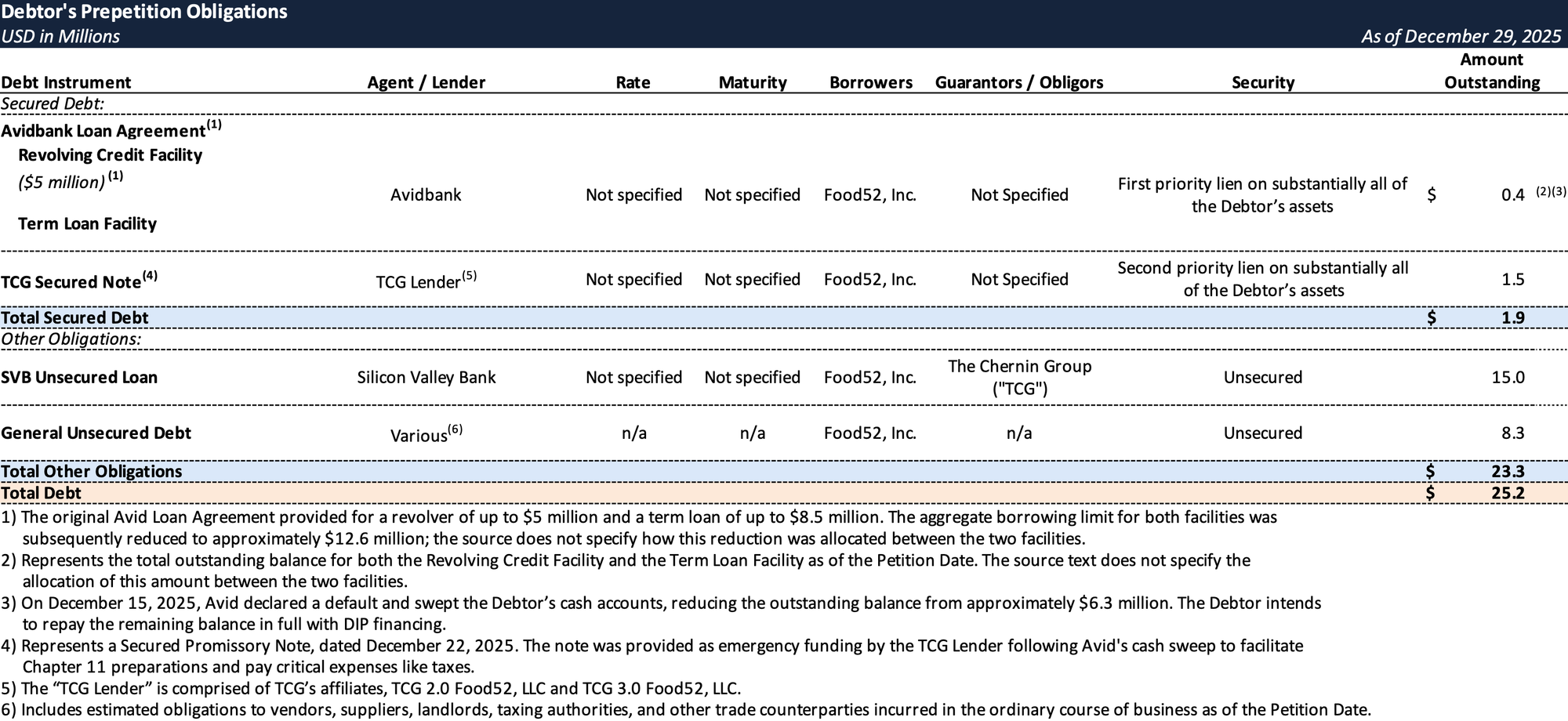

Prepetition Obligations

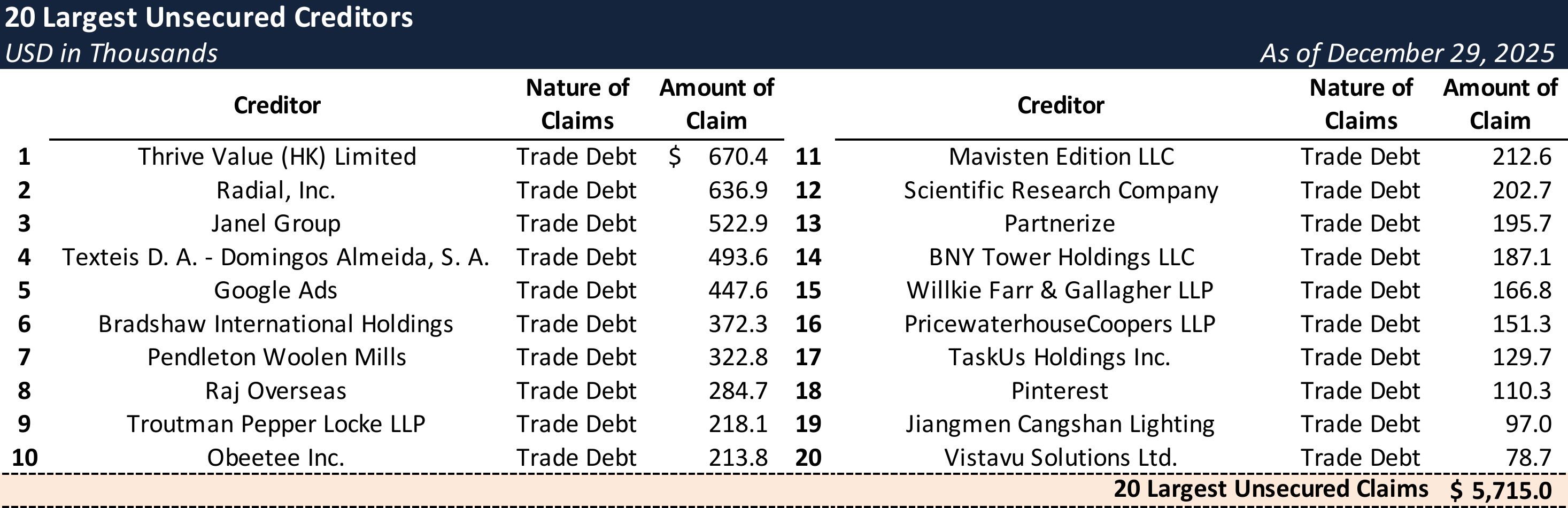

Top Unsecured Claims

Events Leading to Bankruptcy

Post-Pandemic Challenges and Operational Headwinds

- While the Company initially capitalized on the COVID-19 "home and food" boom by deploying capital to drive aggressive growth, it struggled to pivot to a sustainable profitability model as consumer demand normalized:

- The Company managed three distinct brands—Food52, Schoolhouse, and Dansk Designs—across two offices separated by 3,000 miles. These segments operated with few synergies, unique business models, and significant structural inefficiencies.

- Despite efforts by new management appointed in 2024 to curate assortments and improve supply chains, the business remained burdened by high fixed costs, unfavorable legacy contracts, and outdated technology.

- The transition from a "growth-at-all-costs" strategy to profitable growth was hindered by external headwinds, including tariffs and rising overhead, alongside internal challenges such as executive turnover and cultural misalignment across brands.

Prepetition Strategic Review and Marketing Process

- In the summer of 2025, the Board initiated a review of strategic alternatives to raise capital or sell business segments, supported by an incremental equity commitment from TCG to bridge the process:

- In September 2025, the Company retained Core Advisors LLC and Buchbinder & Co. LLC to solicit interest from strategic buyers and special situation investors. The process involved outreach to over 200 parties, resulting in 35 non-disclosure agreements.

- By mid-December 2025, the Company had received seven indications of interest (IOIs). Based on these proposals and TCG’s commitment, the Company anticipated remaining in good standing and generating sufficient proceeds to repay its $6.3 million obligation to secured lender Avid by early 2026.

Precipitating Liquidity Crisis and Lender Actions

- The Company’s financial position deteriorated rapidly following unexpected actions by its senior lender:

- Despite a productive meeting on December 12, 2025, where Avid acknowledged the Company's progress, Avid swept substantially all of the Debtor’s cash—including payroll and tax trust funds—without warning on December 15, 2025.

- Although the Company secured the return of funds for payroll and partial health insurance premiums, the sweep created an immediate liquidity crisis, rendering it near impossible to determine accurate cash balances or maintain ordinary course operations.

Emergency Stabilization and Bridge Financing

- In response to the sudden loss of liquidity, the Company executed emergency cost-cutting measures and sought interim funding to avoid immediate liquidation:

- Workforce reductions were implemented immediately, with approximately 60% of employees terminated on December 17, 2025, followed by an additional 20% on December 26, 2025.

- On December 22, 2025, the TCG Lender provided a $1.505 million secured bridge loan. These funds enabled the Company to pay tax obligations swept by Avid, retain restructuring professionals, and fund the preparation of Chapter 11 filings.

DIP Financing and Proposed Sale Transaction

- With limited liquidity and no other actionable offers, the Company pivoted to an in-court sale process anchored by America’s Test Kitchen, LP (via its subsidiary F52, LLC):

- Stalking Horse Bid: F52, LLC agreed to serve as the stalking horse bidder with a total purchase price of $6.5 million, a portion of which is expected to be satisfied through a credit bid of the DIP obligations, plus the assumption of certain liabilities.

- DIP Financing: To fund operations during the sale, F52 is providing a $3.42 million DIP facility, with $1.92 million available on an interim basis. A portion of these proceeds is earmarked to fully satisfy remaining obligations to Avid, leaving TCG as the remaining prepetition secured creditor.

- Sale Timeline: The Company intends to execute a 35-day marketing process pursuant to Section 363 of the Bankruptcy Code, targeting a sale hearing on or about February 2, 2026, to preserve the business as a going concern.

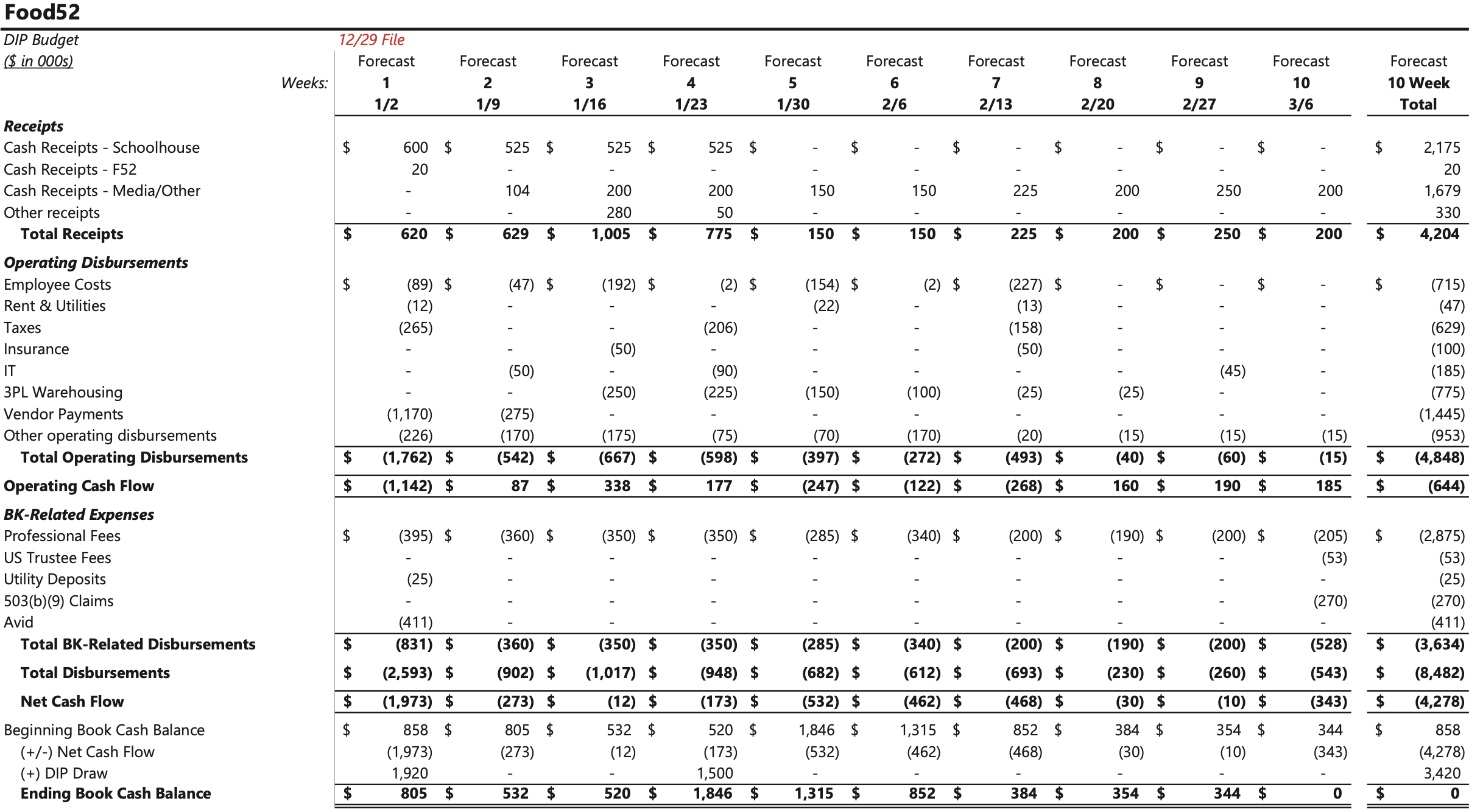

Initial DIP Budget

Key Parties

- Young Conaway Stargatt & Taylor, LLP (counsel); Core Advisors LLC (investment banker); Meru, LLC (financial advisor); Kurtzman Carson Consultants, LLC dba Verita Global (claims agent).

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.