Case Summary: Fortress Holdings Chapter 11

Fortress Holdings has filed for Chapter 11 bankruptcy to prevent foreclosure and complete the Chariot, projected for Q3 2025 completion.

Business Description

Fortress Holdings, LLC ("Fortress" or the "Debtor") owns three key properties in New Jersey that collectively form the Chariot, a restaurant and catering facility.

- These properties are located at 555 Preakness Avenue, 561 Preakness Avenue, and 322-324 Berkshire Avenue in Totowa and Paterson.

The facility comprises 80,000 square feet over seven floors, featuring a Kosher kitchen and a rooftop restaurant with views of New York City.

- An appraisal by Mid-Atlantic Appraisal, Inc. valued the Chariot at $42 million as of October 1, 2024.

- Bogota Savings Bank ("BSB"), the Debtor’s secured creditor, obtained an appraisal dated April 6, 2023 by Cushman & Wakefield that reported an “As Is” market value of $28 million.

- In addition, Fortress owns a vacant lot at 381 Linwood Avenue adjacent to The Chariot; this lot is not included in the appraisal.

Fortress filed for Chapter 11 protection on Jan. 30 in the U.S. Bankruptcy Court for the District of New Jersey. As of the Petition Date, the Debtor reported $42 million in assets and $26.2 million in liabilities.

Corporate History

Fortress is equally owned by two members, Paul Qassis and Majid Krikor, each holding 50% interest.

- Paul manages day-to-day operations, while Majid has invested $5 million.

Balcony Holdings, LLC, a non-Debtor entity owned by Paul Qassis, holds the necessary liquor license for the Chariot.

Operations Overview

The Chariot transformed from a 20,000 sq ft office building into an 80,000 sq ft facility with seven floors, including a Kosher kitchen and rooftop restaurant.

The Chariot is nearing completion and is in the final stages of obtaining a temporary certificate of occupancy.

- It is designed to accommodate weddings and other galas with a capacity of over 600 guests and parking for 200 vehicles.

- All final land use approvals were obtained in 2020 after years of development.

Construction was funded by a $11 million loan and significant investments from members.

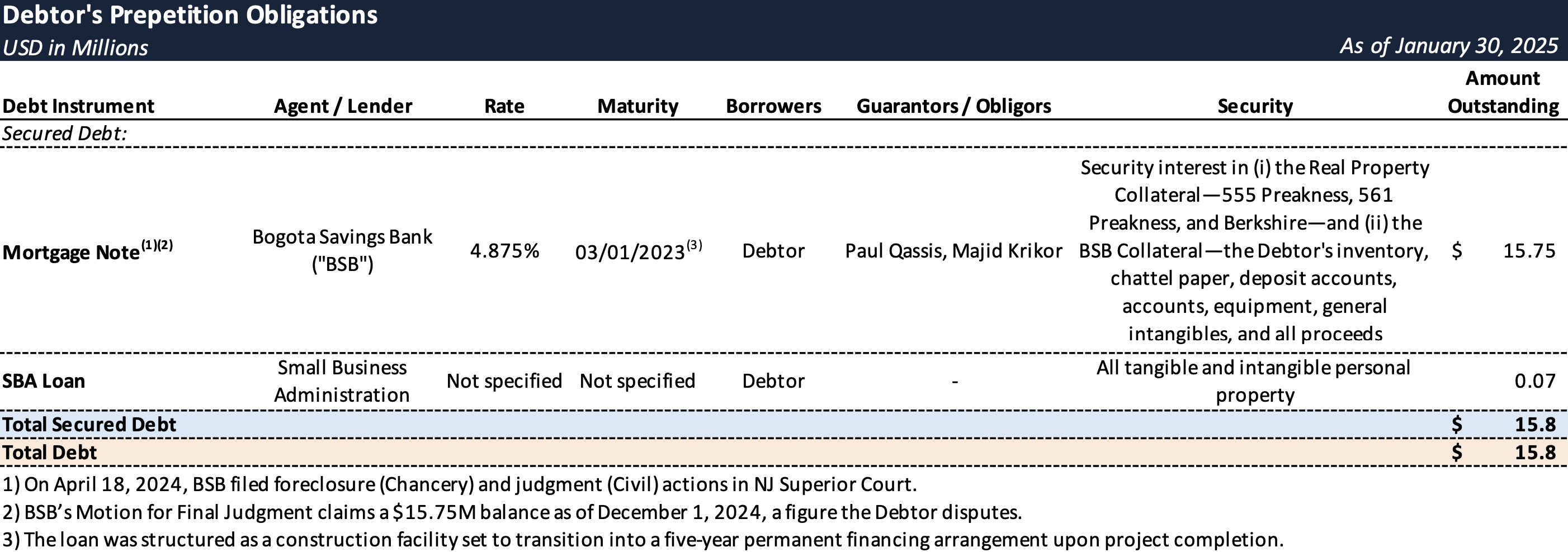

Prepetition Obligations

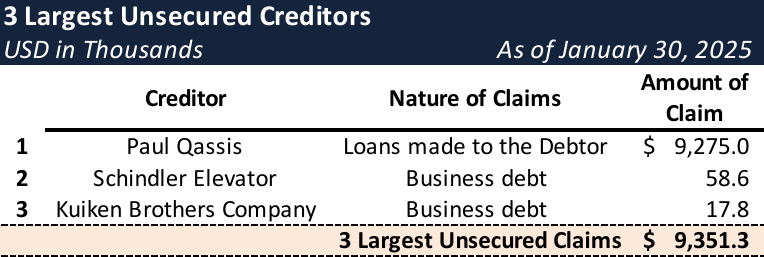

Top Unsecured Claims

Events Leading to Bankruptcy

Loan Challenges and Foreclosure Actions

- On August 11, 2021, BSB provided Fortress with a construction loan structured to convert into a five‑year permanent facility upon project completion.

- The loan included an interest reserve in excess of $700,000 and carried an initial rate of Prime plus 1.625 percent, with interest payments scheduled from September 1, 2021 until March 1, 2023—when the full balance would have been due.

- Subsequent rate spikes have significantly increased financing costs.

- Following the maturity of the interest period, BSB demanded immediate repayment and, on April 18, 2024, initiated foreclosure and related legal actions while also requiring that the Chariot be listed for sale.

- These actions have materially impaired Fortress’ ability to complete the project and generate the cash flow needed for repayment or refinancing.

Project Progress and Commercialization Milestones

- Fortress secured all final land use approvals in 2020 following several years of development.

- On January 27, 2025, Fortress met with representatives from the Borough of Totowa and other officials to finalize the requirements for a temporary certificate of occupancy—a critical step toward initiating operations.

- According to the Debtor, the Chariot remains on track for a Q3 2025 opening.

Chapter 11 Filing and Restructuring Goals

- In response to liquidity constraints and foreclosure actions, Fortress filed for Chapter 11 protection on January 30, 2025.

- The filing is designed to provide the necessary breathing room to continue operations and protect asset value.

- The reorganization plan focuses on completing the construction of the Chariot and launching the restaurant and catering facility while operating in the ordinary course.

- Fortress is committed to working collaboratively with creditor constituencies to advance a plan of reorganization that maximizes asset value and establishes a sustainable path forward.

DIP Financing and Operational Continuity

- The Debtor will rely on existing cash and future revenues to support operations under a structured DIP operating budget. In parallel, the Debtor is actively pursuing court-approved DIP financing to bolster liquidity and ensure the continuity of business activities throughout the restructuring process.

Subscribe for access to coverage of all Chapter 11 bankruptcy cases with liabilities exceeding $10 million.