Filing Alert: Global Clean Energy Chapter 11

Global Clean Energy Files Chapter 11 in Southern District of Texas

Update (April 27, 2025): Bondoro has published a full case summary for the Global Clean Energy Chapter 11 filing.

Global Clean Energy Holdings, Inc. and its debtor affiliates⁽¹⁾, a Bakersfield, CA-based vertically integrated renewable energy company focused on the development and production of ultra‑low carbon fuels from proprietary non‑food oilseed feedstocks such as Camelina, filed for Chapter 11 protection on Apr. 16 in the U.S. Bankruptcy Court for the Southern District of Texas.

The filing follows significant delays and cost overruns related to the construction of its core Bakersfield Facility and ensuing disputes with EPC contractor CTCI Americas, Inc. ("CTCI"), which asserted approximately $949 million in claims and filed a mechanic’s lien.

Prepetition restructuring efforts included marketing processes led by Lazard targeting investment in its Upstream Business (starting July 2024) and a sale of the company (starting December 2024), which did not yield actionable bids by the February 2025 deadline.

Subsequently, the debtors negotiated a restructuring support agreement (RSA) with key consenting stakeholders including an ad hoc group representing 96% of its approximately $1.1 billion prepetition term loans, CTCI, and prepetition RCF lender Vitol Americas Corp ("Vitol"). The RSA underpins a proposed plan contemplating $2.1 billion in various take-back debt facilities, a settlement resolving the CTCI dispute involving debt and 55.6% of new preferred equity, and the conversion of prepetition term loan claims into debt, 44.4% of new preferred equity, and 100% of new common stock.

To fund the cases toward a targeted effective date within 120 days, the company is seeking approval of $250 million in multi-tranche, superpriority, priming DIP financing, comprising a $100 million RCF from Vitol, a $75 million term loan from prepetition term lenders, and a $75 million CTCI payment facility.

The company reports $1.6 billion in both assets and liabilities. The filing indicates that no funds will be available for distribution to unsecured creditors after administrative expenses are paid. The case number is 25-90113.

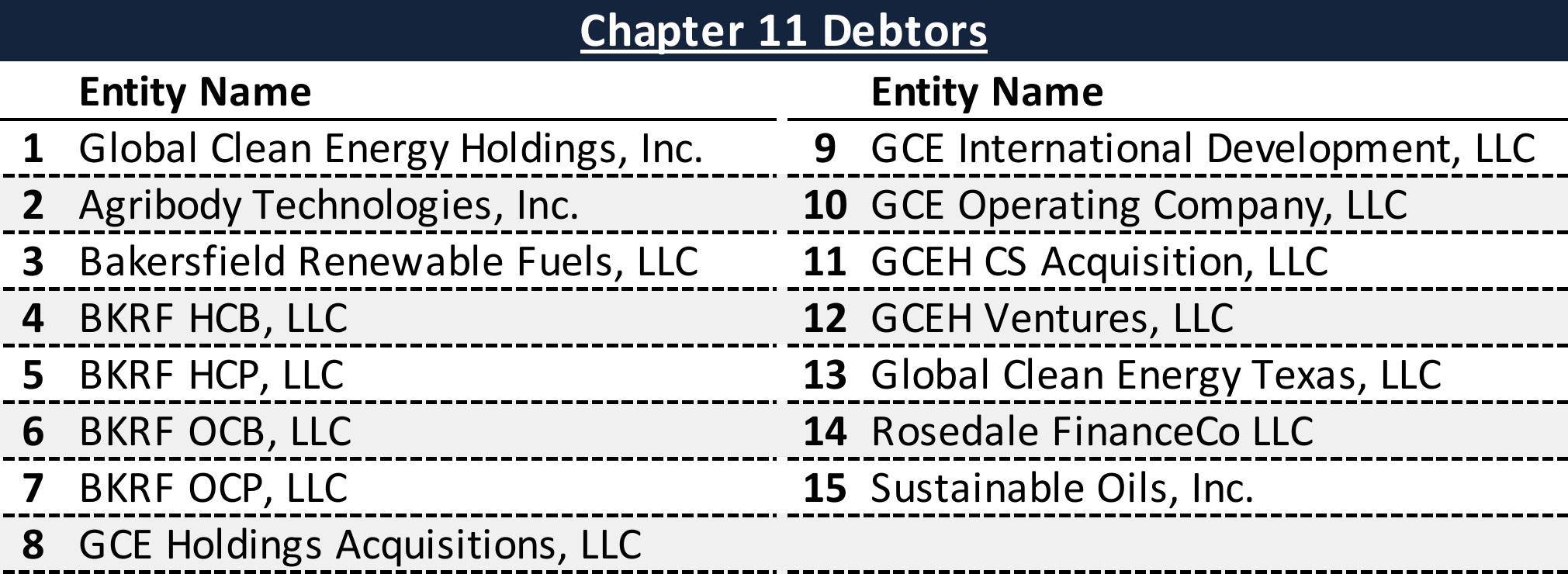

⁽¹⁾ For a complete list of debtor entities, see the Chapter 11 Debtors table.

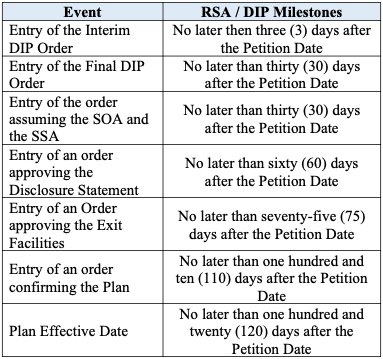

Proposed Timeline

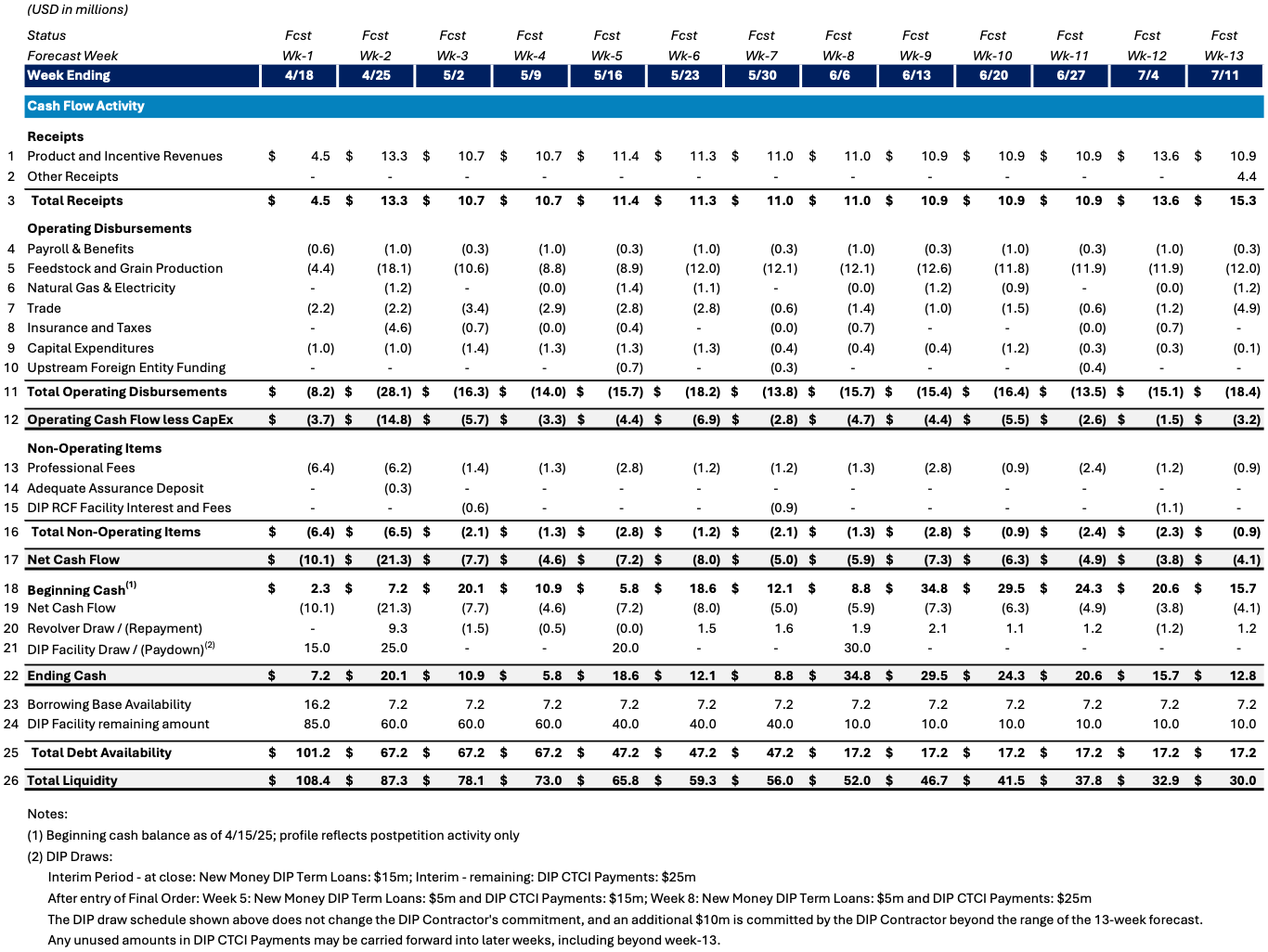

Initial Budget

Chapter 11 Debtors

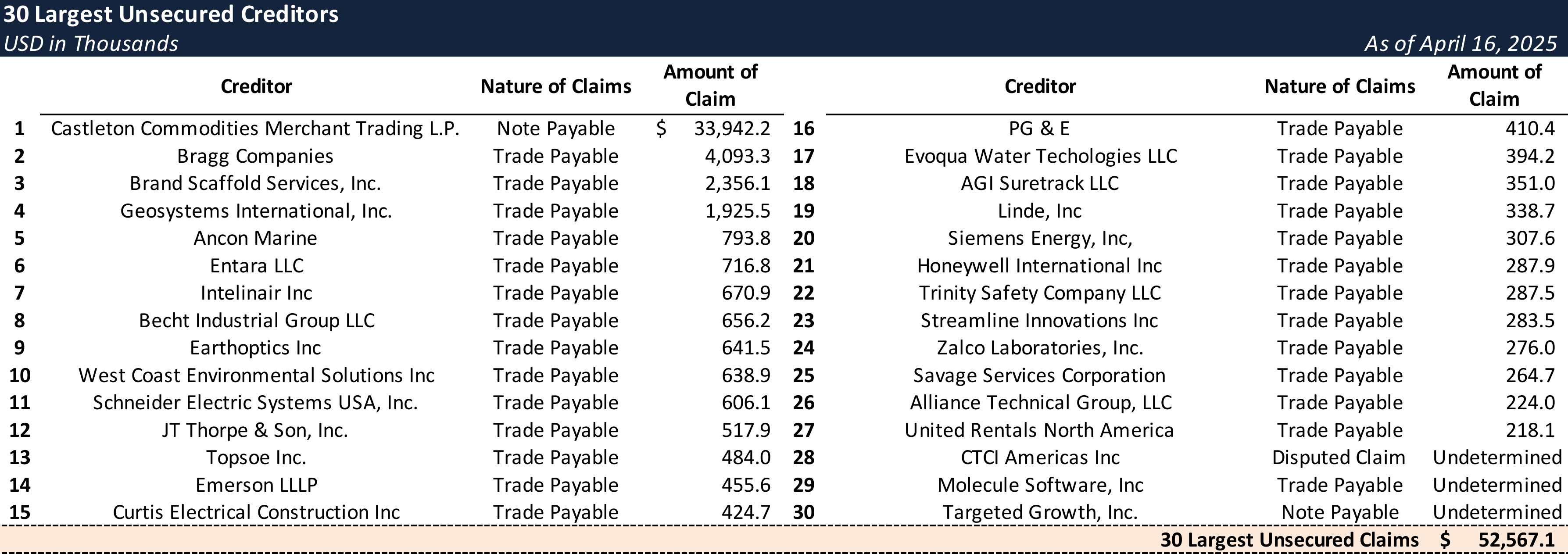

Top Unsecured Claims

Key Parties

Local Bankruptcy Counsel:

- Jason L. Boland

- Norton Rose Fulbright US LLP

- Email: jason.boland@nortonrosefulbright.com

General Bankruptcy Counsel:

- Kirkland & Ellis LLP and Kirkland & Ellis International LLP

Investment Banker:

- Lazard Frères & Co. LLC

Financial Advisor:

- Alvarez & Marsal North America, LLC

Appraisal Advisor:

- Hilco Valuation Services, LLC

Signatories:

- Noah Verleun – Chief Executive Officer

Claims Agent:

Equity Security Holders:

- Richard Palmer – 24.0% Equity Interest

- Michael Zilkha – 8.6% Equity Interest

- Pacific Sequoia Holdings LLC – 8.0% Equity Interest

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.