Filing Alert: Global Joint Venture Chapter 11

Global Joint Venture Files Chapter 11 in Eastern District of New York

Global Joint Venture, Inc. (the "Debtor"), a Forest Hills, NY-based real estate developer and owner of a mixed-use commercial condominium in Manhattan, filed for Chapter 11 protection on May 1 in the U.S. Bankruptcy Court for the Eastern District of New York, Brooklyn Division.

The filing is driven by the Debtor’s inability to obtain a further extension from its sole secured lender, Emerald Creek Capital 3 LLC, beyond May 2 to adjourn a UCC foreclosure sale on equity interests securing approximately $32 million in mortgage debt. The debt is secured by a mixed-use condominium property located at 139-141 Bowery, New York, comprising 18 residential units, 14 commercial offices, one community facility, and one retail space. The property recently completed its conversion and received a certificate of occupancy in October 2024, along with Attorney General approval for unit sales.

The property was appraised last year with a fully stabilized value exceeding $50 million, and the Debtor currently estimates its “as is” value at $35 million to $40 million. A $35 million purchase and sale agreement has been executed, subject to diligence and supported by a $1 million deposit. Alternatively, the Debtor is pursuing a potential refinancing. The filing was made with the lender’s knowledge following weeks of active negotiations.

The Debtor reports $10 million to $50 million in both assets and liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The case number is 25-42139.

Exhibits

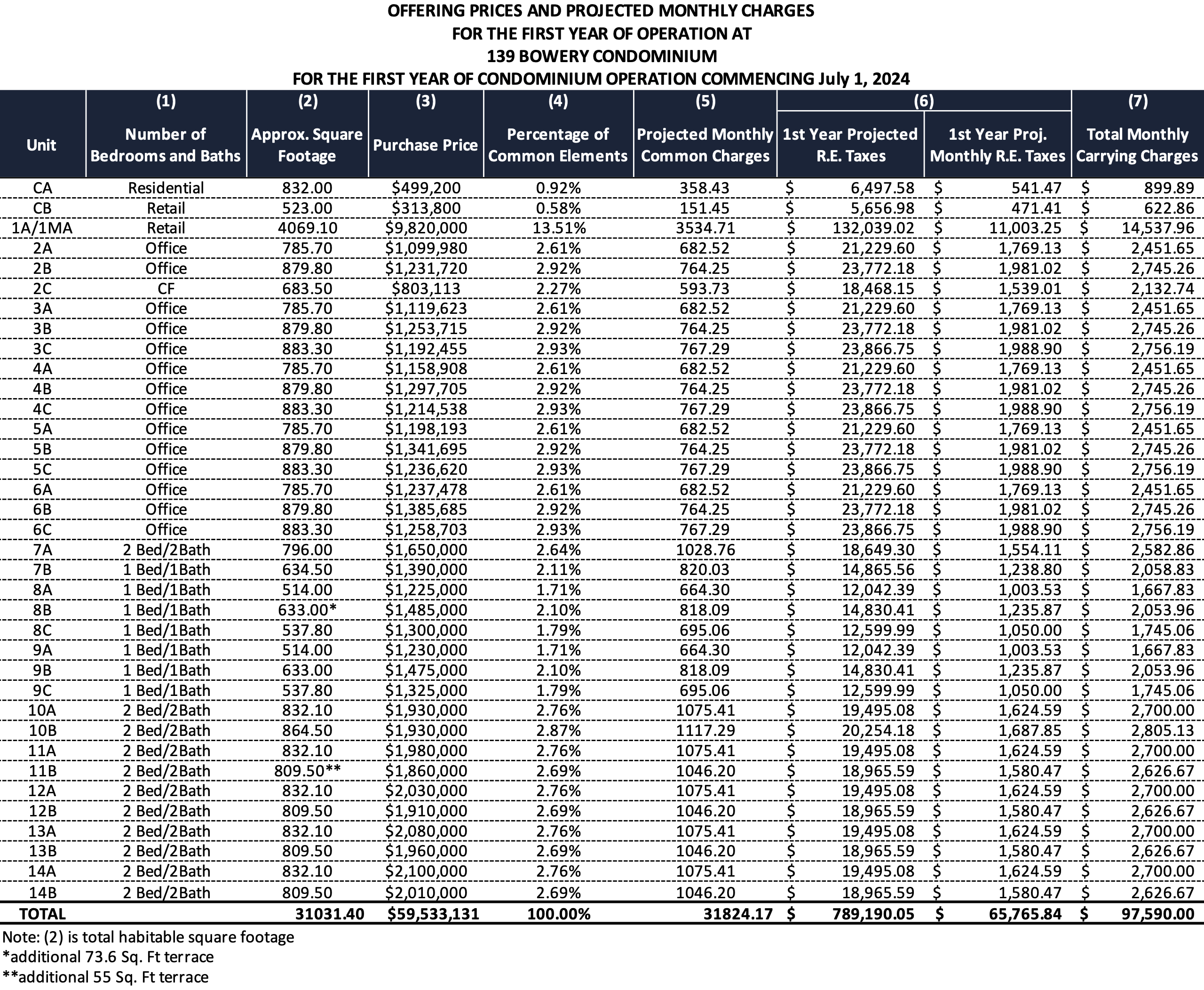

Detailed Unit Pricing and Projected Monthly Charges

Key Parties

Counsel:

- Kevin Nash

- Goldberg Weprin Finkel Goldstein LLP

- Email: [email protected]

Signatories:

- Hung Kwong Leung – President

Real Estate Broker:

- BKREA

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.