Filing Alert: Grand River Medical Group Real Estate Arm Files Chapter 11

Grand River Medical Group Real Estate Arm Files Chapter 11 in Northern District of Iowa

Update (Oct. 30, 2025): A comprehensive case summary is now available for the Chapter 11 bankruptcy filing of GRMG Real Estate L.L.P.

GRMG Real Estate L.L.P. and affiliate DMB-GRMG Medical Building Investment LLC, which own substantially all of Grand River Medical Group’s commercial real property in Dubuque, Iowa, and southwest Wisconsin, filed for Chapter 11 protection on Oct. 30 in the U.S. Bankruptcy Court for the Northern District of Iowa.

The filing is the second step in a two-phase restructuring that began with the May 2025 sale of Grand River’s clinical operations to UnityPoint Clinic and JWDR Dialysis, through which the operating practice was transferred and the buyers agreed to lease the debtors’ real estate. The chapter 11 cases are intended to restructure more than $12 million in secured debt owed to Premier Bank and eliminate equity redemption / repurchase obligations that were triggered when physician-owners departed the group.

The debtors’ distress followed physician departures that reduced revenue and left the real-estate entities servicing debt on properties no longer fully utilized. The prepackaged plan, supported by key lenders, would move the real estate into newly formed entities and implement new financing to preserve the estimated $12 million to $15 million of equity value for all GRMG physician-owners—current and departed—on a pro rata basis, rather than forcing value-destructive foreclosure or piecemeal liquidation. The debtors are also seeking authority to sell the vacant Lake Ridge Property for $720,000.

GRMG Real Estate L.L.P. reports $10 million to $50 million in both assets and liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The case number is 25-01208.

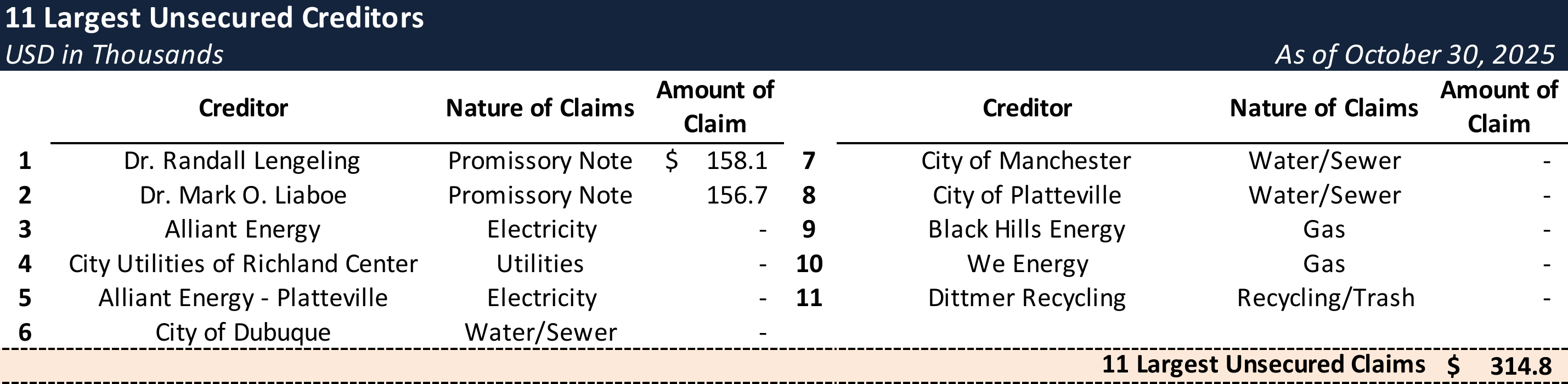

Top Unsecured Claims

Key Parties

Counsel:

- Roy Leaf

Nyemaster Goode, P.C.

Email: [email protected]

Signatories:

- Dr. Ronald Iverson – Authorized Partner

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.