Filing Alert: Greentree Estates Chapter 11

Owner of Ocala, FL, Mobile Home and RV Park Oaktree Village/Greentree Estates Files Chapter 11 in Southern District of New York

ASAP Highline Ocala, LLC ("ASAP") and its parent holding company, Oaktree Ocala JV, LLC ("Oaktree", together with ASAP, the "Debtors")⁽¹⁾, filed for Chapter 11 protection on July 29 in the U.S. Bankruptcy Court for the Southern District of New York. ASAP owns and operates Oaktree Village/Greentree Estates, a 46.79-acre mobile home and RV park in Ocala, FL, which it acquired in March 2022 for $15 million.

The filing was precipitated by a dispute with ASAP’s lender, CPIF MRA, LLC ("CPIF"), and an imminent UCC foreclosure sale. According to court filings, ASAP’s business plan was to renovate and stabilize the property, which consists of 140 manufactured homes and 221 apartment units. To finance the acquisition and upgrades, ASAP entered into an $18 million loan agreement with CPIF in November 2022.

The Debtors allege that CPIF failed to fund the full loan amount, withholding approximately $4.36 million in future advances for the renovations and a $117,000 tax escrow. This funding shortfall allegedly prevented ASAP from completing the necessary upgrades, leading to operating losses and an inability to refinance the loan before its November 2024 maturity.

Following the loan’s maturity, CPIF initiated a foreclosure action against the property and later unilaterally withdrew approximately $723,000 from ASAP’s operating account. CPIF then scheduled an Article 9 UCC sale of Oaktree’s 100% membership interest in ASAP for July 29, 2025.

The Debtors state the Chapter 11 filing was a defensive measure to halt the UCC sale, which would have allowed CPIF to take control of the property by credit-bidding its disputed claim and bypassing a judicial resolution of ASAP’s defenses and counterclaims. The bankruptcy is intended to provide a structured forum to resolve the disposition of the property through either a sale or refinancing.

ASAP reports $10 million to $50 million in both assets and liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The cases are being jointly administered under Case No. 25-22701.

⁽¹⁾ Oaktree is a holding company and sole member of ASAP.

Prepetition Obligations

ASAP’s prepetition liabilities include a disputed mortgage loan held by CPIF, originally issued in November 2022 in the principal amount of $18 million. The loan bears interest at 11.5% and is secured by a first-priority lien on the Ocala property, an assignment of leases and rents, and a pledge of 100% of ASAP’s equity by Oaktree.

The note matured on November 17, 2024. CPIF asserts that more than $14.2 million is outstanding. The Debtors dispute the claim, characterizing it as disputed, contingent, unliquidated and subject to setoff.

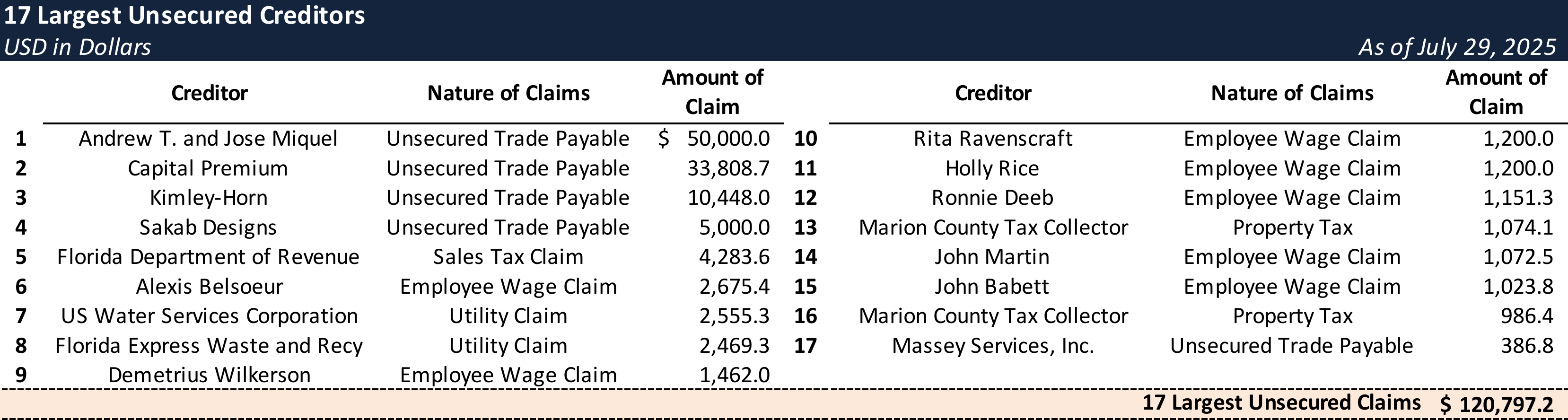

The Debtors also list approximately $135,000 in general unsecured claims. No other funded debt is scheduled.

Top Unsecured Claims

Key Parties

Counsel:

- Kenneth M. Lewis

- Whiteford, Taylor & Preston L.L.P.

- Email: [email protected]

Signatories:

- Raphael C. Milstein – Authorized Signatory

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.