Filing Alert: Grow Schools Chapter 11

Grow Schools Files Chapter 11 in District of Delaware

Charter School Capital, Inc. (dba Grow Schools), a Beaverton, OR-based provider of financing and support services to charter schools, filed for Chapter 11 protection on Jun. 8 in the U.S. Bankruptcy Court for the District of Delaware.

The filing follows a two-year liquidity squeeze driven by a steep decline in the company's “Money to Run Your School” receivables business (approximately $32.6 million financed in 2024 versus roughly $300 million pre-COVID), higher interest rates and property-carrying costs that stalled real estate exits, and a $2.9 million arbitration award entered on May 22, 2025, in favor of preferred shareholder Orthogon⁽¹⁾.

The company states that the Chapter 11 filing will allow it to pursue an expedited §363 going-concern sale. It has retained Rock Creek Advisors as its investment banker and is negotiating stalking-horse terms with a strategic buyer that submitted a prepetition term sheet.

The company reports $10 million to $50 million in both assets and liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The case number is 25-11016.

⁽¹⁾ Orthogon Charter Special Opportunities, LLP, Orthogon Charter Special Opportunities II, LP, and Orthogon Charter Special Opportunities III, LLC (collectively “Orthogon”).

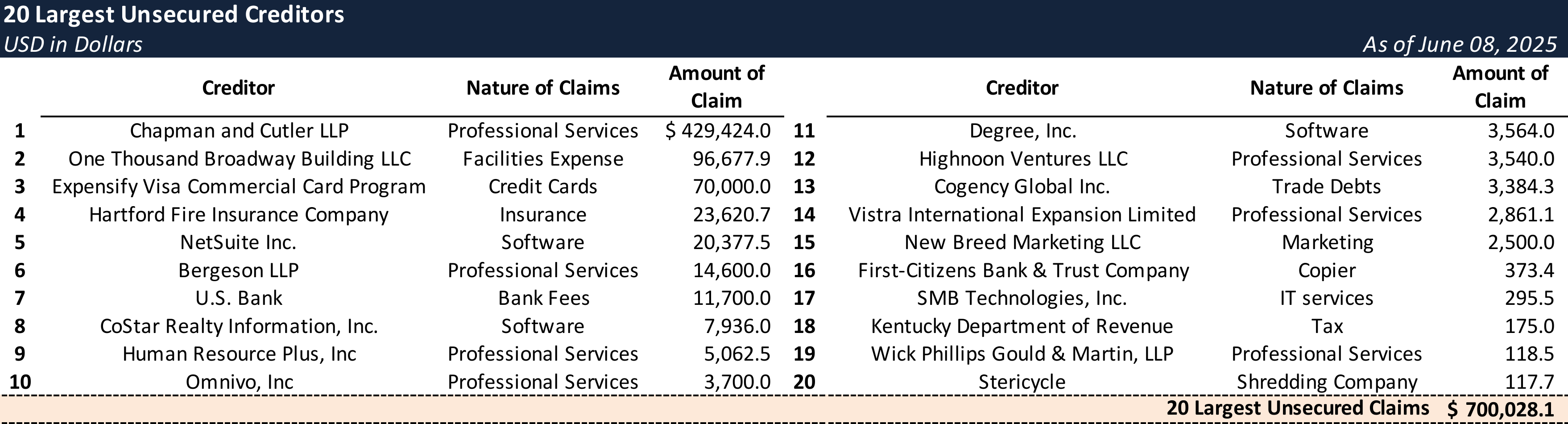

Top Unsecured Claims

Key Parties

Bankruptcy Co-Counsel:

- Aaron H. Stulman

- Potter Anderson & Corroon LLP

- Email: [email protected]

Bankruptcy Co-Counsel:

- Goodwin Procter LLP

Signatories:

- Stuart Ellis – Chief Executive Officer

Claims Agent:

Equity Security Holders:

- Orthogon (various entities) – 52.1% Equity Interest

- Stuart Ellis – 16.8% Equity Interest

- Bradley W. Coburn – 14.6% Equity Interest

- Other Minority Holders – 16.5% Equity Interest

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.