Case Summary: Harvest Sherwood Chapter 11

Harvest Sherwood has filed for Chapter 11 bankruptcy to finalize its wind-down and monetize remaining assets, including its Dallas facility and key litigation claims, with support from a $105 million DIP from existing lenders.

Business Description

Headquartered in Detroit, MI, Harvest Sherwood Food Distributors, Inc., along with its affiliated Debtors⁽¹⁾ (collectively, "Harvest Sherwood" or the "Company"), was, prior to its April 2025 shutdown⁽²⁾, the largest independent wholesale food distributor in the United States. The Company generated approximately $4 billion in annual revenue by distributing a wide array of food products, including beef, pork, poultry, seafood, deli items, and bakery products.

- Harvest Sherwood served a diverse customer base of over 6,000 clients, including independent food retailers, regional and national grocery chains, ethnic grocers, foodservice distributors, and cruise lines.

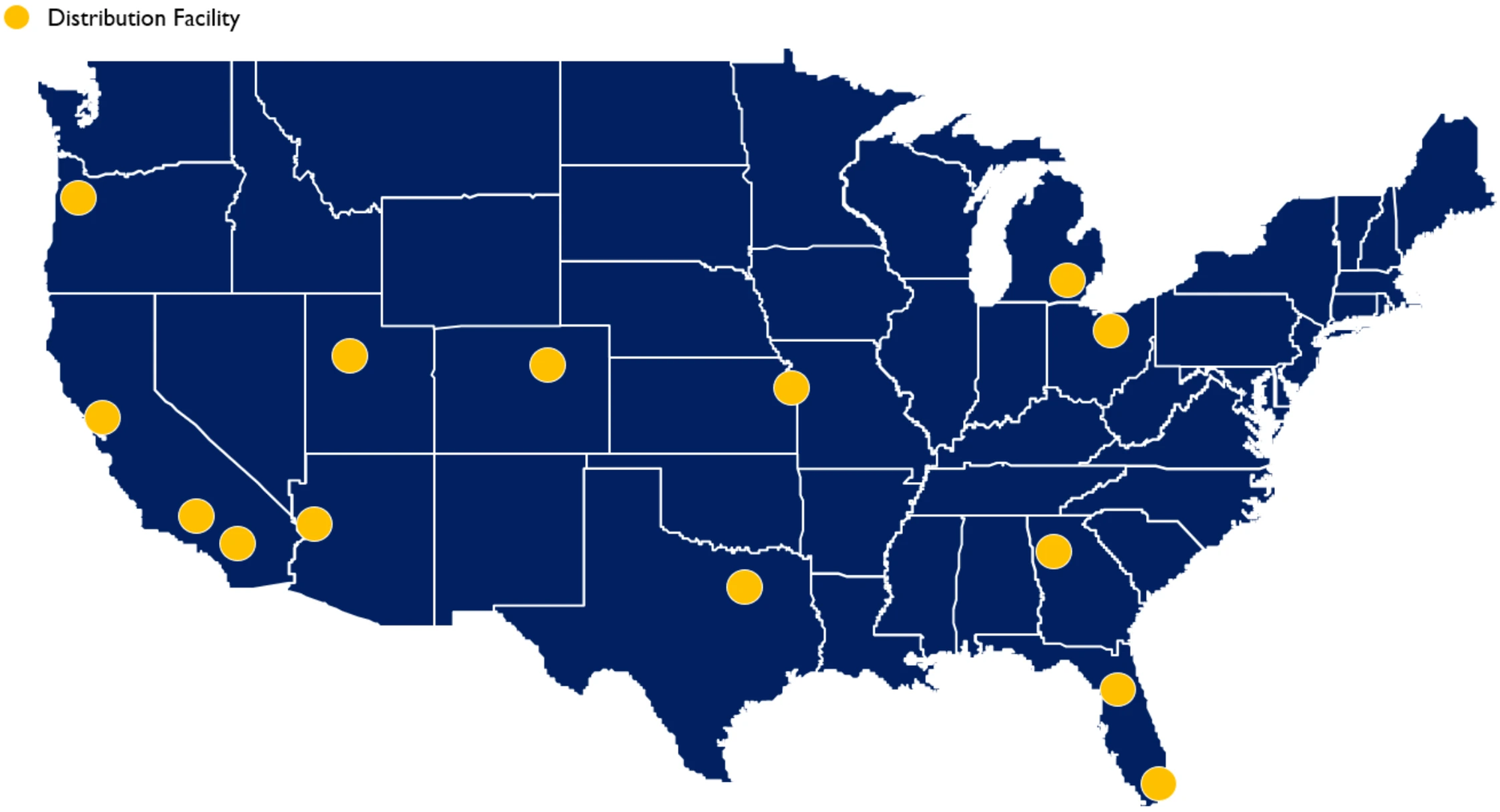

- The Company operated 14 primary distribution centers with a combined capacity to ship more than 32 million pounds of food weekly.

- Its in-house logistics arm, SFD Transportation, operated a fleet of approximately 300 trucks.

Harvest Sherwood employed around 1,500 individuals before ceasing operations. The Company prided itself on its ability to service niche markets and provide tailored product assortments, acting as a crucial link between over 650 suppliers and nearly 3,500 active customers at any given time.

Harvest Sherwood Food Distributors, Inc. and its affiliates filed for Chapter 11 protection on May 5, 2025 (the "Petition Date"), in the U.S. Bankruptcy Court for the Northern District of Texas, reporting $1 billion to $10 billion in assets and $500 million to $1 billion in liabilities.

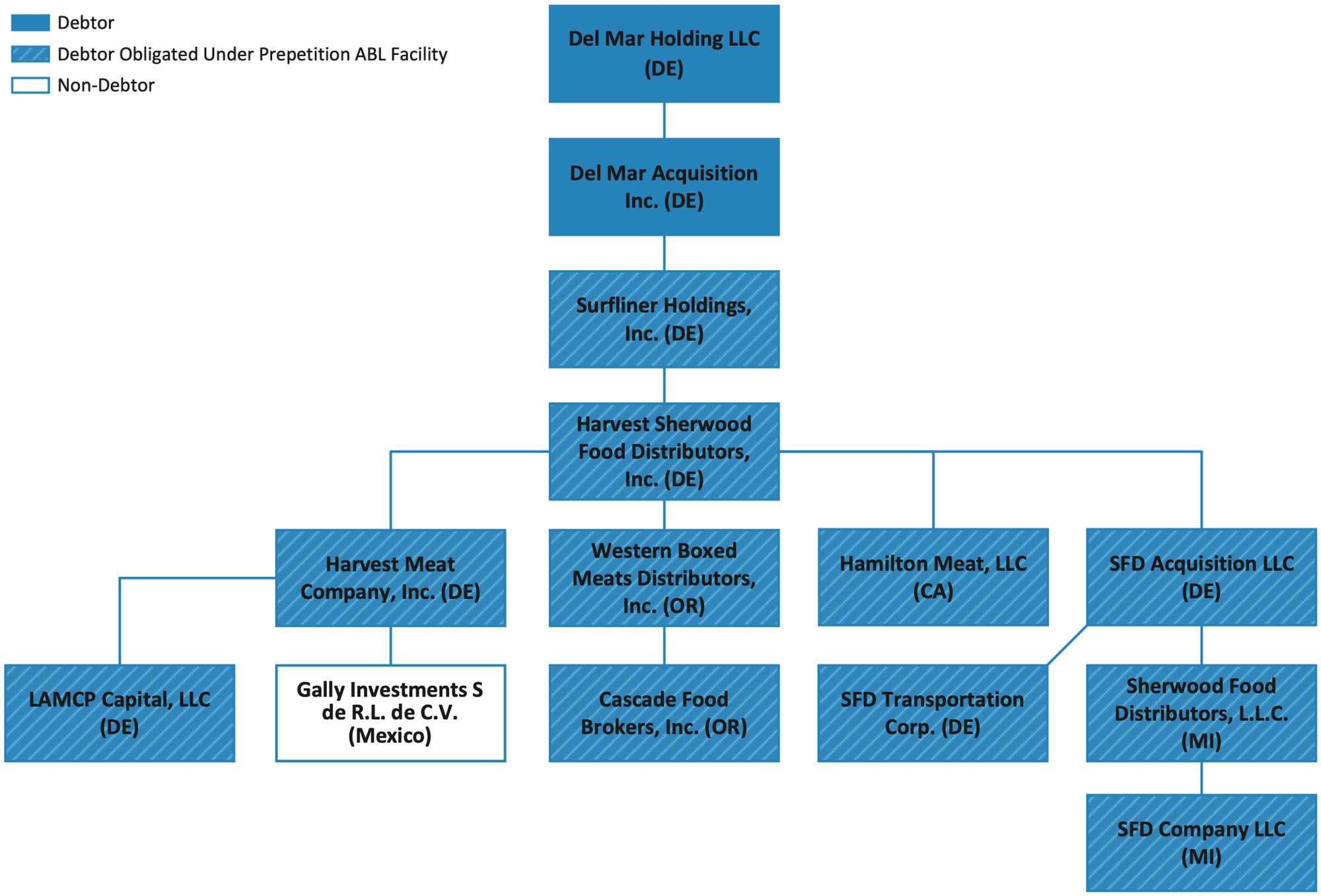

⁽¹⁾ For a complete list of Debtor entities, see organizational structure chart below.

⁽²⁾ The Debtors ceased operations by April 21, 2025, following WARN notices issued in February 2025 (Dkt. 14).

Corporate History

Harvest Sherwood Food Distributors was formed in April 2017 through the merger of two prominent family-owned food distribution businesses: Sherwood Food Distributors of Detroit, MI, and Harvest Food Distributors (originally Harvest Meat Company) of National City, CA.

- Sherwood Food Distributors: Founded in 1969 as Regal Packing Co. by Earl Ishbia and Alex Karp, Sherwood grew into a major independent meat distributor in the Midwest and Southeast, operating five distribution centers and shipping approximately 20 million pounds of product weekly.

- Harvest Food Distributors: Established in 1989 by Frank Leavy and his sons, Harvest Meat Co. focused on supplying independent food retailers on the West Coast. By 2017, it operated 10 distribution centers, serving over 6,000 customers.

The 2017 Merger

- The merger created the largest independent wholesale food distributor in the U.S., with approximately $4 billion in revenue and 14 distribution centers nationwide. The combined entity was headquartered in Detroit.

- Leadership was shared, with Jay Leavy (Harvest) and Earl Ishbia (Sherwood) as co-CEOs, and Kevin Leavy and Jason Ishbia as co-Presidents.

Corporate Organizational Structure

Operations Overview

Prior to its cessation of operations, Harvest Sherwood managed a vast nationwide distribution network, integrating sourcing, warehousing, and logistics to serve a diverse customer base with a comprehensive product portfolio.

Distribution Network and Logistics

- The Company operated 14 primary distribution centers, including locations in Detroit, MI; Cleveland, OH; Atlanta, GA; Miami and Orlando, FL; Portland, OR; and Denver, CO, among others.

- These centers featured refrigerated, frozen, and dry storage, serving as regional supply nodes.

- Its subsidiary, SFD Transportation Corp., managed an in-house fleet of over 300 tractors and trailers, handling fresh produce, meat, and refrigerated goods. This provided control over deliveries, often multiple times per week.

Product Portfolio

- The Company distributed an extensive range of products, primarily proteins (beef, pork, poultry, lamb, veal, seafood) and other perishable items like deli products, bakery goods, and some produce.

- Inventory included thousands of SKUs across a wide range of food categories, encompassing both commodity and branded items, including national, natural, organic, and ethnic food brands.

Customer Base and Market Segments

- Harvest Sherwood served over 6,000 accounts, including:

- Independent retailers and regional retail chains.

- National specialty chains (such as Sprouts Farmers Market for meat and seafood until early 2025).

- Distributors, further processors, and foodservice entities, including cruise lines.

- A key value proposition was providing smaller retailers access to large-scale distributor buying power and assortment, with frequent deliveries acting as an "extended warehouse."

- The Company had a strong presence in niche markets, such as urban ethnic grocers, supplying specialized products and marketing support.

Supply Chain

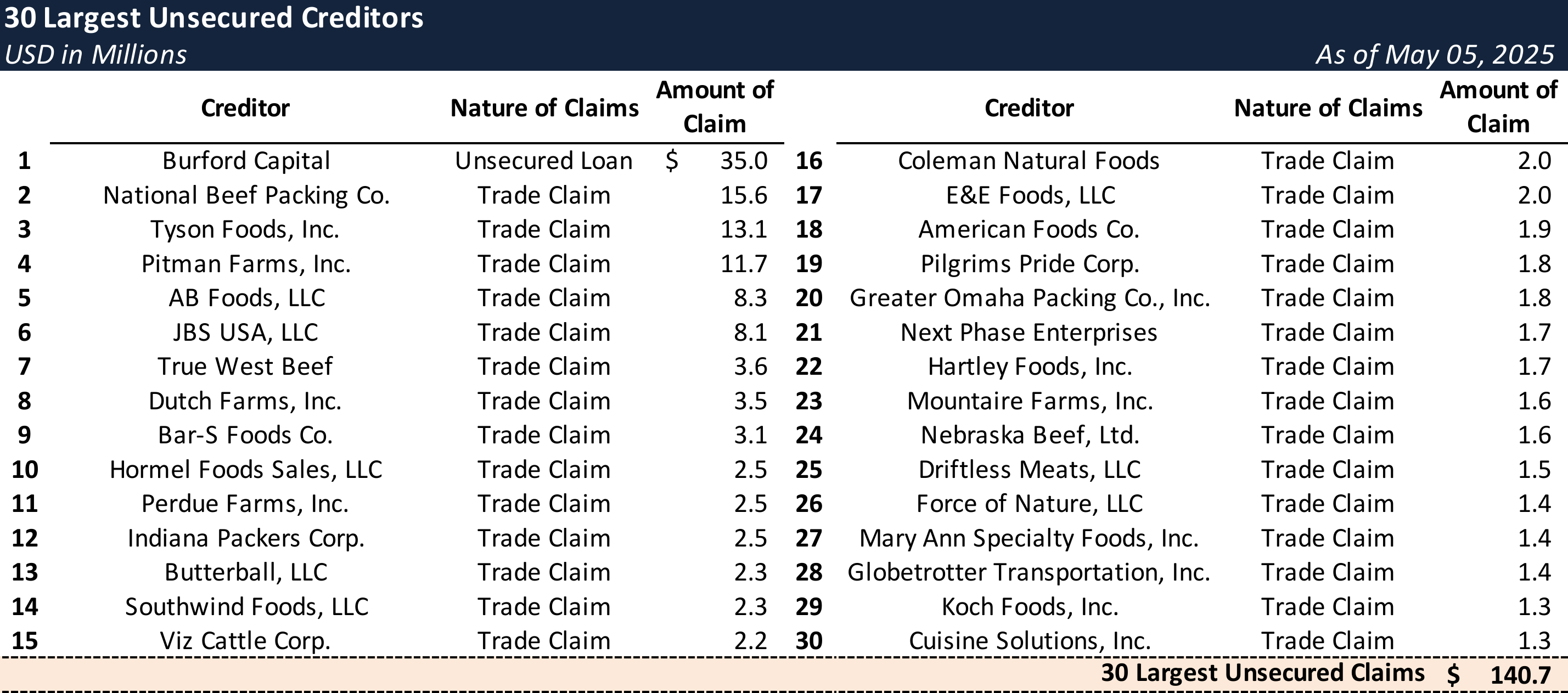

- Harvest Sherwood sourced products from major food producers, with top trade creditors as of the Petition Date including National Beef Packing Co. and Tyson Foods.

- The business operated on low margins and high volumes, making supplier credit terms crucial. A credit rating downgrade in January 2025 impacted these terms.

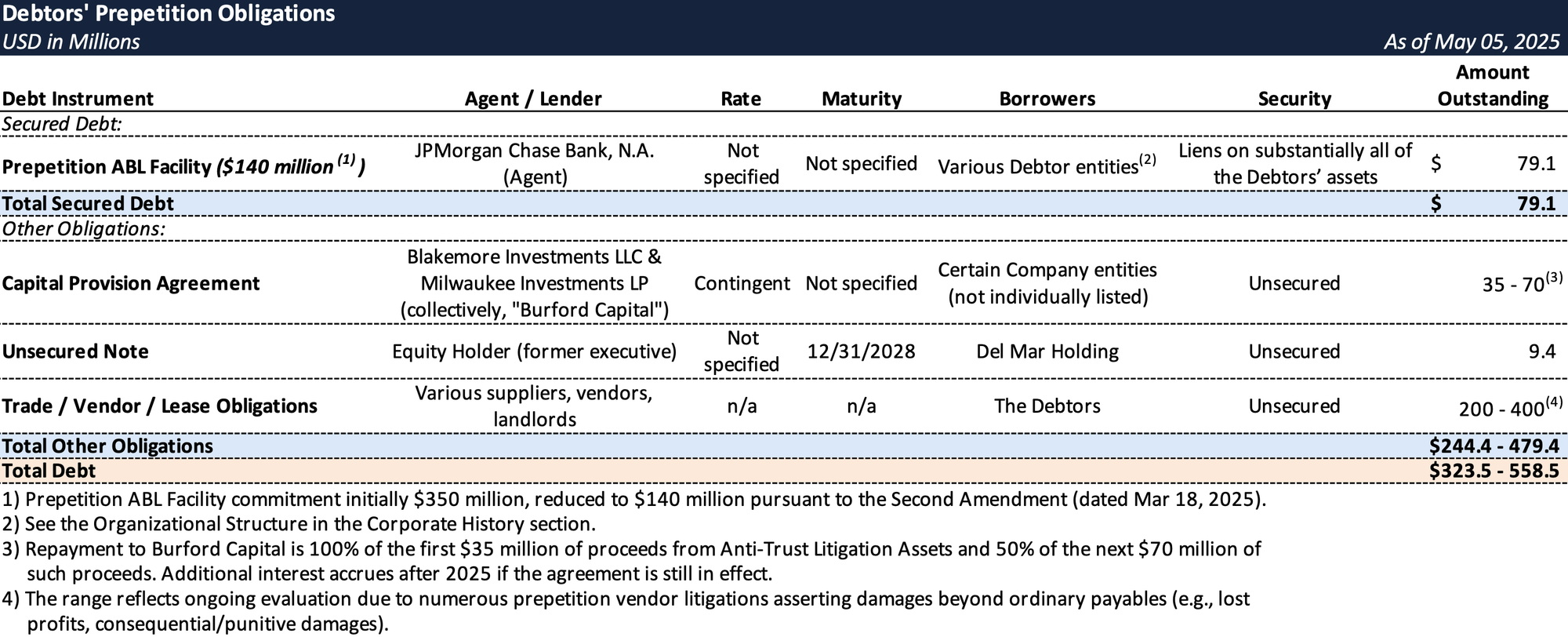

Prepetition Obligations

Top Unsecured Claims

Events Leading to Bankruptcy

Initial Operational Challenges and Strategic Review

- Harvest Sherwood faced higher costs for key inputs such as fuel, labor, and transportation, combined with volatile food prices (partly due to shortages) and changing consumer demands (e.g., for variety and sustainability). These factors increased operational complexity and expenses, further pressuring already thin margins in a highly competitive, low-margin market.

- In June 2024, the Company engaged Sidley and Ankura Consulting to assess restructuring options. In August 2024, Andrew Scriven of Ankura was appointed Chief Transformation Officer, and Houlihan Lokey was engaged to run a marketing process for the Company’s assets.

- The marketing process, which contacted 63 parties, yielded initial indications of interest for a subset of assets.

Mounting Pressures: Sprouts Dispute and Credit Downgrade

- Sprouts Relationship Deteriorates: In late 2024, Sprouts Farmers Market ("Sprouts"), a national specialty retail grocery chain and the Company’s largest customer, notified Harvest Sherwood of its intent to transition to self-distribution. The parties signed an MOU on Dec. 26, 2024, intended to facilitate a smooth transition, but the Company asserts that no definitive transition plan was agreed upon. Sprouts, however, claims the MOU obligated the Company to negotiate definitive terms in good faith, alleging Harvest Sherwood breached this obligation.

- For over a decade, Harvest Sherwood operated as Sprouts' sole distributor for meat and seafood products, sourced from Sprouts-approved vendors.

- Sprouts directly negotiated product prices with these vendors; Harvest Sherwood facilitated the distribution and billed Sprouts for the vendor-negotiated product cost plus a distribution fee (typically ~8%).

- This arrangement was operationally critical for Sprouts, which relied on Harvest Sherwood for frequent, high-volume deliveries (e.g., ~$16 million weekly) of perishable goods due to its stores' limited inventory capacity.

- Credit Downgrade and Intensifying Liquidity Crisis: The Company faced a liquidity crunch after SEAFAX downgraded its credit rating to “Cautionary” from “Recommended” on Jan. 27, 2025. The downgrade prompted vendors and some customers to impose credit holds or demand cash terms.

Failure of Strategic Options

- The initial indications of interest from the marketing process were substantially reduced or withdrawn altogether following the credit downgrade and ongoing Sprouts dispute, ultimately rendering them unactionable.

- Efforts to secure incremental liquidity from ABL Lenders or third-party investors were unsuccessful, with proposed terms being too costly or unviable.

Escalation of Sprouts Dispute

- Feb. 5: Sprouts withheld approximately $55 million owed to Harvest Sherwood for prior distributions, citing concerns about the Company’s financial stability and alleged nonpayment to vendors. The Company responded by halting product distribution.

- Sprouts alleged Harvest Sherwood diverted vendor funds and failed to adequately respond, prompting Sprouts to initiate split payments directly to vendors.

- Feb. 11-14 (Disputed Settlement): According to Harvest Sherwood, an informal settlement was reached around Feb. 11, leading to resumed distribution and partial payments from Sprouts.

- Sprouts contends it paid roughly $37.5 million between Feb. 11-14 under duress, after Harvest Sherwood allegedly demanded an immediate $45 million payment and accelerated terms under threat of halted deliveries. Sprouts further claims Harvest Sherwood did not use these funds for intended vendor payments.

- Feb. 17-18 (Termination): Harvest Sherwood alleges Sprouts breached this purported settlement within six days by again withholding payments, ultimately totaling around $42 million.

- After securing an alternative distributor on Feb. 17, Sprouts terminated its relationship with Harvest Sherwood on Feb. 18.

- Feb. 24 (Litigation Initiated): Harvest Sherwood filed suit against Sprouts in Delaware Superior Court seeking recovery of approximately $42 million.

- Sprouts subsequently countersued for over $50 million, citing claims including duplicative payments.

Prepetition Wind-Down Efforts

- Facing the Sprouts dispute, the failure of the marketing process, and severe operational revenue loss, the Company determined a going-concern transaction was unviable and decided to wind down operations in mid-February 2025.

- On February 18, 2025, WARN Act notices were issued to approximately 1,500 employees, announcing a shutdown by April 21, 2025.

- The Company subsequently commenced an orderly liquidation, engaging Hilco Global ("Hilco") to assist. Substantially all inventory was monetized (recovering ~$140 million on ~$154 million cost), and five distribution centers (Denver, Salt Lake City, Los Angeles, Kansas City, Miami) were sold.

- As of the Petition Date, all employees had been terminated (with a few assisting as independent contractors), and all distribution centers except the Dallas facility had been exited.

Chapter 11 Filing and Objectives

- An involuntary Chapter 7 petition was filed against Sherwood Food Distributors by three creditors on April 18, 2025, in Michigan, but was subsequently stipulated for dismissal in favor of the voluntary Chapter 11 cases.

- On May 5, 2025, Harvest Sherwood Food Distributors and 12 affiliates filed for Chapter 11 protection in the Northern District of Texas. The primary goals are to conclude the orderly wind-down, monetize remaining assets (including the Dallas facility and key litigation claims), and maximize value for stakeholders.

- The Company entered Chapter 11 with the support of its ABL Lenders and an ad hoc committee of unsecured creditors representing about $27 million in claims.

Key Post-Petition Developments and Strategy

- DIP Financing: On May 12, 2025, the Debtors secured interim approval for a $105 million DIP facility from their prepetition ABL Lenders (Dkt. 108). This includes approximately $25.9 million in new money (with $5 million available on an interim basis) and a $79.1 million roll-up of prepetition ABL debt.

- Asset Monetization: The primary remaining physical asset is the Dallas, TX distribution facility, which is anticipated to be sold during the Chapter 11 cases.

- Litigation Assets: A core component of the restructuring strategy is the pursuit of valuable litigation claims:

- Sprouts Litigation: Claims for approximately $42 million against Sprouts for withheld payments.

- Goodman Litigation: A fraud lawsuit filed in November 2024 against a former employee ("Goodman"), alleging a multi-year scheme to defraud the Company and divert business, with estimated losses potentially exceeding several million dollars.

- Antitrust Litigation Assets: Claims against various pork, chicken, and beef producers for alleged price-fixing, with asserted damages exceeding $1.1 billion (excluding treble damages).

- Under a December 21, 2022, Capital Provision Agreement, Burford Capital advanced $35 million and now holds an unsecured right to recover 100% of the first $35 million from proceeds obtained from the Antitrust Litigation Assets, and 50% of the next $70 million of such proceeds.

- Burford has asserted rights to control the Antitrust Litigation Assets, which the Company disputes.

- Corporate Governance and Advisors:

- The Board included independent director Jill Frizzley to oversee restructuring. Eric Kaup of Hilco was appointed Chief Restructuring Officer.

- Key advisors include Sidley Austin LLP as bankruptcy counsel and Meru, LLC as financial advisor. Houlihan Lokey previously served as investment banker. Winddown support was provided by Hilco. Epiq serves as the claims agent.

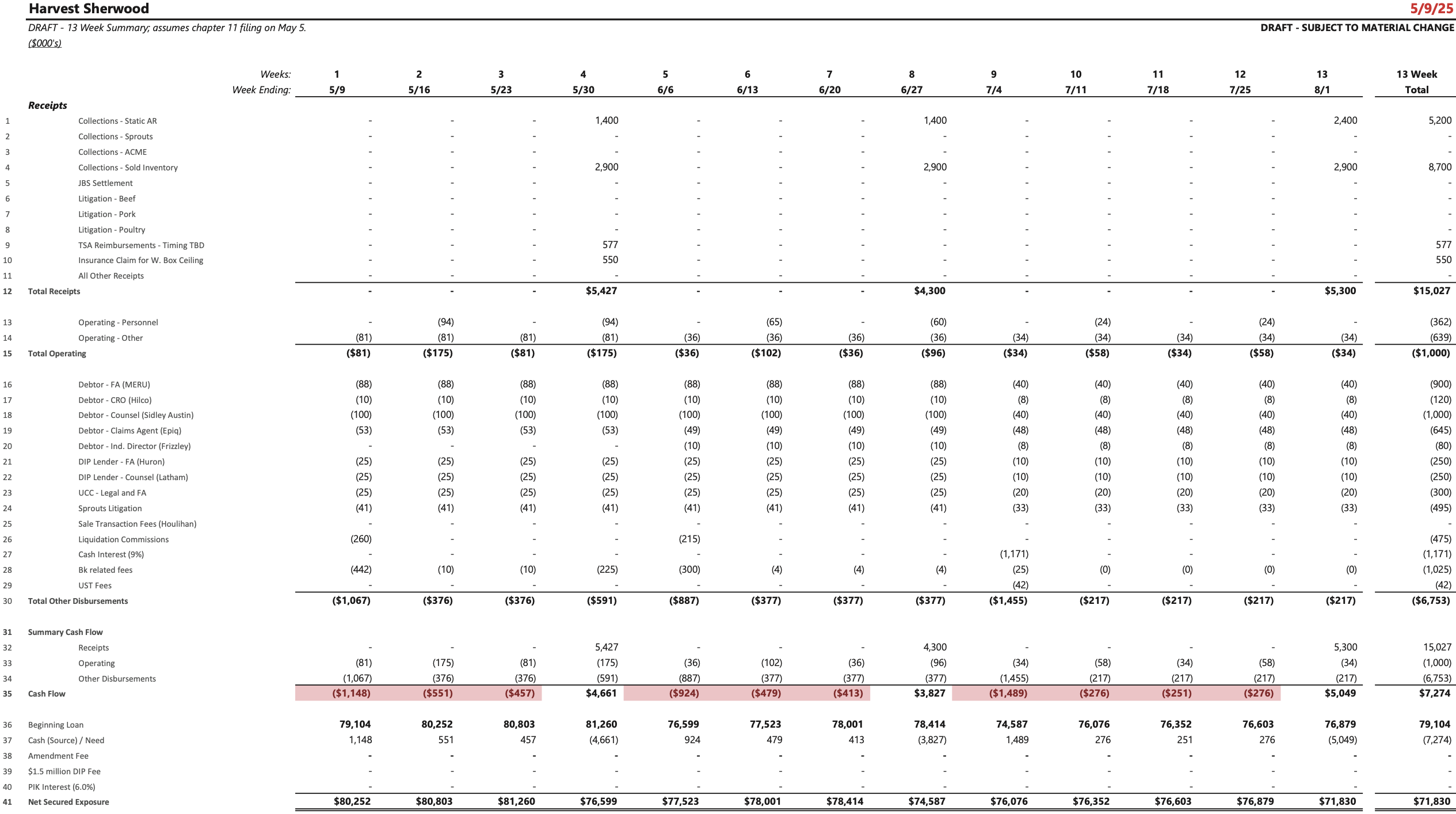

Initial Short-Term DIP Budget

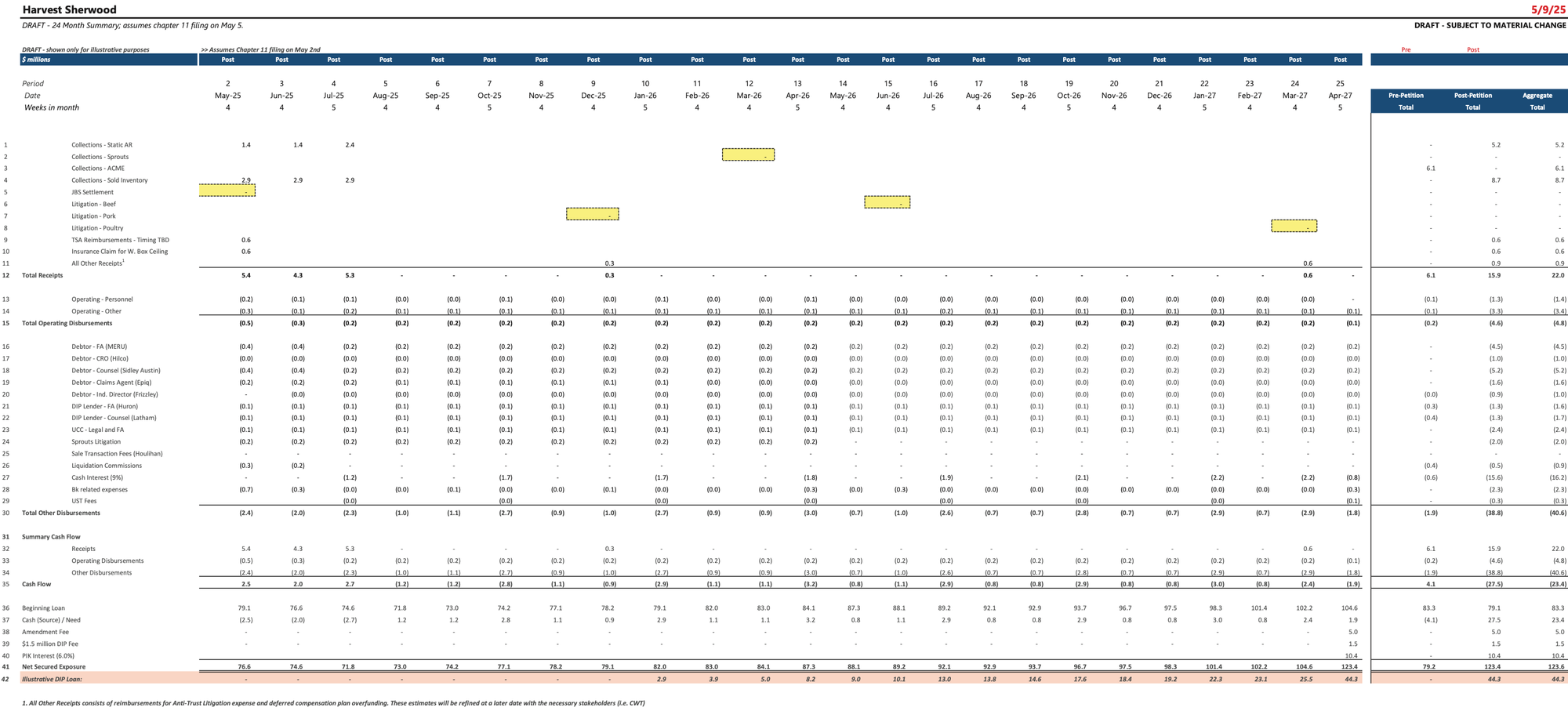

Long-Term DIP Budget

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.