Filing Alert: Harvest Sherwood Chapter 11

Harvest Sherwood Food Distributors Files Chapter 11 in Northern District of Texas

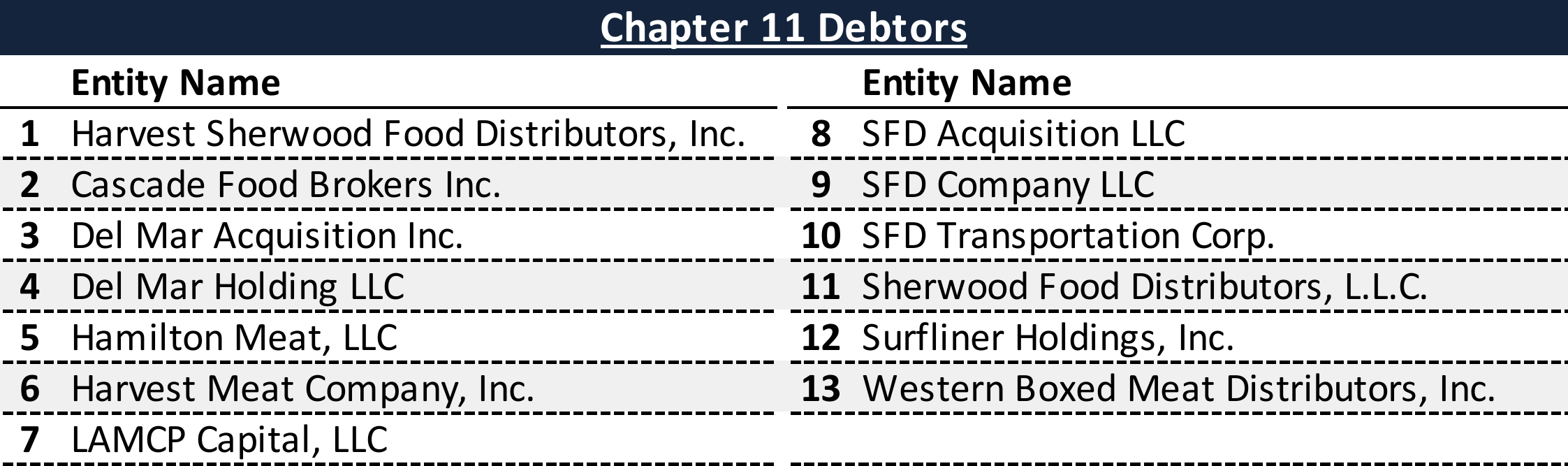

Harvest Sherwood Food Distributors, Inc. and its debtor affiliates⁽¹⁾ (collectively, the "Company"), the largest independent wholesale food distributor in the U.S., filed for Chapter 11 protection on May 5 in the U.S. Bankruptcy Court for the Northern District of Texas.

The filing follows a decision to wind down operations after operational challenges, including the loss of major customer Sprouts Farmers Market ("Sprouts") and a key industry credit rating downgrade, rendered strategic sale or restructuring efforts unviable. Sprouts reportedly withheld tens of millions in payments, leading to a lawsuit by the Company to recover approximately $42 million. Prior to this, a marketing process by Houlihan Lokey for all or part of the Company’s assets did not yield actionable bids for a going-concern sale, and a subsequent prepetition winddown process, supported by its ABL Lenders and an ad hoc group of unsecured creditors, commenced in mid-February 2025. The Company has since liquidated most inventory and sold five distribution centers, ceasing ordinary course operations and terminating approximately 1,500 employees as of April 21, 2025.

The Chapter 11 cases will facilitate an orderly conclusion to the winddown, including pursuit of litigation assets (such as anti-trust, Sprouts, and Goodman claims) and the sale of its remaining key facility in Dallas, and are supported by a $105 million DIP financing from its prepetition ABL lenders, consisting of approximately $25.9 million in new money and a $79.1 million roll-up.

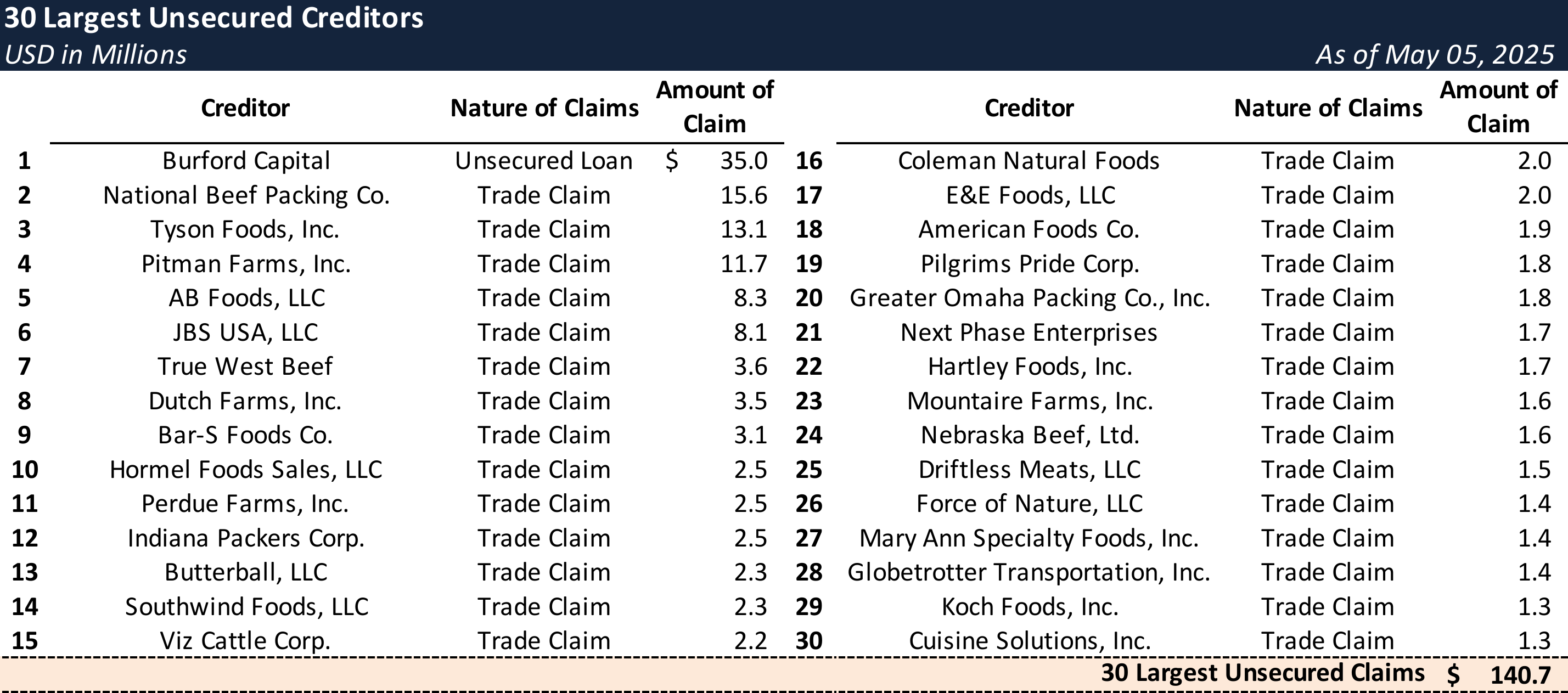

Harvest Sherwood Food Distributors, Inc. reports $1 billion to $10 billion in assets and $500 million to $1 billion in liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The case number is 25-80109.

⁽¹⁾ For a complete list of debtor entities, see the Chapter 11 Debtors table.

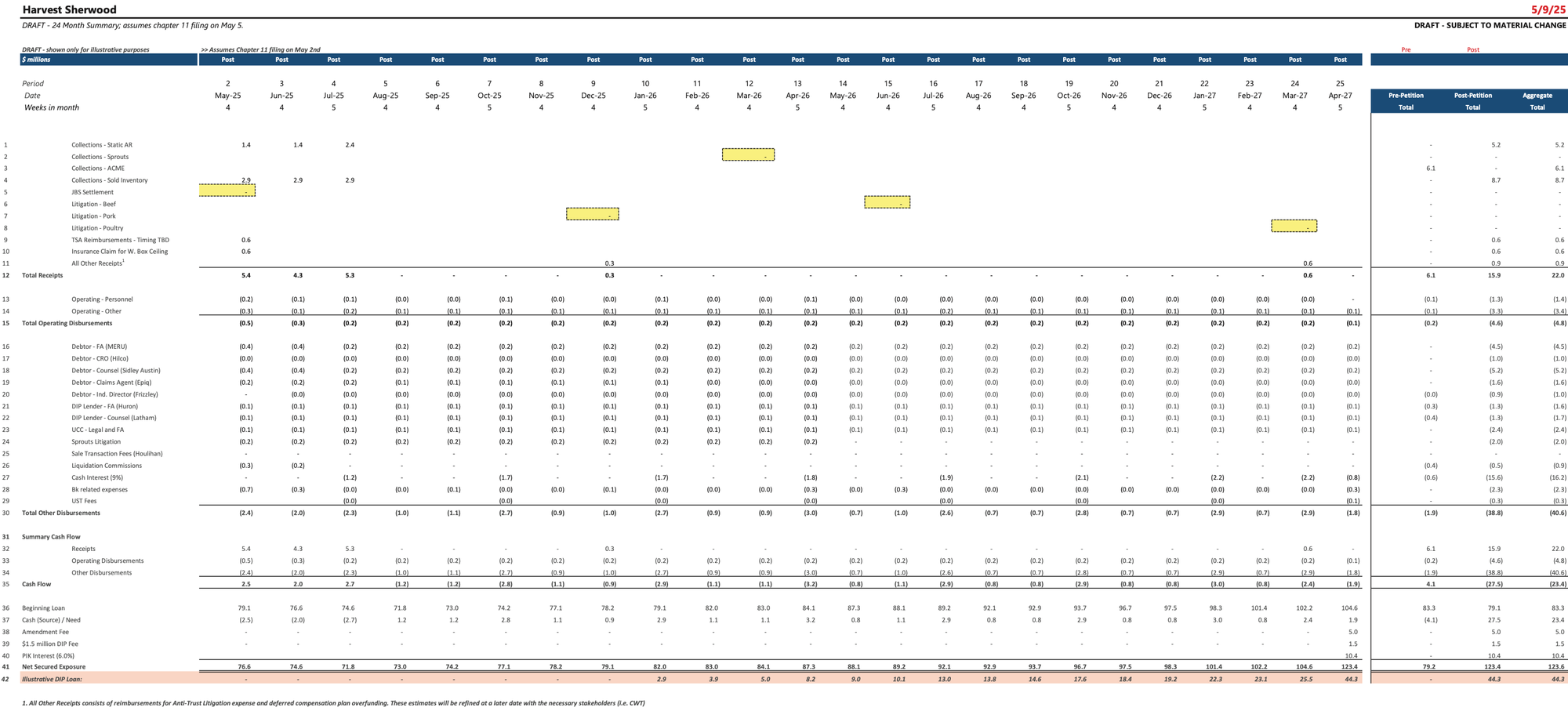

Long-Term DIP Budget

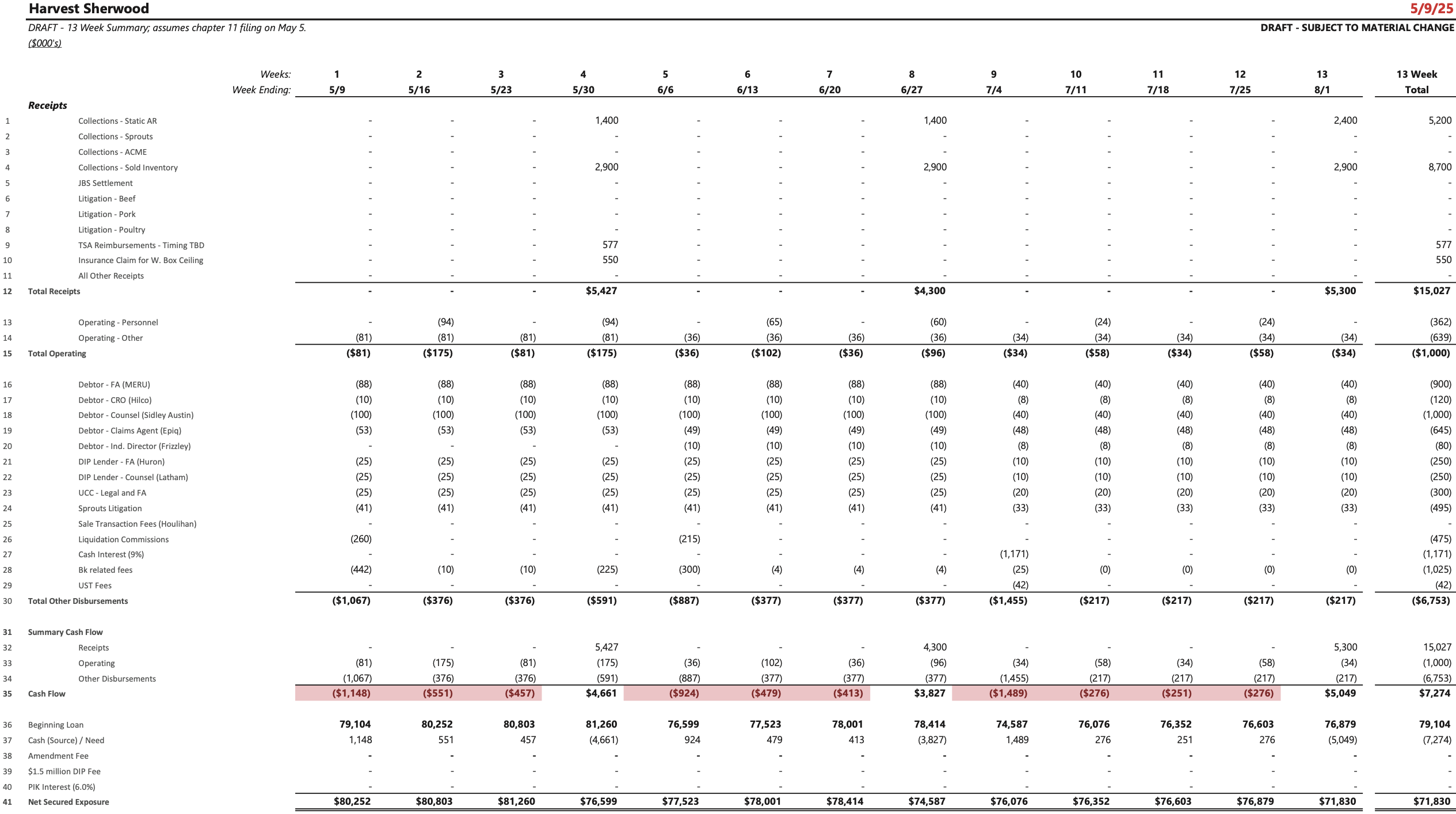

Initial Short-Term DIP Budget

Chapter 11 Debtors

Top Unsecured Claims

Key Parties

Counsel:

- Thomas R. Califano

- Sidley Austin LLP

- Email: [email protected]

Financial Advisor:

- Meru, LLC

Investment Banker:

- Houlihan Lokey Capital, Inc.

Winddown Advisor:

- Hilco Commercial Industrial, LLC

- Hilco Receivables, LLC

Signatories:

- Eric Kaup – Chief Restructuring Officer

Claims Agent:

Equity Security Holders:

- Surfliner Holdings, Inc. – 100% Equity Interest

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.