Case Summary: Hearthside Food Solutions Chapter 11

Hearthside Food Solutions has filed for Chapter 11 to address liquidity challenges stemming from inflation, declining demand, contractual constraints, and a $3.1 billion debt load while pursuing a comprehensive restructuring plan with key creditors.

Business Description

Headquartered in Downers Grove, IL, H-Food Holdings, LLC (“Hearthside,” d/b/a “Hearthside Food Solutions”), along with its Debtor and non-Debtor affiliates (collectively, the “Company”), is a leading contract manufacturer specializing in packaged food products.

- Originally established with four facilities in Grand Rapids, MI, the Company has grown into a global partner for leading and emerging food brands, providing high-quality manufacturing solutions across North America.

- Hearthside manufactures approximately 1.7 billion pounds annually, producing some of the most iconic and valued food brands globally.

The Company operates 28 state-of-the-art facilities across 11 U.S. states and Canada, offering diversified production capabilities including:

- Nutrition bars, frozen packaged foods, meal kits, snacks, sauces, refrigerated trays, overwrap, and custom packaging solutions.

Hearthside is recognized for best-in-class operational efficiency and an extensive production network, enabling leadership in the fast-growing co-manufacturing and co-packaging sectors.

The Company has grown its revenue from $145 million in 2009 to $3.3 billion LTM as of September 30, 2024.

- In 2023, total net revenues reached $3.5 billion, underscoring consistent growth across all business segments.

As of the Petition Date, the Debtors employ a workforce of approximately 12,100 individuals, including:

- 11,000 permanent employees and 1,100 temporary staff.

- Approximately 1,200 salaried employees and 9,800 hourly workers, with 1,300 hourly employees represented by unions under collective bargaining agreements.

As of the Petition Date, the Debtors reported $1-$10 billion in assets and liabilities.

Corporate History

Founded in 2009 by Rich Scalise.

In 2014, Hearthside was acquired by Goldman Sachs Group and Vestar Capital Partners.

- In 2018, Goldman Sachs sold its stake in Hearthside to Charlesbank Capital Partners and Partners Group.

The Company’s growth has been driven by a series of strategic acquisitions, including:

- 2018: Acquired Greencore U.S., a leader in frozen contract packaging and a top producer of refrigerated sandwiches, entrees, and salad kits.

- 2021: Acquired Interbake Foods, LLC and Interbake Canada, Inc., prominent manufacturers specializing in baked goods, including cookies, cones, crackers, and wafers.

In 2023, the Company divested its European nutritional functional bars business.

Operations Overview

Diverse Product Portfolio

Hearthside’s product offerings are organized into four primary platforms, including:

- Refrigerated & Frozen (40.1% of YE’23 net revenues): Includes refrigerated, frozen, and fresh products such as sandwiches, ready meals, ingredient packets, and salad kits.

- Baking (32.4% of YE’23 net revenues): Includes cookies, crackers, baked snacks, cones, and ice cream equipment.

- Bars & Components (15.6% of YE’23 net revenues): Focused on snack components, snack bars, granola, cereal enrobing, and functional bars.

- Packaging (11.9% of YE’23 net revenues): Provides custom packaging solutions for snacks, cereal, cookies, crackers, candy, and dry pet food and treats.

Extensive North American Manufacturing Footprint

The Company operates a large-scale production network, with 28 manufacturing facilities located across the U.S. and Canada. Key U.S. locations include:

- California, Idaho, Illinois, Indiana, Kentucky, Michigan, Minnesota, Ohio, South Dakota, Utah, and Virginia.

Critical Partner with Enduring Relationships

Hearthside distinguishes itself as the only contract manufacturing and packaging provider capable of serving customers across more than 20 distinct product categories, solidifying its role as an indispensable partner in the food supply chain.

This critical role is evidenced by the exceptional durability of the Company’s customer relationships, with major customers maintaining an average tenure of approximately 30 years, highlighting the Company’s reliability, consistency, and value as a trusted partner in their operations.

Prepetition Obligations

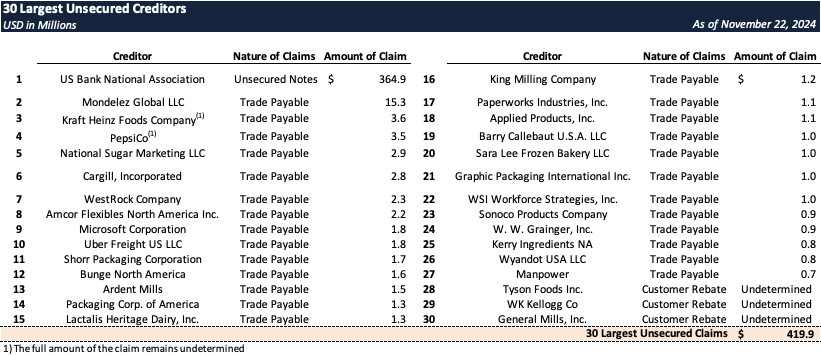

Top Unsecured Claims

Events Leading to Bankruptcy

Wage Rates and Inflation

Significant wage rate increases connected to overall inflation have adversely affected Hearthside’s financials.

- Over the last three years, wage rates have increased by 17.2% compared to 2021.

The Company has been unable to fully pass through these increased costs to customers due to contractual limitations.

- For example, price adjustments on certain customer contracts are tied to changes in the Producer Price Index (PPI) or Consumer Price Index (CPI), which have not kept pace with wage inflation.

General efforts to increase pricing have been challenged by broader food price inflation.

Industry Headwinds

Hearthside has faced industry headwinds, including a reversal of post-COVID stay-at-home trends, leading to reduced demand for retail and at-home food products.

Consumer behavior has shifted toward value shopping and lower-priced, lower-margin products, a trend that has continued into 2024.

- As of November 2024, market volume trends have remained relatively flat across all four of the Company’s platforms: Refrigerated & Frozen, Baking, Bars & Components, and Packaging.

- Key customers have reported similar trends, highlighting softness in volume and challenges in driving revenue through pricing.

Co-manufacturers like Hearthside have been particularly affected due to contractual terms allowing customers to reduce volumes without penalties.

- Customers often reduce volumes contracted to co-manufacturers while maintaining in-house production, leaving co-manufacturers with open capacity and fixed overhead costs, leading to lower profitability.

These challenges have contributed to a decline in operating results, with adjusted EBITDA decreasing from $258 million in 2021 to a projected $184 million for 2024.

Capital Structure Overhang

Operational challenges have intensified issues related to the Company’s funded debt load.

- Total debt balance stands at approximately $3.1 billion, including capital leases.

- Debt service payments totaled approximately $301.5 million in 2024, with an estimated $283.2 million due in 2025 if the capital structure remains unchanged.

The substantial size of these payments and the maturity profile have put significant pressure on the business.

- The First Lien Revolving Loans, totaling ~$200 million, mature on November 23, 2024.

- The First Lien Term Loans, totaling ~$1.9 billion, mature in May 2025.

The Company’s balance sheet has drawn focus from rating agencies, resulting in downgrades.

- In April 2024, Moody’s downgraded the Company to ‘Caa3’ from ‘Caa1’.

- In June 2024, S&P Global Ratings downgraded the Company to ‘CCC-’ from ‘CCC’.

- These downgrades have exacerbated operational challenges and increased scrutiny.

Labor Challenges and Transitions

In February 2023, a New York Times article alleged labor issues related to third-party staffing agencies, leading to:

- Negative media scrutiny, customer concerns, and government investigations.

- Significant investments in labor policy improvements, including:

- Reducing reliance on third-party staffing agencies.

- Enhancing compliance processes with robust identification, eligibility, and verification procedures.

The Company has been fully cooperative with government regulators. While investigations are ongoing, no material penalties are anticipated, though the ultimate outcomes remain uncertain.

Hearthside proactively communicated its commitment to a best-in-class workforce to employees, customers, and regulators, highlighting actions taken to ensure compliance and operational integrity.

Prepetition Operational Initiatives

Hearthside implemented strategic actions to drive EBITDA and margin expansion, including:

- Strengthening relationships with existing customers and gaining market share in existing product categories.

- Expanding into private label offerings and new product categories to win new customers.

- Initiating pricing optimization strategies to account for inflationary pressures.

- Network consolidation efforts included closing underperforming plants and reallocating volumes to leverage fixed overhead costs.

The Company engaged in asset sales in 2023 and 2024 to streamline operations and focus on core platforms.

- In 2023, it sold its European nutritional functional bars business, generating approximately €235 million, with proceeds held by ROS B.V., its Dutch unrestricted subsidiary.

- In July 2024, approximately $187.9 million of the proceeds were repatriated to Hearthside Sub, LLC, which is not an obligor or guarantor on the prepetition debt.

- Continued divestiture of non-core assets occurred in Q1’24.

Engagement of Restructuring Advisors

In November 2022, Hearthside engaged Ropes & Gray LLP and Evercore Inc. to assist with operational and balance sheet concerns, prepetition initiatives, and lender engagement.

In September 2023, Alvarez & Marsal was engaged to assist with operational and strategic analyses.

Appointment of Special Committee

In November 2023, independent fiduciaries Patrick Bartels and Carol Flaton were appointed to the Company’s board.

- They formed a Special Committee tasked with overseeing strategic initiatives and have exercised day-to-day oversight since December 2023.

- They were also delegated investigative authority regarding affiliate transactions and potential claims against directors and officers.

Financing Efforts

Beginning in early 2024, the Company engaged with prepetition creditors and potential third-party financing sources regarding an accounts-receivable securitization and a “1.5 lien” financing structure.

Despite extensive engagement and diligence with multiple prospective financing parties, few actionable proposals emerged, and none offered a comprehensive solution addressing significant debt maturities.

Strategic Engagement

In May 2024, Hearthside signed confidentiality agreements with creditor groups to explore a comprehensive strategic transaction.

- The process involved extensive diligence, management meetings, and dialogue to explain the Company’s business trajectory and development pipeline.

After months of good-faith, arm’s-length negotiations, the Company reached consensus on a comprehensive restructuring transaction with holders of approximately:

- 81.2% of First Lien Loans;

- 100% of Second Lien Term Loans;

- 77.7% of Senior Unsecured Notes;

- The Sponsors.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.