Case Summary: Hooters Chapter 11

Hooters has filed for Chapter 11 bankruptcy, citing inflation-driven margin pressures, shifting consumer preferences, and unsustainable debt obligations, aiming to restructure through a pre-negotiated plan involving the sale of certain company-owned stores.

Business Description

Headquartered in Atlanta, GA, Hooters of America, LLC (“HOA”), along with its affiliated Debtors⁽¹⁾ (collectively, “Hooters” or the “Company”), is the franchisor and operator of the Hooters restaurant brand, a globally recognized chain known for its casual dining format, sports-bar atmosphere, signature chicken wings, and distinct service model featuring female servers ("Hooters Girls") in trademark uniforms.

- The Company positions its offering as blending a classic sports bar experience with "guest-obsessed hospitality" in a relaxed, fun environment.

- The menu centers on American bar-and-grill staples, including burgers, sandwiches, seafood, and its famous breaded chicken wings, typically complemented by full bar service. Ancillary revenue is generated through branded merchandise sales, such as apparel and calendars.

The Hooters brand historically involved two corporate entities: Hooters, Inc. (the original entity founded in 1983, based in Clearwater, FL) and HOA (Atlanta-based). By 2025, HOA controlled the majority of franchise rights and operations, while Hooters, Inc. continued to own and operate 22 Hooters restaurants in Tampa Bay and Chicagoland.

As of the Petition Date, the Company's operations comprised more than 300 restaurant locations globally, including approximately 151 company-operated units across 22 U.S. states and 154 franchised locations run by 35 independent franchisees in 19 U.S. states and 17 international markets.

- The total unit count had declined from a peak of over 430 locations in 2019, driven by strategic closures of underperforming stores in recent years.

Hooters filed for Chapter 11 protection on March 31, 2025, in the U.S. Bankruptcy Court for the Northern District of Texas. As of the Petition Date, the Debtors reported $50 million to $100 million in both assets and liabilities.

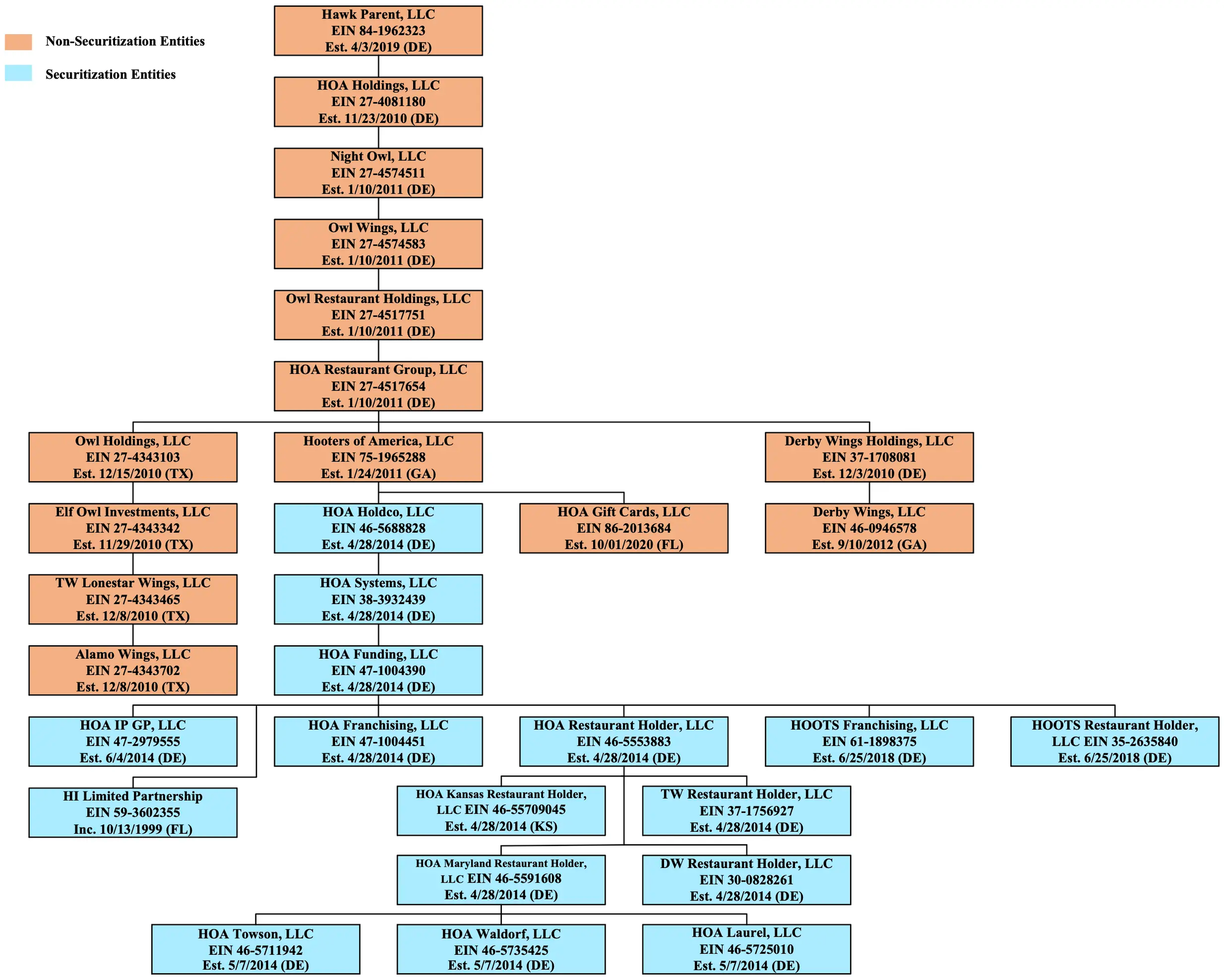

⁽¹⁾ For a complete list of Debtor entities, see the organizational structure chart below.

Corporate History

Hooters was founded on April 1, 1983, in Clearwater, Florida, by six co-founders. The first location opened in October 1983, establishing the brand's core concept of a beachside beer-and-wings establishment with an all-female waitstaff in distinct uniforms.

- The concept proved highly successful, leading to rapid expansion across the U.S. through franchising and corporate development during the late 1980s and 1990s. Hooters became a pop-culture fixture known for its sports bar ambiance and unique branding.

- International expansion began in the mid-1990s, as the Company sought to replicate its U.S. success abroad, gradually establishing a global presence. Under the control of Robert H. Brooks, who acquired majority ownership in the 1980s, the Company also experimented with brand extensions, including the short-lived Hooters Air (2003–2006).

- Brooks' death in 2006 led to a sale of Hooters of America by his estate in 2011, marking the end of nearly three decades of founder/family ownership.

Ownership Changes and Private Equity Era

- In January 2011, HOA was acquired by a consortium including H.I.G. Capital, KarpReilly, and Chanticleer Holdings (a Hooters franchisee).

- Under this private equity ownership, the chain faced stagnating growth by the mid-2010s, prompting exploration of a potential sale in 2015.

- Instead of a sale, Hooters initiated strategic changes, including menu updates, store remodels, and the 2017 launch of "Hoots," a fast-casual, counter-service spin-off concept featuring a similar menu but without the Hooters Girls, aimed at attracting a broader customer base and tapping into the growing fast-casual market. As of the Petition Date, the concept includes three franchised locations.

Nord Bay/TriArtisan Acquisition and Pre-Pandemic Challenges

- In July 2019, Nord Bay Capital and TriArtisan Capital Advisors acquired HOA from the H.I.G.-led group. At the time, the Company operated over 430 locations worldwide.

- Despite strong brand awareness and a period of nine consecutive quarters of same-store sales growth leading into the acquisition, warning signs existed:

- U.S. sales declined by approximately 1.7% from 2017 to 2018, totaling nearly $800 million in 2018, according to Technomic estimates.

- According to Business Insider, Hooters' total unit count decreased by approximately 7% between 2012 and 2016.

- The new owners, experienced in casual dining (TriArtisan also held stakes in TGI Friday's and P.F. Chang's), aimed to revitalize the brand. Sal Melilli, a long-time Hooters executive, became CEO during this period.

Organizational Structure

Operations Overview

The Company's operations are divided into two primary business segments:

Company-Owned Restaurants

- Prior to the Chapter 11 filing, the Company directly owned and operated 151 Hooters restaurants across 22 U.S. states.

- This segment generated the majority of the Company's revenue volume, totaling approximately $358.9 million in FY2024, derived from:

- Food Sales: ~$254.4 million (71%)

- Alcoholic Beverage Sales: ~$101.4 million (28%)

- Merchandise Sales: ~$3.1 million (1%)

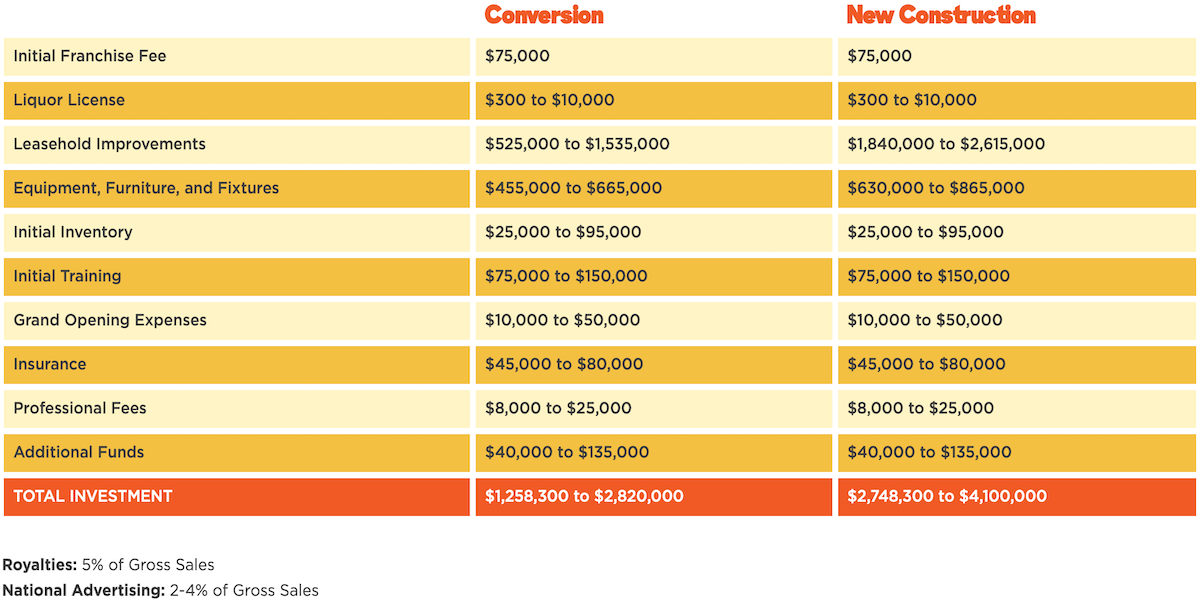

Franchise & Licensing

- The Company generates revenue through franchise agreements by collecting initial fees, ongoing royalties, and other service/licensing fees from its 35 independent franchisees operating 154 restaurants globally (as of the Petition Date).

- Hooters provides support services including branding, marketing, and operational assistance to maintain system consistency.

- In 2024, the Company expanded its licensing efforts via an agreement with a major food manufacturer to produce Hooters-branded frozen meals and sauces for retail sale in grocery stores.

- This segment generated approximately $22.6 million in revenue in fiscal year 2024 with minimal associated cost of sales.

Operational Model and Workforce

- A typical Hooters location is a full-service, casual dining restaurant and sports bar, open for lunch and dinner, often situated in high-traffic commercial or entertainment areas.

- As of the Petition Date, the Company employed approximately 5,957 people (1,945 full-time, 4,012 part-time). The workforce is not unionized.

- The Company has faced historical employment practice litigation related to its female server model, defending its practices based on the Hooters Girls being integral to its brand and entertainment concept.

Strategic Initiatives and Performance

- In recent years, Hooters pursued initiatives to modernize operations and diversify revenue, including:

- Launching the Hoots fast-casual concept (2017).

- Expanding into delivery through third-party apps and developing virtual brands (e.g., Hootie’s Burger Bar) for online ordering.

- Developing retail product lines (sauces, frozen foods).

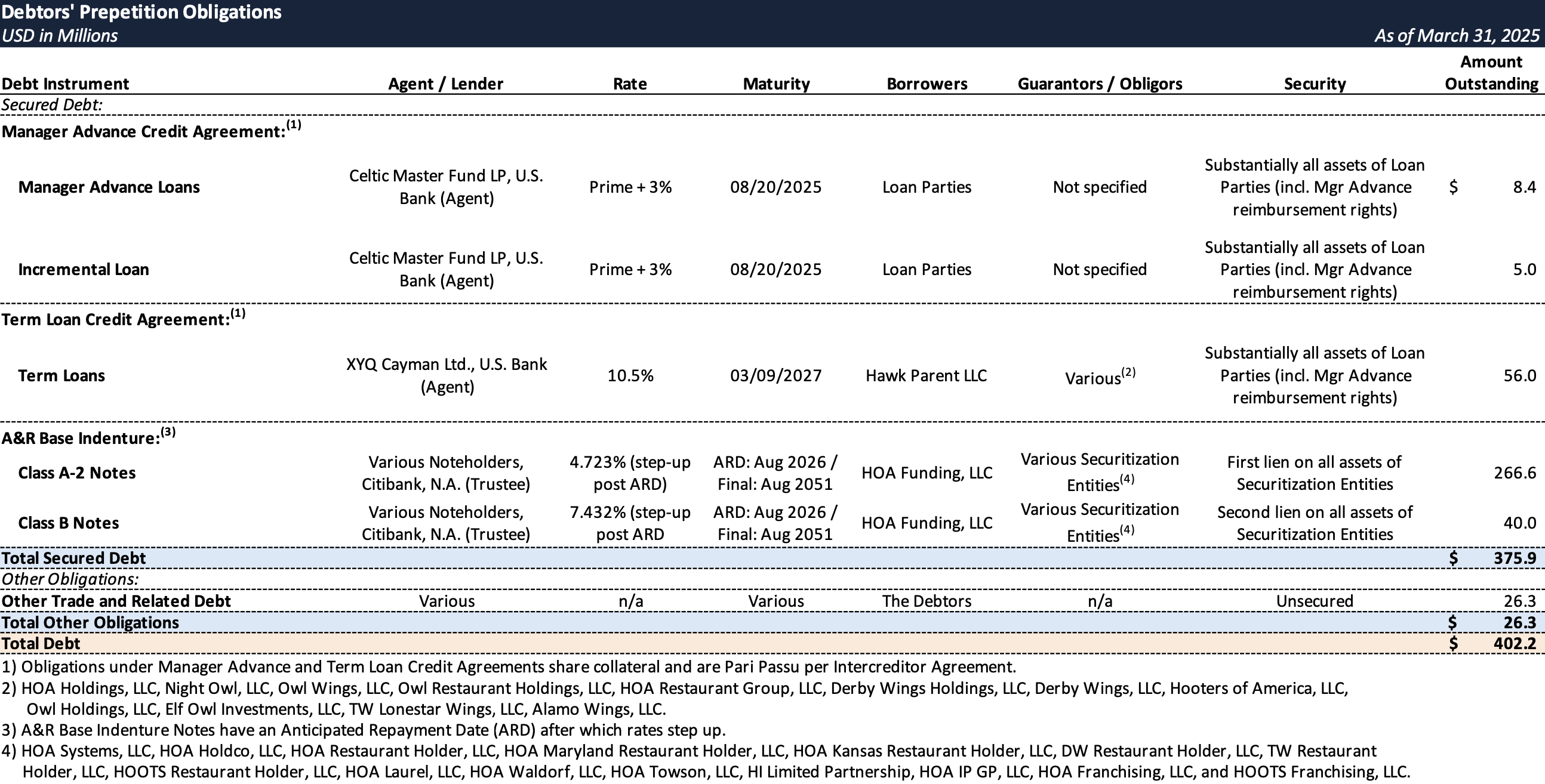

Prepetition Obligations

- In addition to the capital structure outlined above, Debtors HOA and HI Limited Partnership are party to an agreement requiring payment of purported legacy royalty obligations to Lags Equipment, LLC. This obligation reportedly involves a monthly royalty payment in perpetuity equal to 3% of gross sales from certain Company-Owned Stores, averaging approximately $4.2 million annually. The Debtors explicitly state they do not concede the validity of these obligations as true royalties and reserve all rights and defenses in connection therewith.

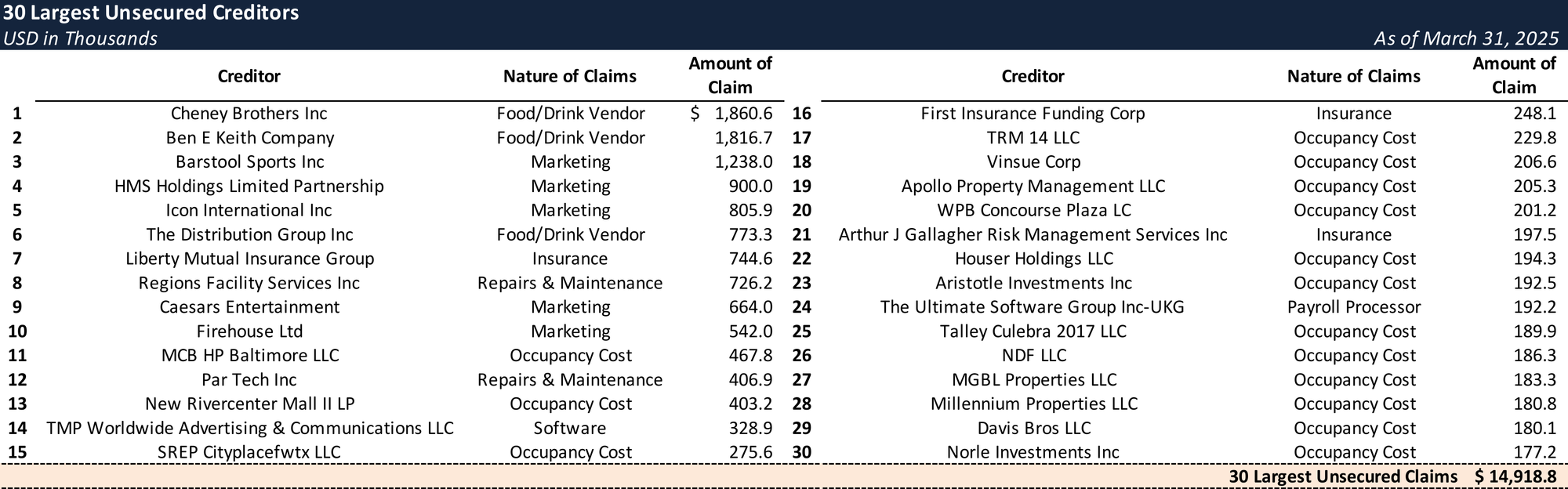

Top Unsecured Claims

Events Leading to Bankruptcy

Inflationary Pressures and Rising Costs

- Hooter's profitability was severely impacted by the post-COVID inflationary environment, particularly rising costs for labor and commodities.

- The increased cost of dining out strained consumers, while the Company found it difficult to fully offset higher input costs with menu price hikes without negatively affecting customer traffic, leading to margin compression.

- This financial pressure resulted in strained liquidity, forcing the Company to defer essential capital expenditures such as restaurant maintenance, refurbishments, employee training, and menu innovation, creating a cycle of under-investment that further harmed performance.

Shifting Consumer Preferences and Brand Fatigue

- Many observers noted that Hooters faced challenges adapting to evolving consumer tastes and social norms. They pointed out that the brand's traditional concept and overt sexualization were perceived as dated by some demographics, particularly younger consumers (Millennials and Gen Z).

- Increased competition from direct rivals (e.g., Twin Peaks, Buffalo Wild Wings, Wingstop) and the broader shift towards off-premise dining (takeout/delivery) eroded Hooters' dine-in-centric model and foot traffic.

Financial Deterioration and Operational Retrenchment

- The combination of cost pressures and changing consumer behavior led to deteriorating financial performance, with company-owned stores generating operating losses by 2024.

- The Company faced a significant liquidity crunch, evidenced by severely delayed vendor payments. By 2024, the Company was reportedly taking four times longer than industry peers to pay suppliers, with over 20% of its bills exceeding 90 days past due, according to data from Creditsafe.

- Since the beginning of 2024, Hooters has closed 48 underperforming company-owned restaurants across multiple states to reduce losses and conserve cash.

Unsustainable Capital Structure

- The Company carried a substantial debt burden, totaling approximately $376 million at the time of filing. Debt service obligations were significant, exceeding $30.9 million in 2024.

- Projected 2025 debt service was ~$19 million, with a $3.9 million interest payment due May 20, 2025.

- The capital structure was further burdened by Legacy Royalty Obligations requiring ~$353,000 in monthly payments.

Pre-Bankruptcy Restructuring Efforts

- Management implemented operational initiatives, including closing unprofitable stores and launching guest service training programs.

- The Company engaged restructuring advisors: Ropes & Gray LLP (legal) and Accordion (financial advisor, providing the CRO) in June 2024, and SOLIC Capital (investment banking) in October 2024.

- Governance was enhanced in July 2024 with the appointment of Adam Paul as an Independent Manager and the formation of a Special Committee to oversee restructuring alternatives.

- Short-term liquidity was sought through negotiations with lenders:

- June-September 2024: Amendments to the Term Loan Credit Agreement and entry into the Manager Advance Credit Agreement released ~$13.8 million in restricted cash for operational use.

- Starting November 2024, SOLIC conducted a marketing process, contacting over 95 potential investors/partners, but these efforts did not yield a standalone solution outside of bankruptcy. By early 2025, it became clear that a comprehensive, in-court restructuring was necessary.

Chapter 11 Filing

- On March 31, 2025, HOA and certain affiliates filed voluntary Chapter 11 petitions in the U.S. Bankruptcy Court for the Northern District of Texas.

- The filing was supported by a pre-negotiated RSA executed with key stakeholders:

- 100% of Prepetition Lenders (Term Loan and Manager Advance).

- A super-majority of Ad Hoc Group of Noteholders (securitization investors).

- The Buyer Group (Hooters, Inc. and Hoot Owl Restaurants, LLC – representing original founders and major existing franchisees).

- The RSA outlines a path forward via a joint plan of reorganization centered on a sale of certain company-owned stores to the Buyer Group and transitioning the Company to a pure franchisor model.

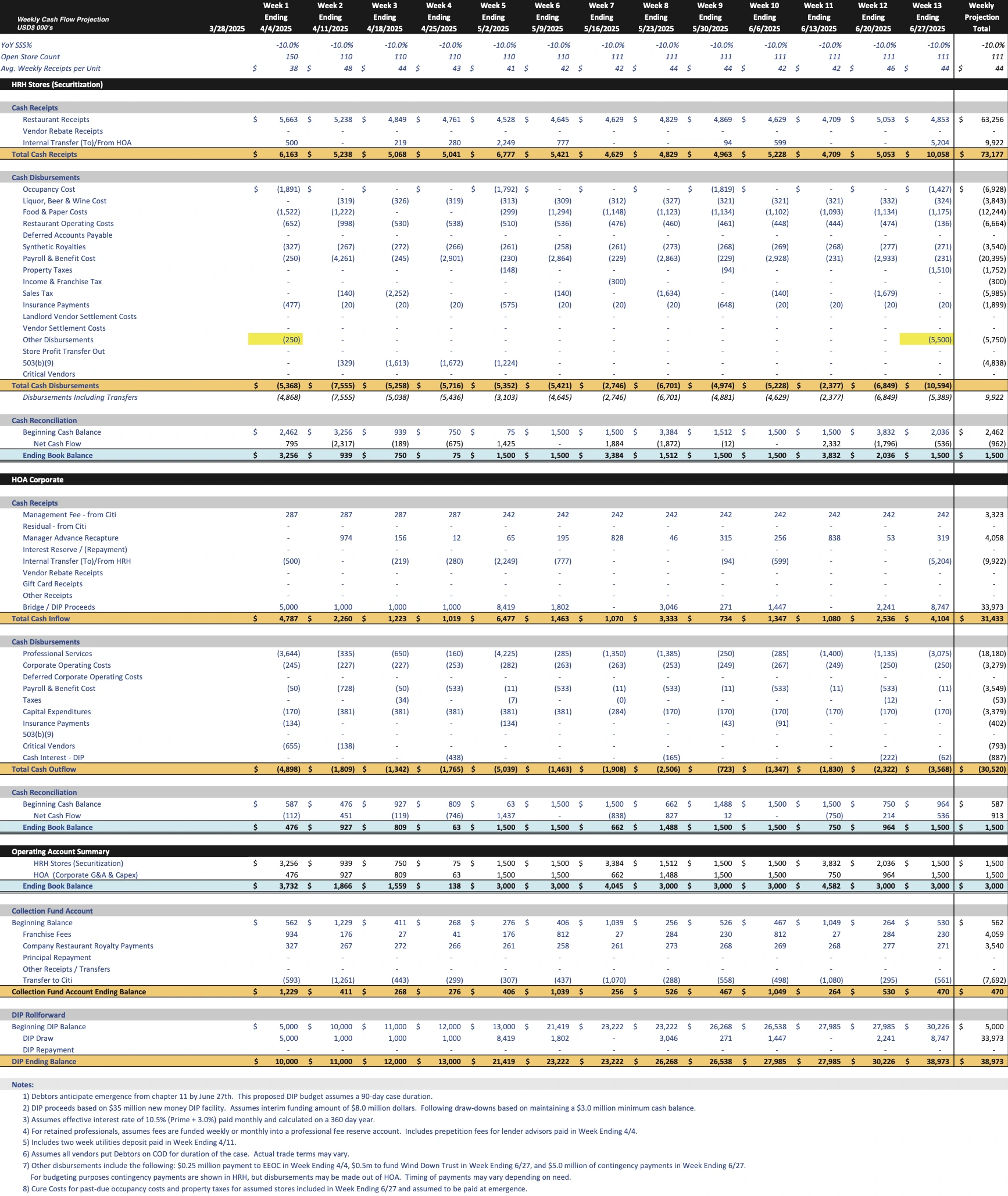

- To facilitate the restructuring, the Debtors secured interim court approval on April 3, 2025, for up to $40 million in superpriority, priming DIP financing ($35 million new money, $5 million prepetition debt roll-up) led by Celtic Master Fund LP, funding operations and the case via budgeted DIP Manager Advances.

Approved Budget

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.