Case Summary: Hwy 55 Chapter 11

Hwy 55 Burgers Shakes & Fries has filed for Chapter 11 bankruptcy, citing financial strain from pandemic-related disruptions, cost inflation, high-interest debt from expansion efforts, and internal mismanagement.

Business Description

Headquartered in Mount Olive, NC, The Little Mint, Inc. (“Hwy 55” or the “Company”) operates a fast-casual restaurant chain under the brand “Hwy 55 Burger Shakes & Fries.”

- Historically focused on strip mall locations, the Company transitioned in 2018 to a stand-alone prototype with pick-up windows to align with modern trends.

Despite generating $24.4 million in revenue in 2023, the Company has experienced consecutive net losses in both 2022 and 2023.

As of the Petition Date, the Debtor reported $1-$10 million in assets and $10-$50 million in liabilities.

Corporate History

Founded in 1991 by Kenny Moore in North Carolina, the business began as a single restaurant, “Andy’s Cheesesteaks & Cheeseburgers,” named after Moore’s son.

In 2012, the Company rebranded to “Hwy 55 Burgers Shakes and Fries” and introduced a franchise model, with many franchisees being former corporate store managers.

Kenny Moore retains 100% ownership of Hwy 55.

Operations Overview

Hwy 55 operates 93 locations, including 22 corporate-owned and 71 franchised stores.

- The stores are primarily located throughout the Southeast, with operations in North Carolina, South Carolina, Georgia, Florida, Tennessee, and Texas.

- Recent closures include 13 corporate-owned locations prior to filing.

The Company does not own real property, instead operating under extensive equipment and real estate leases.

Prepetition Obligations

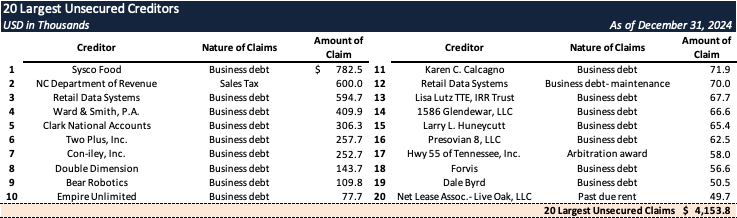

As of December 31, 2024, the Company's secured debt totals approximately $11 million, while trade and other unsecured obligations amount to $5.8 million.

- These figures are subject to updates pending further filings.

Certain proceeds from the Company’s operations may constitute cash collateral under § 363 of the Bankruptcy Code, potentially subject to the security interests of the U.S. Small Business Administration (SBA), Johnson Breeders, Inc., CSC, Institution Food House, Inc., and Performance Food Group, Inc. (collectively, the “Secured Parties”).

- The Secured Parties assert liens over Hwy 55’s inventory, payment intangibles, payment card receipts, general intangibles, and their respective proceeds.

Top Unsecured Claims

Events Leading to Bankruptcy

Expansion Efforts and Initial Setbacks

- In 2012, Hwy 55 rebranded and shifted to a franchise model while maintaining corporate-owned stores.

- Expansion efforts in 2018 involved a transition to stand-alone restaurant prototypes.

- A planned $5 million line of credit for equipment in 2019 failed to materialize, complicating efforts to fulfill contractual obligations for new store openings.

Challenges During Expansion

- The Covid pandemic in 2020 significantly disrupted expansion timelines, creating labor shortages and raising operational costs.

- Between 2021 and 2024, the Company opened 30 new locations without traditional financing, relying on high-interest loans and personal funds.

- Supply chain disruptions increased equipment costs per location from $225,000 to over $375,000, while attempts to secure financing in 2022–2023 were impeded by the collapse of Silicon Valley Bank.

Internal Financial Mismanagement

- Inadequacies in the in-house accounting department led to missed payments for utilities, taxes, and other expenses, causing financial instability.

- The accounting team was replaced, but the damage had already been done.

Immediate Triggers for Chapter 11 Filing

- The Company faced mounting pressure from creditor demands, tax collection efforts, and the expiration of a forbearance agreement with Performance Food Group, Inc. ("PFG").

- A threat of legal action by PFG and limited cash flow ultimately forced the Company to file for Chapter 11 bankruptcy on December 31, 2024, to stabilize operations and protect creditor interests.

Enjoyed this summary? Stay informed on new Chapter 11 filings over $10 million in liabilities—subscribe to Bondoro for free and get insights delivered directly to your inbox.

Plus, explore our full archive for all past summaries.