Case Summary: iLearningEngines Chapter 11

iLearningEngines has filed for Chapter 11 bankruptcy amid SEC investigations, executive resignations, and impending Nasdaq delisting following allegations by Hindenburg Research.

Business Description

Headquartered in Bethesda, MD, iLearningEngines, Inc. ("iLE"), along with its Debtor and non-Debtor affiliates (collectively, the “Company”), is a publicly traded enterprise specializing in AI-powered learning and work automation solutions.

- iLE offers an AI-powered learning and engagement platform designed to automate learning processes and empower organizations to achieve critical outcomes at scale.

The platform incorporates advanced capabilities, including cloud-based access, mobile functionality, offline usability, and multimedia integration, enabling the delivery of highly personalized learning and engagement experiences.

- The system’s in-process learning framework allows organizations to embed education seamlessly within everyday workflows.

iLE is a publicly traded company listed on Nasdaq under the ticker symbol “AILE.”

- As of September 30, 2024, the Company had 141,173,275 shares of common stock issued and outstanding, held by more than 100 registered shareholders of record.

- This figure excludes shares held in “street name” by brokers, banks, and other financial institutions on behalf of beneficial owners.

On December 23, 2024, the Company was notified of its impending delisting from Nasdaq, with trading suspension of its common stock and warrants effective January 2, 2025.

As of the Petition Date, the Debtors reported $100-$500 million in assets and liabilities.

Corporate History

The Company originated as Arrowroot Acquisition Corp. (“ARRW”), a special purpose acquisition company.

On April 27, 2023, ARRW entered into a definitive Agreement and Plan of Merger and Reorganization (the “Merger Agreement”) with ARAC Merger Sub, Inc. (“Merger Sub”), a Delaware corporation and ARRW subsidiary, and iLearningEngines Holdings, Inc. (formerly iLearningEngines Inc.), a Delaware-based entity ("Holdings").

- The merger was completed on April 16, 2024, following approval by ARRW’s stockholders during a special meeting held on April 1, 2024.

- This transaction resulted in the consolidation of Merger Sub into Holdings, with Holdings as the surviving entity.

- Concurrently, ARRW was rebranded as iLearningEngines, Inc., and Holdings adopted the name iLearningEngines Holdings, Inc.

Operations Overview

iLE operates across the United States and Dubai Free Zone, UAE, with additional non-Debtor subsidiaries based in India and Australia.

The Company’s principal offices are located at 6701 Democracy Boulevard, Suite 300, Bethesda, Maryland 20817.

The workforce primarily comprises software engineers and business support personnel, distributed between the U.S. and UAE.

- As of the petition filing date, the Company directly employed seven full-time staff members, with four located in the U.S. and three in the UAE.

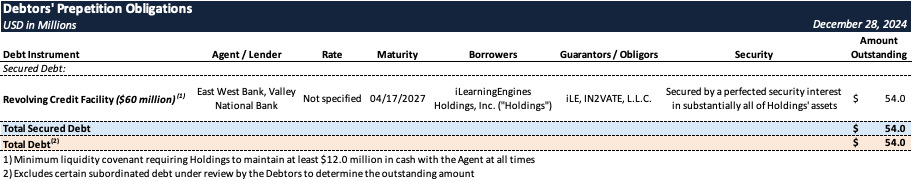

Prepetition Obligations

The Company’s most recent unaudited financial statements, as of September 30, 2024, report total assets valued at approximately $149 million and total liabilities of approximately $141 million.

- The Company’s assets are predominantly composed of accounts receivable.

- Its liabilities include accounts payable, accrued expenses, obligations under the Revolving Loan Agreement, and certain subordinated debt, which remains under review to confirm the outstanding balance.

Events Leading to Bankruptcy

Special Committee Investigation

- The Company's Board of Directors formed a special committee on September 5, 2024, to investigate allegations raised in a report by Hindenburg Research LLC, with Paul Hastings, LLP conducting the investigation.

- The investigation led to the Audit Committee determining that various financial statements, including audited and unaudited statements for different periods, should no longer be relied upon due to inaccuracies.

- Marcum LLP, the Company's independent registered public accounting firm, also concluded that its reports on previously issued consolidated financial statements should no longer be relied upon.

Other Investigations and Inquiries

- The SEC's Division of Enforcement issued a subpoena to the Company on October 17, 2024, seeking documents and information, to which the Company is responding and cooperating.

Executives on Administrative Leave and Resignations

- On December 5, 2024, several key executives, including the CEO, President, and others, were placed on administrative leave pending the investigation's conclusion and later resigned on December 23, 2024.

- Some of these executives, such as the former CEO and President, continue to serve on the Board despite their resignation from executive positions.

- Thomas Olivier was appointed as the Interim Chief Executive Officer on December 5, 2024, and designated as the interim principal executive officer.

Enjoyed this summary? Stay informed on new Chapter 11 filings over $10 million in liabilities—subscribe to Bondoro for free and get insights delivered directly to your inbox.

Plus, explore our full archive for all past summaries.