Case Summary: IMG Holdings (Dana Classic Fragrances) Chapter 11

IMG Holdings, parent of Dana Classic Fragrances, filed for Chapter 11 to pursue a 363 sale backed by a $3M stalking horse bid from Fragrance Xtreme and a $500K DIP facility.

Business Description

IMG Holdings, Inc., through its primary operating subsidiary Dana Classic Fragrances, Inc. (together with its affiliates, the "Company"), is a New York-based personal care and perfumery business that manages and markets a portfolio of iconic, long-established fragrance brands.

- The Company’s signature products include legendary mid-20th-century scents such as Tabu (launched in 1932), Chantilly, Love’s Baby Soft, English Leather, and British Sterling, many of which were acquired from other fragrance houses over time.

- The Company’s product lineup, which includes perfumes, colognes, aftershaves, body sprays, and gift sets, is sold direct-to-consumer through its e-commerce website (DanaClassics.com) and distributed through major retailers, including Walmart and Amazon.

Despite its well-known brands, the Company is a small-scale enterprise, generating approximately $3.5 million to $4 million in annual gross sales in recent years. The Company operates a lean, remote-only model with just five employees as of the Petition Date, outsourcing nearly all production and distribution functions.

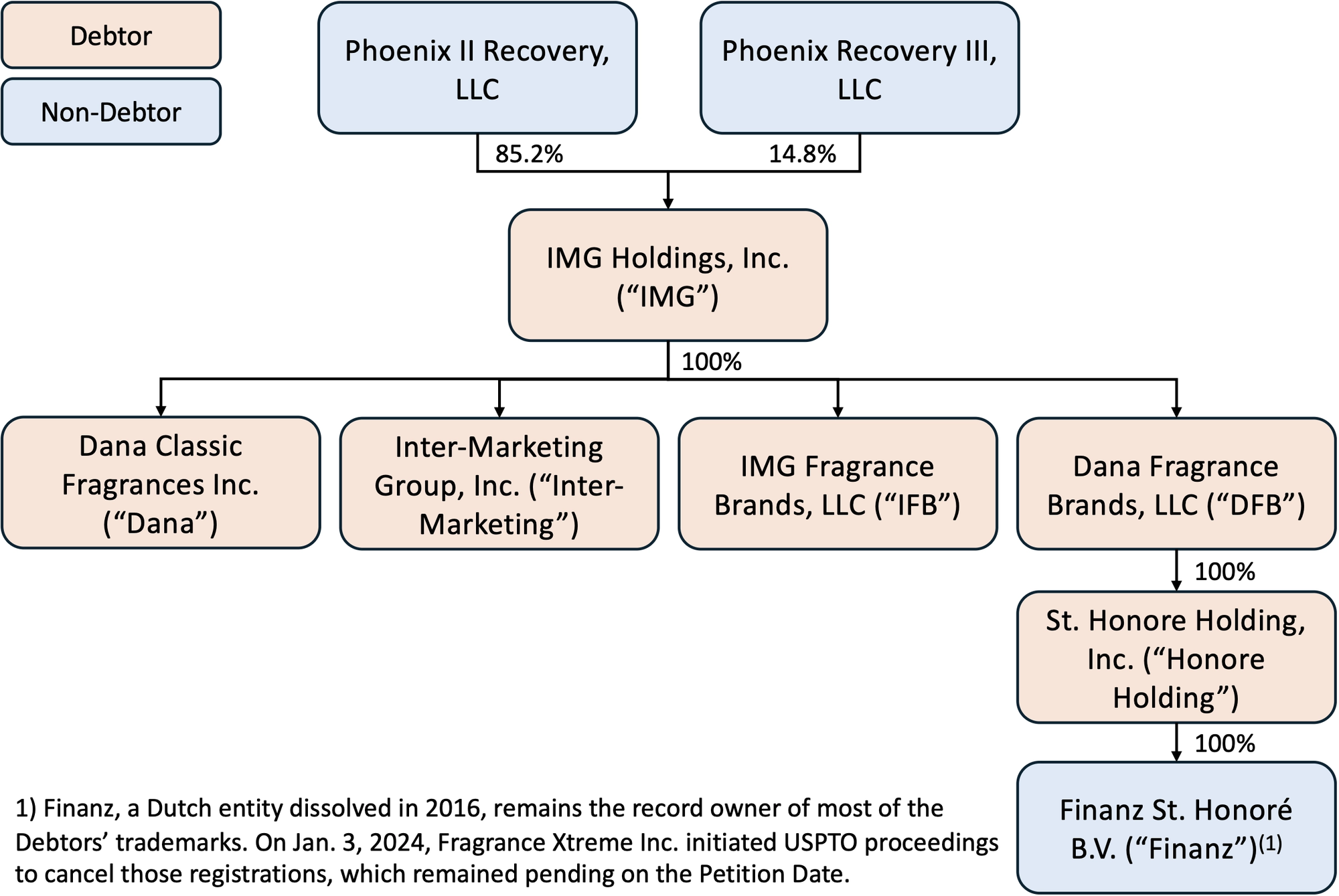

IMG Holdings, Inc. and 5 of its affiliates⁽¹⁾ (the "Debtors") filed for Chapter 11 protection on August 11, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the District of Delaware, reporting $1 million to $10 million in assets and $50 million to $100 million in liabilities.

⁽¹⁾ For a complete list of debtor entities, see the organizational structure chart below.

Corporate History

The Company traces its origins to 1932 with the founding of the House of Dana in Barcelona, Spain, by Javier Serra. Its first perfume, Tabu, became a global classic and established the brand's reputation. The business later relocated its base to Paris, eventually moving primary operations to the United States during the 1940s amid World War II.

Portfolio Expansion and Ownership Changes

- Through the 1990s, the Company bolstered its portfolio by picking up licenses to legacy perfume lines such as Chantilly, Love’s Baby Soft, English Leather, British Sterling, Toujours Moi, Monsieur Musk, Heaven Sent, and Navy for Women.

- In 1995, Renaissance Cosmetics, Inc. bought Dana Perfumes Corp. as part of a strategy to revive and consolidate classic fragrance brands. Four years later, Renaissance collapsed under a debt load and entered Chapter 11 (Case No. 99-02136). In mid-1999, its fragrance assets were sold for about $29 million to Fragrance Express and Dimeling, Schreiber & Park. The buyer consolidated operations under the banner New Dana Perfume Corp., keeping manufacturing and distribution in-house.

- By 2003, New Dana’s chief executive Isaac Cohen carved out Dana Classic Fragrances, Inc., which acquired the fragrance trademarks and assumed responsibility for brand management, sales, and distribution, while New Dana continued to manufacture at its Mountain Top, PA plant under contract.

Shift to Asset-Light Model

- In late 2004, New Dana Perfumes shuttered its Mountain Top, Pa. plant, eliminating roughly 200 jobs. With the closure, manufacturing was no longer performed in-house.

- Dana Classic continued to own the trademarks and oversee marketing and sales, while outsourcing production to third-party manufacturers. The closure cemented an asset-light operating model focused on brand management and licensing rather than manufacturing.

The Patriarch Partners Era

- In the late 2000s, the Company obtained financing from Lynn Tilton’s Patriarch Partners, with the Zohar CLOs (Zohar I, II, III) becoming majority equity holders. Patriarch, as collateral manager of the Zohar funds, retained broad governance and consent rights.

- In 2018, the Zohar funds filed Chapter 11, leading to a court-approved plan that shifted fund assets into creditor recovery vehicles. Equity interests in the Company were ultimately allocated to Phoenix II Recovery, LLC (85.2% as of the Petition Date) and Phoenix Recovery III, LLC (14.8% as of the Petition Date), entities formed for the benefit of Zohar creditors. Patriarch Partners Agency Services continues to act as agent on certain loan facilities.

Corporate Organizational Structure

Operations Overview

The Company operates a streamlined, asset-light business model focused on brand management, with nearly all physical production and logistics outsourced to third-party partners.

Manufacturing and Supply Chain

- The Company sources and blends all its fragrance oils and solutions within the United States to maintain quality control.

- Physical components, including glass bottles, caps, and pumps, are procured from manufacturing partners in China.

Trademarks

- Exhibit A: Trademarks – List of Dana common-law and IMG registered marks with goods, first-use dates, and USPTO registration.

Sales and Distribution

- The Company sells through a multi-channel strategy, including:

- Direct-to-consumer via its own e-commerce site, DanaClassics.com.

- Mass-market retailers including Walmart, Amazon, drugstores, and other discount chains.

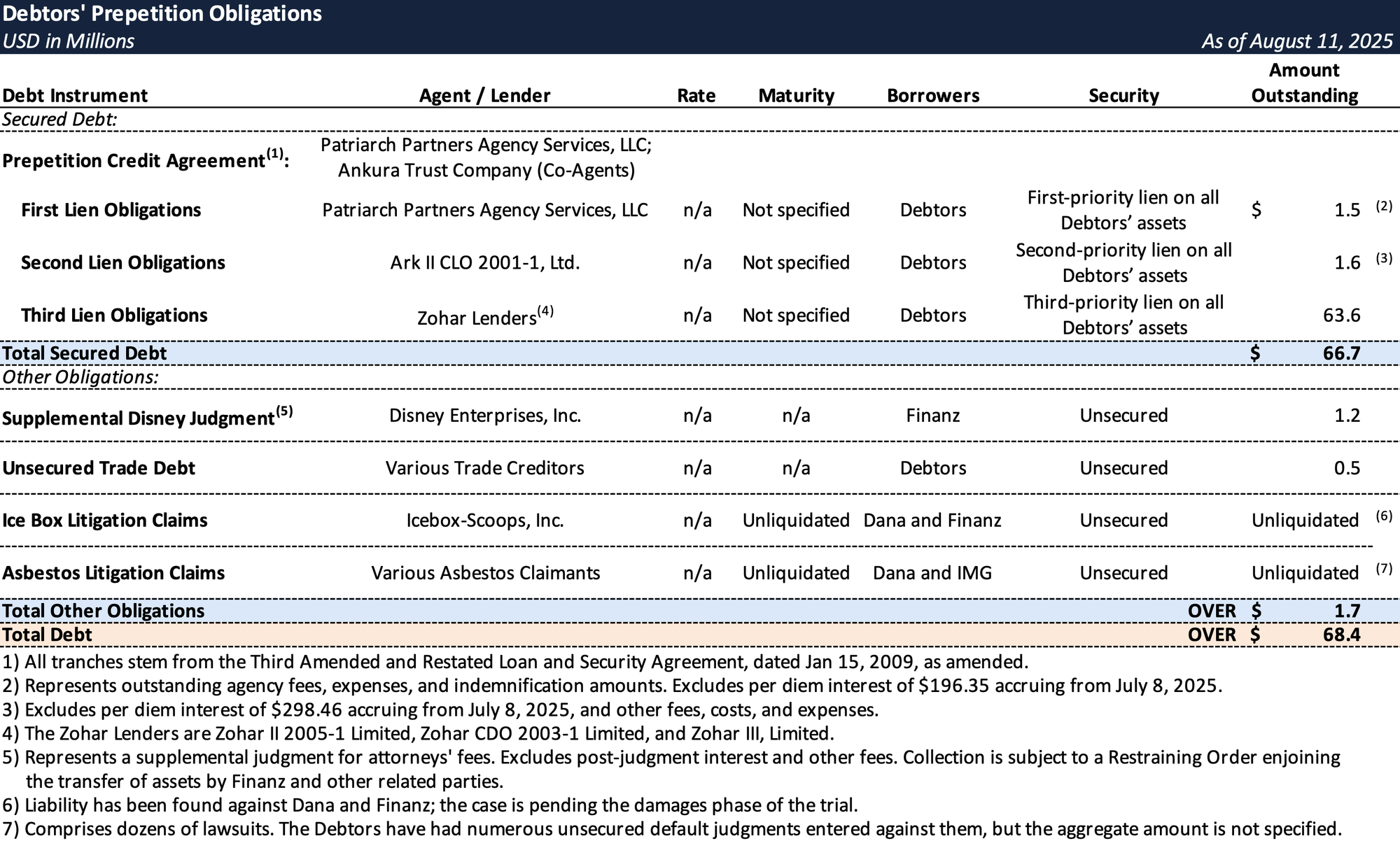

Prepetition Obligations

Top Unsecured Claims

Events Leading to Bankruptcy

Unsustainable Debt and Litigation Paralysis

- The Company’s capital structure was untenable, with approximately $64 million in secured debt owed to the Zohar funds against annual revenues of only $3.5 million to $4 million.

- A 2013 lawsuit filed by Disney Enterprises, Inc. resulted in a 2017 judgment of approximately $1.2 million against Finanz. To enforce the judgment, Disney obtained a restraining order that was renewed annually, effectively freezing the Company’s assets.

- This order crippled the business by preventing any sale or refinancing of its assets outside a formal bankruptcy proceeding, creating a multi-year stalemate that blocked any out-of-court resolution.

The Fragrance Xtreme Trademark Dispute

- In January 2024, competitor Fragrance Xtreme, Inc. filed a cancellation action with the USPTO (No. 92084070) seeking to cancel about 23 trademark registrations held by the Company’s Dutch affiliate, Finanz.

- Fragrance Xtreme alleged that because Finanz was dissolved in 2016, subsequent maintenance filings were invalid and the registrations should be cancelled for constructive abandonment. It also filed intent-to-use applications to register the marks in its own name.

- The proceeding was stayed while the parties pursued a broader settlement and sale.

Prepetition Sale Efforts and Stakeholder Settlement

- For years, the Company attempted to market its business and intellectual property, but the Disney restraining order and tangled creditor liens prevented any transaction from closing.

- A breakthrough occurred on December 30, 2024, when the Debtors brokered a comprehensive Creditor Resolution—a settlement among the Zohar lenders, Patriarch Partners (as agent for a portion of the debt), and Disney.

- Under the agreement, the parties consented to a sale of the business and established a framework for allocating proceeds, clearing the path for a sale process.

Chapter 11 Filing and Stalking Horse Sale

- With a stakeholder settlement in place, the Company lined up a buyer, ultimately negotiating an Asset Purchase Agreement (APA) with Fragrance Xtreme, which transitioned from litigant to suitor.

- To implement the sale free and clear of all liens and encumbrances, the Debtors filed for Chapter 11 protection. The key terms of the proposed transaction include:

- Fragrance Xtreme will serve as the stalking horse bidder with a $3 million offer for substantially all of the Company's assets, primarily its trademarks and related intellectual property.

- The sale is contingent on obtaining releases from all major stakeholders, ensuring the buyer acquires the assets free of any legacy claims.

- The transaction will provide a global resolution to the Company's major legal battles, as the trademark cancellation proceeding will be dismissed and the Disney judgment will be satisfied per the settlement agreement.

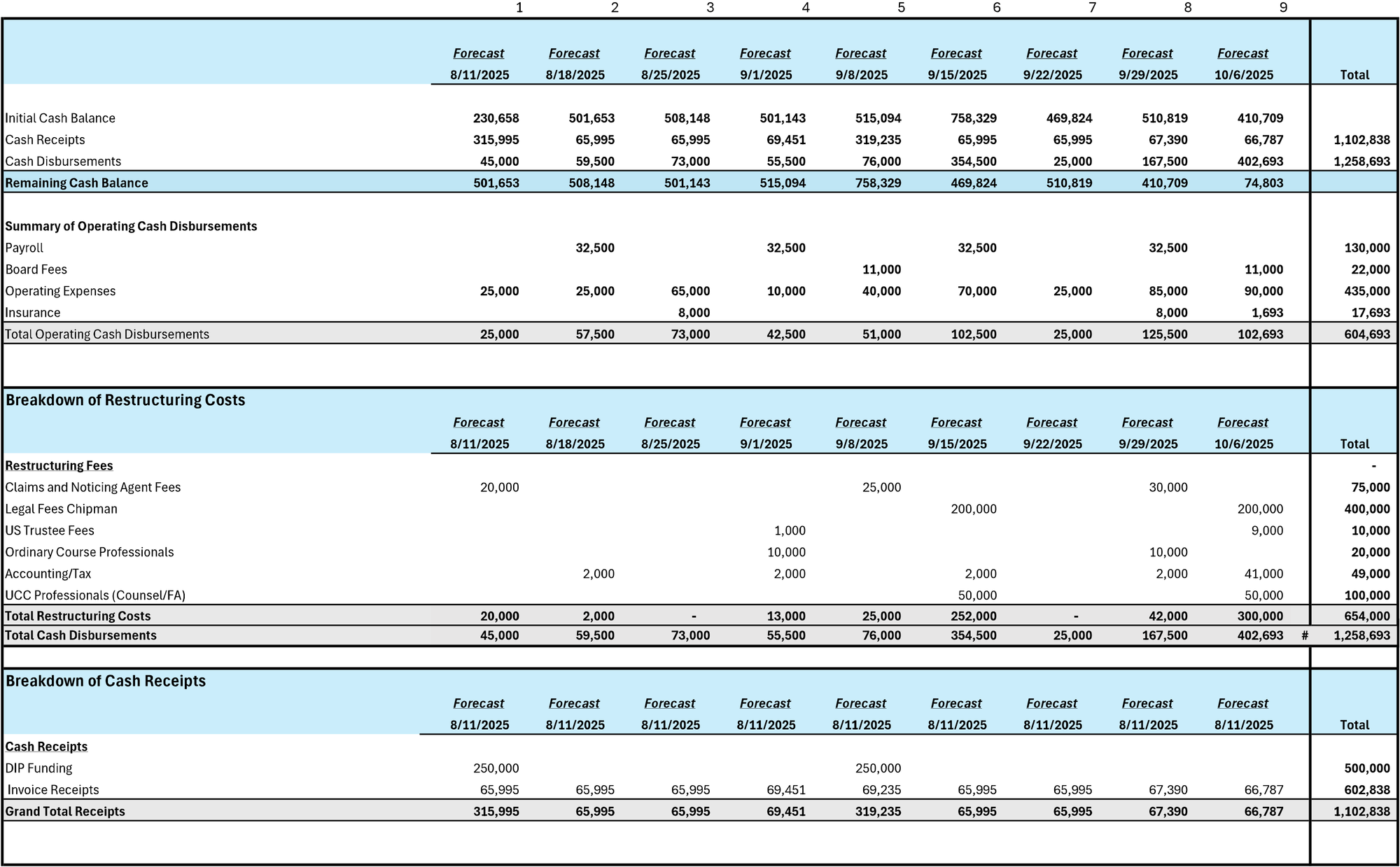

- To fund operations through the Chapter 11 process, the Debtors secured up to $500,000 in DIP financing from Fragrance Xtreme. The cases are now proceeding toward a sale hearing scheduled for October 6, 2025.

Initial DIP Budget

Key Parties

- Chipman Brown Cicero & Cole, LLP (counsel); Stretto, Inc. (claims agent).

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.