Case Summary: InvaTech Chapter 11

InvaTech has filed for Chapter 11 bankruptcy, citing working capital constraints from restrictive SBA loan terms, with plans to secure new funding and expand production.

Business Description

Headquartered in East Brunswick, NJ, InvaTech Pharma Solutions, LLC ("InvaTech" or the "Company") is a generic pharmaceutical developer and manufacturer.

- The Company specializes in producing prescription products for a broad range of therapeutic areas, including cardiovascular, gastrointestinal, dermatological, hypertension, respiratory, dental, pain, muscle spasm relief, women’s health, and ophthalmic treatments.

- These products are available in various forms such as injectables, ophthalmic dosages, oral solids, liquid orals, and controlled substances.

In 2024, InvaTech generated revenue of $5.6 million and reported an EBITDA (before R&D) of $500,000.

As of the Petition Date, the Company employs 40 individuals and operates out of a 46,000-square-foot leased facility in New Jersey.

InvaTech filed for Chapter 11 protection on Feb. 13 in the U.S. Bankruptcy Court for the District of New Jersey. As of the Petition Date, the Debtor reported $1 billion to $10 billion in assets and $10 million to $50 million in liabilities.

Corporate History

InvaTech was founded in 2013 by its CEO, Nilesh M. Patel, who brings over 25 years of experience in the pharmaceutical industry, including roles in manufacturing, quality assurance, and regulatory affairs.

- Patel previously co-founded a generics company that achieved over $100 million in revenue between 2004 and 2012.

- Throughout his career, he has overseen the filing and approval of over 75 Abbreviated New Drug Applications (“ANDAs”) and more than 30 changes being effected (“CBE”) and prior approval supplement (“PAS”) protocols.

- Director of Manufacturing, Bhaskar Patel, has over 20 years of experience with global pharmaceutical companies, contributing to the development of 70+ ANDAs and the filing of 60 products.

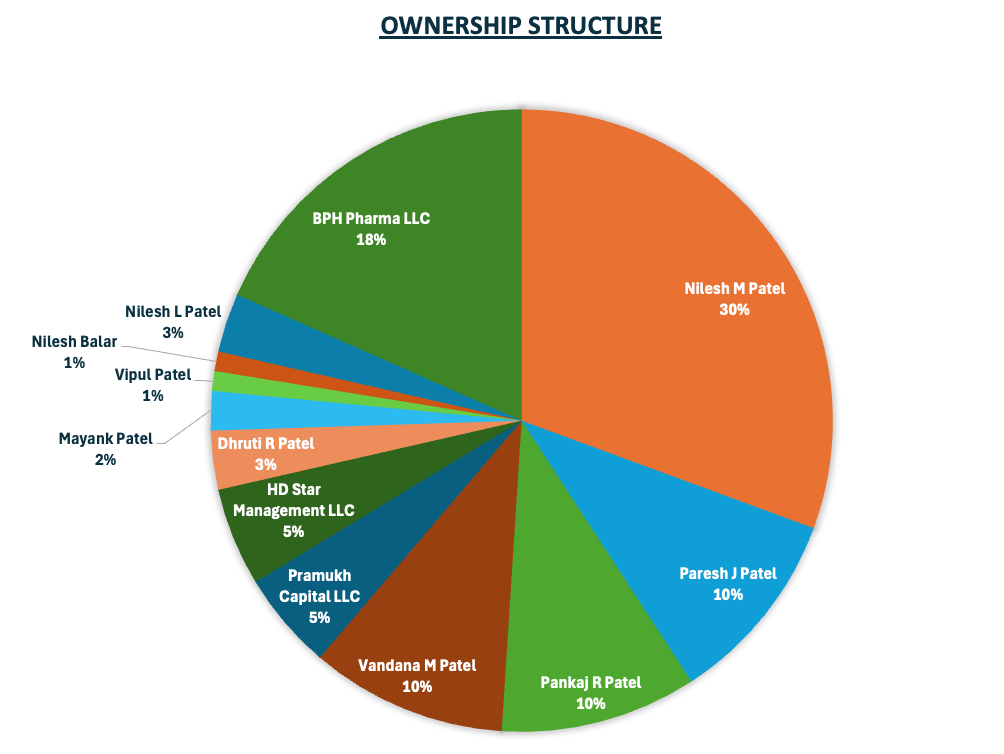

Ownership Structure

Operations Overview

InvaTech focuses on manufacturing and distributing generic pharmaceuticals under cost- and profit-sharing arrangements with established U.S. pharmaceutical interests and distributors, such as Patrin Pharma, Rising Pharmaceuticals, Eywa Pharma, and Strides Pharmaceuticals. Its target customers include government agencies (e.g., Veterans Affairs and Department of Defense), large wholesalers, retail chains, and pharmacy benefit managers.

- Product Pipeline: The Company has filed over 40 ANDAs, with 28 already approved. An additional 3-4 are expected to be approved in 2025, while 10-12 more are at various stages of filing and 6-8 are under active development.

- Facilities and Capabilities: InvaTech’s 46,000-square-foot premises include pharmaceutical-grade manufacturing lines (for oral solid and liquid dosage forms), an R&D lab equipped to file 10-12 products annually, on-site warehousing, regulatory and quality assurance functions, utility infrastructure, and offices to support further expansion. The facility has passed multiple FDA inspections without significant observations.

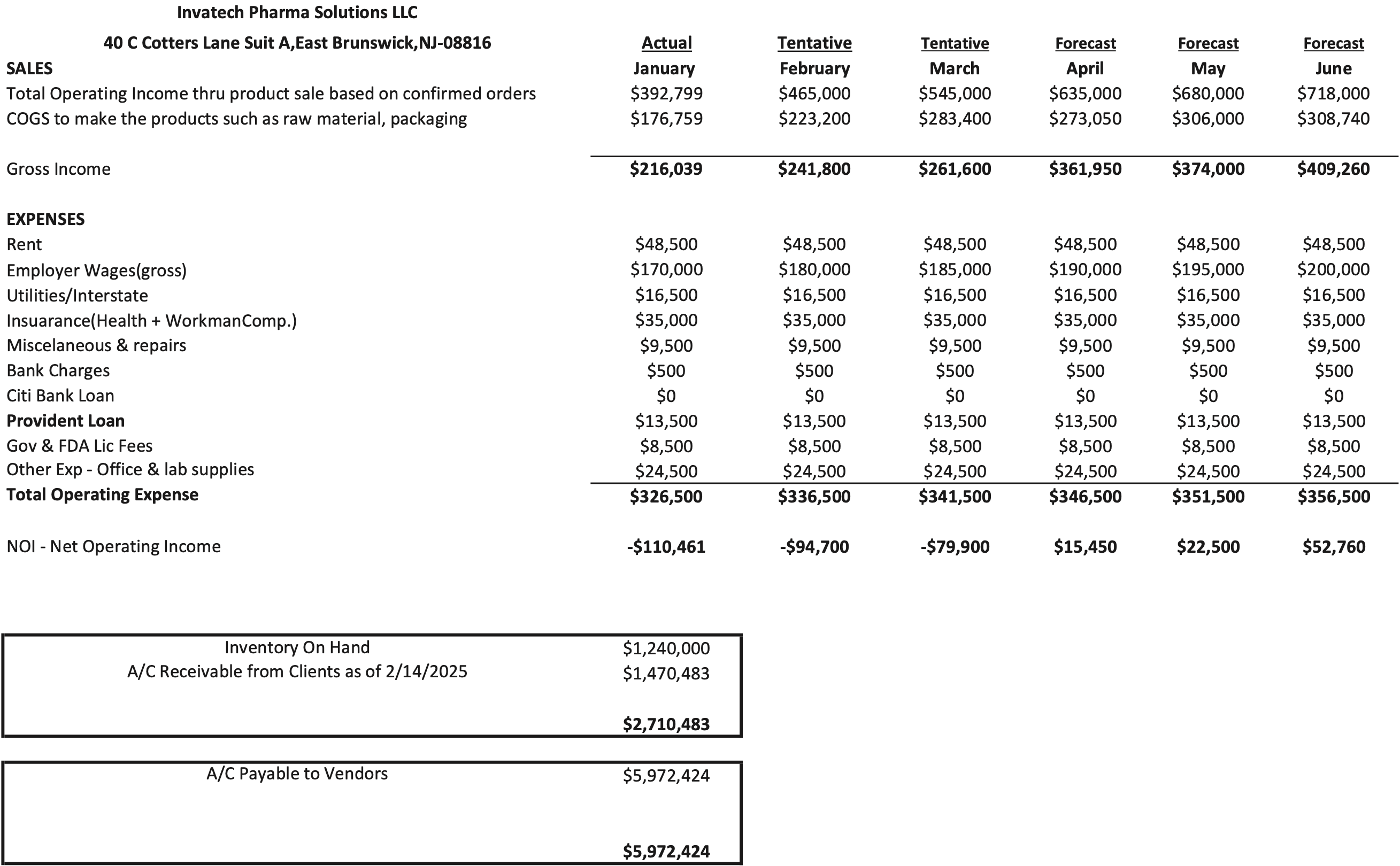

Financial Position and Projected Cash Flow

- Seasonality and Operating Income: November and December are seasonally slow months, yielding a total operating income of $216,039 in January 2025. Management projects a steady increase to $409,260 by June 2025.

- Current Assets: As of the Petition Date, InvaTech reports approximately $1.24 million of inventory and $1.47 million of accounts receivable. Payments on shipped product generally occur within 30-60 days.

- Future Capital Needs: InvaTech’s leadership aims to secure new funding to accommodate larger production demands and continue expanding.

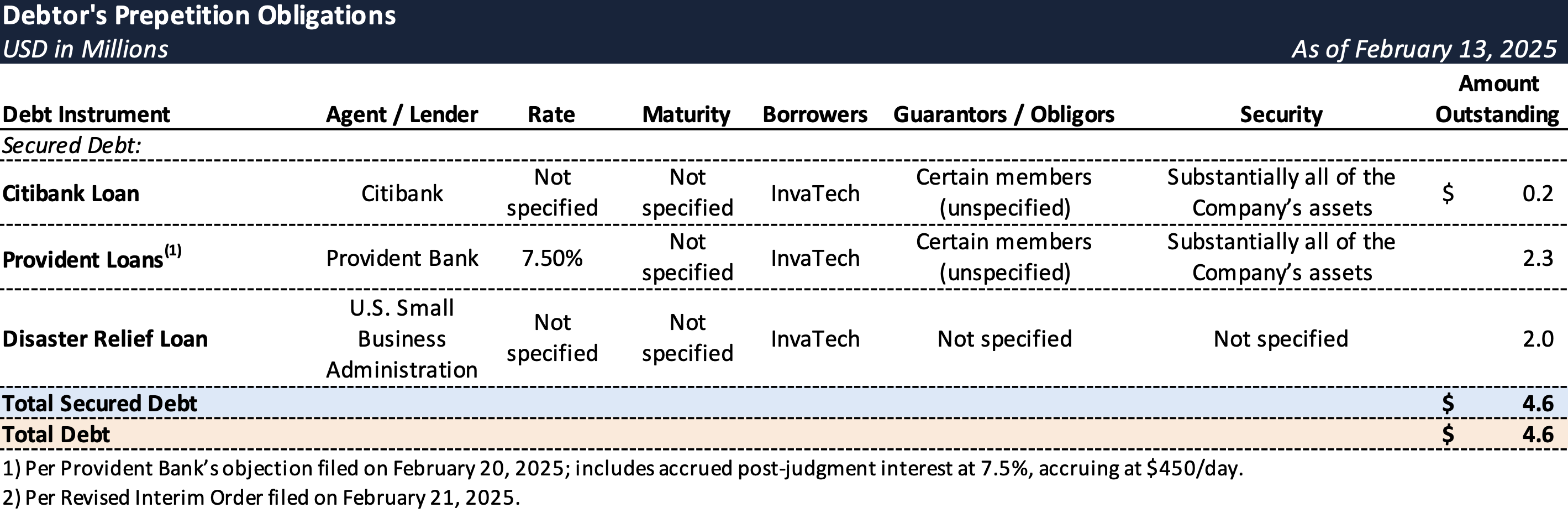

Prepetition Obligations

Events Leading to Bankruptcy

Liquidity Constraints and SBA Loan Restrictions

- InvaTech’s financial challenges were compounded by restrictive covenants tied to two SBA-backed loans from Provident Bank (the “Provident Loans”), which limited access to additional financing.

- Initially used to construct a pharma-grade facility and acquire FDA-compliant equipment, the loans included provisions that prohibited the Company from securing new debt, restricting its ability to raise working capital.

- As liquidity pressures mounted, these limitations constrained the Company’s ability to scale production and meet growing demand, ultimately contributing to its Chapter 11 filing.

Cash Collateral Authorization

- Following the bankruptcy filing, InvaTech secured interim court approval to access cash collateral in accordance with a court-approved budget (outlined below).

- The interim order permits the use of proceeds from post-petition inventory sales, deposit accounts, and accounts receivable, subject to prepetition lender liens.

- As part of the lender protection package, Provident will receive $450 per day (or approximately $13,500 per month), while lenders are granted replacement liens on post-petition collateral.

- A $100,000 carve-out was approved to cover U.S. Trustee fees and professional expenses, ensuring continued access to legal and financial advisors throughout the restructuring process.

- The Court has scheduled a second interim hearing for March 4, 2025.

Restructuring Initiatives and Path Forward

- With immediate liquidity secured, the Company is exploring longer-term restructuring solutions.

- Discussions with Elysium Pharmaceuticals LTD remain ongoing as the Company seeks new capital to support operations and address long-term funding needs.

- Management expects that a successful capital raise, coupled with operational restructuring under Chapter 11, will provide a path to long-term stability and improved financial performance.

Debtor’s budget

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you’re already a subscriber and would like to receive timely filing alerts, please reach out and we’ll add you to the distribution list.