Case Summary: Jackson Hospital Chapter 11

Jackson Hospital has filed for Chapter 11 bankruptcy amid sustained financial pressure from rising costs, stagnant revenue, and market challenges, aiming to restructure debt and pursue strategic alternatives.

Business Description

Jackson Hospital & Clinic, Inc. (“JHC”) is a prominent healthcare provider based in Montgomery, AL. JHC directly or indirectly owns a network of non-Debtor affiliated physician practice groups and subsidiaries, as well as Debtor JHC Pharmacy LLC ("JHP", and together with JHC, the "Debtors"), which delivers pharmacy services to its patients.

Operating a 344-bed facility, JHC offers a broad spectrum of services ranging from cardiac and cancer care to neurosciences, orthopedics, women’s health, and round-the-clock emergency services.

- The hospital serves 16 counties across central Alabama.

The Debtors filed for Chapter 11 protection on Feb. 3 in the U.S. Bankruptcy Court for the Middle District of Alabama. As of the Petition Date, the Debtors reported $100 million to $500 million in both assets and liabilities.

Corporate History

JHC’s origins date back to 1894, when Watkins Infirmary first opened its doors at the current Montgomery location. The institution underwent a significant transformation on September 16, 1946, when Jackson Hospital was inaugurated with 37 patient beds and five attending physicians.

- Over the ensuing decades, JHC evolved into one of Alabama’s largest hospitals.

- As an Alabama non-membership non-profit corporation, JHC has expanded its operations to include various affiliated entities, notably JHP, further diversifying its service offerings.

Operations Overview

JHC delivers a full range of clinical services from its 344-bed facility, maintaining a focus on specialized areas including cardiac, cancer, neurosciences, orthopedics, and women’s care, alongside providing 24-hour emergency services.

Service Delivery:

- The hospital’s comprehensive care model addresses the healthcare needs of a broad patient base across 16 counties in central Alabama.

- Ancillary physician practice groups and the wholly owned subsidiary, JHP, bolster its service capabilities.

Workforce and Infrastructure:

- JHC employs approximately 1,641 full-time staff, 50 part-time employees, 361 PRN nurses, and 31 contract workers.

- The majority of the hospital’s real estate is held by the Medical Clinic Board.

Prepetition Obligations

Bond Issuance and Associated Bridge Financing

- Pursuant to a Trust Indenture administered by UMB, the Debtors issued Series 2015 Bonds with an aggregate principal amount of $61 million. In connection with this bond issuance, the Debtors also incurred a bridge loan obligation of $5 million made to the bondholders.

- Key terms such as interest rates and maturities have not been disclosed.

Credit Facility with ServisFirst Bank

- In addition to the bond-related financing, the Debtors, along with certain non-Debtor entities, are parties to a credit agreement with ServisFirst Bank. This agreement provides for a credit facility comprising:

- A revolving loan facility with a commitment of up to $12 million, and

- A bridge loan facility in the amount of $5 million.

- The credit facility is secured by a security interest in the majority of the Debtors' assets, including accounts receivable.

- As with the bond financing, the specific details regarding interest rates, maturities, and amounts outstanding as of the Petition Date for this Credit Facility remain unspecified.

Trade Debt

The Debtors also report trade debt in excess of $100 million, owed to vendors and other parties as of the Petition Date.

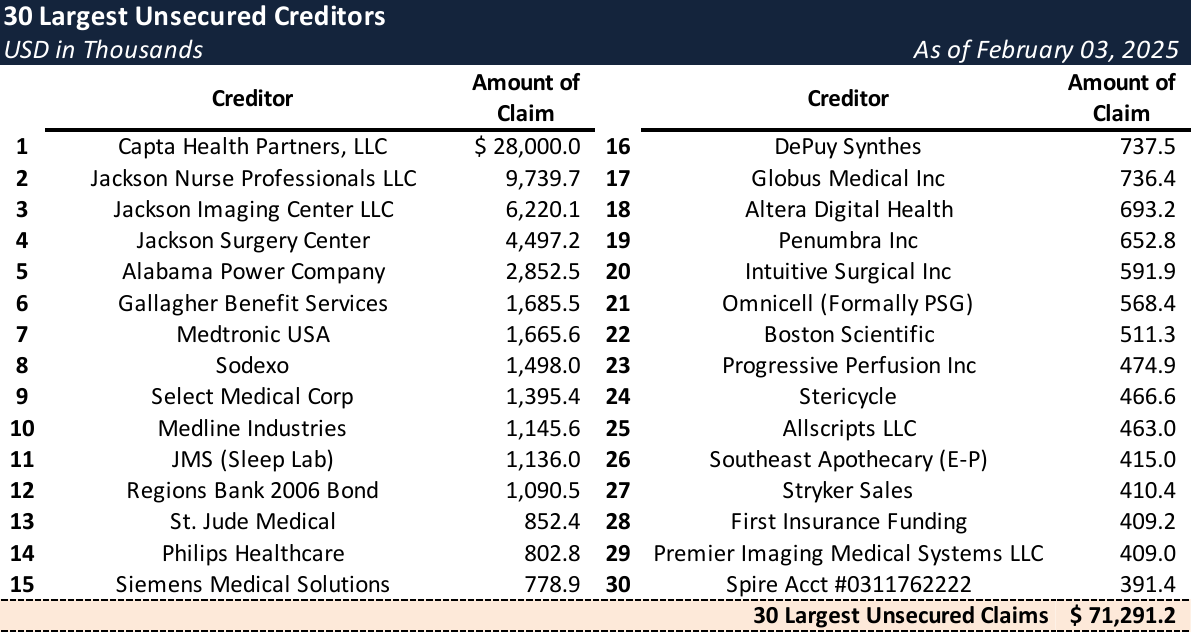

Top Unsecured Claims

Events Leading to Bankruptcy

Financial Pressures and Operational Challenges

- In recent years, the Debtors have contended with escalating financial pressures driven by rising operating costs, stagnant reimbursement rates, and a deteriorating payor mix. These headwinds depleted $60 million in available investments by June 2021 and precipitated a default on secured debt in April 2024. The challenges were further compounded by:

- A healthcare environment increasingly unfavorable to standalone community hospitals.

- Rising expenses associated with a patient base heavily weighted toward uninsured or underinsured individuals—costs that exceeded $10.3 million in 2022.

- A burgeoning accounts payable backlog that led vendors to demand cash-on-delivery and, in some instances, to initiate litigation.

- Significant workforce attrition and the loss of key medical personnel.

- The lingering impact of COVID-19, which strained resources and depressed patient volumes.

- In June 2024, the Debtors entered into an affiliation with a private equity firm to secure capital and operational support; however, the expected funding failed to materialize, and a related revenue cycle consulting initiative underperformed. The Debtors terminated the affiliation in September 2024.

- For the fiscal year ended December 31, 2022, the Debtors reported operating losses of approximately $36.7 million, a revenue shortfall of around $44 million, and negative cash flows of roughly $3.9 million.

- Despite these adverse results, the Debtors maintained that targeted structural and operational changes could ultimately reverse the downturn.

Restructuring Initiatives and Bondholder Actions

- In June 2024, Moody’s Ratings underscored the hospital’s weakened financial profile—citing an ineffective financial strategy, deficient risk management, and lapses in management credibility—while S&P Global Ratings downgraded its debt to D following a missed bond interest payment on September 3, 2024.

- In response, and under the direction of bondholders and the Board, the Debtors launched a series of stabilization measures:

- On September 4, 2024, the Debtors engaged Eisner Advisory Group to lead a restructuring initiative, which included appointing a CRO to report directly to the Board.

- In December, the Board of Trustees terminated the CEO and COO, subsequently naming Ronald Dreskin from Eisner Advisory Group as Interim CEO to refocus management on day-to-day operations and enhance restructuring oversight.

- In the months preceding the Chapter 11 filing, the Debtors engaged in extensive negotiations with the bondholders and local government officials to evaluate all available restructuring and financing alternatives. As part of these efforts, bondholders proposed providing DIP financing, contingent upon the City of Montgomery issuing a fully collateralized $20.5 million loan guarantee.

- The Debtors worked closely with City officials to advance this request, culminating in a City Council meeting on January 31, 2025, to vote on the proposed guarantee. However, during the meeting, certain council members requested additional information and introduced material modifications to the resolution, delaying a final decision.

- The bondholders, citing concerns over the uncertainty of securing the guarantee, subsequently withdrew their financing proposal.

- Ultimately, the Debtors secured a commitment for DIP financing from third-party lender Jackson Investment Group LLC.

- The proposed DIP facility provides $24.5 million in new-money financing.

- Upon court approval, the DIP facility, in conjunction with cash flow from operations, is expected to support the Debtors through the Chapter 11 process.

- Additionally, a comprehensive restructuring plan was rolled out, focusing on revenue enhancement and operational efficiency through divestitures of non-core operations, the closure of outpatient pediatric services, workforce reductions, and initiatives aimed at reducing patient length of stay to industry benchmarks.

- In early January 2025, the Debtors retained SSG Capital to evaluate strategic alternatives—including potential financing, a sale, or a restructuring transaction.

- The Debtors subsequently filed for Chapter 11 protection on February 3, 2025, contending that JHC and its related entities are viable assets that can be preserved and restructured through a 363 sale or refinancing.

Subscribe for access to coverage of all Chapter 11 bankruptcy cases with liabilities exceeding $10 million.