Case Summary: Jervois Global Chapter 11

Jervois Global has filed for Chapter 11 bankruptcy, citing market and cost pressures, with Millstreet Capital backing its restructuring through new capital and equity investments.

Business Description

Headquartered in Melbourne, Australia, Jervois Global Limited ("JGL"), along with its Debtor and non-Debtor affiliates (collectively, the “Company”), is a leading global supplier of advanced manufactured cobalt products. The Company serves customers across the powder metallurgy, battery, and chemical industries, emphasizing responsible sourcing and environmental performance to provide a secure and reliable supply of products.

The Company operates primarily in Finland, the United States, and Brazil, with a diverse global customer base. As of the Petition Date, the Company employs approximately 230 employees.

- JGL is publicly listed on the Australian Securities Exchange since December 1, 1980, and the Toronto Venture Stock Exchange since June 2, 2019.

- As of the Petition Date, JGL had approximately 2.7 billion shares of common stock issued and outstanding.

The Debtors filed for Chapter 11 protection on Jan. 28 in the U.S. Bankruptcy Court for the Southern District of Texas. As of the Petition Date, the Debtors reported $100 million to $500 million in both assets and liabilities.

Corporate History

Incorporated on October 25, 1962, as Jervois Mining Limited, the Company has evolved into a prominent global Western supplier of responsibly sourced cobalt manufactured products, known for ethical and sustainable business practices.

Key Acquisitions and Developments

- In July 2019, the Company acquired the Idaho Cobalt Operations ("ICO") in Lemhi County, ID, a partially constructed mine site. Post-acquisition, the Company invested over $150 million in development, including a water treatment plant, underground mine infrastructure, and a mining camp.

- The U.S. Department of Defense awarded the Company a $15 million grant under the Defense Production Act Title III for mineral resource drilling and a feasibility study on a domestic cobalt refinery, expected to be completed by Q1 2025.

- In 2021, the Company acquired Debtor Jervois Finland, which includes a refining agreement with Umicore N.V. for cobalt refining in Kokkola, Finland, and long-term contracts with global cobalt hydroxide suppliers.

- In July 2022, the Company acquired the SMP Refinery in São Paulo, Brazil, a nickel and cobalt electrolytic refinery, with plans to restart operations following a bankable feasibility study.

Non-Core Assets

- Non-Debtor Nico Young Pty Ltd owns a nickel and cobalt deposit in New South Wales, Australia, considered a strategic future source of Western nickel and cobalt, with $20 million invested to date.

Operations Overview

JGL's principal assets include an operating cobalt facility in Finland, a non-operating cobalt mine in the U.S., and a non-operating refinery in Brazil, aiming to integrate mining, refining, and product sales.

Key Facilities

- Kokkola, Finland: A world-class cobalt refinery and conversion operation, one of the largest outside China, offering advanced production capabilities and R&D support.

- Idaho Cobalt Operations: The largest and highest-grade confirmed cobalt orebody in the U.S., anticipated to be the only primary cobalt mine in the country upon commissioning.

- SMP Refinery, Brazil: A nickel and cobalt refinery near São Paulo, undergoing restart efforts with access to key infrastructure for domestic and export markets.

Non-Core Assets

- Nico Young deposit in Australia, suitable for low-strip, open-pit mining, representing a future strategic resource.

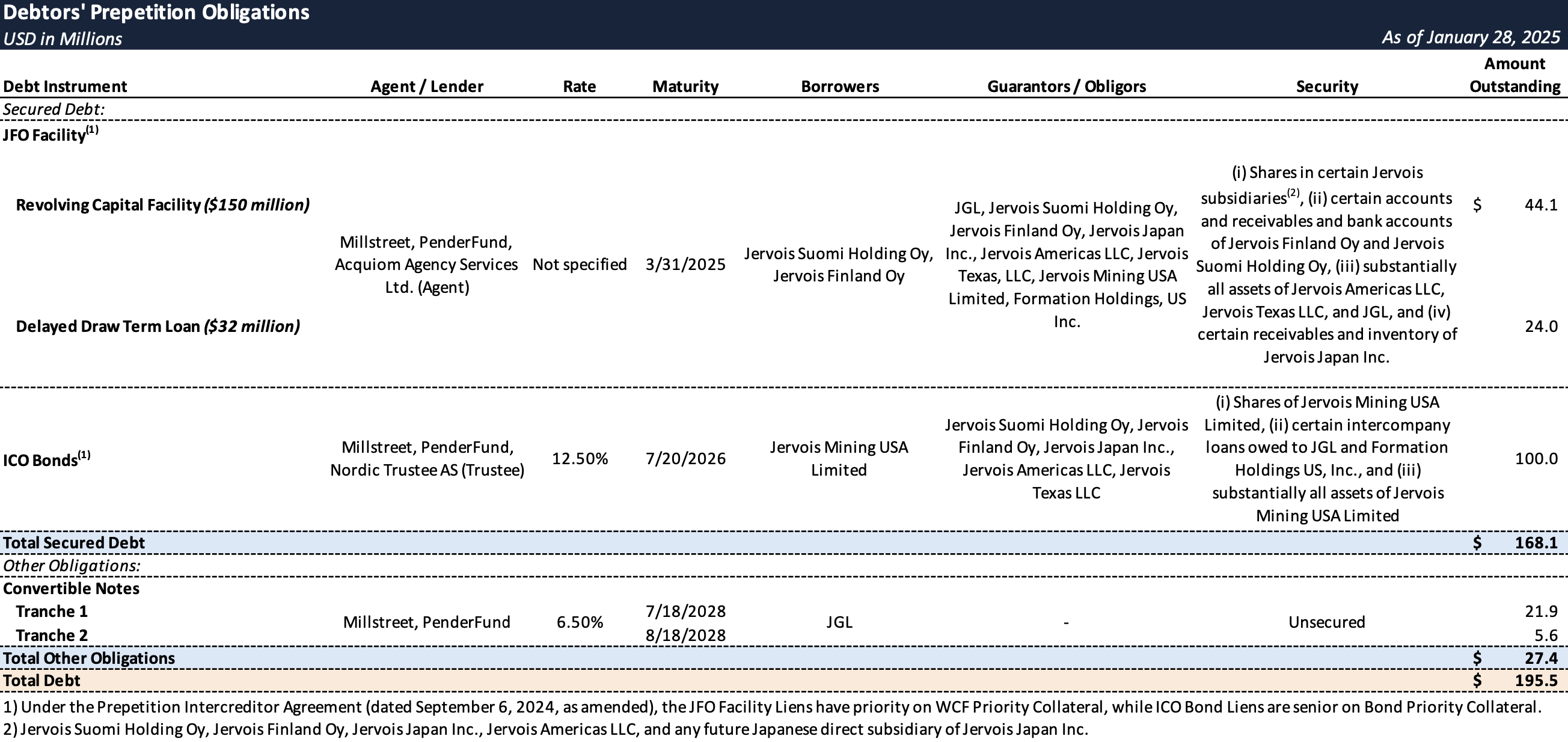

Prepetition Obligations

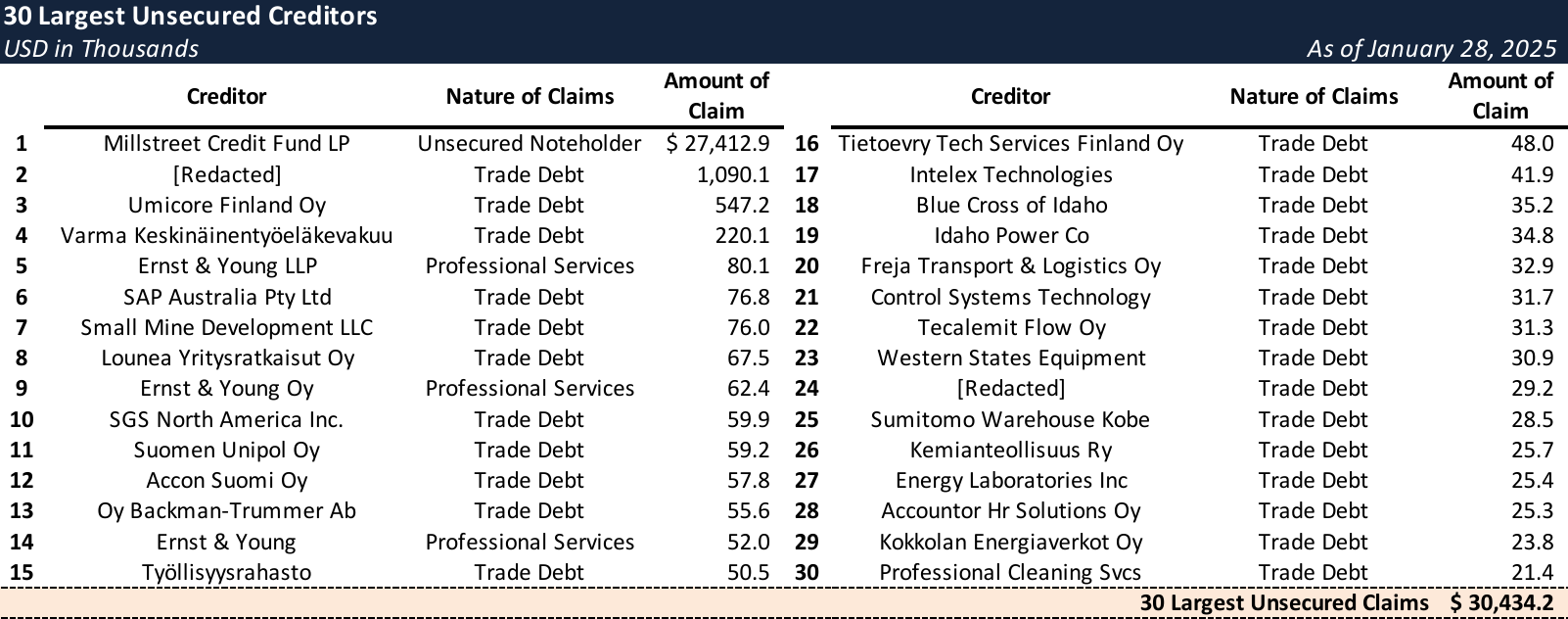

Top Unsecured Claims

Events Leading to Bankruptcy

Challenging Market Conditions

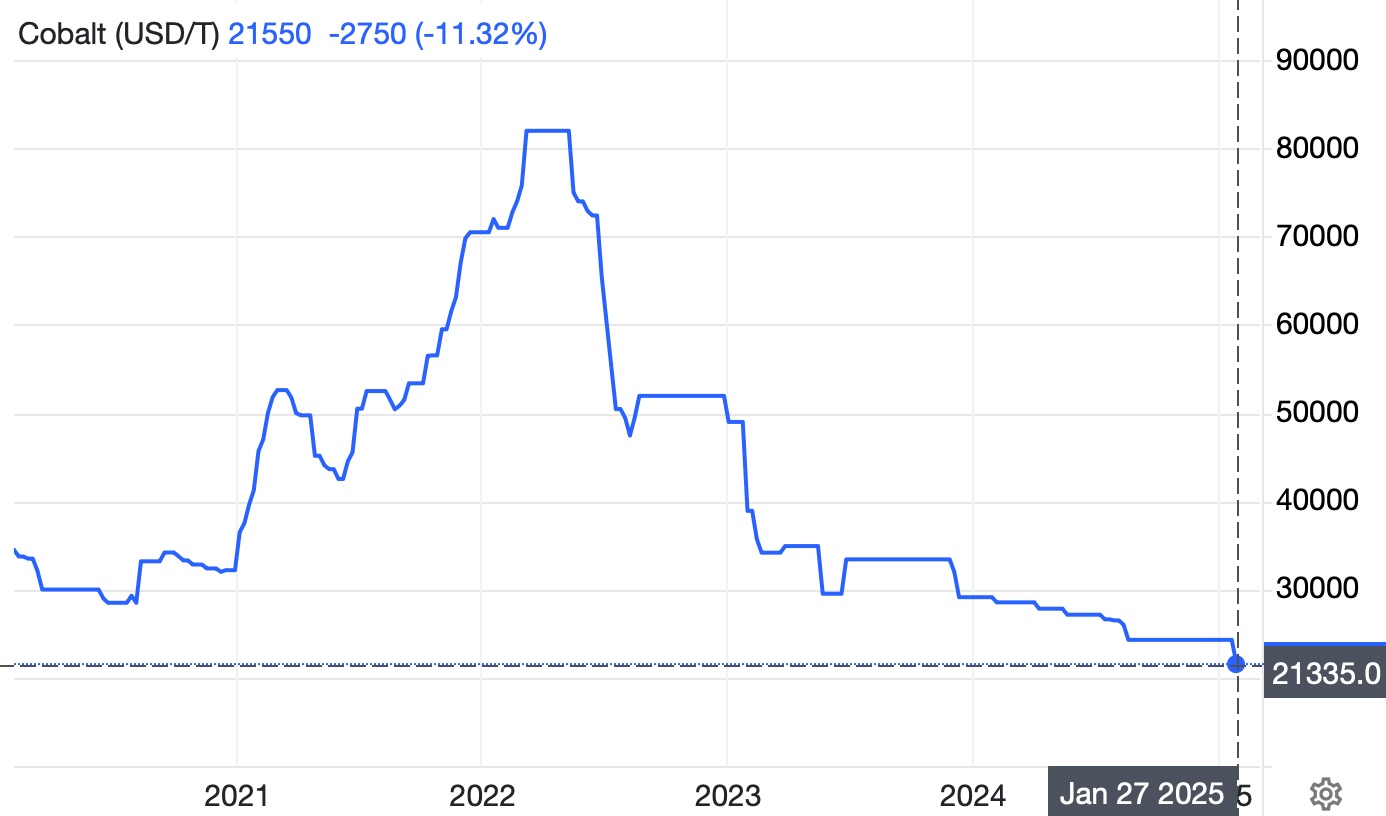

- The Company faced significant market challenges beginning in 2022, exacerbated by declining cobalt prices due to oversupply from Chinese-owned mines in the Democratic Republic of the Congo. As a cobalt producer, the Company was directly exposed to the volatility of cobalt prices, which have remained historically low in recent years.

- These challenging conditions persisted through 2023 and 2024, with cobalt prices continuing to weigh on the Company’s financial performance.

- Additionally, demand for the Company’s products weakened due to increased competition in downstream markets, particularly from China, across all powder metallurgy applications.

Operational Challenges

- Rising interest rates and inflationary pressures on construction and capital costs led the Company to suspend final construction at the ICO.

- Additionally, increasing energy and consumable costs drove up overall operating expenses, compounding financial challenges amid declining sale prices.

Prepetition Restructuring Efforts

- In Q2 2023, JGL initiated discussions with third parties to explore partnership opportunities across multiple assets. By September 2023, the Company had launched formal processes to solicit interest in asset sales, partnerships, and strategic transactions aimed at strengthening its balance sheet and improving liquidity.

- Despite an extensive marketing process and significant engagement from interested parties, no actionable proposals materialized.

- In early 2024, JGL expanded its strategic review to include potential mergers or a sale of the Company, supported by funding from Millstreet Capital Management LLC (“Millstreet”), a key financial stakeholder and funded debt holder.

- These efforts continued through late 2024 but similarly did not yield any actionable proposals.

- In April 2024, faced with upcoming bond interest payments and the maturity of the JFO Facility at the end of 2024, the Company engaged advisors to explore a potential balance sheet restructuring.

- Over the next nine months, the Company engaged in extensive discussions with Millstreet to address balance sheet challenges.

- Millstreet provided the Company with amendments, waivers, and deferrals under the JFO Facility and ICO Bonds, as well as two rounds of increased commitments and fundings under a newly created term loan.

Restructuring Support Agreement and Chapter 11 Filing

- In early December 2024, the Company and Millstreet began discussing a comprehensive restructuring and take-private transaction to be implemented through Chapter 11 proceedings in the U.S. and sequential Australian Proceedings.

- With the assistance of advisors, including FTI, the Company and Millstreet negotiated the terms of the Restructuring Transactions, culminating in the execution of a Restructuring Support Agreement (“RSA”) on December 31, 2024. The RSA was amended and restated on January 28, 2025.

- Pursuant to the RSA, the Consenting Lenders agreed to:

- Commit substantial new capital, including a $49 million JFO DIP Facility and a $90 million New Money Investment.

- Provide an additional $55 million in equity financings to support the restart of the SMP Refinery in Brazil.

- Vote to accept the Prepackaged Plan and provide necessary releases.

- Refrain from actions that could delay or impede the consummation of the Prepackaged Plan.

- The RSA contemplates a holistic balance sheet restructuring and recapitalization, including DIP financing to support the Chapter 11 Cases and Australian Proceedings, as well as exit financing for go-forward operations.

Subscribe for access to coverage of all Chapter 11 bankruptcy cases with liabilities exceeding $10 million.