Case Summary: JOANN Chapter 11

JOANN has filed for Chapter 11 bankruptcy for the second time in a year, citing declining sales, inventory shortages, and ongoing supply chain disruptions.

Business Description

Headquartered in Hudson, Ohio, JOANN Inc. ("JOANN"), along with its Debtor and non-Debtor affiliates (collectively, the "Company"), operates as the nation's category leader in sewing and fabrics, offering one of the largest assortments of arts-and-crafts products.

As of the Petition Date, the Company managed approximately 800 stores in 49 states, all of which are operated from leased premises, with a significant online presence through its e-commerce platform, joann.com, and mobile app.

- In 2024, approximately 86% of sales revenue was generated in-store, while approximately 14% of JOANN's annual sales revenue was generated through the Company's e-commerce offerings.

During the 2024 calendar year, JOANN had net sales of approximately $2 billion, with $900 million attributable to Sewing, $1.1 billion to Arts and Crafts and Home Décor, and $19 million to the Additional Non-Merchandise Services category.

As of the Petition Date, the Debtors reported $1-$10 billion in assets and liabilities.

Corporate History

Founded in 1943 as the "Cleveland Fabric Shop" in Cleveland, Ohio. By 1963, the Company had grown to 18 stores.

Key Milestones and Acquisitions

- JOANN was publicly listed on the American Stock Exchange in 1969 and joined the New York Stock Exchange in 1976.

- The Company opened its 500th store in 1980 and, following the acquisition of two fabric companies in 1998, became the largest fabric and crafts retailer in the United States.

- In 1998, the business was renamed Jo-Ann Stores Inc., and all stores operating under other names were rebranded as "Jo-Ann Fabrics."

- In 2011, JOANN was purchased by Leonard Green & Partners and taken private.

- The Company went public again in March 2021, with its shares listed on the NASDAQ under the ticker symbol "JOAN."

Recent Developments

- The COVID-19 pandemic led to a surge in demand for JOANN's products, resulting in a 23.5% increase in sales from FY 2020 to FY 2021.

- On March 18, 2024, JOANN Inc. and certain then-debtor affiliates filed for Chapter 11 bankruptcy in the District of Delaware to implement a prepackaged plan of reorganization focused on reducing the Company's funded debt load.

- The Company emerged from the prior cases on April 30, 2024, as a private company, and its shares were no longer listed on the NASDAQ.

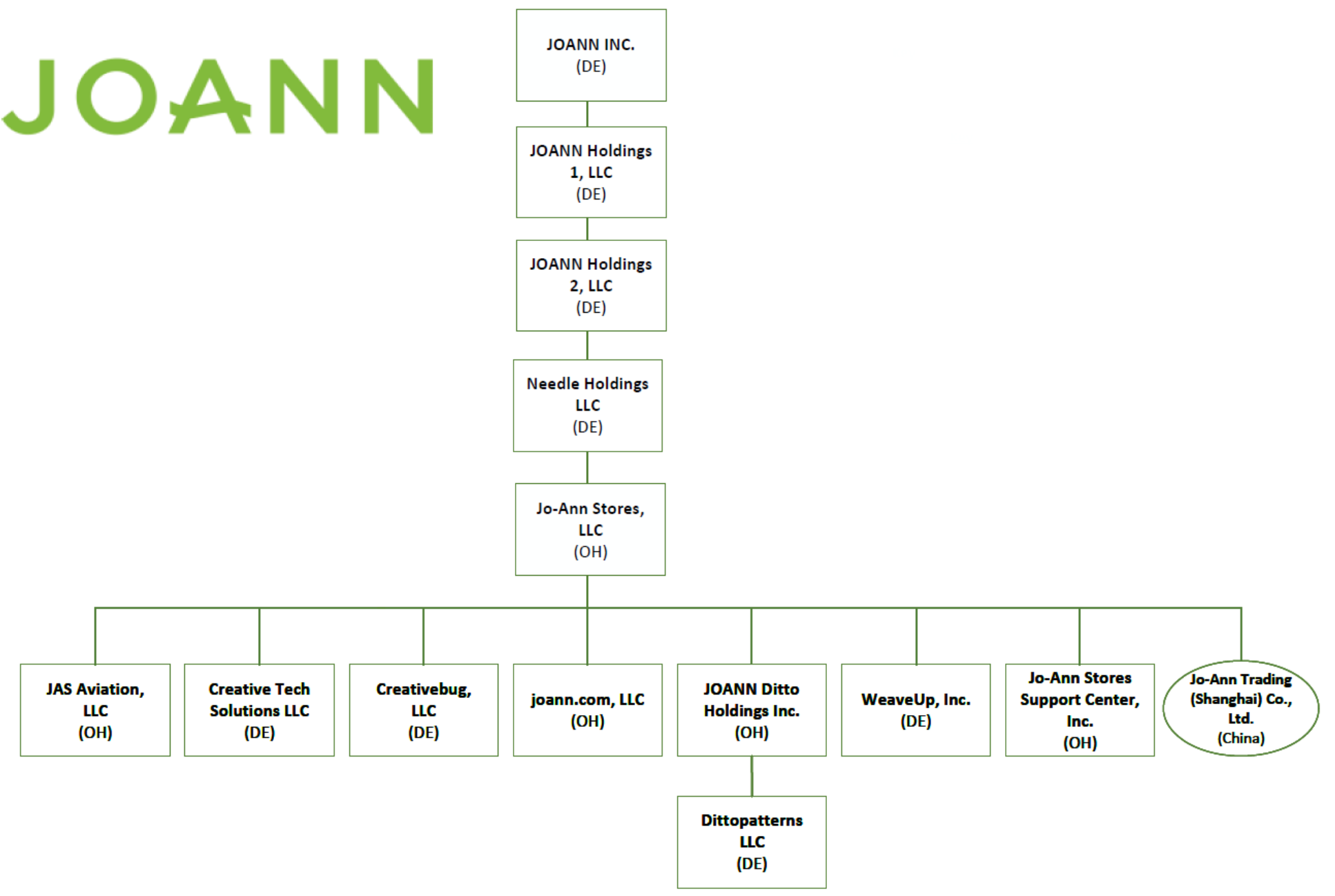

Organizational Structure

JOANN’s corporate structure includes 13 wholly-owned subsidiaries, 12 of which are Debtors in these Chapter 11 proceedings, alongside one foreign non-Debtor entity.

Operations Overview

JOANN operates through three primary product segments: Sewing, Arts and Crafts and Home Décor, and Additional Non-Merchandise Services.

- The Sewing segment includes seasonally themed fabrics, a variety of fabrics for home improvement, décor, and fashion projects, sewing machines, and other sewing supplies.

- The Arts and Crafts and Home Décor segment comprises yarn and yarn accessories, crafting materials, technology and organizers, seasonal décor, and cake decorating materials.

- The Additional Non-Merchandise Services category includes shared freight revenue, revenue from subletting store space, and non-merchandise services such as revenue from subscriptions to Debtor Creativebug, LLC's online content.

Supply Chain and Distribution

- JOANN has multiple domestic and international supply sources for each of its product categories, with approximately 65% of its purchases sourced from domestic suppliers and the remaining from foreign suppliers in 2024.

- The Company's purchasing is performed centrally through its store support center, and merchandise is directed to one of its three distribution centers or its e-commerce fulfillment center.

Retail and E-Commerce

- JOANN's products are available to customers online or in its brick-and-mortar stores, with e-commerce sales primarily fulfilled through its stores and e-commerce fulfillment center.

- A small portion of orders are fulfilled from the Company's distribution centers or directly by vendors.

Workforce

- As of the Petition Date, JOANN has approximately 19,000 employees, with 3,400 employed full-time and 15,600 employed part-time.

- 1,300 employees are salaried, and 17,700 are paid on an hourly basis, with approximately 17,500 employees working in the Company's retail stores.

- Approximately 300 employees are unionized, all of whom work at the Hudson, OH Distribution Center and are represented by the United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union.

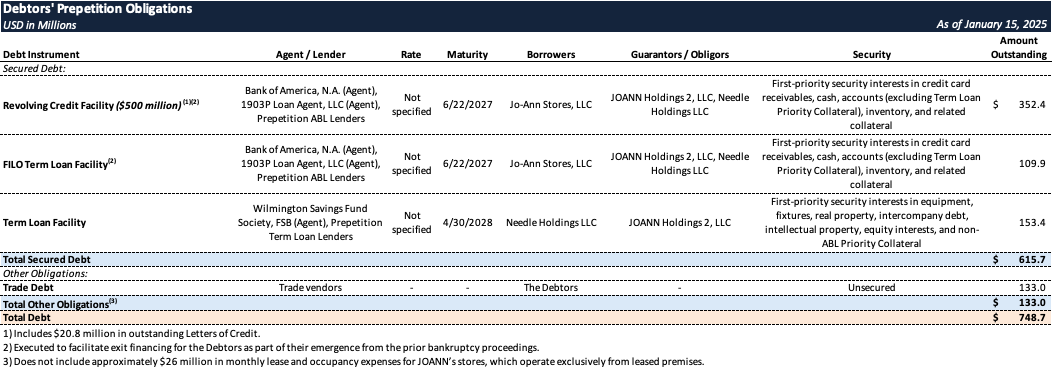

Prepetition Obligations

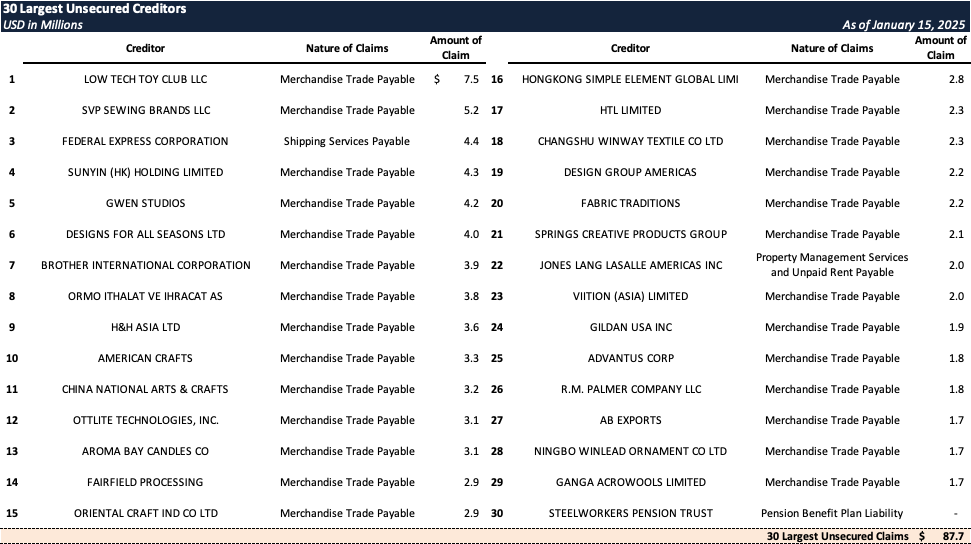

Top Unsecured Claims

Events Leading to Bankruptcy

Challenging Retail Environment and Operational Decline

- The retail industry has faced significant challenges over the last year, including a stagnant economy, persistent inflation, and high interest rates, which have negatively impacted the Company's performance.

- These macroeconomic factors have led to a decline in consumer spending, with many retailers experiencing financial difficulties, including a significant increase in bankruptcy filings and store closures.

- JOANN has been particularly affected by these challenges, as consumers have reduced their discretionary spending on craft, décor, and similar products.

- Furthermore, the Company's competitors have implemented price reductions, making it difficult for JOANN to maintain its profit margins and react to the downward pressure on prices in the retail sector.

- The Company's loyal customer base has become accustomed to competitive pricing, making it challenging for JOANN to adjust to the changing market conditions.

Unanticipated Inventory Challenges Post-Emergence

- Following its emergence from bankruptcy in April 2024, the Company faced significant and unforeseen inventory and restocking challenges, which prevented it from achieving its revenue projections and continuing as a viable going concern.

- The Company's inventory challenges were exacerbated by the fact that its vendors did not resume pre-petition production levels, leading to a shortage of key products and a decline in in-stock levels.

- The Company's efforts to address the inventory shortages, including providing financial assurances to vendors and renegotiating contracts, were initially unsuccessful, and in-stock levels reached historical lows.

- The inventory challenges had a significant impact on the Company's revenue and profitability, making it difficult to service its restructured debt load.

- The Company's reliance on high in-stock levels to maintain customer loyalty and drive sales made the inventory challenges particularly problematic.

JOANN's Reliance on High In-Stock Levels

- The Company's success is heavily dependent on maintaining high in-stock levels, as its customers rely on the availability of products to complete their projects.

- When the Company experiences stock shortages, customers are likely to abandon their purchases, leading to a significant impact on revenue and profitability.

- The Company's products require a high level of in-stock availability, with customers typically purchasing multiple items per trip, making inventory management critical to the Company's success.

- The Company's inability to maintain high in-stock levels has had a devastating impact on its business, leading to a decline in sales and profitability.

Vendor Uncertainty and Supply Crunch

- The Company's business plan following its emergence from bankruptcy was premised on vendors shipping products on terms commensurate with pre-bankruptcy levels.

- However, many suppliers halted production of key products, leading to a shortage of inventory and a decline in in-stock levels.

- The Company's efforts to address the vendor constraints, including providing financial assurances and renegotiating contracts, were initially unsuccessful.

- The vendor uncertainty and supply crunch have had a significant impact on the Company's ability to maintain high in-stock levels and drive sales.

Strategic Initiatives to Address Inventory Challenges

- JOANN has executed a series of targeted measures to address ongoing inventory issues, including the provision of financial assurances to key vendors, renegotiation of critical contracts, and implementation of cost optimization strategies.

- The Company has engaged professional advisors to support these efforts, with the dual objective of achieving substantial cost savings and restoring profitability.

- Despite these initiatives, recovery in in-stock levels has been gradual, with inventory challenges exerting a sustained impact on liquidity and debt serviceability.

- The remediation efforts have been further complicated by extended lead times required to restart production and stabilize inventory availability.

Cost Optimization and Liquidity Management

- To mitigate liquidity pressures, the Company has initiated comprehensive cost-cutting programs aimed at streamlining operations and reducing expenditure.

- Advisors have been retained to identify and execute cost-saving opportunities, with the overarching goal of enhancing profitability and operational resilience.

- These initiatives have yielded meaningful cost reductions across key areas, including COGS, distribution, and SG&A.

Advisory Engagements and Strategic Alternatives

- Operational and financial challenges persisted, necessitating the retention of strategic advisors to address these concerns and explore viable pathways to financial stability.

- Advisory Retention:

- Alvarez & Marsal: Engaged to provide interim management services and support the Company’s restructuring initiatives, including efforts to stabilize operations and optimize liquidity.

- Centerview Partners: Retained on December 9, 2024, to provide investment banking services, including advising on potential asset sales and financing options, as well as exploring strategic alternatives, such as a Chapter 11 process.

- Kirkland & Ellis LLP: Engaged as restructuring counsel on December 20, 2024, to support strategic realignment efforts, including advising on the potential for a Chapter 11 filing.

Anticipated Path Forward

- In response to inventory shortages, unpredictable delivery schedules, and reduced borrowing capacity, the Debtors initiated these Chapter 11 Cases with three key objectives:

- Sustaining Operations: Maintain business continuity for employees, vendors, and customers with access to liquidity under Bankruptcy Court oversight.

- Completing the Marketing Process: Enable Centerview to finalize its marketing efforts, capitalizing on the Company’s demonstrated going-concern potential.

- Securing and Managing Liquidity: Secure sufficient liquidity to support operations, complete the marketing process, and ensure the Chapter 11 process proceeds efficiently.

Enjoyed this summary? Stay informed on new Chapter 11 filings over $10 million in liabilities—subscribe to Bondoro for free and get insights delivered directly to your inbox.

Otherwise, you can also explore our full archive for all past summaries.