Case Summary: Klöckner Pentaplast Chapter 11

Klöckner Pentaplast has filed for a prepackaged Chapter 11 bankruptcy to eliminate ~€1.3 billion of debt, after securing broad creditor support for a debt-for-equity swap that will hand ownership to its first-lien lenders, backed by a €984 million DIP facility.

Business Description

Headquartered in Luxembourg with major corporate offices in Germany, the UK, and the United States, Klöckner Pentaplast (through its Debtor⁽¹⁾ and non-Debtor affiliates, collectively "Klöckner" or the "Company") is a global leader in the manufacturing of rigid and flexible plastic packaging solutions. The Company serves critical end-markets including food, pharmaceuticals, medical devices, consumer products, and specialty technical sectors.

Klöckner’s extensive product portfolio is divided between two primary divisions, Food Packaging (FP) and Pharma, Health & Protection and Durables (PHD), and features seven main product lines:

- Food Packaging: Produces rigid trays, lidded containers, and flexible films that extend the shelf life of fresh and prepared foods, often utilizing Modified Atmosphere Packaging (MAP) technology.

- Pharma & Nutraceutical Packaging: Manufactures high-barrier blister films, such as its kpNext® packs, to protect pharmaceuticals and dietary supplements.

- Medical Device Packaging: Supplies custom rigid films and trays designed to safeguard sterile medical instruments and devices.

- Consumer Packaging: Offers thermoformed plastic packaging, including its Pentaform® rigid film technology, to protect consumer goods such as electronics and personal care items.

- Label Films: Creates printable shrink-sleeve films that provide 360-degree branding for beverage containers, aerosol cans, and other consumer products.

- Cards & Graphics Films: A major supplier of durable, rigid films used as the core stock for credit cards and in graphic displays and signage.

- Home Building & Construction Films: Produces decorative and protective films for building materials like luxury vinyl flooring, cabinetry, and furniture, as well as industrial applications.

The Company is a leading producer of recycled-content packaging and has launched several sustainability-focused products, including its “Tray-to-Tray” and “kp Elite” recyclable systems.

- Klöckner invests over $15 million annually in R&D to advance sustainable packaging solutions.

With annual sales of approximately €1.8 billion, the Company operates 27 production plants across 16 countries and employs over 5,000 people. Its diversified customer base spans more than 60 countries and includes a mix of blue-chip multinationals and local firms.

Kleopatra Finco S.à r.l. ("Kleopatra Finco") and certain affiliates filed for Chapter 11 protection on November 4, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the Southern District of Texas, reporting $1 billion to $10 billion in both assets and liabilities.

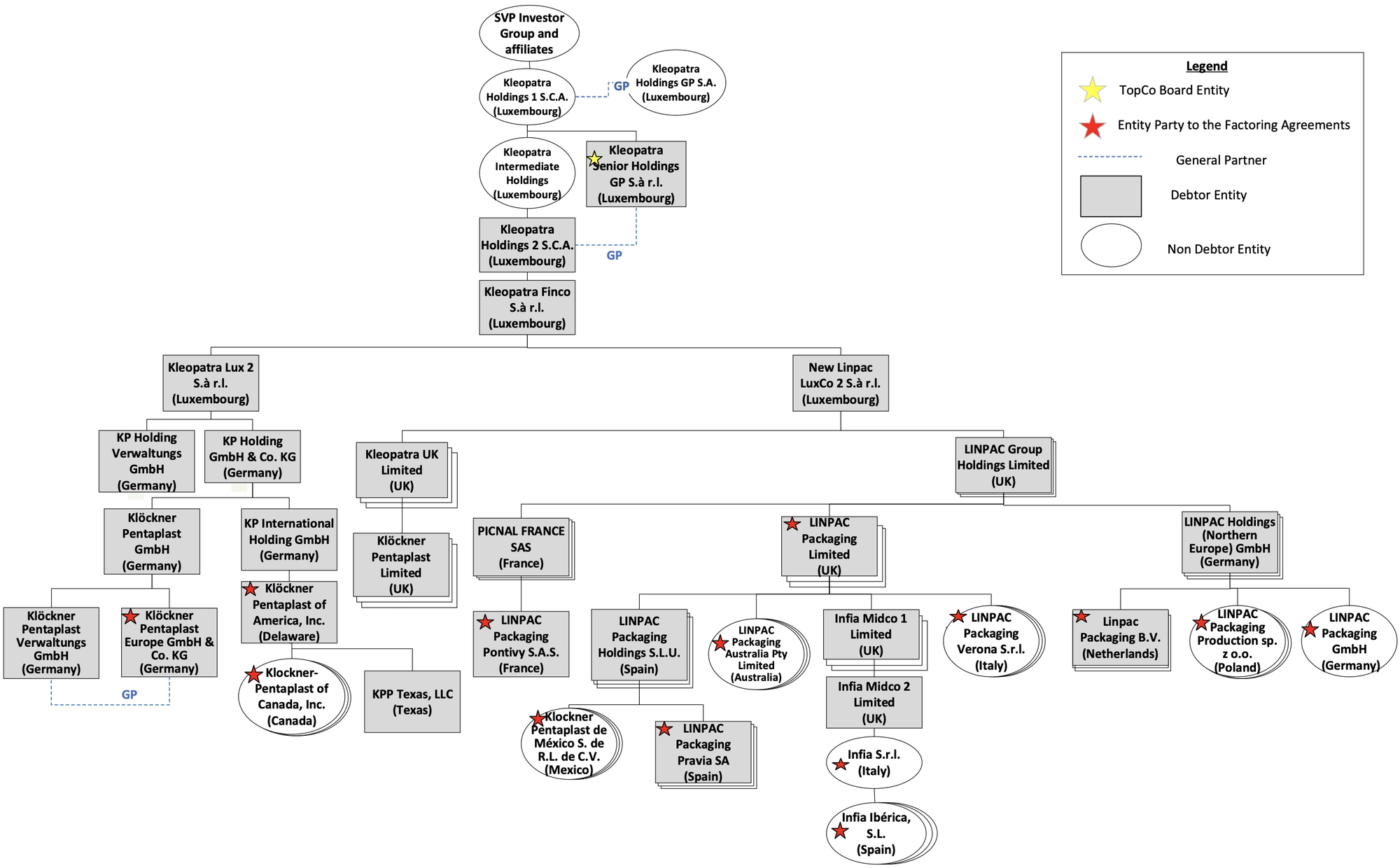

⁽¹⁾ For a complete list of Debtor entities, see organizational structure chart below.

Corporate History

Klöckner Pentaplast was founded in 1965 in Montabaur, Germany, as a plastics division of the industrial conglomerate Klöckner-Werke AG. The Company expanded internationally in 1977, establishing its first overseas manufacturing plant in Gordonsville, VA, to serve the North American market.

Innovation and Private Equity Ownership

- Throughout the 1990s, the Company pioneered Modified Atmosphere Packaging (MAP) technologies, expanded through strategic acquisitions, and diversified its product offerings into specialty films for cards, printing, and construction.

- In 2001, Klöckner Pentaplast was sold to a partnership of Cinven and J.P. Morgan, beginning an era of private equity ownership.

- Blackstone Group acquired Klöckner Pentaplast in 2007 in a highly leveraged transaction valued at approximately €1.3 billion. The significant debt burden from this LBO proved challenging following the 2008 global financial crisis.

SVP-Led Restructuring and Growth

- By 2012, Klöckner required a balance-sheet restructuring, leading to a takeover led by distressed investment fund Strategic Value Partners (SVP), which became the majority owner and injected new equity.

- Under SVP's ownership, the Company stabilized its finances and pursued growth initiatives, including:

- Establishing its first "i.center" innovation hubs to facilitate customer collaboration.

- Expanding its manufacturing footprint with a new facility in Montréal (2015), increased capacity in Germany (2016), and the acquisition of Turkish film producer Farmamak (2016).

Transformational Acquisition and Recent Challenges

- In 2017, Klöckner executed a transformational acquisition of LINPAC Group, a British leader in food packaging, which significantly increased its revenue, employee base, and geographic presence in Europe. The deal was intended to precede a U.S. IPO, but the public listing did not materialize.

- Entering the 2020s, the Company experienced a surge in demand during the COVID-19 pandemic, prompting a refinancing of its capital structure in early 2021 that left it with approximately €1.85 billion in first-lien debt maturing in 2026.

- Beginning in late 2021, Klöckner faced a sharp downturn as customers began destocking excess inventory. This was compounded by a spike in raw material and energy costs, which severely compressed profit margins and strained liquidity, setting the stage for another restructuring.

Corporate Organizational Structure

Operations Overview

As of the Petition Date, Klöckner Pentaplast operates a global network of 27 manufacturing facilities in 16 countries, producing approximately 500,000 tons of plastic film and packaging products annually. The Company's operations are supported by a workforce of over 5,000 employees and a complex corporate structure comprising 74 legal entities across multiple jurisdictions.

Research & Development and Innovation

- Klöckner invests approximately $15 million annually in R&D and maintains nine innovation hubs worldwide focused on material science and product development.

- A key competitive advantage is its dedicated "i.centers" in Charlottesville, VA, and Girona, Spain. These collaborative technology centers allow customers to work directly with Klöckner's engineers on packaging design, rapid prototyping, and real-time testing, accelerating the innovation cycle.

Manufacturing and Technology

- The Company's manufacturing capabilities include plastic extrusion, thermoforming (the Pentaform process), coating, and laminating to produce highly engineered films for demanding applications.

- Proprietary technologies include multilayer barrier films for pharmaceutical packaging, heat-shrink films for labels, and laminates like kp FlexiLam®, which extends food shelf life by providing a superior oxygen barrier.

Sustainability in Operations

- Sustainability is integral to Klöckner’s operational strategy, with a focus on increasing the use of recycled polymers (rPET, rPVC) and designing for recyclability.

- Key initiatives include the "Tray2Tray" program for closed-loop recycling of PET food trays and the Infia product line, made from 100% post-consumer recycled PET. The Company’s COO also serves as Head of Corporate Sustainability, underscoring its commitment to ESG principles.

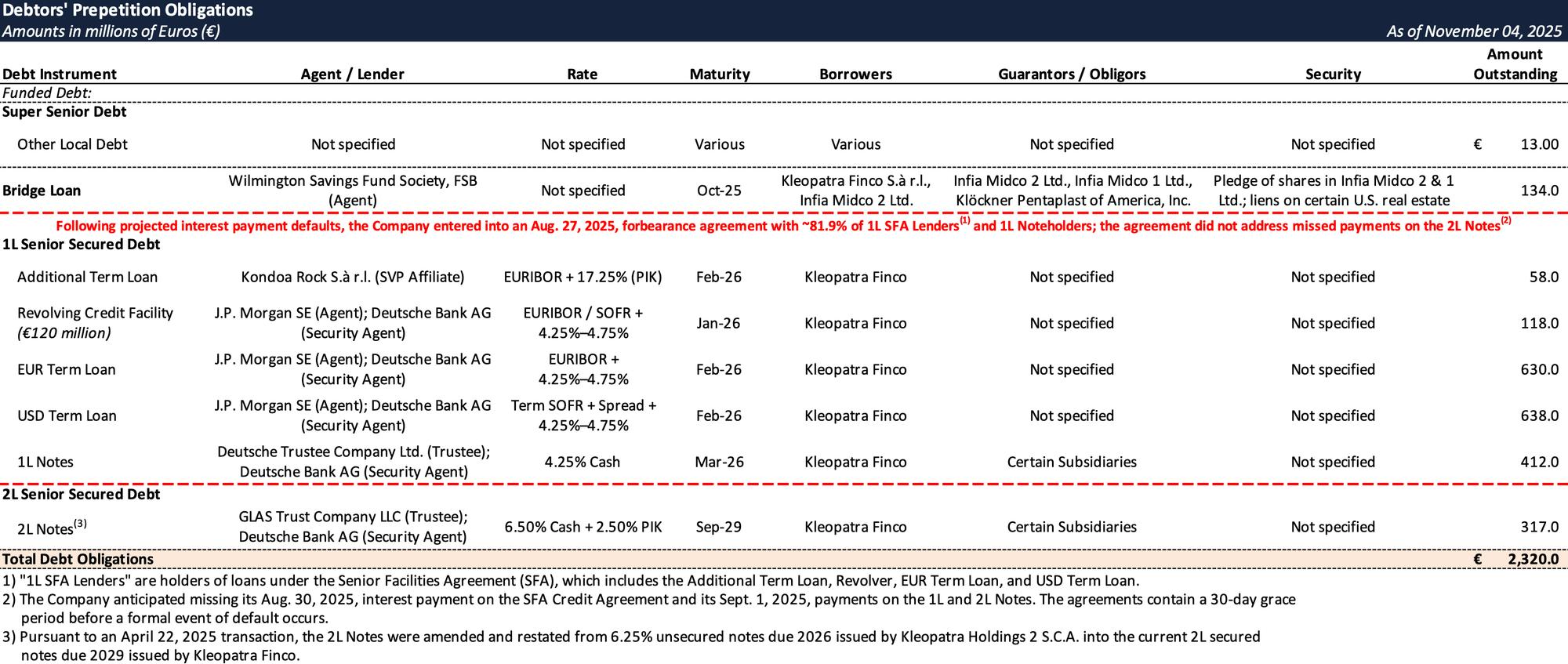

Prepetition Obligations

Factoring Agreements

- Klöckner utilizes a series of 14 accounts receivable factoring agreements with Coface Finanz GmbH and Factofrance (together, the “Factors”) to provide near-term liquidity.

- The program, which includes various Debtor and non-Debtor entities, is critical to the Company's working capital and is subject to an overall purchase limit of approximately $350 million with Coface and $93 million with Factofrance.

- The program provides an estimated $5.6 million in daily liquidity, and according to the Debtors, its absence would create a near-term liquidity shortfall of approximately $280 million.

- Under the agreements, any receivables offered for sale but not ultimately purchased by the Factors are pledged as security for Klöckner's obligations under the program.

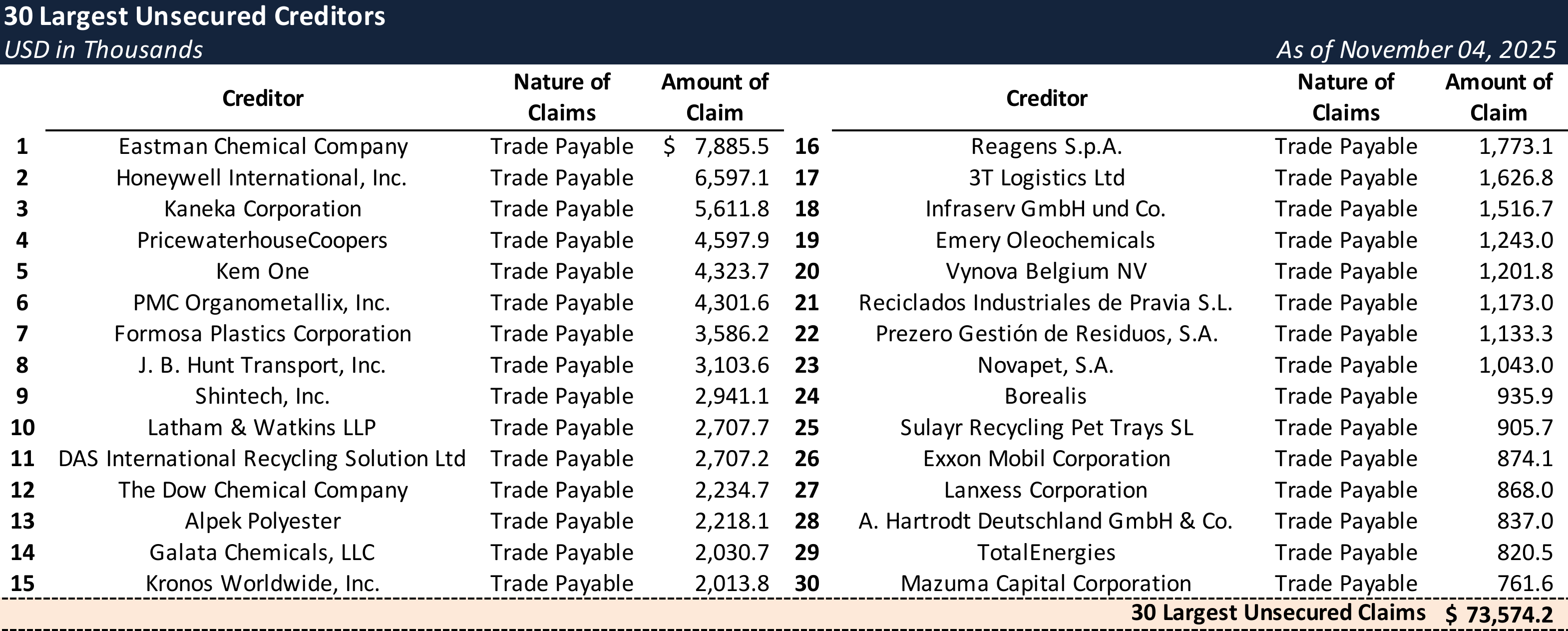

Top Unsecured Claims

Events Leading to Bankruptcy

Klöckner’s Chapter 11 filing was driven by a legacy of high leverage from prior private equity transactions, exacerbated by a subsequent industry downturn and the failure of out-of-court restructuring efforts.

High Leverage and Market Headwinds

- The Company entered 2022 with a highly leveraged capital structure, with debt levels around 8x EBITDA stemming from the 2017 LINPAC acquisition and a 2021 refinancing.

- Beginning in mid-2022, Klöckner was impacted by a confluence of negative factors:

- Post-Pandemic Demand Decline: A sharp downturn in demand occurred as customers worked through stockpiled inventory ("destocking"), leading to significant volume declines.

- Cost Inflation and Margin Squeeze: Surging raw material (plastic resins) and energy costs, coupled with an inability to pass on price increases, severely compressed profit margins and strained liquidity.

- In response to these challenges, majority owner SVP injected approximately €150 million of new equity in May 2023. However, with looming maturities and a high debt leverage ratio, credit rating agencies downgraded the Company, citing an unsustainable capital structure.

Failed Out-of-Court Restructuring

- In early 2025, the Company initiated an out-of-court restructuring.

- In April 2025, it executed a distressed exchange offer, swapping €300 million of unsecured notes for new second-lien secured notes due 2029, successfully pushing out one maturity wall.

- Subsequently, Klöckner negotiated an Amend-and-Extend (A&E) agreement with its first-lien lenders, which was contingent upon a significant new capital injection from SVP.

- In late summer 2025, SVP withdrew its support for the A&E deal, causing the out-of-court solution to collapse and precipitating an immediate liquidity crisis.

Bridge Financing and Path to Chapter 11

- Facing imminent interest payment defaults, the Company secured a €112 million super-senior bridge loan in August 2025 from an ad hoc group of first-lien lenders.

- Concurrently, approximately 85% of first-lien lenders entered into a Forbearance Agreement, providing Klöckner with the necessary time to negotiate a consensual, prepackaged Chapter 11 plan.

- Negotiations culminated in a Restructuring Support Agreement (RSA) backed by over 90% of first-lien lenders and more than two-thirds of second-lien noteholders.

Prepackaged Plan and DIP Financing

- On November 4, 2025, Klöckner filed for Chapter 11 protection to implement its prepackaged plan, which centers on a debt-for-equity swap that will eliminate approximately €1.3 billion of funded debt.

- Under the plan, first-lien lenders will exchange their claims for 100% of the equity in the reorganized company. Second-lien noteholders will receive a minimal recovery of €17.5 million in new first-lien loans, while existing equity will be canceled.

- General unsecured creditors, including trade vendors, will be unimpaired and paid in full to ensure operational continuity.

- To fund the process, the first-lien ad hoc group provided a €984 million DIP financing facility, comprising €349 million in new money and a €635 million roll-up of existing first-lien debt. The DIP is structured to convert into an exit facility upon emergence.

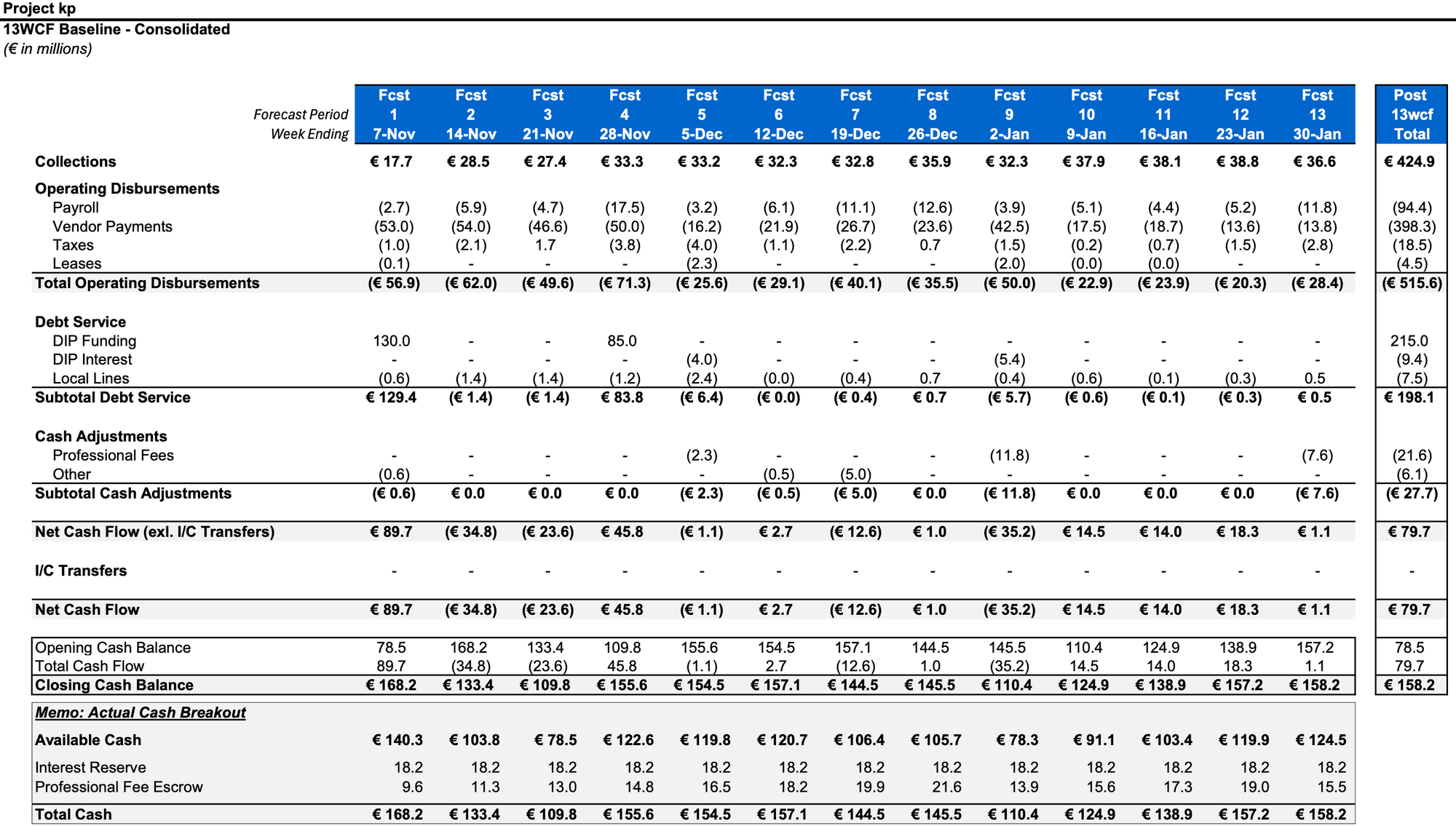

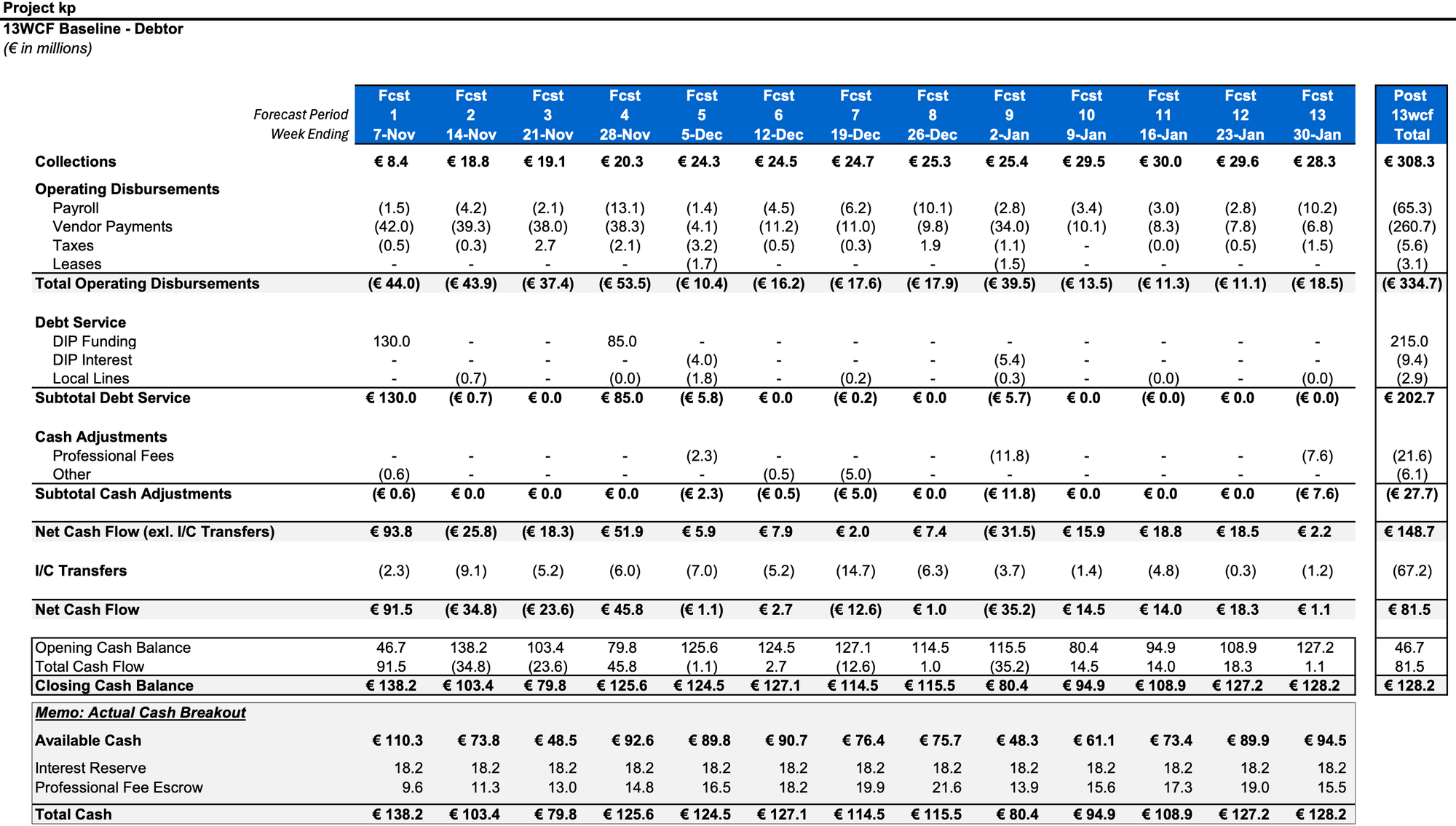

Initial DIP Budgets

Key Parties

- Porter Hedges LLP (co-bankruptcy counsel); Kirkland & Ellis LLP and Kirkland & Ellis International LLP (restructuring counsel); PJT Partners, Inc. (investment banker); Alvarez & Marsal North America, LLC (financial advisor); Stretto, Inc. (claims agent).

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.